Do You Qualify For A Self

Are you a self-employed professional planning for your retirement? A self-employed 401 is an excellent plan to build out your retirement nest egg. Whether you are a freelancer, shop owner, or small business owner without employees, a solo 401 retirement plan can help you live your dream life when you retire. Here well discuss an overview of a self-employed 401, setting one up, how to withdraw from the account and other vital information.

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

Covering Your Spouse Under Your Solo 401

The IRS allows one exception to the no-employees rule on the solo 401: your spouse, if he or she earns income from your business.

That could effectively double the amount you can contribute as a family, depending on your income. Your spouse would make elective deferrals as your employee, up to the $19,500 employee contribution limit . As the employer, you can then make the plans profit-sharing contribution for your spouse, of up to 25% of compensation.

Read Also: How To Use Solar Energy At Home

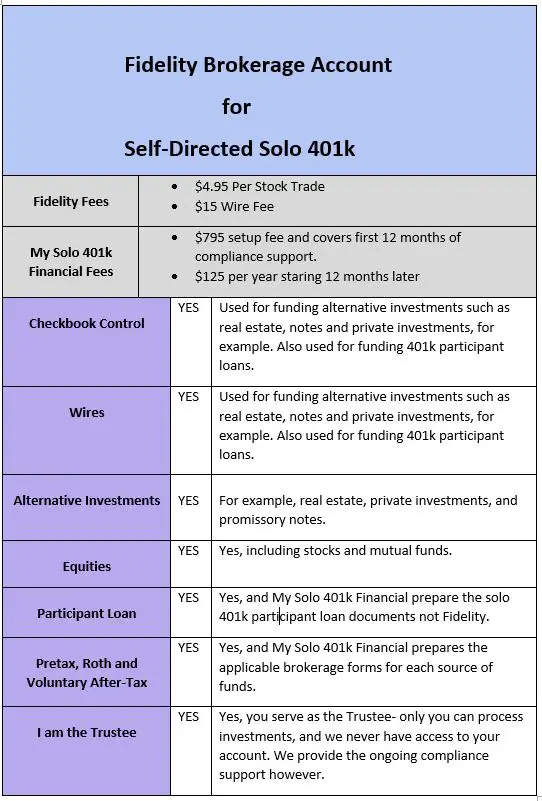

How To Open A Fidelity Account For The Solo 401k

Each brokerage house is different in how they classify their investment-only accounts and applications can update at any time. We have made our best efforts to provide you the most up to date applications here, but please check with Fidelity to ensure you have the right application to open an investment-only brokerage account under your Solo 401k plan and trust.

It’s important to remember you’re not opening a Fidelity 401k. Rather, your 401k plan and trust are opening an investment-only account with Fidelity.

Fidelity calls these types of accounts “non-prototype retirement accounts” and they are designed to work with your Solo 401k.

Best For Low Fees: Charles Schwab

Charles Schwab

The Individual 401 Plan from Charles Schwab is our top choice for low fees. The account has no opening or maintenance fees as well as no commission trades for stocks or ETFs and over 4,000 no-load, no-transaction-fee mutual funds. Customers can also use its robo-advisor, Schwab Intelligent Portfolios, with no extra fees.

-

Accounts are free to open and charge no recurring fees

-

Access to trade stocks, ETFs, and thousands of mutual funds for free

-

Option for a no-cost robo-advisor

-

No solo 401 loans

-

High fees for some mutual fund trades and broker-assisted trades

Charles Schwab is our top choice for low fees in a solo 401 plan. Schwabs version charges no recurring fees and no setup fees. It offers commission-free trades for all stocks and ETFs as well as over 4,200 no-transaction-fee funds on the Schwab OneSource funds list. While Schwab offers excellent customer service, be aware that automated phone trades cost $5 and broker-assisted trades cost $25 each. However, many customers could use this account without paying any fees.

Schwabs Solo 401 doesnt offer 401 loans. Its active investment platform may not satiate all expert investors, and its active charting and analysis tools lag behind some other brokerage platforms for active traders. However, the pending integration of TD Ameritrade will bring the coveted thinkorswim® platform under the Schwab umbrella, which is something active traders at Schwab can look forward to.

Recommended Reading: What Is A Solar Charger

Why A Solo 401k Over A Sep Ira

Those accounts were really popular until legislation created the solo 401k, which gives business owners even more benefits. The biggest perk is that a solo 401k allows both employee and employer contributions.

So as the business owner, you can essentially contribute twice. SEP IRAs are funded through employer contributions alone.

Here are a few more reasons why more people are choosing a solo 401k over a SEP IRA:

- You can make catch-up contributions. SEP IRAs do not allow catch-up contributions for participants who are 50 and over. Catch-up contributions are an additional $6,500 for 2021.

- They allow employee deferrals. Like I was saying before, contributions can be made as an employee and as a profit-sharing contribution . This benefit allows the business owner to contribute up to $19,500 in 2021 even if the business loses money in that year.

