The Importance Of An Operating Agreement For Single Member Llcs

While drafting an operating agreement might seem unnecessary if there are no other LLC members, this document can still put vital information about the LLC and its operations in writing. A bank may request a copy of an operating agreement for you to open an account. Potential investors will also likely want to see it as proof of LLC ownership. Other crucial reasons to draft a single-member LLC operating agreement include:

- Establishing your business assets as separate from your personal assets

- Clarifying how LLC funds are distributed to the owner for record-keeping purposes

- Specifying a successor who will run the business if you pass away or become incapacitated

- Providing lenders with information about your companys objectives and plans

- Creating rules that apply to the operations of your company that supersede the default rules set forth by state law

Even if you keep your companys assets separate from your personal finances and open a bank account in the LLCs name, creditors may raise a question regarding separation. Having an operating agreement in place can help alleviate any confusion and lend credibility to the LLCs distinct existence. Without an operating agreement, an LLC can appear more like a sole proprietorship and potentially jeopardize your liability protection.

Membership Changes And Transfers

This is where you need to think ahead a little. Things change, and even close-knit business partners sometimes need to part ways. What will you do if one of your members goes bankrupt, becomes incarcerated, or heaven forbid dies?

If your Operating Agreement doesnt address membership changes and transfers, a member can transfer their membership to any person or entity, without approval from the remaining members. This means that your LLC could someday be controlled by members you never approved.

If you want some say over how membership is transferred, its important to specify your arrangement in your Operating Agreement. For example, an Operating Agreement might specify that membership transfers be decided by a unanimous or simple majority vote.

How To Draft An Operating Agreement For Your Llc

Do you need an operating agreement when you form a limited liability company ? As a quick refresher, operating agreements are legal documents that ensure the LLC is conducted in a proper manner and protects the personal liability of the business. Most states do not require LLCs to have this document, so many LLCs choose not to draft one.

While it may not be a requirement to have an operating agreement, its actually in the best interest of an LLC to draft one. And by drafting it, Im referring to creating a . Some LLCs, depending on the number of members, may think an oral agreement is sufficient enough to run a business. However, a written operating agreement defines in writing how the LLC is run. It establishes the rules and structure for the LLC. Members may refer back to the document if they have questions. Its also readily available in the event the state questions the validity of your LLC.

Ready to draft an operating agreement for your LLC? Here are the key areas to thoroughly cover in this document.

Learn why it’s important for your LLC to have a formal operating agreement in place.

Also Check: How To Use Pine Sol On Wood Floors

Give A Complete Description Of Your Llc

Do you know that someone can define everything about your business entity by just checking out your operating agreement? An operating agreement represents a complete document that describes:

- Your business affairs

- Your business formation process

- The operating rules and procedures used during normal business transactions

- How you contribute funds for your business endeavor and share business profits

As you can see, the agreement keeps records of every aspect of your companys business formalities. You can even use it as a reference from time to time with your business partners should disputes arise.

What Is A Single

A single-member LLC is a company that has one owner and is commonly created for tax planning and to separate the owner from the assets and/or liability placed in the LLC. All revenue that is generated by a single-member LLC, and after expenses have been properly deducted, will be passed-through at the same tax rate as the owners personal level. Barring a State tax or levy, a single-member LLC does not pay taxes at the entity level. For these reasons, creating an LLC for a small business, real estate venture, or any other tangible or intangible revenue-generating asset is highly recommended.

Recommended Reading: What Type Of Batteries For Solar Lights

Claims Against The Llc

First, the LLC shields its members from individual liability from claims made against the LLC. A person with a claim against the business can recover on a judgment against the LLC only from LLC assets rather than from the personal assets of individual members. This protection is referred to as a corporate shield. People with multiple investment assets should have each asset owned by a separate LLC to isolate each LLCs exposure to only the affected LLCs own assets.

There are exceptions to this legal shield. One exception is when a member personally guarantees an LLC obligation. The creditor may sue the owner individually based on the guaranty whether or not the creditor sues the LLC. Another exception is when an LLC is established to defraud creditors. The affected creditor may pursue an action to pierce the LLC liability shield and hold the LLC owners liable.

What Should A Single Member Llc Operating Agreement Include

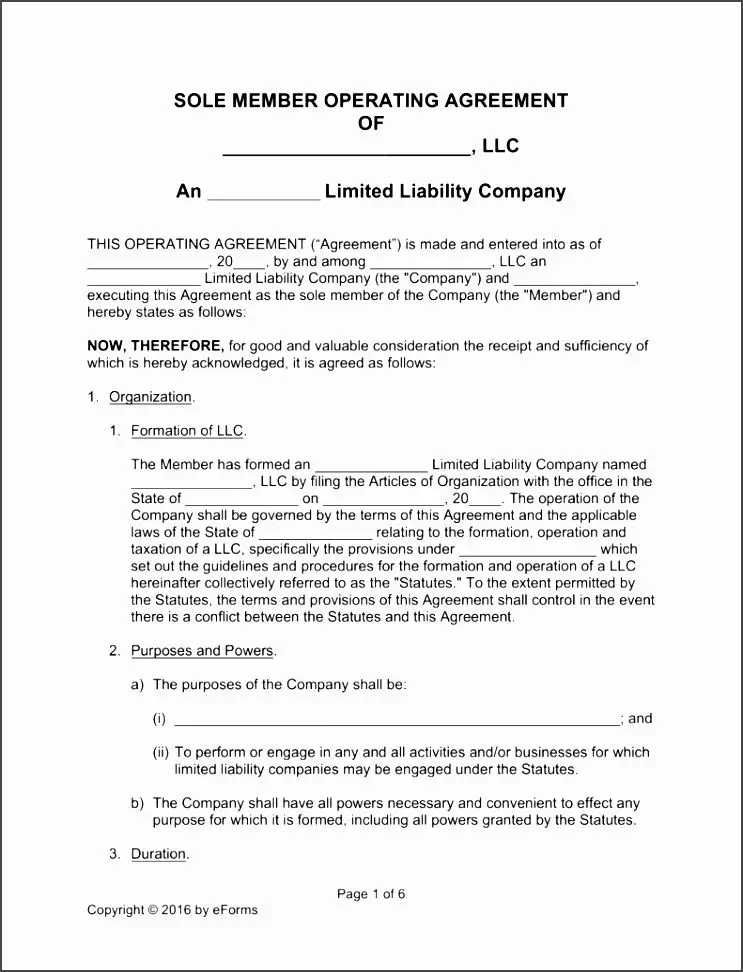

Your single member operating agreement should include information on contributions, bookkeeping, management, dissolution and more. Our free single member LLC operating agreement template covers the essential topics your LLC needs:

Article I: Company Formation

This first section of the single member LLC operating agreement basically serves 4 functions:

Affirms that the LLC has been or will be formed with the state

Lists key business information, including LLC name, registered agent, state, purpose and principal place of business

Lists the situations that can end the business

Explains how to add new members

Article II: Capital Contributions

Even though youre the one creating your LLC, you still have to buy in. In other words, youll fund the LLC with money or other assets in exchange for your ownership interest. Youll list the total value of your contributions in this section.

Article III: Profits, Losses and Distributions

Youre in business to make moneythis section explains how and when you get your money. Profits and losses are determined and allocated annually. After you pay expenses and any liabilities, you can make distributions at any time. If your company or membership interest is liquidated, distributions follow Treasury Regulations.

Article IV: Management

As the sole member, you run the show. This section spells out your powers and your responsibilities .

Article V: Compensation

Article VI: Bookkeeping

Article VII: Transfers

Article VIII: Dissolution

Exhibits

Recommended Reading: How Reliable Is Solar Power

Management For Your Llc Sole Proprietorship Operating Agreement

State whether your business is manager-managed or member-managed. If member-managed, you need to indicate your sole ownership. As a sole owner of the business, your percentage of ownership should be 100%. If your business is manager-managed, you need to state the number of managers you work with and their ownership percentages.

