Monthly Credit Card Revenue

Businesses applying for merchant services accounts will need to supply estimates of their monthly credit card volume or the processing history and average volume of monthly credit card revenue of their current merchant account.

Some merchant account providers ask for additional documentation as well, such as financial statements and bank account statements.

What You Need To Open A Business Bank Account

What you need to open a business bank account will vary depending on your type of business entity, the state you live in, and where your business was established. Some banks also ask for more documentation than others. Its typically simpler to open a business bank account online.

Hereâs what you need to open a business bank account:

Certificate Of Assumed Name

Many businesses operate under a trade name that is different from their legal name. For example, ABC Bakery, LLC, might operate as ABCs. If this is true in your case, youâll need to file a fictitious business name, also known as a doing business as name , with your states secretary of state. The bank will ask for a copy of your DBA filing documents as proof of your businesss trade name.

Also Check: What Does Solar Energy Mean

Which Bank Should I Choose

There are many international banks operating in Malaysia, so it’s worth talking to your home bank to see if you can transfer your account over to their local brand. If that’s not possible, then one of the Malaysian Big Four is a safe bet. Start off your search for the perfect account with the following:

Maybank

Maybank has a dedicated portfolio of banking products suited to small and medium sized enterprises. As well as currency accounts and payment cards, you can get overdrafts and loans to grow your business. As Malaysias largest bank, Maybank has a good branch and ATM network, and operates across the whole Asian region.

CIMB Bank

CIMB Bank offers banking for businesses via their branches or online. You can also work with a dedicated relationship manager at a branch who will help with developing your business. There are over 1080 branches across the region, making CIMB one of the best networked banks available.

Public Bank Berhad

With a 50 year history, Public Bank Berhad is well established in the region. You can access a full range of financial products for your business, including business current accounts for both residents and non-residents. Accounts can be opened with a minimum opening deposit of RM3000 for sole traders, and RM5000 for larger businesses.

RHB Bank

Whats The Process For Opening A Business Bank Account In Malaysia

Opening a business bank account in Malaysia shouldn’t be a difficult process, but different bank branches might be more or less stringent in how they apply the process. For example, it’s normal to have an introduction to a bank by an existing customer, but some branches might be able to waive this if you’re unable to get a recommendation.

The specific documents needed will vary between banks, but typically include the following:

- Letter of introduction and recommendation from an existing customer of your chosen bank

- Company rubber stamp

- Company details such as proof of proper registration and address

- Approval to open the account from all directors, confirmed in a company resolution

As the requirements can vary, you should call ahead to check which specific documents your chosen branch needs.

