Financing A Sole Proprietorship Vs Llc

Whatever type of legal entity you choose to file, funding will likely be a hot topic and a challenge. Experienced small business owners will likely suggest you keep your full-time job while you get your business off the ground this personal income can be a steady stream of capital as you get your operation moving. Either way, get a business bank account and a business credit card if possible.

Getting a startup loan can be difficult for a new business, but there are other funding opportunities available. You can consider crowdfunding where you can offer donors a gift for their contribution, make them shareholders, or just rely on the goodness of their heart. There are also a number of non-profit lenders offering microloans for new or disadvantaged businesses.

Sole Proprietorship Vs Llc Vs Corporation

When you form a business, you have a lot of decisions to make regarding its structure. Do you need to worry about liability? What about taxes? There’s no substitute for asking for advice from a qualified tax professional, but you should still research on your own the structure that might be right for you.

Sole Proprietorship Vs Corporation

What is the difference between a sole proprietorship and corporation? The difference between these two forms of business lies in the capital available to them and the liability of its owners to business debts. Other factors such as regulation, management, and continuity of the business relative to the owners existence are also important.

A sole proprietorship has only the owner to raise capital, enjoy profits or losses, pay taxes and pay any debts the business owes people. It is easy to start a sole proprietorship business since it requires little capital and has the lowest regulatory burden. Here, the owners personal assets are at stake for paying business debts. Since you are one and the same, your financial capability is reflected on how much capital the business has, which is in effect limited. You are in full control of all business decisions however, you may face difficulties raising enough capital and lack continuity whenever you are absent.

You May Like: What Solid Food To Introduce To Baby First

What Is The Difference Between A Sole Proprietorship And A Corporation

A sole proprietorship and a corporation are two different business structures that have different advantages and disadvantages.

Sole proprietorships are an informal business structure that offers no tax benefits or personal liability protection but allows more flexibility and freedom for business owners.

Comparatively, corporations are formal legal business structures that offer personal liability protection, tax benefits, and investor opportunities but are complicated to maintain.

Corporation Vs Sole Proprietorship

A corporation is a separate entity from those who own it. When we look at a sole proprietorship vs. corporation, however, the business and the owner are one in the same in in the sole proprietorship. It is a similar comparison when we look at the partnership vs. corporation. With a partnership, there is not a legal barrier between owners and the individuals.

A corporation is a stock-issuing business entity. Stockholders elect the corporations board of directors, who elect officers, who are then authorized to carry out the day-to-day business of the corporation. A corporations officers are often comprised of a president, vice-president, secretary, and treasurer. Big corporations typically have a variety of different officials as part of the board of directors. In most jurisdictions one individual can take on the role of a corporate director and hold all other corporate offices at the same time.

Owning stock in a corporation can provide a shield of protection against business lawsuits. Thus, individual creditors may think twice about challenging a corporation in court. Whereas with a sole proprietorship or partnership, a lawsuit against the business equals a lawsuit against the owners as well.

Read Also: How Strong Are Solar Panels

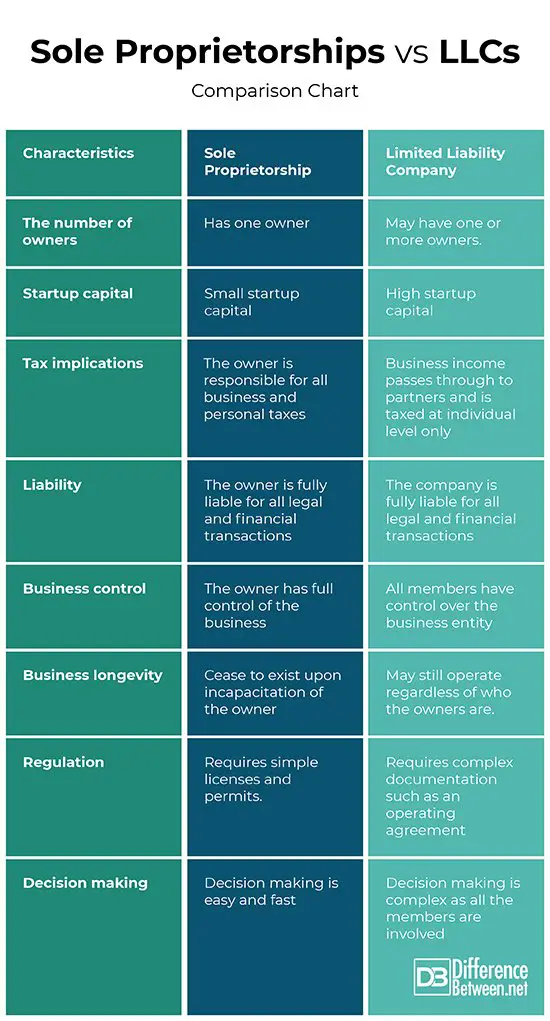

Summary Of Sole Proprietorships Versus Llcs

The importance of the type of a business entity cannot be emphasized enough. