Business Tax Id Number Example

Having a tax id number for your farm means that you are serious and that you mean business. you will need a tax id number if you desire to open a bank account in your farm’s name and also if you desire to hire new employees to work on you. Typically, if you need a federal tax id n. Gerlinda grimes meet joe and amy. Obviously, when it’s time to pay the internal revenue service , you want to make sure every detail and all the calculations are co. Looking up a business tax id number is accomplished through major public databases with defined search parameters.

Who Needs A Tax Id

An EIN is required for many reasons for businesses, taxable entities and non-profit organizations. If any of the follow apply to your business or entity you will need an EIN:

- Hiring Employees

- Operate your business as a Corporation or Partnership

- If you will file any of following tax returns: Employment, Excise or Alcohol, Tobacco and Firearms

- Have a Keogh Plan

- Plan Administrators

Apply For A Sole Proprietorship Tax Id Number Via Mail Or Fax

If you dont need your tax ID number urgently, you can print out your form and send it in via mail or fax. If you send it in via mail, the form may take anywhere from four to six weeks to process: it depends on the time of year and how busy it is. If you send it in via fax, you will usually get a response faster: normally within three to five business days.

Either way, you wont be able to receive your EIN Number as quickly as sending in the form online, and you will need the same information. An online form is usually the fastest and most convenient option.

Recommended Reading: Are Solar Panels Harmful To Your Health

Do I Need An Ein If Im Filing For A Sole Proprietorship

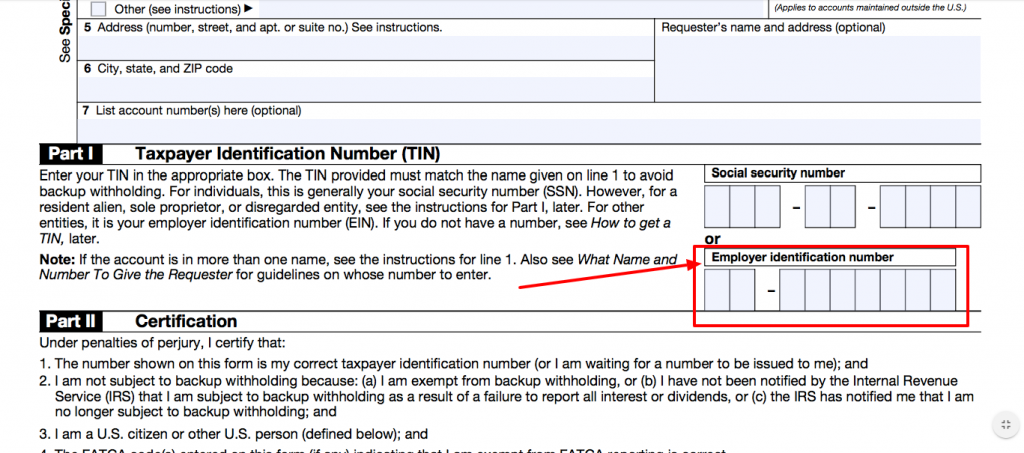

An employer identification number, also known as an EIN or federal tax identification number, is a nine-digit set of unique numbers assigned to your company and used by the Internal Revenue Service to identify your business for tax-related purposes.

The Need and Importance of an EIN

The IRS wants company owners to apply for an EIN online under certain circumstances, including if they have workers, are part of a Keogh plan or are involved with trusts, estates, non-profits, farmers cooperatives, or plan administrators. They should also file if they operate as a partnership or corporation, or withhold taxes on income, other than pay, for a non-resident alien.

Banks may require a business to have an employer identification number to open a business banking account.

What Is a Sole Proprietorship?

A sole proprietorship is a company that has a sole owner not registered with the state as a corporation or limited liability company. This entity type is affordable and relatively easy to establish. You dont have to file paperwork in order to get it set up.

Do I Need an EIN for a Sole Proprietorship?

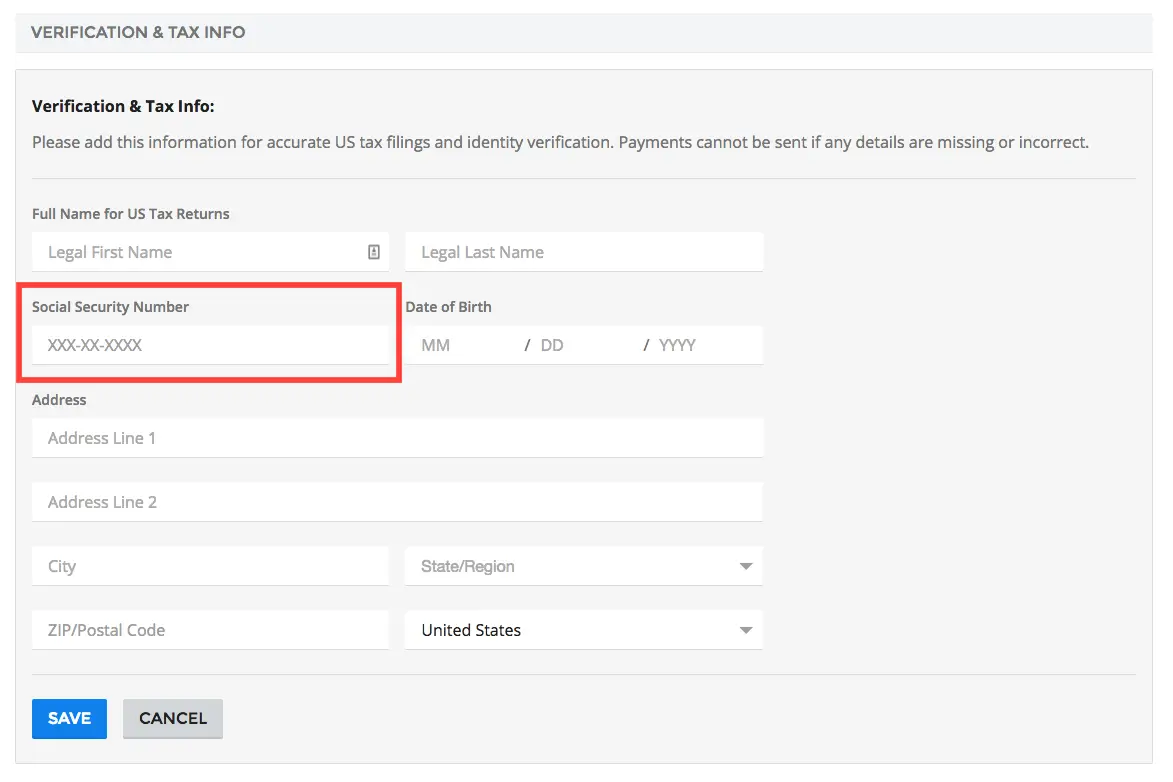

It is not necessary to obtain an EIN for sole proprietorship. This is because you can use your social security number. However, many business owners choose to obtain an employer identification number to protect them from giving out their social security numbers. If you have hired an employee, an EIN is required.

EIN Online Application

Member of NSTP

Legal Info & amp Disclaimer

How Long Does It Take To Obtain A Tax Id Number For My Sole Proprietorship

Many times, you may need an EIN Number quickly. This is especially true for a sole proprietorship: sole proprietors may not need an EIN Number until theyre actually in the midst of hiring someone or trying to open a 401. Because of this, its best to apply online.

If you apply online, yous hould be able to get a Tax ID Number within an hour. Youll be able to immediately use it for whatever you needed it for.

If you apply through mail, you may be waiting up to six weeks. For the purposes of hiring, opening a retirement account, or trying to incorporate a larger business, this may be too long.

If you apply through fax, you will need to wait up to five days. While this is better than applying through the mail, some issues could still occur: if there are errors with your application, you will need to start over, and the timer will begin again.

If youre applying for an EIN Number at your leisure, you can use virtually any method. But if you need to get your Tax ID Number quickly, the online application will deliver it in an hour.

Don’t Miss: Do It Yourself Solar Water Heater

How Much Does A Business License Cost In Pa

To start a business in Pennsylvania, you will likely have to pay application and licensing fees. To obtain a Pennsylvania LLC Certificate of Organization, for example, costs about $125. Additional fees might be required if your business is structured as a corporation, sole proprietorship or partnership.

What If I Need My Business To Be Federally Incorporated

If you intend to incorporate your business federally, the Business Number is supplied by Innovation, Science and Economic Development Canada when your incorporation is approved. To apply for federal incorporation you can visit Corporations Canada and be sure to learn the difference between federal and provincial incorporation beforehand. After receiving the Business Number from ISED, you can apply for any of the above-mentioned tax ID program accounts through the CRA.

Recommended Reading: What Can You Run Off A 100 Watt Solar Panel

Get Your Business A Name

Many sole proprietors usually give their business their name and a literal description of the service they offer. For example, if your name is Michelle Baxter and you decide to sell sports shoes and apparel, you can name your business Michelle Baxter Sportswear. You may not register this business name. However, if your business grows and you want to take it to the next level, you may decide to trademark your business name to avoid naming disputes later.