Also Check: How To Design Solar Power System

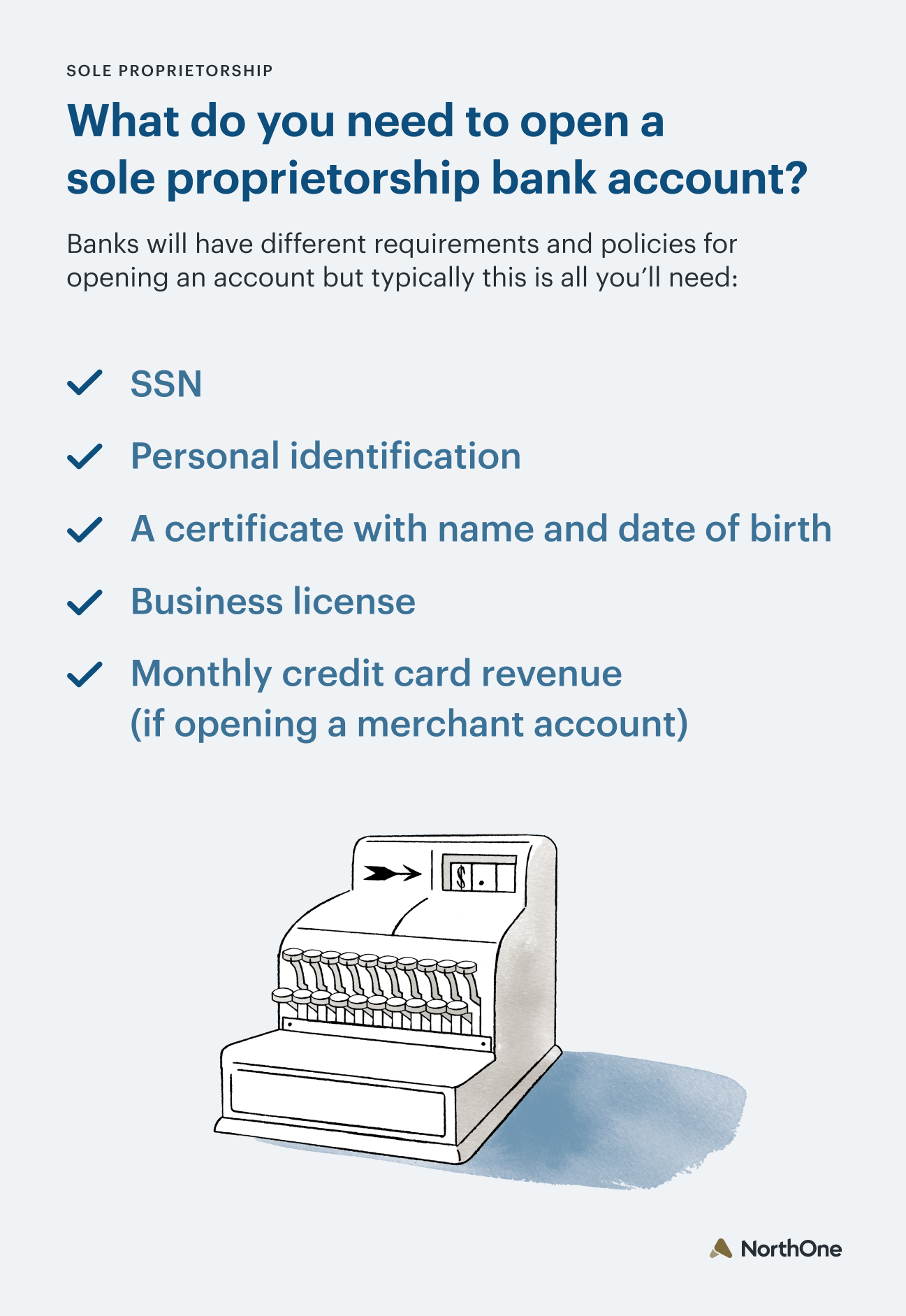

What Does A Sole Proprietor Need To Open A Business Bank Account

It is actually pretty easy for a sole proprietor or DBA to get a business bank account. Some banks even allow you to sign up online. You just need to have the proper business documentation. Requirements vary, so it is a good idea to contact your bank to see exactly what documents you will need. Most banks have this information on their website. Generally, sole proprietors need to show:

- A Social Security Number or Tax ID Number Many sole proprietors may open an account with only their own Social Security Number or their businesss Federal Tax ID Number. To get a tax ID number instantly, visit www.IRS.gov.

- A Business License Business licensing requirements vary from state to state. Only a few states have a general statewide business license requirement. Most businesses are licensed at the city or county level. The Small Business Administration provides links to each states licensing directory, so you should start by browsing the SBA License and Permit Directory.

- An Assumed Name or Trade Name Certificate If your sole proprietorship operates under a name other than your own legal name, you will need to show the bank an Assumed Name Certificate or a Trade Name Certificate. This is the certificate you receive from the state when you register your assumed name or trade name.

Which Bank Should I Choose To Start My Business Account In Singapore

The Accounting and Corporate Regulatory Authority requires all businesses in Singapore set up a bank account. With more than 200 banks present in Singapore, it can get a little confusing to choose one that suit your business the most. Read on to check out our ranking of the top banks in Singapore for entrepreneurs and founders, as well as a great solution for entrepreneurs: ASPIRE.

Don’t Miss: Is Dba Same As Sole Proprietorship

Do I Need To Open A Business Bank Account

The short answer is: More than likely, yes. You might be wondering, Why do I need to open a business bank account? The IRS recommends keeping separate business and personal accounts for easier recordkeeping.

Some businesses are legally required to open a separate business bank account. And even if you dont legally need to separate funds, you may want to.

How To Add A Dba To A Bank Account

BankersOnline.com For bankers. From bankers. Business Acct. w/DBA-Add as Signer as Well? A wife requests to open a business account and add a DBA listing her husbands name. The account set up would be: Jane Doe DBA John Doe. Jane Doe is listed as the owner/signer on the account and then her husbands name listed as the DBA on the account.