- You can make both Roth and traditional contributions. Roth contributions are made with after-tax dollars and good if you expect to make more closer to your retirement date. Traditional contributions are taxed in retirement. SEP IRAs only allow traditional contributions.

- You can borrow from your 401k. Unlike a SEP IRA, participants can take out a loan thats equal to the lesser of 50% of your 401k balance or $50,000.

- Your spouse can make contributions. If your spouse pulls in income from your business, then they can also make contributions.

Opening A Solo 401 At Fidelity And Rolling Over My Sep

This article/post contains references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services.

At long last, Ive finally gotten around to opening a Solo 401 with Fidelity. My primary motivation for doing this is to move pre-tax contributions out of my SEP-IRA and into a qualified plan so I can convert non-deductible Traditional IRA contributions into a Roth IRA with minimal tax consequences.

If youre not sure what Im talking about, take a look at these older posts, as I dont want to re-hash everything here:

So now that you know why, lets talk a bit about how.

You May Like: How To Turn A Sole Proprietorship Into A Partnership

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

What Are The Ways To Contribute To Self

You can contribute to an individual 401 account as an employee and an employer. As an employee, the solo 401 limits for 2020 allow you to contribute the lesser of either $19,500 or 100% of your income. Participants who are 50 years and older can increase their contributions by $6,500 each year for a total of $26,000.

As an employer, the 2020 guidelines permit you to contribute up to 25% of your annual compensation, and up to a maximum of $57,000 in combined contributions per year. For 2020, the IRS limits the self-employed 401 contribution of participants 50 years and older to $63,500.

A solo 401 plan offers tax breaks if you are eligible. You can deduct the contributions from your personal income if you did not incorporate the business. If you run a corporation, you can classify the contributions as a business expense.

Recommended Reading: How Many Amps Does A 200 Watt Solar Panel Produce

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

How To Generate An Electronic Signature For A Pdf On Ios

To sign a fidelity solo 401k contribution form right from your iPhone or iPad, just follow these brief guidelines:

After its signed its up to you on how to export your 401k form: download it to your mobile device, upload it to the cloud or send it to another party via email. The signNow application is equally as efficient and powerful as the online solution is. Connect to a reliable web connection and begin executing forms with a fully legitimate eSignature within minutes.

Recommended Reading: How Much Solar Power Needed To Run A House

Who Has The Best Solo 401k

All of the providers on this list are worth checking out if you are self-employed and want to invest for retirement. That being said, heres a quick overview:

- Best for low fees: Fidelity

- Best for mutual funds: Vanguard

- Best robo advisor feature: Charles Schwab

- Best for active investors: TD Ameritrade

- Best for features: E-Trade

Personally, fees and the overall cost is one of the biggest factors I would consider. Fees can quickly add up if you are not paying attention. This can drastically eat into your retirement savings.

Lower fees = more to invest. Its that simple.

From there, Id look at who has the most investment options, followed by being able to make both traditional and Roth contributions, then being able to take out a 401k loan last of all.

Really consider your priorities, and you can make the right choice from there.

Round #3 When Is The Contribution Deadline For Solo 401 And Sep Ira

For 2020, the contribution deadline for the Solo 401 as well as the contribution deadline for the SEP IRA has been extended to May 17, 2021. This deadline is specifically for the employer contributions.

If youre setting up a solo 401 just now for the tax year 2020, you cannot contribute as an employee, unfortunately. But you can do so for the tax year 2021. The takeaway is you still have time to create and put in money to either a solo 401 or a SEP IRA, as the Employer. Make sure you do this before the deadline. Take a break from uploading your TikTok video for a day!

Round 3 Winner: Its a tie. The Solo 401 contribution deadline and SEP IRA contribution deadline are the same.

Also Check: Is Solar Good For My House

Open Fidelity Investment Account: Rolling Over From A Fidelity 401k

Open a non-prototype retirement account . Include your full Adoption Agreement and your full trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Complete the form to transfer between existing Fidelity accounts

Personalize, complete and sign the rollover acceptance sample template : If you use this template, be sure to update the information in red to reflect your information. This simple document lets Fidelity know you are accepting the rollover as the 401k plan administrator.

Mail your application along with your full Adoption Agreement and full Trust Agreement to Fidelity at:Fidelity Investments, P.O. Box 770001, Cincinnati, OH 45277-0036.

If you have any questions on completing your non-prototype retirement account application, please contact Fidelity at 544-6666.

What Is Cryptocurrency

For a growing number of investors, cryptocurrency is not only the future of money. Its an attractive and potentially profitable investment asset. At the time of writing this article , Bitcoin has made a comeback. Currently, it is over $11,000, the highest price for Bitcoin in 15 months. As the price of Bitcoin and other cryptocurrencies are rising, so is the confidence among retirement investors looking to purchase crypto.

Bitcoin has become the publics most visible and popular cryptocurrency and its among the oldest. . Over one year, the market capitalization for Bitcoin has increased enormously. In May, it was around $7.16 billion. Today, Bitcoin is at $27.9 billion.

The process of buying cryptocurrency is still somewhat unclear for a lot of people. Its not a stock or a traditional investment. For most people in the U.S., Coinbase may be the easiest option to buy cryptocurrency. This includes the most popular:

- Bitcoins

- Ethereum

- Litecoin

After verifying the account, you can add a number of payment methods. This includes credit or debit cards, U.S. bank accounts, or transfer wire funds.

Cryptocurrency transactions are not anonymous and its easy to identify the currency to a real-world identity.

Read Also: How To Read A Smart Meter With Solar Power

What Is A Solo 401

A solo 401 is a tax-advantaged retirement account for self-employed business owners. A solo 401 is the same as a large company 401 but limited to just the business owner and his spouse. Like a 401 from an employer, you may be able to make either pre-tax or after-tax contributions and take out 401 account loans. Depending on the account provider you choose, your investment choices and costs may vary.

What Is A Solo 401k

A solo 401k is a retirement plan designed for people who work for themselves. If you run a small business with no employees, you can qualify for a solo 401k.

Your spouse can qualify if he or she is involved in the business. A fellow business partner who is an owner is also eligible.

The key is that no common-law employees are eligible to participate. A solo 401k is not the right option for your business if you have employees that you want covered by a retirement plan.

This retirement plan can be a powerful tool in your savings efforts. It allows you to invest in just about anything. Investment options include stocks, mutual funds, bonds and exchange-traded funds.

Keep in mind there are some prohibited investments. Consult with your 401k custodian firm for more information.

Contributions to a solo 401k can be made on a pre-tax basis to a traditional account. They can also be made on an after-tax basis to a Roth account if your custodian offers this option.

Just like employer 401k plans, you typically cant withdraw money in a solo 401k until age 59 ½. Taking money out before then means you may pay taxes on those funds in addition to a 10% penalty.

You May Like: How Much Is Solid Gold Worth

Balances Hit A New All

- Retirement account balances are at new highs, according to Fidelity Investments.

- Thanks to the markets recent run-up and increased savings, the number of 401 and IRA millionaires also hit all-time records in the second quarter of 2021.

Although many Americans continue to face financial uncertainty due to the pandemic, the outlook for retirement savers is only improving.

Retirement account balances, which took a sharp nosedive in 2020 when the coronavirus outbreak caused economic shock waves, are now at new highs, according to the latest data from Fidelity Investments, the nation’s largest provider of 401 savings plans.

The overall average 401 balance hit $129,300 as of June 30, up 24% from the same time last year, according to Fidelity.

Individual retirement account balances were also higher reaching $134,900, on average, in the second quarter, up 21% from a year ago.

Despite Covid case numbers rising in the U.S. and around the world, the year’s market highs have been a boon for savers. In the second quarter, the S& P 500 ended up 8.2%, before retreating more recently.

Nearly 12% of workers increased their contributions during this time, while a record 37% of employers also automatically enrolled new workers in their 401 plans.

As a result, the number of 401 and IRA millionaires hit fresh highs, as well.

Together, the total number of retirement millionaires has nearly doubled from one year ago.

How Do I Open A Brokerage Account With My Solo 401k

As self-directed investing becomes more mainstream, were finding more and more brokerage houses are able/willing to open an account in the name of the Solo 401k Trust . There are many brokerage houses out there, all with distinct application processes and stringent regulatory processes to follow.

If youre opening a brokerage account with another company, youll need the information found in your Adoption Agreement and Opinion Letter. These can be found in your Solo 401k documents packet.

Below are some helpful guides and articles on how to open a brokerage account for your Solo 401k with some of the more common brokerage companies:

To fill out these applications, youll need some basic information about your Solo 401k trust. Heres where you can find this information:

-

Name/Title of trust: Page 4 of your Adoption Agreement under The Trust shall be known as

-

Trustee: Page 4 of your Adoption Agreement under Plan Trustees

-

Grantor: This is your Adopting Employer listed on page 2 of your Adoption Agreement above

-

Trust/Entity Identification Number : Page 4 of your Adoption Agreement under Trust ID Number”

Read Also: What Are Solar Panels Good For

Withdrawing Funds From A Self

As with traditional 401 plans, the self-employed 401 is intended to help you save money for retirement, and there are regulations in place to encourage you to do so. For example:

- Withdrawals prior to age 59½ may be subject to a 10% early withdrawal penalty, along with any applicable income taxes1

- You must take required minimum distributions from self-employed 401s beginning at age 722

- Plans can be structured to allow loans or hardship distributions3

- Plans can be structured to accept rollovers from other retirement accounts, including SEP IRAs and traditional 401s, into your self-employed 401

- You can roll your self-employed 401 assets into another 401 or an IRA

Because of its high contribution levels, flexible investment options, and relatively easy administration, the self-employed 401 is an attractive option for small-business owners or sole proprietors who want to be able to save aggressively for the future.

If there is the potential that your business might add employees at a later date, however, know that you will either have to convert your self-employed 401 plan to a traditional 401, or else terminate it. But if you’re confident that you will remain a one-person operation, and you want the high savings options that these plans offer, this type of account may be a good fit.