What Is A Limited Liability Company

A limited liability company offers new business owners something of a win-win from a tax and legal standpoint the pass-through taxation benefits of a business partnership or sole proprietorship along with the limited liability protection that comes with being a corporation.

Think of an LLC as a blend of a business partnership and a corporation.

The term limited liability means exactly that unlike a sole proprietor, a limited liability business owner is protected against lawsuits, debts, and other financial obligations related to the operation of the LLC. By and large, a limited liability company owner has largely protected himself or herself from creditors and legal trouble.

Llc Vs Sole Proprietorship: Which Should You Choose

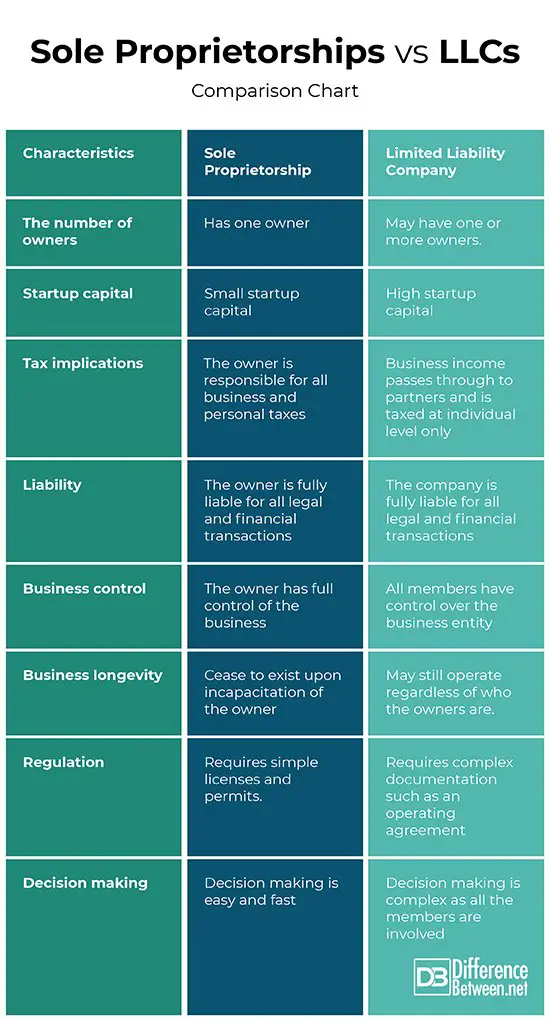

Many business owners, particularly freelancers or consultants, start out as sole proprietors because its easy. Minimal paperwork is required at the outset, and theres no big outlay of cost, which is attractive for new entrepreneurs, particularly those testing a business idea. Taxes are also simple for sole proprietors, since a separate business tax return need not be filed.

The rubber hits the road as your business starts growing. A sole proprietorship structure offers no legal protection for your personal assets, so you could end up personally bankrupt if your business doesnt succeed as planned, or faces an unexpected challenge. LLC owners, on the other hand, arent personally liable for business debts, so you get more protection in the event of a business bankruptcy or business lawsuit.

On top of this, LLCs offer tax flexibility. Most LLC owners stick with pass-through taxation, which is how sole proprietors are taxed. However, you can elect corporate tax status for your LLC if doing so will save you more money. All 50 states recognize the LLC structure to encourage small business growth. The best business structure for you will depend on many factors, and its best to consult a business lawyer before making this important decision. However, due to the combination of liability protection and tax flexibility, an LLC is often a great fit for a small business owner.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

S Corporation Business Operations

There are significant legal differences in terms of formal operational requirements, with S corporations being much more rigidly structured. The numerous internal formalities required for S corporations include strict regulations on adopting corporate bylaws, conducting initial and annual shareholders meetings, keeping and retaining company meeting minutes, and extensive regulations related to issuing stock shares.

Further, an S Corporation may use either accrual or cash basis accounting practices.

Read Also: How Many Kwh Should Solar Panels Produce

Why Would You Choose An S Corporation

An S corporation provides limited liability protection so that personal assets cannot be taken to satisfy business debts by creditors. S corporations also can help the owner save money on corporate taxes since it allows the owner to report the income thats passed through the business to the owner to be taxed at the personal income tax rate. If there will be multiple people involved in running the company, an S corp would be better than an LLC since there would be oversight via the board of directors. Also, members can be employees, and an S corp allows the members to receive cash dividends from company profits, which can be a great employee perk.

