Business Licenses & Permits

Even though they do not prescribe exclusive proprietors in Texas to obtain general business licenses, there might still be some additional licenses and permits to acquire for your kind of enterprise to establish it in agreement with the local rules and regulations.

The majority of the local licenses and permits in the state are obtained at the state level since there is no general state enterprise licensing policy in Texas. You might have to inquire with the county official at the municipality where you intend to establish your enterprise which specific licenses and permits you would have to obtain to agree with their particular local licensing policies.

You can look through the local Business Licenses & Permits Guide, where you will discover all the general information concerning the licensing policy in Texas alternatively, there is online access to the BPO, the Business Permits Office.

Besides that, you will also do well to inquire whether you have to obtain specific licenses and permits for your enterprise at your particular location in the state.

Austin, San Antonio, and Corpus Christi, for instance, do have their specific local licensing rules and regulations.

Get The Legal Guidance You Need In Forming A Sole Proprietorship From Our Brazoria County Business Formation Attorneys Located In Lake Jackson

There are a variety of different types of business structures in Texas, with sole proprietorship being the simplest. It is easy to set up and involves few requirements. As opposed to businesses that require forming a separate legal entity, a sole proprietorship involves simply naming yourself as the owner and the person solely responsible for the business assets and debts.

The process is relatively simple but it is important to understand you receive NO personal liability protection with a sole proprietorship and your personal assets could be subject to judgment creditors.

If a sole proprietorship is right for you, at the Cordoba Law Firm, PLLC, our Brazoria County business formation attorneys located in Lake Jackson can help you determine whether a sole proprietorship is right for you. Working together, you can count on us to provide the trusted legal guidance you need throughout the process. Steps you will need to take include:

- Choosing the name of your sole proprietorship

- Secure any business licenses needed

- Submitting the appropriate forms to the Brazoria County Clerk to register your business

- Guiding you in state and federal tax forms that are required.

Conduct The Wind Up Process

When a corporation winds up, it is going through the process of dissolution. The corporations bylaws and the Texas BOC provide wind up procedures that the corporation must complete to dissolve.

Under the BOC, these include:

- Ceasing to carry on business, except to wind up the business

- Notifying each known claimant of the corporation of the dissolution

- Discharging all the corporations obligations and liabilities, such as debts and taxes

- Completing outstanding lawsuits

- Collecting and selling corporate property, except for the assets to be distributed to the entitys owners or members and

- Distributing any remaining assets to the shareholders.

It is important to note that all liabilities, such as creditors claims and taxes, must be satisfied before the shareholders receive any corporate assets. Additionally, if your corporation has any foreign corporations associated with it, those entities must be dissolved before your Texas corporation.

You May Like: What Can A 300 Watt Solar Panel Power

How Much Does A Dba Cost

Since a DBA isn’t a formal business structure, there are usually no additional incorporation or organization costs associated with starting one. To register a DBA, you’ll file paperwork with the Secretary of State in your state and pay filing fees ranging from $10 to $100, depending on where you live.

Reach Out To Professionals For Guidance

Every business owners situation has unique qualities that can impact what they need to do to cover all the bases when closing a sole proprietorship or partnership. To make sure no necessary tasks get overlooked, consult the expertise of a trusted business attorney and accounting professional.

This is especially important for partnerships. The businesss partnership agreement should spell out how to go about closing the business. And it should explain how assets and liabilities should be divided among the partners. Unfortunately, things can become complicated if the partnership agreement is not clear or the partners disagree with how to interpret the agreements provisions. Also, states have rules regarding some aspects of winding up a partnership. So, a lawyers assistance can help ensure a smoother process and avoid drama.

Read Also: How To Start A Sole Proprietorship In South Carolina

When Is An Llc Properly Formed

In order for one to properly understand the dissolution of an LLC, one must first understand what an LLC is and how it is properly formed. An LLC is a business structure that is created in order to protect the personal assets of the members in case the business entity is sued. In short, there are four main steps that one must follow in order to form an LLC:

If You Have Employees

You need to file additional forms for a sole proprietorship that has employees. You must check boxes on both the quarterly Form 941 and annual Form 940 that you use to file taxes for your employees. On Form 941, you will find the check box in part 3, and on Form 940 it is on the first page, as of 2010.

References

Recommended Reading: Are Solar Panels Tax Deductible

What Is A Sole Proprietorship

Sole proprietorships are the most basic form of business structure. If you dont form a business entity, like an LLC or corporation, but start conducting business, you’re automatically considered a sole proprietorship. This means your business is not an entity separate and apart from its owner and your businesss assets and liabilities are not separate from your personal assets and liabilities. This means you can be held personally liable for the debts and obligations of the business, which is one of the main differentiators from an LLC.