Find Out If Your Business Needs A Tax Id Number To Operate In Canada

The tax ID number is part of the 15-character program account number assigned to your business by the Canada Revenue Agency . The program account number consists of three parts:

- Nine-digit Business Number that identifies your business

- Two-letter identifier for the program type

- Four-digit reference number for the program account

An account number would look like this: 123456789 RT0001

Think of your Business Number as your business tax ID number because that’s why it exists. The CRA assigns your company a Business Number when you first register for any one of the four major program accounts you will need to operate your business:

The nine-digit tax ID number is the same across program accounts the numbers for the program ID and account number will change based on which of the four it’s referring to. You can apply for the number through The Canada Revenue Agency’s Business Registration Online service.

Note that in Quebec, the Business Number does not include your GST/HST accounts. You must register for a separate GST/HST account with Revenu Québec. Its General Information Concerning the QST and the GST/HST provides further clarification.

Several other tax accounts, such as Excise Tax, require a tax ID number/Business Number if they apply to you.

Read Also: Where Are Rec Solar Panels Manufactured

Drawbacks Of Being A Sole Proprietorship In California

When it comes to being a California sole proprietor, the biggest drawback is liability.

This can be scary because a business creditor can go after all of your assets, including your personal assets. This could include your personal bank accounts, car, and house.

Similarly, a personal creditor can go after your business assets, such as your business bank accounts and your business equipment.

As a sole proprietor, youre personally liable for business-related lawsuits.

For example, if someone slips and falls in your office, you can be personally sued for damages. This is why its wise to get insurance that protects you against these types of lawsuits.

Pro tip: You can avoid this level of liability by forming an LLC or a corporation, which will limit your personal liability for business debts and lawsuits.

Thanks to Collective, I dont have to worry about bookkeeping, taxes and other government related tasks and can focus a 100% on my work. If youre self-employed and need help with legal, tax, bookkeeping and ongoing support, all-in-one place, youll love Collective!

Arjun Dev Arora

Start A Sole Proprietorship Or Partnership

To conduct business as a sole proprietorship or partnership, you need to reserve a business name and register the business.

If you’re going to do business under your name, you do not need to request a business name or register the business with the province.

OPTIONAL: If you’re not sure which business structure you should choose,consider the different business structure options available. You may also want to:

- Explore resources from the Small Business Branch or Small Business BC

- Get advice from a chartered accountant or lawyer before setting up your business

Request and reserve a business name online

Businesses must have their name approved and confirm that it doesn’t conflict with a name already being used by a corporation. Only incorporated companies, cooperatives or societies can guarantee exclusive use of their name. Find out how to choose the right name.

If you’re unable to submit a request online, complete the Name Request form and mail it or drop it off at a Service BC locationwith payment. Make cheque or money order payable to the Minister of Finance.

It takes about 7 to 14 days to process a name request.Once it’s complete, you’ll receive a confirmation email and a name request number you can use to register your business. Be sure to complete the registration before the name request expires . If not, you’ll need to submit another name request. Request priority service if you need to have a name approved in 1 to 2 business days.

Don’t Miss: Can You Take Solar Panels With You When You Move

Is An Ein The Same As A Tax Id Number

In addition to registering the EIN, many businesses will also need to get state of California tax numbers in order to pay for a variety of state business taxes.

Business tax numbers in California are often confused with the Employer Identification Number. The EIN is a separate number that is used to federally register a business with the Internal Revenue Service and may be needed in addition to state tax numbers. The most common reasons a business in California will need to register for a state business tax numbers include:

- Sales Tax Businesses selling products and certain services are required to collect sales taxes and will need to register with the California Department of Tax & Fee Administration. Learn more about registering for a California sales tax number.

- Employees Businesses with employees will need to register with the California Employment Development Department to get a Withholding Tax Number and Unemployment Number to pay for payroll taxes. Learn more about registering as an employer in California.

Legal Info & Disclaimer:

Easy Doc Filing, LLC, and its employees, agents, and representatives, are not affiliated with the Internal Revenue Service or any other governmental or regulatory body or agency. Easy Doc Filing, LLC provides paid services to obtain Federal Tax Identification Numbers from the IRS. As a Third Party Designee, pursuant to IRS Form SS-4, Easy Doc Filing, LLC prepares and submits applications for an Employer Identification Number to the IRS on behalf of its clients. Easy Doc Filing, LLC does not verify EIN application submissions and is not responsible for the accuracy of the information provided. Any individual may obtain and submit his or her own EIN application at no cost through the official IRS website at www.irs.gov Easy Doc Filing, LLC may derive revenue from the partnerships we have entered with, and/or our promotional activities may result in compensation paid to Easy Doc Filing, LLC. Fundbox makes capital available to businesses through business loans and lines of credit made by First Electronic Bank, a Utah chartered Industrial Bank, member FDIC, in addition to invoice-clearing advances, business loans and lines of credit made directly by Fundbox.