Recommended Reading: How To Obtain Sole Custody

Advantages And Disadvantages Of Sole Proprietorships

Like the LLC or SMLLC, sole proprietorships have their own advantages and disadvantages as well.

- It is considered one of the easiest and least costly business types thanks to the absence of filing fees and the need for formal agreements.

- Sole proprietorships are popular for people who want to be their own boss.

- A potential disadvantage is that courts have ruled that doing business under another name does not qualify as creating a separate and distinct legal entity from the owner.

- Insurance coverage might be pricey for sole proprietors.

- Sole proprietorships do not have access to venture capital.

- Sole proprietorships can be limited in scope and their lifetime, which means they end if the business is discontinued or the owner passes away.

Also Check: Is Solar Power Cost Effective

File Your Llc With The State

This is the step weve all been waiting for its time to officially form a limited liability company. You can do this on your own, with the help of a lawyer, or through a professional LLC filing service.

Most states offer online filing and fees for registering your LLC will vary from state to state.

To learn exactly how to complete this step for your LLC, just select your state.

Everything You Need To Know About Sole Proprietorship Vs Llc

Choosing the structure of your business as an entity is one of the most important decisions to make when it comes to being a small business owner, but it can be confusing. You need to understand your choices fully to make this decision since it will impact how much you pay in taxes, what paperwork you need to keep track of, and what happens if someone sues your company.

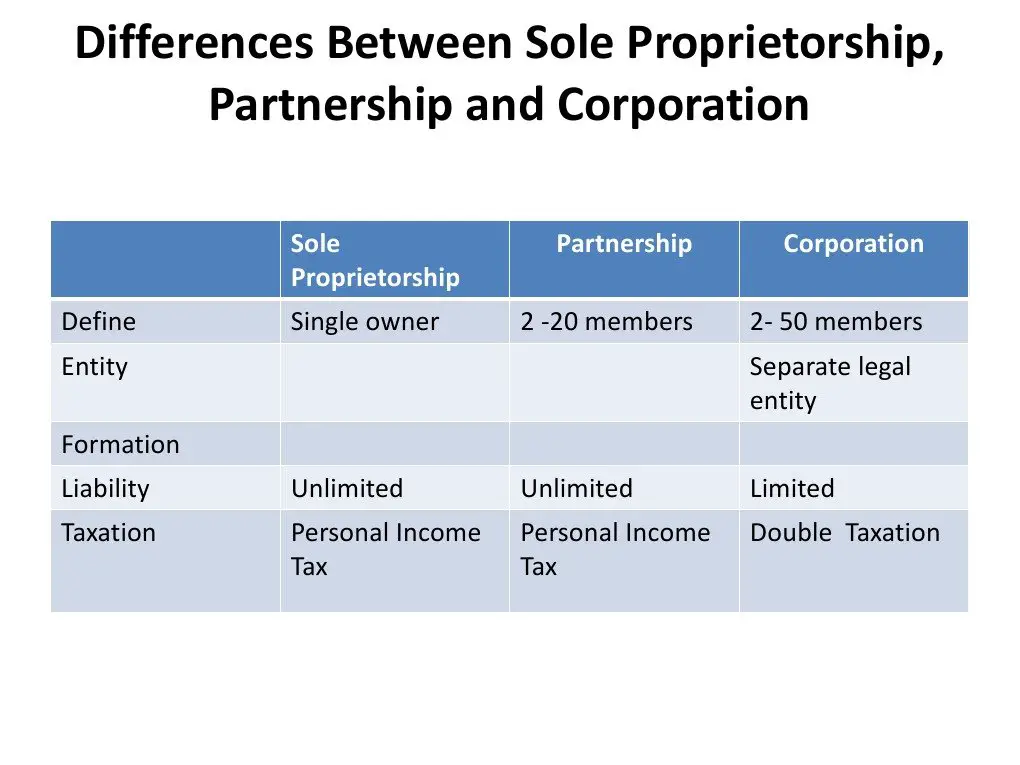

While most businesses operate as sole proprietorships, a business structure with an LLC can provide several benefits to your company. In this article, well look at the difference between LLCs vs. sole proprietorships, so we can explain exactly how they differ in terms of formation, taxes, legal protection, and more.

Recommended Reading: Is Solar Power Environmentally Friendly

Set Your Business Up For Success Regardless Of Business Structure

For first-time entrepreneurs, building a business will bring a host of considerations much different from those that come with full-time or part-time employment. As you grow your client base and hire employees, its helpful to have a support network of people whove been through similar experiences.

Coworking solutions like WeWork are ideal for this, offering a built-in community of collaborators and innovators at every office location. With a mix of entrepreneurs, startups, and established companies using WeWork, theres no shortage of expertise to call upon at times youre looking for guidance.

Growing a business can open new opportunities and lead to financial success and fulfillment. Yet to be successful, its important to choose a business structure that affords the appropriate balance of flexibility and protection. Sole proprietorships and LLCs are popular starting points for entrepreneurs, as they offer ownership, control, and protection if you need it.

For more tips on starting a business and growing a team, check out all our articles on Ideas by WeWork.

Caitlin Bishop is a writer for WeWorks Ideas by WeWork, based in New York City. Previously, she was a journalist and editor at Mamamia in Sydney, Australia, and a contributing reporter at Gotham Gazette.

Growing from a few to a few hundred employees takes strategy and the right space.

Whats The Difference Between An Llc And A Sole Proprietorship

A limited liability company is a legal entity formed at the state level. An LLC exists separately from its ownersknown as members. However, members are not personally responsible for business debts and liabilities. Instead, the LLC is responsible.

A sole proprietorship is an unincorporated business owned and run by one person. This option is the simplest, no muss, no fuss structure out there. You are entitled to all the profits of the business.

However, unlike an LLC, you are also responsible for all of the liability.

Recommended Reading: How Big Is A 1000 Watt Solar Panel

Don’t Miss: How To Keep Pigeons From Under Solar Panels

Only Llcs Can Choose Corporate Tax Status

A key difference between LLCs vs. sole proprietorships is tax flexibility. Only LLC owners can choose how they want their business to be taxed. They can either stick with the defaultpass-through taxationor elect for the LLC to be taxed as an S-corporation or C-corporation. An S-corporation is a pass-through entity. If taxed as a C-corporation, the LLC will pay a corporate income tax at the federal level .

LLCs can sometimes save money by electing corporate tax status. When a company is taxed as a corporation, dividends from the business are usually taxed at a lower rate than ordinary business income. Plus, retained earnings in a corporation arent subject to income tax. In contrast, LLC members cant treat income as dividends and must pay taxes on all profits of the business, whether retained in the company or not. A corporation is also eligible for more tax deductions and credits.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Does A Sole Proprietorship Work

What’s The Difference Between An Llc And A Sole Proprietorship

A limited liability company is a legal entity formed at the state level. An LLC exists separately from its ownersknown as members. However, members are not personally responsible for business debts and liabilities. Instead, the LLC is responsible.

A sole proprietorship is an unincorporated business owned and run by one person. This option is the simplest, no muss, no fuss structure out there. You are entitled to all the profits of the business.

However, unlike an LLC, you are also responsible for all of the liability.

How Is The Business Taxed

When tax season comes around, the difference between having an LLC versus a sole proprietorship is a big motivator for small business owners.

Tax season isn’t fun for anyone, but as a business owner starting your company, taking into account how you’ll be taxed is important.

As the business owner of a sole proprietorship, you’ll file your business taxes, along with your personal taxes. When tax season rolls around, you’ll typically file a Profit or Loss From Business , which is Schedule C .

As a sole proprietorship, taxes are paid based on the profit from your business, rather than the entire income of your business. Depending on how well your business does financially in a given year, you will usually owe fewer taxes.

As a sole proprietor, you may be eligible for certain tax deductions. We suggest consulting a tax expert or accountant to learn more about which deductions you can take.

For LLC business owners, there are several options, because the Internal Revenue Service doesn’t have a special tax classification. You can choose to be taxed as a :

- Sole proprietorship*

- C Corp

- Partnership

Keep in mind that if your LLC has more than one member, you cannot file as a sole proprietorship.

