Try The Incorporation Wizard

Its pretty difficult to choose which business structure is right for you. One of our favorite resources in BizFilings Incorporation Wizard, which allows you to input some information about your company to help determine what structure is right for you. Every business is different, which is why we highly recommend hiring an accountant or lawyer to help you make the decision thats right for you.

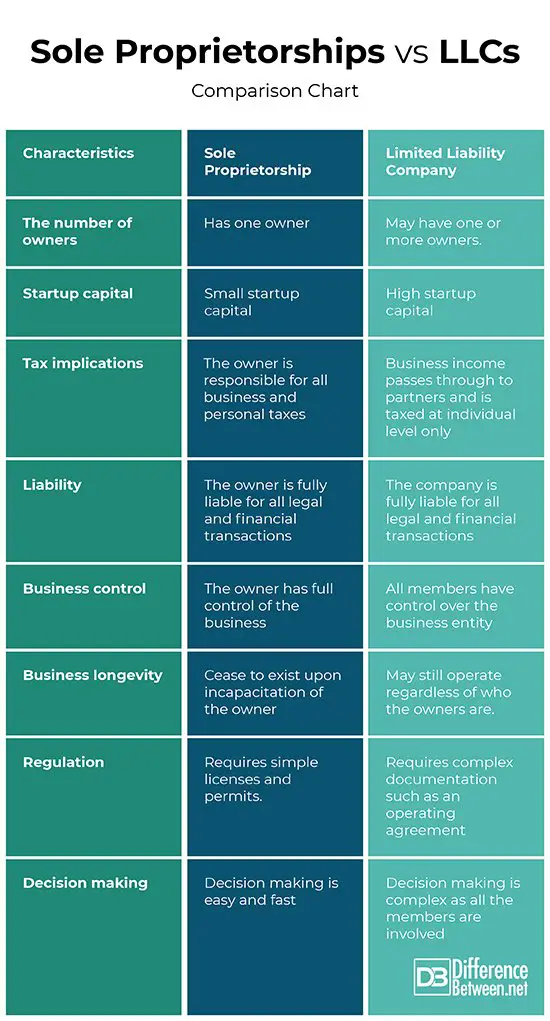

Llc Vs Sole Proprietorship: Taxes

A single-member LLC and a sole proprietorship resemble each other in terms of tax treatment. Both are pass-through entities, which means that the business itself doesnt pay income taxes. The owner reports business income on a Schedule C thats attached to their personal tax return, and the income gets taxed at the owners personal income tax rate.

Multi-member LLCs are also pass-through entities, with each owner reporting and paying taxes on their share of the businesss income. The only difference is that a multi-member LLC must file a business tax return with the IRS, Form 1065, U.S. Return of Partnership Income. In addition, each member must attach a Schedule K-1 to their personal tax return, which shows their share of the businesss income.

In addition to income taxes, both LLCs and sole proprietorships might have additional tax responsibilities. No matter which business structure you adopt, youll need to pay payroll taxes if you have employees. Youll also need to collect state and local sales taxes if you sell taxable goods or services. And finally, as a self-employed business owner, youre responsible for paying self-employment taxes to the IRS. These taxes cover your social security and Medicare tax obligations.

A few states and local jurisdictions levy additional taxes on LLCs. Depending on the state, this might be called a franchise tax, LLC tax, or business tax. Youll also have to pay state and local income taxes and payroll taxes.

What Is An Independent Contractor

A self-employed person is an independent contractor who works for someone else and provides services to an employer. However, an independent contractor isnt an employee. An independent contractor is usually a skilled or creative person.

This kind of person can be an IT professional, photographer, or even a rideshare driver.

Independent contractors are paid based on their work, either by the job or by the hour. Unless theyre subject to backup withholding, there arent any payroll taxes withheld from an independent contractors paychecks.

At the end of the year, an independent contractor will receive a 1099-MISC form. This form will show all of the income they received from the companies they worked for. This form is similar to the W-2 forms that are given to employees.

Because an independent contractor isnt hired as an employee, there arent any payroll taxes deducted from payments to that worker. This means that the independent contractor is responsible for paying income taxes and self-employment taxes .