Advantages of a sole proprietorship

Sole proprietorships are ideal for low-risk businesses and entrepreneurs who want to test their business idea before pursuing a formal entity formation option. As such, there are many advantages.

Disadvantages of a sole proprietorship

Its important to consider the disadvantages of a sole proprietorship. While the financial savings are appealing, there are drawbacks to this business structure.

Dissolving A Corporation Before Business Commences

It has been Dan’s lifelong dream to start a company that renders great sports moments in embroidery. He has put together a board of directors and has filed the appropriate forms with the secretary of state. He will call his company “Dan’s Sports Embroidery, Inc.” In the middle of production, his older brother, Joe, a wealthy investment banker, visits Dan. Joe dismisses Dan’s business idea as ridiculous. Dan decides that he will not continue.

In many states, all Dan and his board of directors have to do is file a Notice of Dissolution with the secretary of state.

Don’t Miss: Are Tesla Solar Panels Available

Collect The Money Owed To Your Business

Once you have chosen to close your business, collect the money owed to your company so that you can pay off creditors. Consider calling the debtors to politely request the remittance of their payment. Offer a discount as an incentive for the debtor to settle what they owe to your business immediately.

Attempt to collect debts before announcing your business closure. A debtor may attempt to hold out on settling the debt if he or she has the idea that the business is closing. If you have accounts receivable, sell them to a company that purchases account receivables. Such companies will purchase your debt at a lower value and pursue the collection of the debts aggressively for their own profit. Although you will not obtain the full amount of your account receivables, you no longer need to collect any debt and will obtain access to funds quickly.

If you have any outstanding orders, fulfill them. If you are under contract to offer certain products or services, fulfill them or negotiate. It is essential to discuss matters with your clients concerning their outstanding orders and resolve such matters. If you fail to reach an agreement or compromise, you can be held accountable for breach of contract.

Contact Suppliers And Contractors

Other parties that will need to know that a business is closing are the folks who provide products and services to it and anyone the company owes money to. Not only is it polite to give them written notice, but there may also be contractual obligations, accounts payables to settle, and possibly even equipment or other property to return.