Read Also: How Many Solar Panels Are Needed To Run A House

Can I Use A Personal Bank Account For A Sole Proprietorship

You can use a personal bank account for your sole proprietorship because its not considered a separate business identity. However, if your sole proprietorship is more than a part-time side gig, a business checking account is a better option. It can help keep your business finances separate from your personal finances and make business finances more manageable.

The Identity Proofs Of Sole Proprietor

The following are the required identity proofs out of which only one is mandatory.

- A Pan Card in the sole proprietor is mandatory

- Voter Identity Card that is the Election Card

- Driving License

- Utility bills such as Electricity bill, Telephone bill which should not be older than 3 months

- Water tax bill along with receipt which should not be older than 6 months

- Property Tax bill which should be less than one year old along with Tax payment receipts

- A latest Three months Bank Statement from scheduled commercial bank with account opening cheque/Bank passbook/Original letter from existing banker with account opening cheque

- Consumer gas connection card/Passbook along with the receipt of gas supply which should not be older than 3 months

- Registered Lease & Licence Agreement along with utility bill which should not be older than 3 months in the name of the landlord

With respect to the above documents and information, a Banker can open a current account in the name of the Sole Proprietorship Business.

Also Check: What Is The Difference Between Sole Proprietorship And Corporation

The Documentations Which Are Required For Opening A Proprietorship Bank Account

On the basis of the guidelines issued by the RBI, there are various banks which have enacted procedures and list of documents required for opening a current account in the name of a Sole Proprietorship firm. There is a list of bank of documents which required for opening Proprietorship Bank Account:

Trust Society Association & Club

List of documents & details to be submitted are as follows :

Note:

Read Also: Where Are Rec Solar Panels Manufactured

Can You Open A Bank Account For A Dba/sole Proprietorship

Yes, you can open a business bank account as a sole proprietor using a DBA. A sole proprietorship is a business owned by one person where there is no legal separation between the owner and the business. A DBA, or doing business as, is the name adopted by a business other than its true legal name. If Bob Smith, a sole proprietor, operates a business under the name Premier Painting, he needs to register the name as a DBA before trying to open a bank account. Usually, it is the secretary of state or the local county clerk that handles DBA registrations.

Is It Better To Apply In Person Or Online

Rampenthal said that some banks do not offer the option of opening a business account online, either to reduce the risk of identity theft or due to the nature of certain businesses.

Banks that do offer the option of applying for a business bank account online may take more time to review your documents and set up the account than they would if you applied in person.

If the bank you choose offers both application options, you’ll need to decide which option is more preferable: the convenience of applying online but waiting longer for your account to be set up or applying in person and having your account set up the same day.

Matt D’Angelo and Simone Johnson contributed to the reporting and writing in this article. Some interviews were conducted for a previous version of this article.

Recommended Reading: How To Find Solo Travellers

Some Practical Advice On This Crucial First Step For Every Business

By David M. Steingold, Contributing Author

One of the most basic tasks when starting any small business is to set up a business bank account. Having a separate account for your business is a good idea for a number of reasons, and the process of establishing the account is usually quick and easyif you take a little time to pull together the necessary documents before dealing with the bank.

Is It Necessary For A Proprietor To Open A Bank Account

When somebody registers as a sole proprietorship one is, in most cases, registering a name other than that of ones own. If an individual wishes cheques to be made out in the name of a sole proprietorship, then he/she has to open up a separate account. Otherwise, the bank did not accept cheques. If the person is operating a sole proprietorship under his/her own personal name then s/he can operate out of a personal account.

Sometimes there may be a benefit to having a separate account set up so that one can keep track of deposits and withdrawals and other important details relating specifically to that business.

Recommended Reading: How To Convert Your Home To Solar Energy

Find Out Which Documents And Licenses You’ll Need To Bring With You When You Apply For A Business Bank Account

- To open a business bank account, you will need your articles of incorporation, employer identification number and personal identification documents.

- You can set up a business checking and savings account.

- A business bank account is necessary to keep your business and personal finances separate.

- This article is for small business owners who are interested in opening a business bank account and want to know what they need to get started.