If you choose your LLC as a “disregarded entity,” your business income will be treated as your personal income, and you’ll be taxed the same as a sole proprietorship.

If you choose a different LLC status, such as a C corporation, then your income will be taxed differently.

Read Also: How To Use A Solar Generator

How To Form An S Corporation

What About Personal Liability Protection

With an LLC, your personal assets are considered hands-off when it comes to business debt collection or other claims if your company is sued. In most cases, creditors can’t touch your home, car, or personal bank accounts.

In a sole proprietorship, there is no separation between you and the business. You are entitled to all of the profits, along with all of the debts and obligations. You can even be held responsible for liabilities caused by your employees.

Recommended Reading: What Is The Best Retirement Plan For A Sole Proprietor

Llc Vs Sole Proprietorship: Business Income

Business income is treated as personal income for a sole proprietor, but an LLC can either be treated as personal income or corporate income and the business owner as an employee.

The difference can matter in several ways:

- A sole proprietor has to claim the income if it is not spent on expenses in that year, while an LLC filing as a corporation can retain the profits and only pay the 21% tax rate for corporations. This makes the income easier to reinvest than a sole proprietor.

- A limited liability company can pay dividends to the owners, which may create a more favorable tax consequence. A sole proprietorship cannot.

- A limited liability company can borrow money from its owners at a fair market rate, while a sole proprietorship cannot. This allows you to get returns on your investment until it is paid off, which qualifies as interest income for the person and a business expense for the LLC. When the LLC pays off the investor, the original capital is not taxable.

An LLC definitely has perks that a sole proprietorship doesnt have when it comes to business income. That means that LLCs take this round.

Become A Flight Attendant

Flight attendants are always on the move, and they get to travel the world for free. You do not need to worry about booking flights, hotels, or accommodations youll have a place to stay at your destination.

The downside is that flight attendant jobs are notoriously difficult to land, requiring an extensive application process and interview. The upside is that many airlines hire new flight attendants yearly, so all you have to do is keep trying.

Recommended Reading: How To Connect Solar Cells Together

What Are The Advantages Of A Sole Proprietorship

The main advantage of a sole proprietorship is that theyre very straightforward and cheap to form. The most legal costs youll have to pay will be for any licenses or permits that you need to operate your business. Youll also have complete control over everything to do with your business. Taxes are much simpler as a sole proprietor because you dont have to file separate taxes, and the tax rates are the lowest out of any business structure.

On the other hand, since there is no separation between the business owner and the business itself you are much more vulnerable to liability as a sole proprietor. If you have any employees, this risk includes them. Its also harder to raise money when you have a sole proprietorship, as you cant sell any stocks, which limits your ability to attract investors. Banks may also be very wary of lending to sole proprietors because of the liability risks.

Asset Protection And Liability

With this particular business structure, you wouldnt get the liability protections. Even if the business incurs losses or goes to bankruptcy due to multiple debts, it will be you who needs to handle the responsibility of these issues. Here, your personal liability wouldnt remain separate from the business assets.

You May Like: Where Can I Sell My Solar Panels

How The Business Is Formed

When starting your small business, the process you take to form an LLC is different than if you wanted to be a sole proprietor.

When starting an LLC, a business owner will need to name a “registered agent.” A registered agent is a person close to the business owner, such as a spouse, lawyer, or friend, who agrees to accept legal communications or other official documents in the business owners absence.

Once a small business owner names a registered agent, they need to prepare an “operating agreement.” An operating agreement details how the business will operate, who will have the power to make decisions , how profits will be allocated, and more.

Keep in mind that not all states require an operating agreement to be filed. If you’re a small business owner starting an LLC, check with your Secretary of State’s office to make sure that you’re following the state’s specific laws around filing your operating agreement.

Once an operating agreement is drafted, the small business owner typically must file “Articles of Organization” with the state, which is a collection of documents, such as the registered agents information, a business plan, and more.

There is a filing fee to register your small business as an LLC. The fee amount differs, depending on which state you’re in, and can usually range from $45 to $500.

Forming a sole proprietorship looks a little different.

If he were to invoice a customer, the small business signature would read: John Doe, DBA. Doe’s Carpentry.