You May Like: What Is The Carbon Footprint Of Making A Solar Panel

Llc Vs Sole Proprietorship: Formation

You might be surprised to learn that theres nothing specific you necessarily need to do to form a sole proprietorship. In fact, you might be operating a sole proprietorship without even knowing it. Any person selling goods and services without a partner is a sole proprietor by default. Depending on where your business is located, you might need to apply for business licenses or zoning permits to legally operate your sole proprietorship. And any business, including a sole proprietorship, that operates under a trade name, needs to apply for a fictitious business name, also known as a DBA or doing business as certificate. However, thats it as far as formation paperwork goes, making sole proprietorships the easiest and least expensive type of business to start.

An LLC might also need to file for business permits and a DBA . But the most important formation document for an LLC is called the articles of organization. This document establishes your LLCs existence and must be filed with the state in which youre operating. The cost to file articles of organization varies by state, but generally ranges between $50 to $200.

Sole Proprietorship And Partnership Taxes

Both business types are “pass-through entities,” which means that the business does not pay corporate tax. Instead, the income “passes through” the entity, and the owners pay taxes on their personal tax return. Owners of both entities pay self-employment tax on their portion of the income but can enjoy the 20% pass-through deduction to reduce their personal tax burden, which you can read more about here.

While the IRS taxes each entity similarly, how the owners of each entity report their income is different:

- Sole proprietors report profits and losses from their business on their personal tax returns, using Schedule C. They submit only one return.

- Partnership owners file two returns: They submit Form 1065, which is its own informational tax return. Because the partnership has allocated a portion of the profits and losses to each partner, each partner reports their portion on their personal tax returns, using Schedule E.

Read Also: What Are The First Solid Foods For Baby

What Is A Sole Proprietor

A sole proprietor is a one-person business that isnt registered as a business entity with a state. Examples of a business entity include an LLC, partnership, and corporation. Basically, a sole proprietor is the default kind of business for income tax reasons.

If you start your own business, count your personal income and expenses separately from your business income and expenses, and you dont do anything to register the business with your state, then youll have to pay business taxes as a sole proprietor.

Overwhelmed By The Paperwork

There are many helpful online services that will aid you in the process of forming your business. Not only do they do most of the work for you, they provide step-by-step instructions, filing expertise, customer service and personalized legal protection. On top of everything else, they save time and almost always save you money!

Read Also: How Do Solar Panel Kits Work

What You Need For Articles Of Incorporation

Below is the information youll need to prepare in order to file your articles of incorporation, a process that Ownr will guide you through when you create an account and choose to incorporate your business.

- Name of your business

- Physical address of head office

- All the names and full addresses of directors

- Citizenship status of directors

- Officer roles

Establishing credibility takes time, and a quick win is incorporating your business. Many customers and suppliers have a preference to do business with established businesses. Incorporating your business establishes a start date to show how long you have been running a legitimate business.

Whatever you decide, the most important thing to know is starting a business is an incredible opportunity to make your dreams a reality.

Theres definitely more to running a business than paperwork, but its nice to know youve set yourself up for success from a legal perspective. Ownr makes it easy, giving you more time to concentrate on doing the things only you know how to do, and grow your business.

Ownr is here to help you start your business today. If you have questions about how Ownr can help you register or incorporate a business, any of our promotions give our customer success team a call at 1-800-766-6302 Monday through Friday 9am-5pm EST.

Alternatively, you can also book a free 30-min session to ask all your questions 1:1 with a member of our customer success team. Schedule a session here.

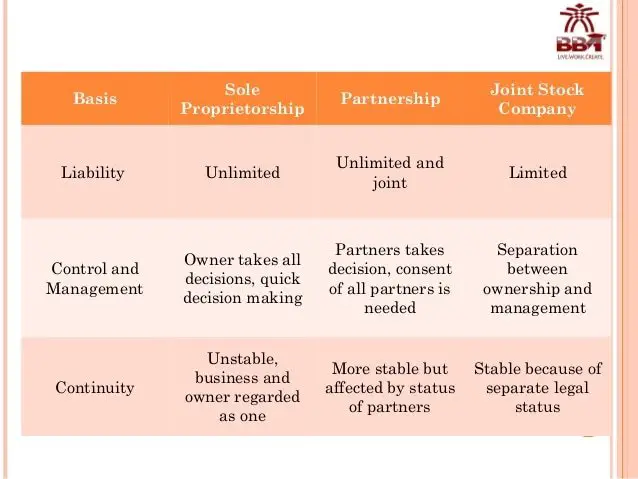

Sole Proprietorship And Corporation Comparison

The biggest advantage of starting a corporation vs. sole proprietorship by far is the personal asset protection that shareholders have in the event the corporation is sued or owes a debt. With a sole proprietorship, the owner is completely responsible for any liabilities or debts of their business which can be an immense risk.

Moreover, corporations can claim self-employment tax savings among other tax benefits, while sole proprietorships offer no tax benefits as an informal business structure. In contrast, sole proprietorships save money with the low cost to establish this business structure, plus they arent liable for unemployment insurance.

Essentially, choosing to form a corporation vs. a sole proprietorship comes down to just a few things:

- Whether your business is small enough to act as an extension of yourself, allowing you to comfortably assume the financial responsibility of your business

- If your business can anticipate the level of growth that will benefit from tax savings, investment opportunity, and personal asset protection offered by a corporation.

Don’t Miss: How Many Solar Panels Would I Need

When To Operate As A Sole Proprietorship

Sole proprietorships are best for businesses with these characteristics:

- They MUST be low risk

- They have a smaller customer base often friends, family, and neighbors

- They might be hobbies like photography, blogging, or video streaming

Sole Proprietorship Advantages

The biggest advantage of starting a sole proprietorship is simplicity it couldn’t be any easier or less expensive to get a business up and running.

Sole Proprietorship Disadvantages

No Personal Liability Protection. Sole proprietorships don’t offer personal liability protection. This means your personal assets are at risk in the event your business is sued or if it defaults on a debt.

Zero Tax Benefits. Sole proprietors pay self-employment taxes and income taxes on their net profit. When a business becomes profitable, it will be very expensive to be taxed as an informal business structure.

Limited Growth Potential. High tax burden and lack of liability protection can keep a business from being successful.

Reduced Credibility and Branding Opportunities. A sole proprietor or partnership must invoice, receive payment, open a bank account, and market with their surname unless their state allows them to register and maintain a doing business as name.

Choosing A State To Incorporate

Since taxes, prices and corporate laws are not the same in every state, it is important to consider your home states advantages and disadvantages when it comes to forming your business.

Some things to consider when youre shopping for states:

- Is it worth incorporating outside your home state , even if that means paying extra tax fees?

- How are corporations taxed? What are the taxes if Im foreign-qualified?

- Would there be an income tax on my corporation?

- Is there a minimum or franchise tax?

- Compare projected revenue against cost of taxes for a given state to recognize any advantages

- Ultimately, the best thing that you can do for your business is research states corporate statutes and find what works best for you.

If youre on the fence, check out our blog post about the seven best states to incorporate.

Also Check: How To Estimate Solar System Size

Choosing A Business Structure: Sole Proprietorship Vs S Corp

In order to be taxed as an S corp, a sole proprietor would need to change their business structure into a corporation or LLC. We recommend using an LLC as your S corp business structure because a corporation would very rarely benefit from electing S corp tax status.

TIP: A corporation with S corp status never makes financial sense unless the business was already established as a corporation.

We will help you decide when it makes sense to:

- Operate as an LLC taxed as an S corp

- Operate as a sole proprietorship

- Operate as an LLC taxed in the default way

Self Employed Vs Sole Proprietor: The Differences Explained

Words: 959

Reading time: ~4 minutes

These days, more and more people are starting to work for themselves. Some of these people are choosing to do so by starting their own businesses and becoming sole proprietors.

Others prefer the flexibility of being self-employed but dont want to take on running their own company. For instance, every third person would rather work as a research paper writer than start their own business. Such self-employment trend can be explained by high business taxes in some countries. This is evidenced by the fact that tens of millions of gig workers are currently working in the United States.

But when it comes to being self-employed vs. sole proprietor, what are the actual differences? And which of these kinds of employment is best for you? Luckily, weve researched so you can better understand how it all works.

So if youre interested in learning more, then keep on reading, and well take you through everything you need to know about the differences between self-employment and sole proprietorship.

Read Also: What Do You Need To Set Up Solar Panels

Pros And Cons Of Sole Proprietorships

If youve decided to take on this endeavor by yourself, a sole proprietorship is probably the way to go. The advantage? Complete control.