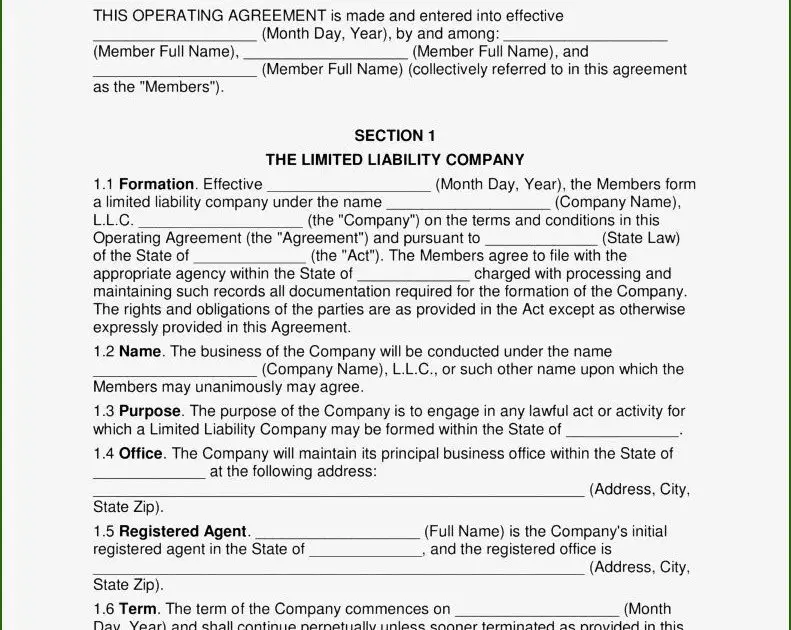

Complete Articles Of Organization

Filing for the Articles of Organization is the formal application for registering a company. This service is offered online in most States and addresses the following information:

- The effective date, that is, the 1st day of business.

- A request for the Certificate of Status, which could be an official document or seal.

- An LLC Name the selected company name must end in either Limited Liability Company or LLC.

- Name of manager

- Name of officer

- Purpose of Business

- Registered Agent who is a representative of the Company/LLC. This can be the owner, but one is recommended to use legal counsel as their representative.

This information can be categorized into the following sections:

- Company details- Details such as the official name, the Principal Place of Business , mailing address- Could the address of the principal office and the purpose of the business.

- Business purpose- Outlining the purpose of the business is another critical factor to have in an operating agreement. One may have already written this up for a business plan.

- Registered agent and office- Most U.S states will require a registered agent, which is someone one have designated to be the recipient of official documents on your businesses behalf. Its essential to check if the state requires a registered agent. Otherwise, one may incur penalties or, even worse, be prohibited from doing any business.

Read Also: Do You Have To Pay For Electricity With Solar Panels

Single Member Llc Colorado Filing Requirements & Benefits

Registering as a Colorado entity, you can maintain the level of control needed to operate the company. The LLC owner also avoids personal liability so long as they follow the letter of Colorado LLC laws.

The filing requirements for a single member Colorado LLC is the same as for a non-single member LLC. Regardless of the type of filings, business owners must comply with the LLC statute or run the risk of personal liability. Note that you do have to file proper articles of organization

Flow-through taxation is always a benefit to becoming a single member owner LLC limited liability company. This means that the business tax benefits also flow through to your personal taxes.

Colorado LLC Personal liability protection. So long as business owners follow the rules, they can be immune from personal liability. Make sure that you have an LLC partnership agreement in place.

The Default Rules Of The State Get Triggered

In the case of a single-person LLC without an operating agreement, the rules that are dictated by the state might kick in at any time. Certain terms are especially dictated in an operating agreement. Without that, the default rules which are set by the state of operation will be considered actionable.

These default rules are made to safeguard the intention of the general public and are very basic and rudimentary.

Recommended Reading: How To Open Sole Proprietorship Bank Account

Process For Adding New Members To The Llc

State whether you will accept new members in the future or not. Outline the formula for recruiting new members into this type of business entity. You need to develop business structures that can accommodate other business people. With proper structure, other business people can understand your form of business organization.

Free Single Member Llc Operating Agreement Templates

A Single-Member LLC Operating Agreement is written for a limited liability company having only one owner. It is used as proof of the limited liability awarded to an owner by the LLC business structure, where the company is taken as a separate entity from the sole owners personal property/assets. It outlines the owner, manager, registered agent, and other officers role in the company.

The IRS adopted definition of a single member is as illustrated:

An LLC is an entity created by state statute. An LLC with only one member is treated as an entity disregarded as separate from its owner for income tax purposes unless it files Form 8832 and affirmatively elects to be treated as a corporation.

A Single-Member Limited Liability Company operating agreement is basically a guide on how a given single-member LLC is expected to be run. Single-member LLC companies are usually set up as a means of tax planning and for the owner to enjoy the benefits of limited liability that stem from an LLC business structure. An LLC owner does not pay tax as an entity, as the single-member LLC is exempted from state tax or levy, but rather as individual taxpayers after revenue has been collected and expenses deducted. As a result, setting up an LLC for small businesses, real estate ventures, or any other tangible or intangible income-generating assets is highly recommended. It is important to note that a single-member LLC enjoys the same tax exemptions as a multi-member LLC.

Recommended Reading: How Strong Are Solar Panels

Single Member Llc Colorado & Operating Agreements

Failure to Grasp the Basics Of Forming a Single Member Can Leave Exposed to Personal Liability and Creditors

Get help with Colorado LLC operating agreement single member companies

There are various types of business entities under the various state laws. In the case of a single-member LLC under LLC Colorado laws, this business entity only has one member. If you are reading this article, you probably already know that having a sole proprietorship is one of the riskiest business strategies to use.

Unless the business owner chooses to become a disregarded company for tax purposes, the IRS will treat your business as a corporation. The process and filing requirements are no different from the traditional LLC.

Knowing how to start an LLC in Colorado means more than simply filing with the Secretary of State. About 28% of business owners find themselves personally liable for business actions because they dont understand the rules of how to start an LLC in Colorado. You have to avoid this peril at all costs.

A limited liability company in Colorado is driven by Colorado LLC laws. If you are considering registering a single owner LLC in Colorado or not, it is important to know that the IRS looks at the LLC formation based on the number of members. The business will either be treated as a corporation or business partnership.

Write A Smllc Operating Agreement

An operating agreement will highlight how ownership of the LLC is held. It also directs on how succession would be distributed in the event of the death of the owner. This way, disputes are avoided as no one other than the declared party has a claim to the company. Verbal promises would not hold if the operating agreement were available in writing.

Read Also: What Can You Do With Solar Panels

The Debate Around Single

So the question you must be asking yourself, the thing all of us single member small business owners ask ourselves, is why would I need an operating agreement with myself? Well, there is an excellent really good reason for protection!

So if you are starting a business you want to make sure you have all of your legal paperwork in place. In researching your states requirements you might even discover that youre not legally required to have an operating agreement for your LLC. .

An Operating Agreement Governs Internal Operations As Directed By The Business Owner

The way your business operates is important to you, and is important to set out basic operations from the very beginning. This need is very pressing, especially in the case of an LLC starting with multiple members, but is also very important even in a single-member LLC.

When there are multiple members in an LLC it is very obvious that each members voting rights, ownership interest, and share of profits must be addressed and recorded. That is the reason you are going into business. But single-member LLCs should also create an operating agreement.

Here are some reasons why:

1) an operating agreement describes your business and helps you keep proper records ,

2) an operating agreement helps separate the business from the owner ,

3) an operating agreement clarifies what happens if you die or are unable to run the business, and

4) you avoid any Missouri default LLC organization rules that you may want to avoid.

An operating agreement is a crucial piece of an LLC and one that should be given careful attention.

You should always have an operating agreement in place to avoid such confusion, expense, and potential for unsatisfactory results in the future.

This is one of those places, as a small business owner, it really pays to hire an attorney. It is worth the expense of a well-drafted operating agreement to avoid costly litigation and disagreements in the future.

Also Check: When Do Babies Eat Solid Food

Do I Need An Operating Agreement For A Single

The short answer! Yes, yes you do. Some states do not require a comprehensive operating agreement for LLC sole proprietorship, asking only for articles of organization. However, the state of California does require an LLC sole proprietorship operating agreement. Even when the business has one owner, you must have an operating agreement at the state and federal level.

Even if it wasnt required, theres a compelling argument to be made for including an LLC sole proprietorship operating agreement along with your articles of organization. Heres how this crucial document can help with your business affairs.

It Solidifies Central Agreements Between Members

As part of forming their business, members of an LLC must agree upon a division of rights, duties, ownership, compensation and more. Going forward, LLCs may find few, if any, other ways to enforce these initial guidelines other than an operating agreement. Without proper documentation, members might not find any legal disincentive to later disregard a companys foundational agreements. An operating agreement may be the only document addressing the companys ownership percentages.

Also Check: How Much Do Save With Solar Panels

Is My California Operating Agreement On The Public Record

No. Though California law requires you to have an Operating Agreement for your LLC, it doesnt require you to file it anywhere. Your California Operating Agreement is an internal document. You may need to show it to banks, lenders, or other California agencies, but your Operating Agreement wont be posted online or entered into the public record.

However, plenty of other documents you file will become part of the public record, like your Articles of Organization and your Statement of Information. This means that your business address will be posted on the California Secretary of States website, exposing your privacy. We value privacy, so we came up with a solution: well let you use our California business address when you hire us.