Business bank accounts help you manage your business finances in a professional manner and separate those funds from your personal finances. Opening a business bank account requires more effort than opening a personal account. There are documents to gather, names to be determined and licenses to get in order. Learn why you should have a business bank account and what you need to do to open one.

How To Waive The Monthly Maintenance Fees

Gold Business Checking Package

You can waive the monthly maintenance fee with one of the following:

- U.S. Bank Payment Solutions Merchant Account

- $10,000 average collected checking balance or $25,000 average collected checking balance on interest-bearing option

- $20,000 in combined average collected deposit balances4 or $50,000 in combined average collected balance on interest-bearing option4

- $50,000 combined average collected business deposits and outstanding business credit balances5

- $75,000 in combined business deposit and outstanding business credit

Platinum Business Checking Package

You can waive the monthly maintenance fee with one of the following:

- $25,000 average collected checking balance

- $75,000 combined average collected business deposits4 and outstanding business credit balances5

Premium Business Checking Account

Analyzed account 3 maintenance and transaction fees can be offset by an earnings credit based on account balance.

You May Like: How Much Solar Do I Need Rv

Social Security Card Or Employer Identification Number

Every business must have a tax identification number for federal income tax purposes. For sole proprietorships, this number may be the business owner’s personal Social Security number, which should be presented to open a DBA bank account.

Partnerships, limited liability companies , and other business structures are required to have an employer identification number to conduct business and must provide proof of that EIN to open a DBA bank account. Note that sole proprietorships may also choose to use an EIN instead of a personal Social Security number to operate a business, in which case they would need to provide the EIN to the bank in order to open a DBA account.

Gives Your Business A Professional Image

Lets say your sole proprietorship supplies groceries to schools in your community. After making the deliveries and sending the invoices, your clients ask for your payment information.

You give them bank account details as follows:

John J. Doe

A/C 1234567, ABC Bank.

What impression will your clients get?

While some might understand that your business is likely a sole proprietorship, their perception of your services might change. Organizations want to do business with other organizations. The only time they want to be sending out money to individuals is when theyre paying their employees.

Now picture the following bank details:

J.J Fresh Groceries

A/C 7654321, ABC Bank.

Doesnt this look more professional?

Its no secret that having a dedicated business bank account for your business gives your business a professional image, especially if your model requires clients to make payments into your account. A professional image not only improves customer loyalty but also helps you attract others.

You May Like: Do Solar Attic Fans Work At Night

Types Of Business Bank Account

There are three main types of business bank accounts:

- Business checking account: Use a business checking account for everyday business transactions.

- Business savings account: Use a business savings account to store surplus cash and build interest.

- Merchant services account: Use a merchant account if your business accepts credit card payments. Merchant account providers front you payment for your sales before the customer pays their credit card company. You need to have a business checking account before you can open a merchant account.

Bank Account For Sole Proprietorship

The Reserve Bank of India has laid out Know Your Customer norms for opening of the current account in the name of a sole proprietorship and all Banks have the procedure to open sole proprietorship current account in the business name. The RBI has widely prescribed the following to be adopted by banks as KYC norms for opening of sole proprietorship current account:

Any two of the above documents would be sufficient for opening of sole proprietorship current account. The RBI KYC norms also mention that these documents should be in the name of the proprietorship.

Read Also: Is My House Good For Solar Map

How Do You Open A Business Bank Account

Some banks allow you to open a business bank account online. Other banks ask that you appear in person with your documentation to open the account. If you arent sure, just call ahead or check the banks website regarding their specific requirements. Dont waste your time making multiple trips to the bank when you should be focused on getting your business off the ground!

Fund Your New Account

Once your account is open, youll need to make your first deposit. With most business accounts, you can fund your account easily with an electronic transfer from another bank account. This is especially true for digital and online-only banks, which dont typically allow cash deposits. However, if your bank does allow for cash deposits, you can make a deposit inside the branch or through an ATM.

Some banks have an initial probationary period where deposited checks may be held longer than normal for additional verification. When a bank places a hold, you wont have access to your funds until the hold has expired. This cautionary period usually lasts from one to six months, depending on the bank. However, as long as you maintain consistent activity, any new account restrictions should be lifted after the probationary period.

Tip: Make your first deposit using an electronic transfer or cash instead of checks for immediate access to funds.

You May Like: How To File Taxes As A Sole Proprietor