Unlike an LLC, there arent any complicated legal agreements involved that determine ownership. If youre a sole proprietor, you can run the business however you want.

| The Pros | |

|---|---|

|

Complete control and flexibility to run the business as you see fit |

Personally liable for all business debts, youre all by yourself |

|

Unlimited liability means creditors are more likely to extend credit if needed |

Banks are reluctant to give loans due to higher turnover rates and usually smaller assets |

|

You receive all business profits |

|

|

Smaller amounts of capital make for easier organization |

Since the business relies on one person only, it is harder to raise capital on a long-term basis |

Getting Set Up: Incorporation Vs Sole Proprietorship

When it comes to starting up, there is a significant difference between sole proprietorship and incorporation. Sole proprietorships are relatively simple. There are fewer registration requirements and the costs are low. Incorporation is more expensive, and the process is more involved. For example, the companys articles of incorporation must be prepared, and name registration is required.

Recommended Reading: Can You Add More Solar Panels To An Existing System

Advantages Of Incorporation Vs Sole Proprietorship

Some of the pros and cons have been touched on above. The main advantages of sole proprietorships are that they are simple and inexpensive to set up and offer the owner a greater degree of flexibility and control in operating the business. We recently discussed five of the key advantages of incorporation: limited liability optimizing income and tax deferral easier to raise capital perpetual existence and business name protection. When it comes to Canadian sole proprietorships, the converse is true: a sole proprietor has unlimited personal exposure for business debts and lawsuits tax deferral is not possible raising capital is more difficult the business ends if the owner dies or ceases to operate the business and there is no name protection.

Sole Proprietorships In Ontario

Starting a sole proprietorship in Ontario is the easiest business structure to organize. Its also the most affordable. Accordingly, its the top choice for new business owners.

As its name implies, you are the sole proprietor of your business organization when you use this structure. As such, the Canadian Revenue Agency considers you and your business as one entity. Accordingly, youll pay personal income tax based on the income of your business. And youll declare business income on your personal tax form.

When it comes to forming a business, a sole proprietorship is as simple as it gets. However, you also attach the risk of your business to your personal assets when you operate this kind of enterprise. If something goes wrong, a sole proprietorship makes it easy for someone to go after your personal belongings.

Recommended Reading: How Much Does A 10kw Solar System Cost

What Are The Tax Implications Of A Corporation

When you form a corporation, it automatically becomes a C corporation for federal tax purposes. A C corporation is the only business form that is not a pass-through entity for tax purposes. Instead, a C corporation is taxed separately from its owners. C corporations must pay income taxes on their net income and file their own tax returns with the IRS. They also have their own income tax rates . Because a C corporation is a separate tax-paying entity, it may provide its employees with tax-free fringe benefits, then deduct the entire cost of the benefits from the corporationâs income as a business expense. No other form of business entity can do this.

You always have the option of having your corporation taxed as an S corporation instead of a C corporation by filing an election with the IRS. An S corporation is taxed like a sole proprietorship or partnership. Unlike a C corporation, it is not a separate taxpaying entity. Instead, corporate income or losses are passed through directly to the shareholders: you and anyone else who owns your business along with you. The shareholders must divide the taxable profit according to their shares of stock ownership and report that income on their individual tax returns. An S corporation normally pays no taxes, but must file an information return with theâ¨IRS showing how much the business earned or lost and indicating each shareholderâs portion of the corporate income or loss.

Considerations And Risks Of An Incorporation

- Stricter regulations, youll need to ensure all your paperwork is in order

- Setting up a corporation is more expensive than a sole proprietorship

- Theres a lot more paperwork involved with corporations, including yearly documentation that must be filed with the government

- Including shareholders and directors opens up the potential for internal conflict

- You will have to maintain ongoing paperwork filings to continue to run

Don’t Miss: How Does Residential Solar Power Work

Consider Forming An Llc Instead

If youre still not convinced that establishing your business as a corporation or sole proprietorship is the right fit, consider forming an LLC instead.

LLCs are a formal legal business structure that offers the same personal liability protection as a corporation with its own tax benefits. Plus, starting and maintaining an LLC is far easier than a corporation and less risky than establishing as a sole proprietorship its the best of both worlds!

You can also use an LLC formation service to register your LLC for you.