Frequently Asked Questions About The Federal Solar Tax Credit

The federal solar tax credit is based on other factors, including taxes you currently owe. Weve covered the most commonly asked questions below.

When am I eligible for the solar tax credit?

Youre eligible for the federal solar tax credit if your system is installed prior to Dec. 31, 2023, you own or finance it, and you live in the home where it is installed.

The credit is higher than the taxes Ill owe this year, what should I do?

You can roll over some of the credit that you would receive to a following years taxes, although the amount will decrease in 2023 and may be unavailable in 2024.

What happens if I get a system installed after Dec. 31, 2022?

After 2022, the credit drops from 26 percent to 22 percent, so you could stand to lose hundreds of dollars in tax savings.

Can I get a federal solar tax credit if I wait a few years?

There are currently no plans for the federal tax credit for residential solar systems to continue beginning Jan. 1, 2024.

What Doesnt Qualify For The Solar Tax Credit

- Solar installed in an income property in which you donât maintain your own residence.

- A system thats leased. In that case, the company that leases it to you gets the credit, though it can pass along all or part of the savings as a discount to you.

- A solar system thatâs used to heat a swimming pool or hot tub. The IRS is vague, though, about whether you can prorate your creditthat is, claim a portion of the credit if only a portion of the energy is used to heat your home. Talk to a tax expert for advice.

A Comprehensive 2021 Guide To Solar Incentives In California

If you plan to install a solar system in your home, that will be the best decision you make in 2021. But is there a California tax rebate for California solar panels?Yes, there are, and you need to take advantage of the federal tax credit, Californias solar property tax exemption, local rebates, net metering, and the financial mechanisms you should economize with the new solar system.

Let us look at theCalifornia solar incentivesavailable to California residents.

Don’t Miss: How Does Buying Solar Panels Work

Does Sdg& E Buy Back Solar Power

With this tariff structure, SDGE charges different prices for electricity use, depending on the time of day, hence the name Time for use. They also buy back excess solar energy produced by solar systems in the home based on these prices, so solar energy is more or less worthwhile depending on the time of day it is produced.

The following expenses are included:

- Solar PV panels or PV cells used to power an attic fan

- Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

- Balance-of-system equipment, including wiring, inverters, and mounting equipment

- Energy storage devices that are charged exclusively by the associated solar PV panels, even if the storage is placed in service in a subsequent tax year to when the solar energy system is installed

- Sales taxes on eligible expenses

Ner With A Solar Expert

The best way to find out how to maximize your federal solar tax credit is to work with a residential energy consulting firm that has helped customers like you prepare for such incentives. At Baker Electric Home Energy, we help you reap the benefits of going solar with our high-quality custom solar solutions, all of which include installation, consultation, repair, and maintenance services.

Baker Electric Home Energy has been providing solar energy solutions to South California homeowners for over 15 years. Our way of doing business, the Baker Way®, is known for building customer confidence through extraordinary service. Contact us to learn more about the federal solar tax credit, other California solar incentives, and to determine your eligibility for economic benefits as a solar power consumer.

Don’t Miss: Where To Buy Zamp Solar Panels

Incentives Offered By The State Of California

Currently, the state of California does not offer incentives or refunds to install a solar panel system. The good news is that there is a discount to install an energy storage system called the Auto generation Incentive Program ! This can be claimed along with the California solar tax credits. California Governor Brown SB recently signed 700. This adds some $ 800 million of additional funds to SGIP and expands the program until 2025.

The California energy storage reimbursement program was established in 2001. Until recently, the application of SGIP has been a difficult process, especially for residential customers. The previous reimbursement worked by providing program funds on a specific day. With most of the funds allocated to large industrial energy storage projects. Leaving little available for homeowners looking to store their solar energy. For homeowners who are customers of GDS & E, PG& E, SCE and SCG are eligible for an incentive of up to $ 400 per kilowatt hour when sending a domestic battery. This great incentive has the potential to cover most of your battery costs. The battery size will determine the value you will get per kilowatt.

Before you go, I hope this summary about the question, California have a solar tax credit? is helpful for you.

Federal Solar Tax Credit: What Is It

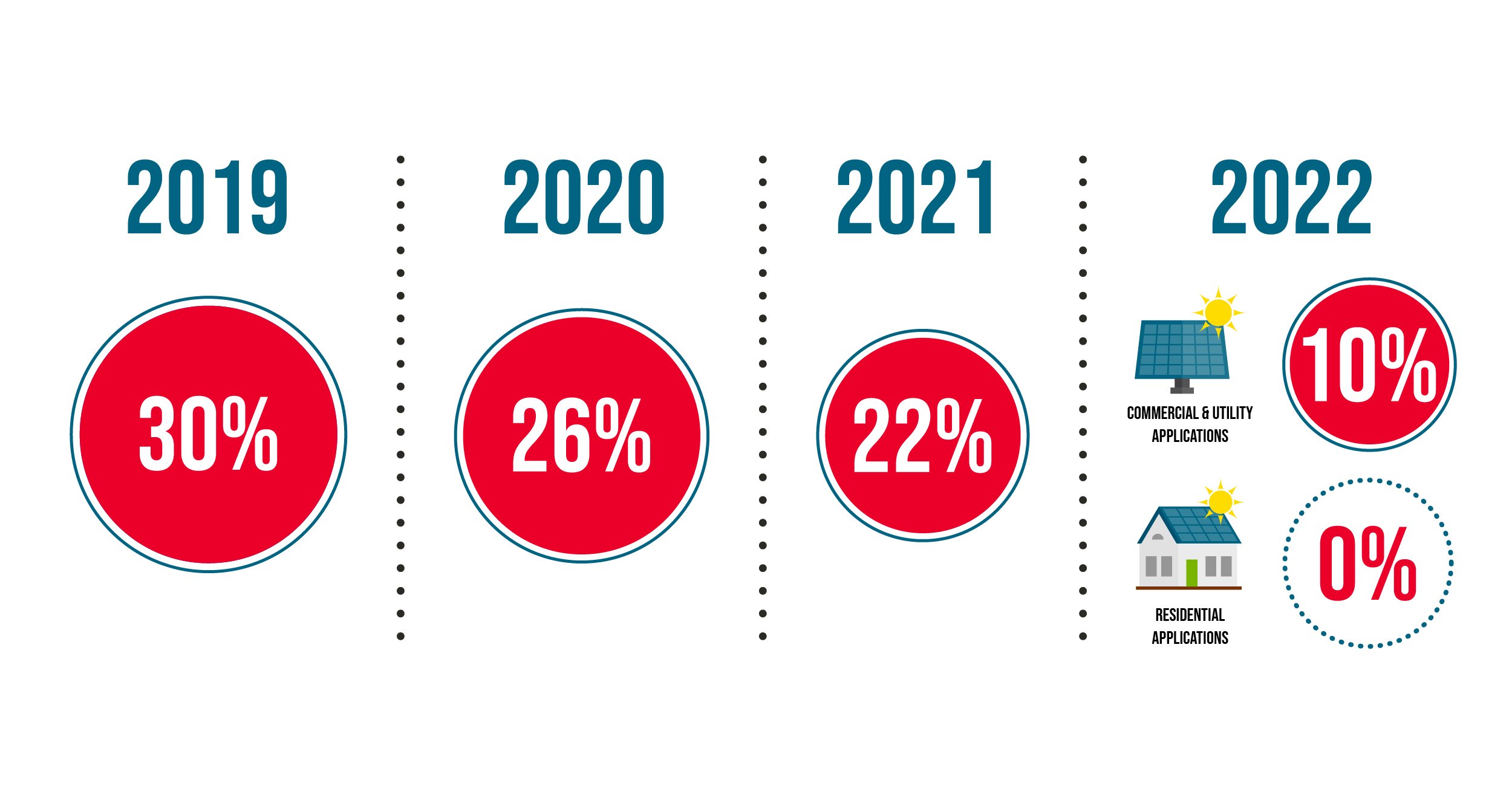

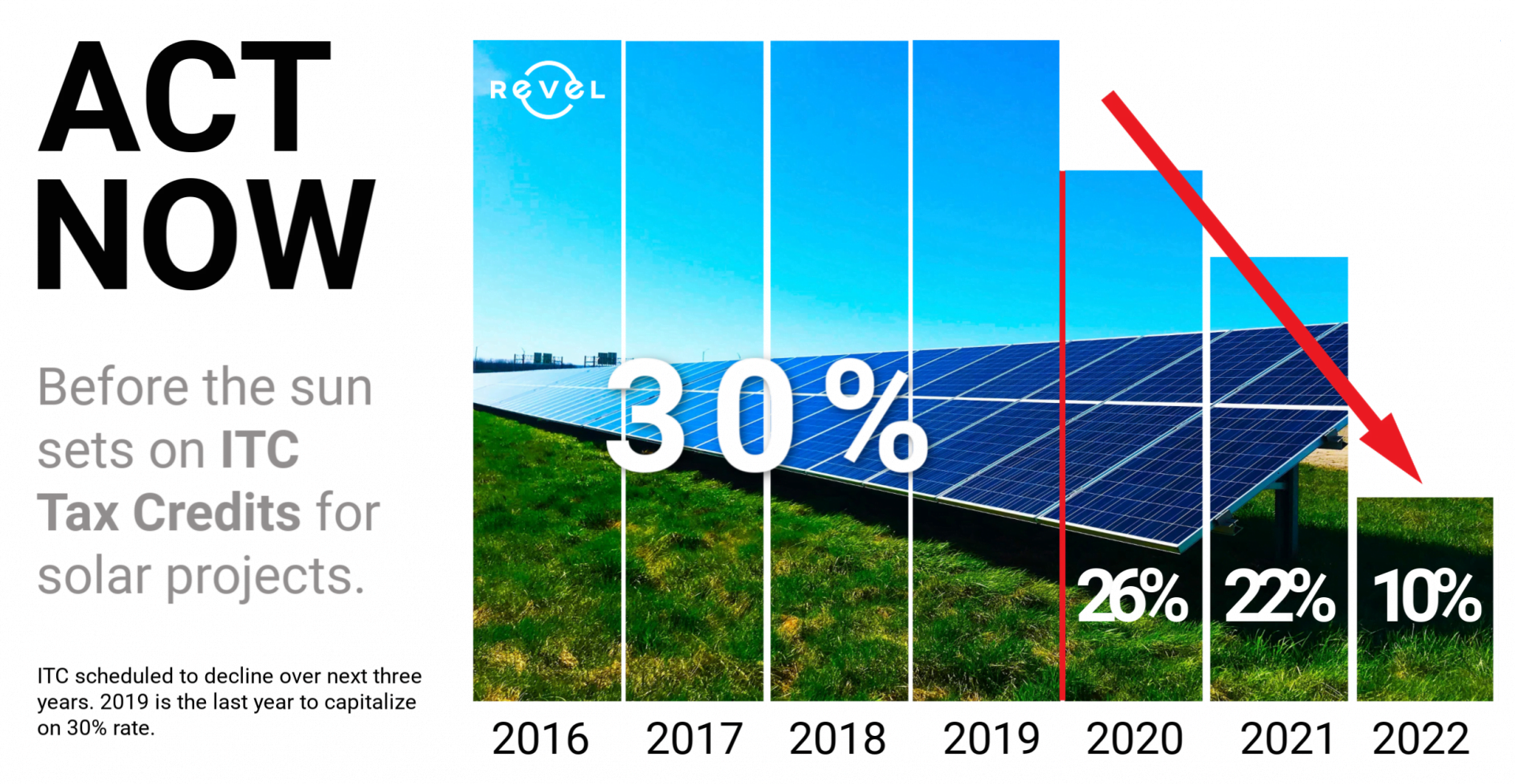

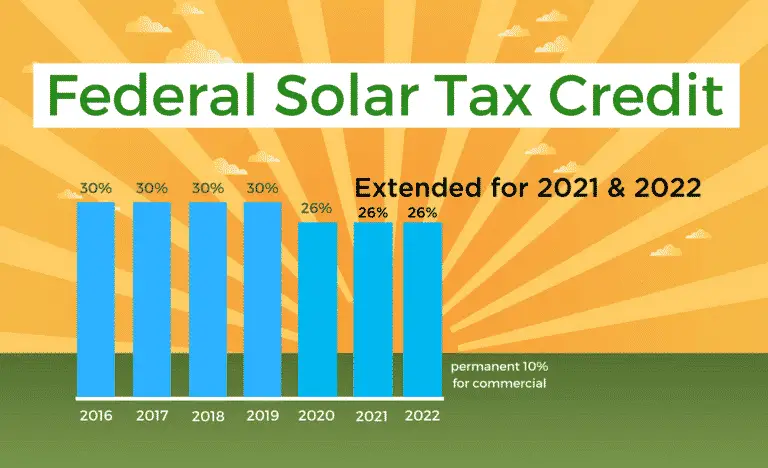

If you install a new solar system for your home or property in 2022, you can receive a tax credit equal to 26 percent of the cost of your solar home energy installation project on your existing tax bill. On an average system, this can add up to around $8,000. The credit will decrease over time, so homeowners need to act now before the incentive disappears altogether.