Easy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLCEasy Doc Filing, LLC Easy Doc Filing, LLC

You May Like: How Fast Do Solar Panels Pay For Themselves

Sole Proprietors Arent Employees

A sole proprietorship doesnt pay payroll taxes on a sole proprietors income or withhold income tax. Because youre working as an independent contractor, your clients dont withhold taxes from your compensation.

Instead, as a sole proprietor, you pay self-employment taxes. Self-employment tax goes towards your Social Security and Medicare and is 15.3% of your net self-employment income. Youll also pay income taxes on your earnings. These taxes must be paid four times a year in the form of estimated taxes.

Anyone that pays you $600 or more within a year must file Form 1099-MISC to report the payment to the IRS.

Do Sole Proprietorships Have An Ein

The federal government classifies a business run by an individual as an unincorporated enterprise as a sole proprietorship. More than 23 million sole proprietors filed tax returns with the Internal Revenue Service as of 2007, according to a 2011 IRS report. While the IRS requires many businesses to have an Employer Identification Number , sole proprietors do not need an EIN unless they fit certain characteristics defined by the federal agency.

Read Also: How To Generate Solar Leads On Facebook

How To Register For An Ein In California

Home » How to Start a Business in California » How to Register for an EIN in California

Quick Reference

One of several steps most businesses will need when starting a business in California is to register for an Employer Identification Number and California state tax ID numbers. These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes, payroll taxes, and withhold taxes from employee wages.

Lets review in more detail what this number is used for when it is required, the cost, and how to register.

Do You Need A New Ein

Generally, businesses need a new EIN when their ownership or structure has changed. Although changing the name of your business does not require you to obtain a new EIN, you may wish to visit the Business Name Change page to find out what actions are required if you change the name of your business. The information below provides answers to frequently asked questions about changing your EIN. If, after reading the information below, you find that you need an EIN, please see How to Apply for an EIN.

Also Check: How To Connect Solar Panel To House Electricity

If I Dont Need An Ein Why Should I Get One

Even if your business, organization or entity is not required to obtain an EIN, it is highly recommended that you obtain one when starting or forming your business/organization for many reasons:

- Use your EIN instead of your SSN on business applications and licenses to protect your personal information

- Many state and local permits require that you have an EIN

- An EIN is required to open a business bank account

- EINs help to establish business credit history

- Minimize delays when you decide to hire employees

Why Does A Sole Proprietor Need To Get An Ein

In most cases, a sole proprietor does not need to get an EIN. Usually, it is totally acceptable for a sole proprietor to use his or her social security number in the place of any other tax identification number.

However, there are some times when a separate number is necessary. In fact, in some instances, having a separate EIN for ones business may even be preferable. Read on to get a rundown of when having a separate EIN is required and makes sense for your sole proprietorship.

When It Is Required

A sole proprietor must get a separate EIN for a business if any one of these things are true:

- That individual wants to hire employees, wants to open a Keogh or solo 401, or chooses to file for bankruptcy protection.

- When that individual plans to purchase an existing business and operate it as a sole proprietorship

- When a partnership or limited liability corporation is formed, or incorporated.

Finally, while not required by the federal government, some banks will not allow you to open a bank account in your business name if you do not have a separate EIN.

When It May Be Preferable

No matter where your sole proprietorship falls on this scale, you can find everything you need to get your status set at www.irs-ein-tax-id.com.

Member of NSTP

Legal Info & amp Disclaimer

Don’t Miss: Can I Get Solar Panels If I Rent

Obtaining An Unemployment Insurance Employer Account

Sole proprietors who have employees also need an unemployment insurance employer account number. Registration should be done as soon as possible after the first wages are paid for covered employment. It must be done before the due date of the first quarterly wage detail report the employer is required to submit.

Use Employer and Agents Self-Service System. You can register for an employer account with the states Unemployment Insurance system online or by phone. See step-by-step instructions to register a new account online.

The state prefers that the automated phone system be used only by employers who do not have access to the Internet. Call 651-296-6141 and press option 4. If the business is a result of a reorganization of, or acquisition from another business, additional information may be required before a tax rate can be assigned.