Maintenance Of Business Secrets

Business secrecy is an important factor for every business. It refers to keeping the plans, technical competencies, business strategies, etc., secret from outsiders or competitors.

In the case of sole proprietorship business, the proprietor is in a very good position to keep his plans to himself since management and control are in his hands.

There is no need to disclose any information to others.

What Makes Up A Sole Proprietorship

A sole proprietorship is a business that is owned and operated by a single person, with no legal separation between the owner and their business. A business automatically becomes a sole proprietorship if it is registered without a designated business structure.

When setting up a sole proprietorship, there are some associated costs involved, depending on the type of business you’re starting. At the state and federal levels, there are licensing fees. Over time, other costs include business taxes, operating costs, and capital improvements or equipment purchases, among other things.

Key takeaway: A sole proprietorship is the default legal structure. It gives the business owner complete control over the company.

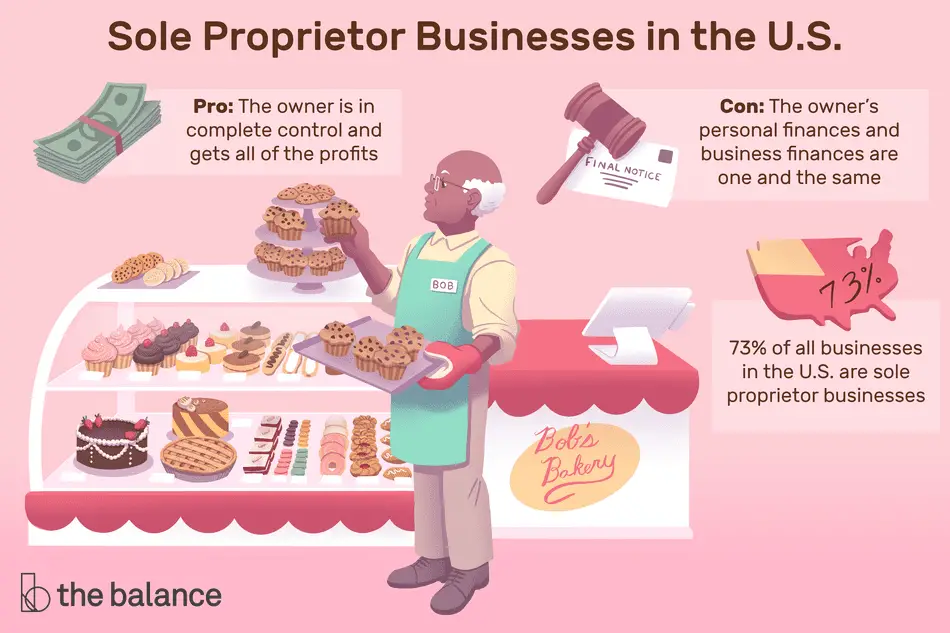

Why Are Sole Proprietorship Businesses The Most Common Type Of Businesses

There were 23 million sole proprietorships operating in the U.S. according to 2014 data from the Tax Foundation. The popularity of the entity is attributed to its minimal regulation and ease of startup and tax filing.

Aside from these benefits, the entity grants entrepreneurs a unique sense of pride in ownership. Since you have no partners or employees, you reap all the after-tax profits your business earns. On the flip side, you carry all of your business’s liabilities squarely on your shoulders.

You May Like: Where Are Jinko Solar Panels Made

Llc Vs Sole Proprietorship: Paperwork And Compliance

The final difference between an LLC vs. sole proprietorship has to do with paperwork and compliance requirements. As we mentioned earlier, a sole proprietorship requires the least amount of paperwork prior to launch. After launch, a sole proprietor only needs to keep up with federal, state, and local taxes. In addition, a sole proprietor might need to renew business permits.

An LLC has more compliance responsibilities. After filing initial articles of organization, LLCs have to file an annual report in many states. An LLC with multiple members has even more responsibilities, such as drafting an operating agreement, issuing membership units, recording transfers of ownership, and holding member meetings. None of these steps are legally required, but are highly recommended for LLCs to preserve liability protection for members. In addition, since an LLC is a registered business entity, dissolving an LLC takes additional paperwork.

Advantages Of Sole Proprietorship:

Some of the popular advantages of a sole proprietorship are.

- Quick decision making A sole proprietor has the freedom to make any decision. Therefore, the decision would be prompt as they dont have to take the permission of others.

- Confidentiality of information- Being only the owner of the business, it allows him/her to keep all the business information to be private and confidential.

- Direct incentive- A sole proprietor directly has the right to have all the profit or benefits of a company.

- Sense of accomplishment- He/she can have the personal satisfaction associated with working without any guidance or alone.

- Ease of formation and closure- A single proprietor can enter the business with minimum legal formalities.

Read Also: How To Get Solar Panels

Different Categories Of Sole Proprietorships

While legal and tax requirements have no differences among them, there are a few different subcategories of business that informally fall under the umbrella of a sole proprietorship business.

Here are three types of sole proprietorships to examine when starting a new business, and we examine the characteristics of each:

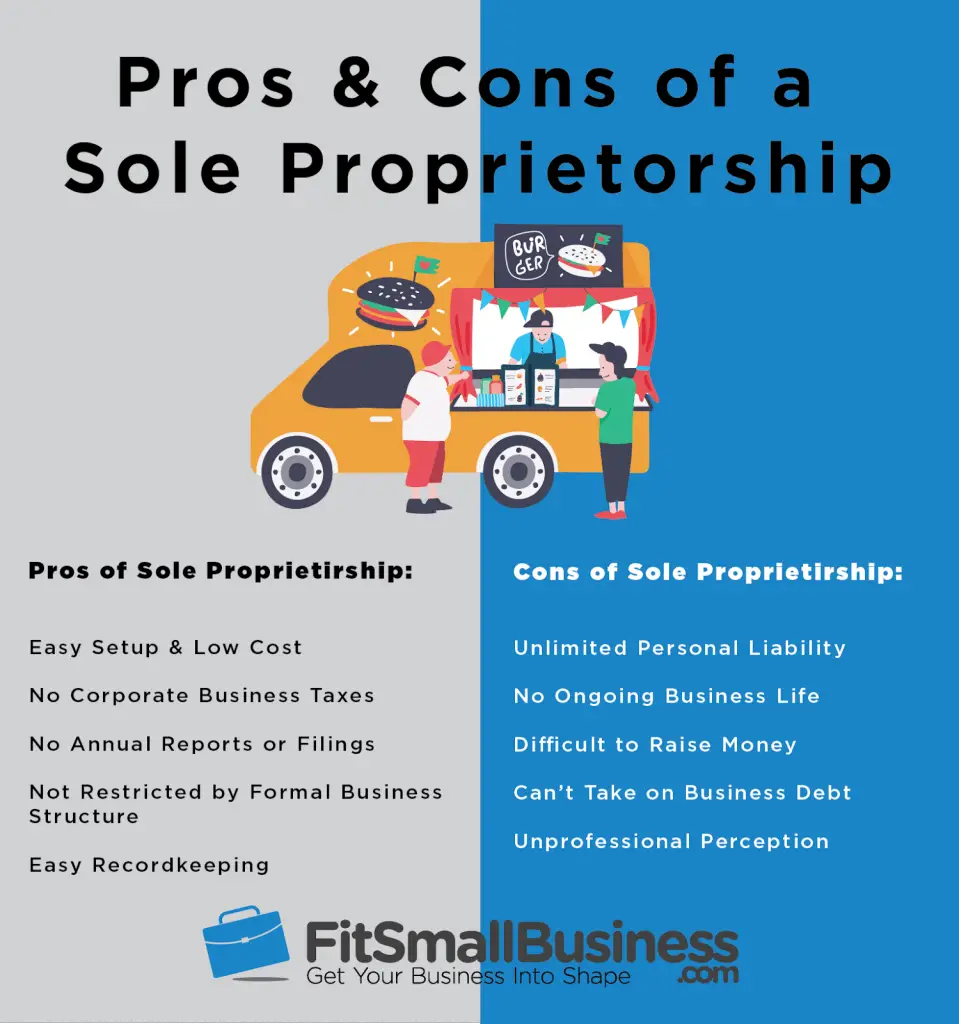

Advantages Of A Sole Proprietorship

Despite its simplicity, a sole proprietorship offers several advantages, including the following:

1. Easy and inexpensive process

The establishment of a sole proprietorship is generally an easy and inexpensive process. Certainly, the process varies depending on the country, state, or province of residence. However, in all cases, the process requires minimum or no fees, as well as very little paperwork.

2. Few government regulations

Sole proprietorships adhere to a few regulatory requirementsSecurities and Exchange Commission The US Securities and Exchange Commission, or SEC, is an independent agency of the US federal government that is responsible for implementing federal securities laws and proposing securities rules. It is also in charge of maintaining the securities industry and stock and options exchanges. Unlike corporations, the entities do not need to spend time and resources on various government requirements such as financial information reportingFull Disclosure PrincipleThe Full Disclosure Principle states that all relevant and necessary information for the understanding of a companys financial statements to the general public.

3. Tax advantages

Unlike the shareholders of corporations, the owner of a sole proprietorship is taxed only once. The sole proprietor pays only the personal income tax on the profits earned by the entity. The entity itself does not have to pay income tax.

Potential disadvantages include the following:

Also Check: How Do You Make A Solar System

How To Form A Sole Proprietorship

As soon as your venture starts turning a profit, youâre a sole proprietorship. This applies to both the 16 year old mowing his neighborâs lawn for gas money, and the wealthy tech entrepreneur investing her personal fortune to colonize the Moon. Until you file the necessary paperwork to elect a different business type, youâre a sole prop.

That being said, there are a few requirements you need to meet before going into business.

Only Llcs Can Choose Corporate Tax Status

A key difference between LLCs vs. sole proprietorships is tax flexibility. Only LLC owners can choose how they want their business to be taxed. They can either stick with the defaultpass-through taxationor elect for the LLC to be taxed as an S-corporation or C-corporation. An S-corporation is a pass-through entity. If taxed as a C-corporation, the LLC will pay a flat 21% corporate income tax at the federal level .

LLCs can sometimes save money by electing corporate tax status. When a company is taxed as a corporation, dividends from the business are usually taxed at a lower rate than ordinary business income. Plus, retained earnings in a corporation arent subject to income tax. In contrast, LLC members cant treat income as dividends and must pay taxes on all profits of the business, whether retained in the company or not. A corporation is also eligible for more tax deductions and credits.

Don’t Miss: How To Keep Pigeons From Under Solar Panels

Disadvantages Of An Llp

Some limitations of LLPs include:

- Limited availability: LLPs are not available in every state, and they may only be available to certain types of businesses.

- Increased complexity: Because LLPs are treated differently in different states, partners will need to research their state requirements and tax laws thoroughly before choosing this structure.

You can explore business ownership types and requirements in any state by visiting the secretary of state website.

What Is An Llc

An LLC is a legally separate business entity thats created under state law. An LLC combines elements of a sole proprietorship, partnership, and corporation, and offers a lot of flexibility for owners. The owners of an LLC can decide their management structure, operational processes, and tax treatment. One person can form a single-member LLC, or multiple people can form a multi-member LLC.

You can identify a business as an LLC because its legal name will end with the phrase limited liability company or the abbreviation LLC. The defining feature of an LLC is that it offers members liability protection from the debts and obligations of the business. In the normal course of business, a business creditor or someone who sues the business cant come after the personal assets of the owners. Well dig into what this means in more detail in a bit.

Read Also: Are Sole Treadmills Any Good

Sole Proprietorship: Definition Features Characteristics Advantage Disadvantages

A Sole proprietorship, also called sole trader or simply a proprietorship, is a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business. The owner receives all profits and has unlimited responsibility for all losses and debts.

Every asset of the business is owned by the proprietor, and all debts of the business are the proprietors.

This means that the owner has no less liability than if they were acting as an individual instead of as a business. It is a sole proprietorship in contrast with partnerships.

A sole proprietor may use a trading name or business name other than his or her legal name. In many jurisdictions, there are rules to enable the true owner of a business name to be ascertained.

In practice, there is generally a requirement to file a doing business as a statement with the local authorities.

Choose The Best Ownership Type For Your Business

As you can see, every business structure poses different benefits and limitations. To find the best option for your situation, youll need to answer fundamental questions about your business.

What is your vision for running the company? How big is your business now, and what are your business development plans? What are your corporate and personal tax rates and how do the various options shake out for your bottom line?

What kind of funding do you need? Once youve answered those questions, consult with your legal and financial advisors to ensure that you set your business up for long-term success.

Read Also: Is Getting Solar Panels A Good Idea

Advantages Of Sole Proprietorship

- A proprietor will have complete control of the entire business, this will facilitate quick decisions and freedom to do business according to their wishes

- Law does not require a proprietorship to publish its financial accounts or any other such documents to any members of the public. This allows the business a great deal of confidentiality which is sometimes important in the business world

- The owner derives the maximum incentive from the business. He does not have to share any of his profits. So the work he puts into the business is completely reciprocated in incentives

- Being your own boss is a great sense of satisfaction and achievement. You are answerable only to yourself and it is a great boost to your self-worth as well

Examples Of Types Of Businesses

Many businesses begin as sole proprietorships, as this type of business is great for many new, small businesses. As they grow and expand, many businesses tend to convert to corporations. eBay is a very famous example of a sole proprietorship that eventually converted into a corporation.

Hewlett-Packard is an example of an incredibly successful and famous partnership. Like eBay, as they grew, they eventually incorporated in 1947. However, the company began as a business partnership between two friends.

Chrysler is one of the largest automobile manufacturers in the United States. Since its inception, Chrysler has maintained its status as a limited liability corporation .

Finally, among the most famous of companies is Apple. Like most large companies that are listed on stock exchanges, Apple, otherwise known as Apple Inc., was incorporated soon after the company began its operations. To this day, Apple remains one of the largest companies in the world. It has continued to exist despite one of its co-founders, Steve Jobs, passing away.

Recommended Reading: How To Design Solar Panel

What Is A Common

According to the IRS, under common-law rules, anyone who performs services for your business is considered to be your employee if you control both what must be done and how something must be done.

Based on the businesss degree of control and oversight, the IRS mentions three general considerations to find out if the person providing a service is an employee or an independent contractor.

- Behavioral: Does the business have the right to control what the person does and how the person performs his or her job?

- Financial: Are the business aspects of the persons job controlled by the business?

- Type of Relationship: Are there written contracts or employee type benefits, such as a pension plan, insurance, or vacation pay? Will the working relationship continue, and is the work performed a significant part of the business?

Selecting A Business Structure

The decision regarding business structure is a decision that a person should make, in consultation with an attorney and accountant, and taking into consideration issues regarding tax, liability, management, continuity, transferability of ownership interests, and formality of operation.

Generally, businesses are created and operated in one of the following forms:

The information on this page should not be considered a substitute for the advice and services of an attorney and tax specialist in deciding on the business structure.

You May Like: How Much Electricity Does A 100 Watt Solar Panel Produce

Llc Vs Sole Proprietorship: How To Choose

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Choosing a business entity structure for your company is one of the most importantbut potentially most confusingdecisions youll make as a small business owner. Unless youre a lawyer or tax expert, the differences between each type of business entity can be hard to understand in real-life terms. However, your choice of business entity does have real-world impact, such as how much you pay in taxes, how much time you have to spend on paperwork, and what happens if someone sues your company.

New business owners are often confused about the difference between a limited liability company and sole proprietorship. In this guide, well look closely at LLCs vs. sole proprietorships, and explain exactly how they differ in terms of formation, taxes, legal protection, and more.

Pros Of Running A Sole Prop

Total ownership

When you have a sole prop, youâre the sole owner. While youâre liable for all the businessâs debts, youâre also entitled to all its income. And when itâs time to make a business decision, youâre not legally required to check with shareholders or partners.

Cheap and easy setup

It costs zero dollars to operate a sole prop under your own name. All you need to do is make sure you file your taxes correctly. Contrast this with other business structures. Virtually every other one costs money to form.

No red tape

C corporations, S corporations, and partnerships have to follow a lot of regulations, especially in terms of how the business is structured, who gets the power to make certain types of decisions, and what information needs to be disclosed to which members. Sole proprietorships are free of these requirements.

Simple tax filing

The only extra tax form every sole prop is required to fill out is Form 1040 Schedule C. Thatâs itâthere are no complicated new routines you need to learn just because youâre a sole prop.

Least recordkeeping

Of all business structures, sole props have the smallest requirement for recordkeeping. Day-to-day bookkeeping is importantâit lets you plan your businessâs future and correctly file your taxes on time. But itâs simple compared to other business structures. For instance, corporations have to keep three different sets of booksâone for internal use, one for the board, and one for the IRS.

Don’t Miss: How Fast Do Solar Panels Pay For Themselves

List Of Advantages Of Sole Proprietorship

1. No Boss One of the reasons entrepreneurs prefer sole proprietorship over other business structures is not having to be accountable to any boss or supervisor since he or she is the owner of the company. This means that the entrepreneur himself is the one at the helm of the business and decisions are made solely by him. There is no need to wait for a go-signal from other people to implement new rules and regulations. This privilege can prove to be useful during emergencies and decisions are needed right away.

2. Low Start-up Costs Sole proprietorship ranges from having no employees and up to a number of employees which is easier to deal with in terms of expenses, taxes and compensation. Costs of opening a business with this structure do not require costly legal expenses as well as corporate taxes. Moreover, if the business only has few employees, health care insurance coverage is not really an obligation of the business owner. As for bonuses and incentives, there will be lesser people to pay.

3. Profit One of the perks of sole proprietorship is that the owner can keep all the profits to himself unlike if he is on a partnership with another individual or if he has a corporation with investors where profits will be divided among themselves.

Is The American Business Women’s Association The Place To Be

The American Association of Women Entrepreneurs is a place for hardworking and entrepreneurial women who want to connect, learn and grow. Get started today with an annual investment of $115. Whether you’re starting a new business, starting a career, or looking for a job, the American Association of Women Entrepreneurs is the place for you.

Don’t Miss: Can I Use Pine Sol On Tile Floors

Disadvantages Of A Series Llc

Series LLCs have the following limitations:

- Complexity: Despite the unified filing setup, its considerably more complex to manage multiple LLCs with separate assets and owners than a single entity. Taxes in particular are complicated by the series structure.

- Administrative costs: The added administrative burden means additional cost and guidance from professional advisors. In addition, fees may be higher for forming a series LLC.

Service Type Firms Offer Professional Skills Expertise Advice And Other Similar Products

A service type of business provides intangible products . Service type firms offer professional skills, expertise, advice, and other similar products. It is an occupation which requires a particular set of skills and expertise to derive maximum profit out of it. While it is the most simple of the. Nov 04, 2021 · the most common forms of business are the sole proprietorship, partnership, corporation, and s corporation.

Also Check: How Much Does An 8kw Solar System Cost