In 2019, the tax credit decreased from 30% to 26%, and its legislated to remain at 26% for projects that are completed and operational in both 2021 and 2022. In 2023, the federal solar tax credit will decrease to 22%. The tax credit program is scheduled to expire January 1, 2024.

Also Check: How Do I Register My Sole Proprietorship

Other Rebates And Incentives

One key issue with solar system installations is that your finacial investments in environmentally-conscious goals used to be supported by a number of institutions. However, in Southern California and San Diego in particular, few incentives remain [Link to What California Incentives Are Available to Homeowners? beyond the federal solar tax credit for homeowners seeking to offset costs.

However, one statewide initiative is worth remembering. Net energy metering , currently allows homeowners who generate more electricity than they need to sell it back to the grid, offsetting future bills. In the future, this will become harder and is another important reason to consider starting your installation in 2022.

How Do Solar Loans Affect The Solar Tax Credit

There are two types of solar loan in relation to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to the lender to buy down your principal and secure that monthly payment. If you do not put your tax credit back into your loan, this will initiate another loan, in the amount of your tax credit, at the same APR.

The second type of solar loan is one in which there is a different payment amount for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit, youll have the option to use it to re-amortize your loan to secure lower monthly payments. You can also keep the federal tax credit, and your payments will remain the same. Solar.com can help figure out which solar financing option is best for you.

You May Like: How Much Is A Solar Panel For Home

Solar Panel Prices By State

Home solar panel costs can vary based on where you live. This is mainly because the average size of solar systems changes by state.

Essentially, states with a hotter climate tend to have larger residential solar systems, which brings up the price. But some solar installers charge less per kW if you invest in a larger system, which can even out the total cost of solar panels. All told, no matter what state you live in, the price you are charged for solar panels will come down to how large your system is.

Recommended Reading: How Much Can Solar Panels Save Me

History Of The Solar Investment Tax Credit

In the early days of solar energy, residential systems were far more expensive than they are now. By many homeowner standards, however, theyre still expensive today. For example, in 2009, it cost $8.50 per watt to install solar panels the current cost per watt, as of publishing, is about $2.40 to $3.22.

This point-of-entry cost into the world of renewable residential solar power dramatically limited the number of homeowners who could take advantage of solar for their home.

The solar investment tax credit was established by the Energy Policy Act of 2005, which established standards for renewable fuels, mandated an increase in the use of biofuels and established renewable energy-related tax incentives.

Under this law, the original policy was set to expire at the end of 2007. However, the solar ITC has been so popular that its expiration date has been extended multiple times.

Solar panel costs have decreased dramatically in the last 20 years, but the ITC can still save individuals and businesses a great deal on their federal taxes.

Today, solar systems are far less expensive due to changes in the industry and the manufacturing of certain parts that make up the solar system. Solar panels, lithium batteries and inverters are all far less expensive to make and buy now than they were in those early days.

You May Like: Does Pine Sol Leave A Sticky Residue

Don’t Miss: How Much Does Solar Window Film Cost

The Federal Investment Tax Credit

At the federal level, youll qualify for the federal solar Investment Tax Credit . In 2021, the ITC will provide a 26% tax credit on your solar panel installation costs, provided that your taxable income is greater than the credit itself.

For most homeowners, this effectively translates to a 26% discount on your home solar system. So, if your system costs $20,000, the ITC would enable you to claim around $5,200 as a credit on your taxes.

Financing Options With Energy Saving Pros

From roof-mounted systems and ground arrays to small PV modules, we offer competitive pricing on solar energy systems of any size. We also offer zero-down financing options and payment plans for every budget. Getting started in solar energy production might not cost as much as you thinktalk to one of our expert energy consultants today.

Recommended Reading: How Many Kw Solar Power Do I Need

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

The solar PV panels are on my property but not on my roof?

Important Solar Installation Factors To Consider

Before installing your solar system, there are a few important things to consider:

- According to the U.S. Department of Energy, solar panels are most effective on south-facing roofs with slopes of between 15 to 40 percent They may not be well suited to older roofs that will need to be replaced in the near future.

- Consider the amount of sun your home gets. California gets a lot more sunshine than some other states, making solar power particularly attractive. But its important to consider how much sun your home receives in your location.

- In some states, HOAs and other neighborhood associations may have restrictions around the installation of solar panels or require prior approval. However, California law prevents bans on solar panels.

Recommended Reading: When Is The Best Time To Install Solar Panels

You May Like: How Much Does A 4kw Solar System Cost

Federal Tax Credit Is Not Calculated From Gross Cost

A lot of homeowners think that the ITC is calculated from the gross cost. That is not the case. As we calculated above, the 30% credit on a $30,000 solar panel system installation would sum up to $9,000. It is only possible if the $30,000 is the net cost. It is against the IRS rules to calculate the gross costs.

In addition, if you received any local or state financial incentives for your residential solar panel installation, it has to be deducted before calculating the 30% credit amount.

Lets dive into this example

Suppose your $30,000 installation qualified for a California solar tax rebate of $2,000 and a $1,000 rebate from your local utility company. It means that your net cost will be $27,000. Hence, the federal solar ITC would then be $8,200 and not $9,000.

Making the ITC calculation from the Gross tax will make you incur a tax bill instead of a deduction.

California Solar Rebates How To Make The Most Of Them

California is the ideal state for solar power and for a commercial facility to install a solar photovoltaic system on site. Sunny days mean plenty of solar power, but more importantly, the state offers some of the best financial incentives in the nation. If youre looking for a list of California solar rebates and tax incentives for commercial properties this is the article for you.

Recommended Reading: How To Set Up Sole Proprietorship In California

Additional Eligibility Requirements For Solar Water Heating:

- The solar water heating equipment must be performance certified by the Solar Rating Certification Corporation or another source endorsed by the governing state where the property is installed.

- At least 50% of the energy used to heat the water must be solar generated.

- The solar investment tax credit only applies for water used within the house or building within the dwelling.

If youre looking to claim your solar investment tax credit on the current tax year, then you will need to consider the time it takes to get the proper permits, the installation time, and the go ahead from the utility company to flip the switch on your solar panel system. This process can take upwards to 10 weeks.

How Can I Get Powerwall For Free

Once a customers solar referrals hit 10 and above, a Powerwall would be awarded for free. Anyone using your referral link can earn a $100 award after system activation for solar panels or Solar Roof to reduce reliance on the grid and produce clean solar energy. You will earn a $400 award for each solar referral.

Also Check: Where Are Most Solar Panels Manufactured

You May Like: Can Solar Panels Go On A Metal Roof

Start Your Solar Journey Off On The Right Foot

On top of all these excellent solar incentive programs, our home solar plans, with or without battery storage, start at $0 down. What’s more, Pacific Gas and Electric , Southern California Edison , San Diego Gas & Electric , and other California utility companies offer net energy metering programs. These NEM programs could let you earn credits on your electric bill for the excess solar energy you produce.13 Net metering in California could help you save money on future energy costs.

Now could be an ideal time to make the switch with a California solar company like Sunrun. To check if our solar and storage products and services are a good fit for your home energy needs, use Product Selector or request a quote to get one-on-one service from our expert Solar Advisors.

Solar For Affordable Housing

Californias Single-Family Affordable Solar Housing program provides incentives to qualifying low-income single family homeowners to help offset the upfront costs of installing solar. The program offers one up-front incentive level of $3/Watt to all qualifying applicants to eligible households within the PG& E, SCE, and SDG& E territories. SASH is overseen by the CPUC and administered by GRID Alternatives.

The states Multifamily Affordable Solar Housing program, which is now closed to new applicants but may have a waitlist, provides incentive rates of $1.10 to $1.80/Watt for qualifying multifamily affordable housing. It is administered by PG& E, SCE, and the Center for Sustainable Energy in SDG& E territory.

Read Also: How To Assemble Solar Panel