Read Also: How To Read Aps Bill With Solar

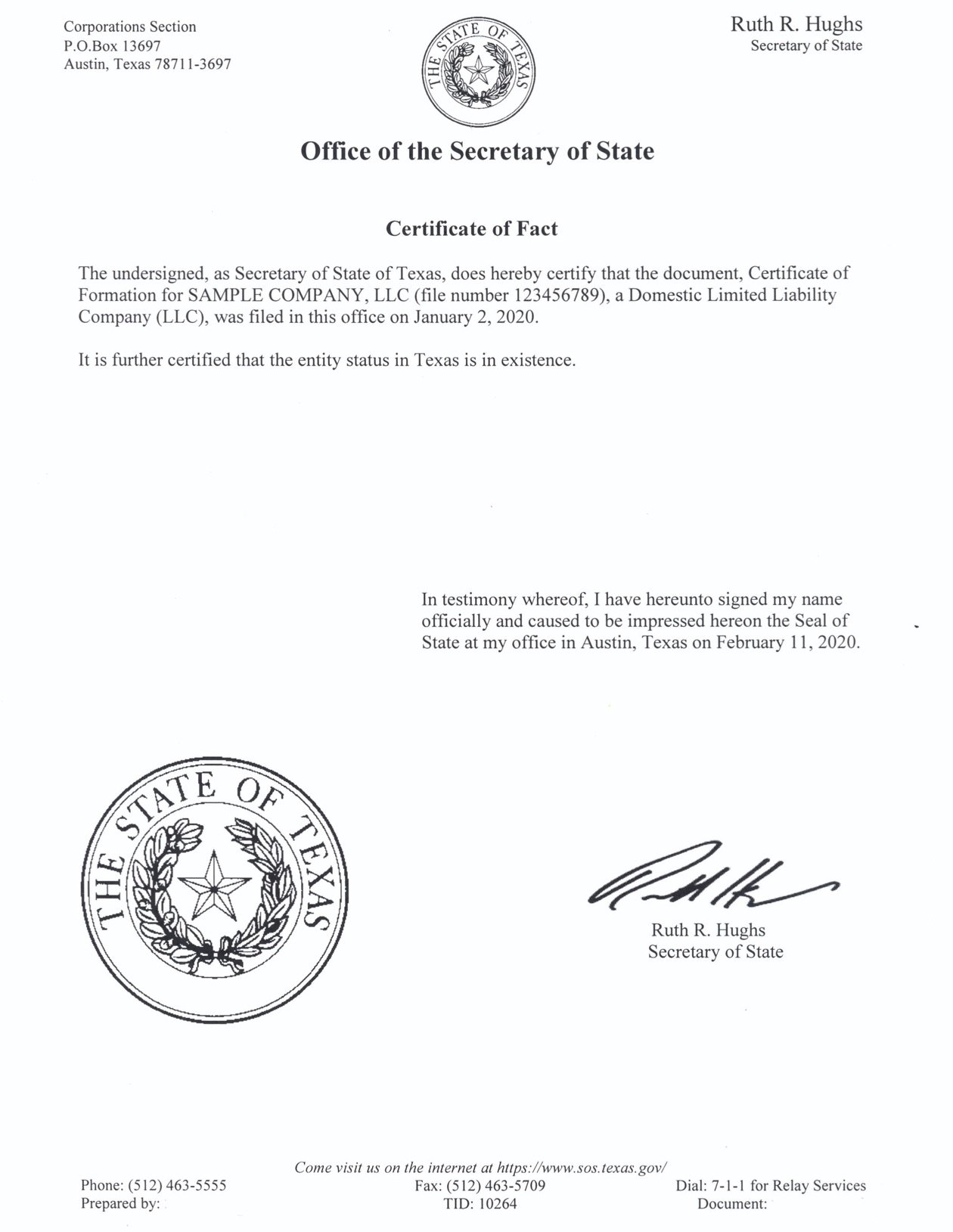

Tax Clearance And Certificate Of Account Status From The Texas Comptroller Of Public Accounts

After you have finished all of the winding up tasks required to close the LLC, then you will need to request a Certificate of Account Status from the Texas Comptroller of Public Accounts. The Certificate essentially indicates that the LLC has paid its taxes and that it can be dissolved.

To obtain a Certificate of Account Status, you will need to file Form 05-039. The Form can be submitted online or as a physical copy at a Comptroller Field Office .

What Is The Penalty If You Do Not Dissolve Properly And Just Dont File Your Annual Reports

Texas has an annual Texas Franchise Tax Report that entities must file instead of a corporate annual report. Once this annual franchise tax report is 45 days past due the entity losses its right to transact business in Texas, and after 120 days its registration is forfeited. A 5% penalty is imposed immediately once the franchise tax report is delinquent, and another 5% penalty is imposed after 30 days. If taxes and penalties and reports become 60 days delinquent, interest begins to accrue at 1% over the prime rate.

Upon the forfeiture of the right to transact business, the officers and directors of the entity become personally liable for each debt of the entity that is created or incurred in this state after the due date of the report and/or tax and before the privileges are restored. Texas Tax Code Section 171.255..

The Texas Secretary of State will forfeit your business registration if your franchise tax report is not submitted and taxes paid 120 days after the due date. You can refer to the Comptrollers Texas Franchise Tax Report and Instructions with information and a step-by-step guide regarding the Texas Franchise Tax Report.

The Texas Comptroller can assist you with your franchise tax report by email at or by calling 252-1381.

You May Like: How To Make Solar Panels In Minecraft

From Where To Start A Small Business

First, think twice, where you would like to interact with a small business. Choose a preferred state to start and obtain important information about the district.

| Wyoming |

A piece of advice. People who want to settle a small business usually select an LLC. Its easier and cheaper to start an LLC. Moreover, it separates business and private assets and keeps an owners property far from risk. If you are interested in an LLC registration, you can either apply to a good LLC service or do it yourself.

Differences Between Llc And Sole Proprietorship

There are important differences between LLCs and sole proprietorships. The most significant difference is whether you have limited liability for the business debts and obligations, as with an LLC, or whether the business liabilities and obligations fall to you personally in the event of a lawsuit or debt collection.

An LLC has distinct advantages in the areas of legal protection and liability. While there are filing fees for setting up an LLC, that cost can be well worth it when compared to the thousands of dollars you could be liable for as a sole proprietor.

On the other hand, it costs no money to start a sole proprietorship. You can also transition into an LLC or other formation option whenever youre ready. This also means dissolving your business is as simple as stopping operations .

Finally, while sole proprietorships have very few regulatory requirements, LLCs are associated with a variety of fees and filings, both initially and ongoing. This can be difficult to manage on your own, which can lead to missing important filings and, in return, incurring penalties.

Read Also: Can Sole Custody Be Changed To Joint

Should Creditors Taxing And Licensing Authorities Be Notified Of The Dissolution

Once the vote has been made to dissolve the LLC and it has been recorded in the minutes, the next step would be to notify all creditors that the LLC is being dissolved and will cease to exist. Creditors should be notified that the dissolution is going to occur and where the creditors can submit claims the deadline to do so is defined by state statute.

Once creditors have been notified, state and local taxing authorities must be notified in order to determine whether the LLC has any outstanding taxes owed. It is important to notify agencies that provided the LLC with licenses and permits of the dissolution.

Benefits Of Sole Proprietorship

Sole proprietorship is an unincorporated business that is owned by an individual. You can also choose to organize your business as a limited liability company , corporation or partnership. If you choose to establish a sole proprietorship in Texas, you do not need to file legal documents with the Texas state government when forming a sole proprietorship. You can just begin operating.

Don’t Miss: How To Remove Solar Panels

File Dissolution Forms With The State

Keep in mind that not only does the businesss partnership agreement dictate the process and rules for closing, but the state might also have rules in place for terminating partnerships.

Depending on the type of partnership e.g., limited partnership or limited liability partnership the state may require filing dissolution paperwork with the Secretary of State and paying a fee. Even general partnerships, which arent official business entities, may have to submit dissolution information or a form to notify the state about the companys intent to terminate. The names of the forms vary from state to state, with most calling them either Statement of Dissolution, Certificate of Dissolution, or Statement of Cancellation. After filing this paperwork, a partnership continues but only to wind up the business.

Again, states rules that govern partnerships vary, so business owners must review the applicable requirements in their state.

Get Legal Help Closing Your Sole Proprietorship

While winding down a sole proprietorship is typically straight-forward and much easier than shutting down a corporation or partnership, it’s still very important to follow the rules and make the process as smooth as possible. The best way to ensure that you’re properly closing your sole proprietorship is to consult with an experienced business attorney near you who can guide you through the process and answer any questions you may have.

Thank you for subscribing!

Recommended Reading: Do Solar Panels Add To Home Value

Disadvantages Of A Dba For A Sole Proprietorship

A DBA is a convenient way to create fictitious business names in multiple geographical locations, but it doesn’t always prevent others from using the same business name. To create that protection, you’d have to trademark your business name.

Although a DBA is a quick and easy way to establish, build and market your business, it won’t protect your personal assets in the event of a lawsuit against your business. If an individual files a legal action against your sole proprietorship, your personal assets are fair game.

Business owners looking to limit their legal liability may wish to consider using an LLC or a corporation instead of a sole proprietorship. An LLC is its own legal entity and protects individual personal accounts from being considered assets of the company. Cars, homes, and checking accounts for personal use are protected from a lawsuit lodged against an LLC.

How Do You Get A Tax Clearance Certificate In Texas

You need to begin with Form 05-359, Request for Certificate of Account Status to Terminate a Taxable Entitys Existence in Texas, which is obtained directly from the Comptrollers office. Follow this link to find more instructions and download the form:Texas Comptroller Tax Forms Library

You can find more information about this process on the Texas Comptrollers Website.

If you are not sure if your business is current with your tax requirements, call the Comptroller at 252-1381 or 463-4600.Send your request to:Texas Comptroller of Public AccountsP.O. Box 149348Austin, TX 78714-9348

Recommended Reading: Is Solar Really Worth It

Why Do I Need To Dissolve My Florida Company

If you are going to be ending your business, you may wonder why go forward with paying the filing fees and submitting paperwork to dissolve the company? Doesnt the business just stop once you decide to stop?

Not necessarily failing to dissolve a company properly can lead to taxes, penalties, potential lawsuits, and other fees until the company is formally dissolved with the Florida Department of State. It is more cost-effective to pay to dissolve your Florida company the right way than it is to face penalties, unknown taxes, and late fees.

Other Important Information:

When companies are going through the dissolution process, many internal factors control how the dissolution is authorized or how it occurs. A Florida companys operating agreement or corporate by-laws may require a certain percentage of the companys owners, its board of directors, or its shareholders to vote on the corporate entitys dissolution.

For paper forms, you can find company dissolution forms for all types of entities in Florida, as well as other valuable corporate forms at the state agency that handles corporate affairs the Florida Secretary of States website.

Additionally, if you need information about the cost to dissolve a company, a schedule of fees for corporations, limited liability companies, and partnerships, including fees for dissolution, we have a page that lists all of this information.

Florida Company Dissolution by Mail

Amendment Section