Goods And Services Tax/harmonized Sales Tax

As a sole proprietor, you should be required to register for the GST/HST if:

- You provide taxable sales, leases, or other supplies in Canada

- You are not a small supplier .

Some Canadian provinces have harmonized their Provincial Sales Taxes with the GST to form the combined HST. Here is a complete overview of charging and collecting sales tax by provinces/territories.

In case a sole proprietors’ total sales and services billings are $30,000 or less, they are considered as “small supplier”. That means they are not required to register with the tax authorities for the purposes of collecting and paying sales tax and the CRA doesn’t necessarily require them to have a BN. Instead, sole proprietors will use their Social Insurance Numbers .

What is a small supplier?

According to the Canadian government, “a person is a small supplier during any particular calendar quarter and the following month if the total value of the consideration for world-wide taxable supplies, including zero-rated supplies, made by the person that became due, or was paid without becoming due, in the previous four calendar quarters does not exceed $30,000 or, where the person is a public service body, $50,000”.

What Are The Tax Implications Of A Sole Proprietorship

When filing your taxes as a sole proprietorship, you report your business’s income and losses on your personal tax returns. You’re also required to submit a Schedule C, “Profit or Loss from the Business,” as part of your IRS 1040 filing. This form is used to document the income and expenses for your business.

“A sole proprietorship doesn’t have to file a separate tax return,” Jensen said. “A business schedule is attached to the owner’s personal tax return.”

Income earned by sole proprietorships is treated like personal income, which is why it’s reported on your personal tax return.

You may instead be able to submit Schedule C-EZ, which documents your net profit from the business. Because the sole proprietor is considered both the employer and the employee, he or she is responsible for paying both the employer and employee portions of Social Security and Medicare taxes through Form SE, “Self-Employment Tax.” The employer portion of the tax can be claimed as a tax deduction when filing your tax return, however.

Key takeaway: If you are the owner of a sole proprietorship, you do not have to file a separate tax return for your business. When you file your personal tax return, you may have to submit a Schedule C or Schedule C-EZ , as well as a Form SE for your sole proprietorship.

Obtain Licenses And Permits

You may also need to apply for licenses and permits at the state, county, and municipal levels to operate your business. This involves filling out an application, paying a fee, and submitting it to the appropriate authorities.

Types of permits to look for include:

- Premises permits: You may need a home occupancy certificate, sign permits, or other facilities permits to operate your business. These are often required at the local level.

- Occupational licenses: Every state licenses its own set of professions, from nail salons to funeral homes. Before you begin offering goods or services, make sure you know the licenses required for your profession.

- Regulated activities: You may need permits for regulated activities such as food service and games of chance.

Recommended Reading: How Much To Add Solar Panels To House

Purchase A Website Domain Name

Once youve settled on a business name and have registered it with your state, its time to purchase your website domain name. Your domain name is what identifies your site. It looks something like this: www.example.com.

Its best to set your domain name as the same name of your business to avoid any confusion. If the domain name you want isnt available, come up with a variation that is still similar to your business name. Its alright if youre not ready to build your website just yet. You can still reserve your domain to ensure no other business takes it.

Get a free Yelp Page

Promote your business to local customers.

Resources That Help Sole Proprietors

These resources provide additional guides for how to set up a sole proprietor in California, among other entities. These offices can administer, issue permits and licenses, and registrations for your business needs. The agencies below can help inform your sole proprietorship on outstanding requirements by different levels of government, county, state or federal.

Governors Office of Business and Economic Development .

California Business Portal.

Its always a good idea to contact your local chamber of commerce and ask them questions you might have concerning your business.

At Stone & Sallus, our attorneys are also available to help answer questions on your sole proprietorship. Visit our other business resources and contact us for all your legal questions.

Don’t Miss: What’s Bad About Solar Energy

How To Set Up A Sole Proprietorship In New York

This article was co-authored by our trained team of editors and researchers who validated it for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.There are 13 references cited in this article, which can be found at the bottom of the page. This article has been viewed 48,532 times.Learn more…

Its easy to form a sole proprietorship in New York. Typically, you can just start working under your legal name and pay business taxes using your Social Security Number. However, some people will need to obtain other licenses or permits, and youll have to jump through more hoops if you intend to hire employees.

How To Set Up A Sole Proprietorship: Registration Procedure

The only requirement for Hong Kong sole proprietorships is to register their business with the Inland Revenue Departments Business Registration Office and obtain a Business Registration Certificate. Business Registration must be done within one month from the date of commencement of business. The business registration number that appears on the Business Registration Certificate is also the sole proprietorships profits tax filing number.The registration procedure involves

- Selection of an appropriate business name. It is important to keep the following factors in mind while choosing a business name:

- A sole proprietorship may be registered with an English name, a Chinese name, or an English and a Chinese name.

- For a Chinese name, you may include English alphabets, but not English words.

- The name should not suggest that the business is incorporated with limited liability.

- The name should not suggest a connection with the Government or any public body when no such connection exists or has existed.

- The name should neither infringe on trademarks nor be offensive or otherwise contrary to public interest.

Read Also: Can You Put Pine Sol Down The Drain

What Is The Difference Between A Sole Proprietor And A Self

Sole proprietor and self-employed mean the same thing essentially. A sole proprietor is the only the sole person who runs his or her business. A sole proprietor is not the same as an independent contractor. An independent contractor typically works for another organization or multiple organizations, such as a creative professional a graphic artist or writer.

An independent contractor will not have taxes held from any payments. Sole proprietors are responsible for paying taxes associated with their businesses.

How To Register A Sole Proprietorship In Canada

You have to register your sole proprietorship with the province or territory in which youll be operating. The only exception is if you plan to run a business under your own first and last name , in which case, you dont have to register so long as you live in BC, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, PEI, the Northwest Territories or Nunavut.

When you register provincially or territorially, youll also receive a federal business number . You need a federal business number if you plan to use a CRA program account, which is used for a variety of business purposes like collecting GST/HST, importing or exporting goods and processing payroll deductions.

Keep all your business information in a safe, accessible place. You may need it to verify your business ownership to clients or financial institutions. You may also need it when interacting with the CRA.

Some extra things to keep in mind:

Read Also: How Many Solar Panels Can Power A House

What Are The Insurance Implications Of Forming A Sole Proprietorship

Sole proprietors are not shielded from any debts or liabilities incurred by the business. Due to personal liability, sole proprietors usually must secure some type of insurance as a way to stay protected in the case of lawsuits. The sole proprietor would want to secure either a small business insurance policy or general liability policy.

Open A Business Bank Account

Its important to keep personal and business expenses separate when running a sole proprietorship . Opening a business bank account ensures a certain level of protection for your business funds, allows customers to pay with a credit card and make checks payable to your business, and allows your business to build a good credit history.

You want to be able to prove to the IRS youre running your business to make a profit. This ensures the losses you experience during the first few years will remain tax deductible.

Its also wise to build a good credit history before starting your business. While credit cards can help you out in your companys early days when cash flow is low, the interest adds up quickly and can easily become overwhelming.

A personal loan is often a better option, and a good credit history is necessary for securing a loan of this type.

You May Like: How Much Power Does A 100 Watt Solar Panel Produce

Get An Employer Identification Number

Another critical step for your business is obtaining an EIN. You can get one for free in minutes through the IRS online application.

Despite its name, an EIN is not just for employers. It is a universal identifier, much like a Social Security number, for your business. If you don’t have one, you’ll have to use your Social Security number on tax forms and other official documents, exposing your personal information unnecessarily.

Everything You Need To Know To Become A Sole Proprietor In Any State

A sole proprietorship is a one-person business that, unlike corporations and limited liability companies , doesn’t have to register with the state in order to exist. If you are the sole owner of a business, you become a sole proprietor simply by conducting business. Even though there aren’t complicated start-up requirements for establishing a sole proprietorship, there may be local registration, business license, or permit laws you need to comply with to make your business legitimate. You also need to know about your income tax and business debt obligations because as a sole proprietor you are personally responsible for paying these debts.

To find out what you need to do to establish a sole proprietorship in your state, choose your state from the list below. You will find all the specifics and information you need, including links to forms, government agencies, and other valuable resources.

Don’t Miss: How Much Can Solar Panels Save Me

How Do I Look Up A Sole Proprietorship In California

If you are looking for a specific sole proprietorship in California, you can sometimes search by the entity number , the identification number provided by the California Secretary of State. Sole proprietors dont always need to obtain an EIN and often use their private social security numbers instead.

Check Out Any Local Licensing And Permit Requirements

Depending on what you do, you may need certain licenses, permits, or other approvals and certifications to get started. For instance, your mac and cheese truck will likely need a health department permit for preparing or serving food.

These can vary by state and whether or not your business activities are regulated by a federal agency. We have some information about business licenses here that can help.

However, unlike other forms of businesses, in most cases you typically won’t have to register or formally declare that youre in business, which can save you time and money right off the bat.

Also Check: What Is The Best Solar System

It Consultant Or Computer/it Specialist

Have you ever run into IT problems? So do countless businesses. As an IT consultant running your own business, you would offer IT troubleshooting services to other companies, resolving issues with both the companys hardware and software solutions. Be open to traveling for this type of sole proprietor business.

File For An Ein If Necessary And Review Tax Requirements

For many sole proprietorships, obtaining an Employer Identification Number from the IRS is unnecessary. You are only required to get one if you hire employees or plan to open a retirement account.

However, securing an EIN is a step you should consider regardless of the requirement. If you plan on opening a business bank account, for instance, most banks prefer an EIN. Your EIN works as an identifier, much like a Social Security number.

If you do not have an EIN, you must use your Social Security number, which opens you up to potential fraud. Obtaining your EIN is also relatively simple. You can fill out the form through the IRS. This is a free service, and youll be able to use your EIN immediately.

Don’t Miss: What Solid Food To Introduce To Baby First

Sole Proprietorships Are So Easy To Establish That You May Already Own One Without Realizing It

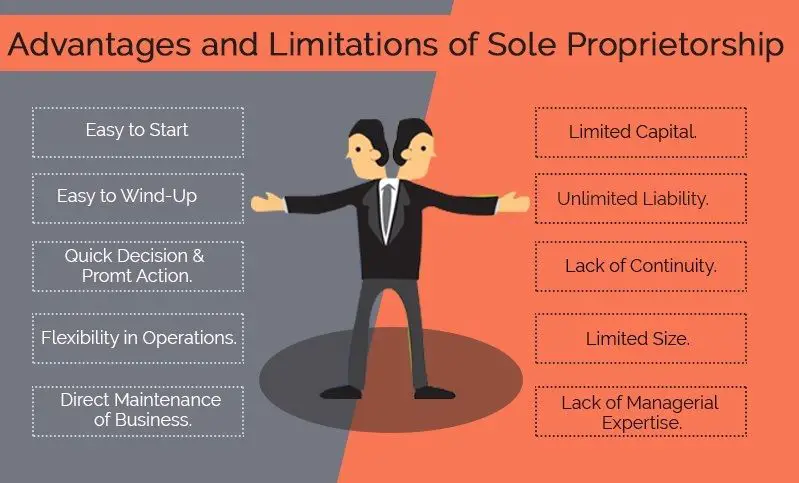

A sole proprietorship is a one-person business that, unlike corporations and limited liability companies , doesn’t even have to be registered with the state in order to exist. There were more than 22.6 million sole proprietorships in the U.S. in 2008, according to the Internal Revenue Service . And even though this type of business is easy to set up, it’s also easy to ignore local registration requirements, business licenses, and paying taxes on your income. “It’s by far the most common type of business, the easiest to set up, and the one that most businesses end up starting as,” says Jerry Osteryoung, director of outreach at the Jim Moran Institute at Florida State University’s College of Business. “You can always migrate up to an LLC or a corporation, but when first starting a business you need to make sure it’s easy to start.”The following guide explains how to set up a sole proprietorship, its financial structure, and the potential drawbacks of starting one.

Setting Up a Sole Proprietorship

Dig Deeper: Choosing a Form for Your Business

The Financial Structure of a Sole Proprietorship

When you start a sole proprietorship, you must separate your personal finances from your business. This helps you prepare financial statements and prepare tax returns. Weltman suggests establishing the following to set up business finances:

Dig Deeper: How to Structure a Partnership

—–

Evaluate The Insurance Needs Of Your Business

Determine how much business insurance your business needs. Sole proprietors are responsible if employees get hurt on the job. They are responsible for all aspects of a business. Entrepreneurs should carry workers compensation insurance including business liability, giving your business financial protection in case someone is injured on its premises. If youre not sure, consult a professional in the insurance business or a business attorney, like Stone and Sallus, to determine those needs.

Sole proprietors are responsible for all debt. They are personally liable for all obligations of business including liability for employees actions on the job. It can be stressful to be a sole proprietor but if done properly it can be equally rewarding.

Tax Forms Needed for Sole Proprietorship in California

The United States Small Business Administration has many free informative tools to assist the sole proprietor, including federal tax requirements for a sole proprietor.

Sole proprietors can locate essential forms for tax purposes on the site of the U.S. Small Business Administration. A sole proprietor will report Profit or Losses on forms: 1) Schedule C and Form 1040 plus self-employment and estimated taxes . The tax rate of the return depends on your individual income tax.

Sole proprietors arent taxed separately from their business. Tax rates are the lowest of the business models and its easy to fulfill the tax reporting requirements as a sole proprietorship.

Read Also: Can I Get Sole Custody Of My Child

Should I Form An Llc Or Sole Proprietorship

Depending on your business, it will be beneficial to create either an LLC or a sole proprietorship. A sole proprietorship is best suited to small businesses with low risk and low profits. The business will not have a wide range of customers but rather a small, dedicated group. Sole proprietorships usually start as hobbies and become a form of business. The reasons to start an LLC would be the opposite of the reasons above. The business is associated with some risks, the possibility for very large profits, a large customer base, and in a position to benefit from certain tax structures.

Set Up As A Sole Trader

If youre a sole trader, you run your own business as an individual and are self-employed.

You can keep all your businesss profits after youve paid tax on them. Youre personally responsible for any losses your business makes. You must also follow certain rules on running and naming your business.

Read Also: How Did Our Solar System Form

How To Set Up A Sole Proprietorship Business

Setting up a sole proprietorship is the quickest and easiest way to formally begin a business. Even though a sole proprietorship does not offer some of the advantages of the different forms of incorporation, or of a limited liability company , it can be one of the better ways of getting a business enterprise up and running. With a little concentration and planning, setting up your business can be an exciting and enjoyable experience.

1

2

Choose your business name and register it with the appropriate local or state office. If you choose to operate your business under your own name, this step, while still worth doing, is not legally required. Operating a business under a fictitious name requires you to register to show that you are the business owner responsible for that business identity.

3

Research and obtain any necessary licensing or certifications you may need to conduct business in your city, county and state. Understand that some business types that deal with chemicals, food or certain services may pose health risks if improperly managed and will require periodic inspections or re-certification to stay in business.

4

5

6

References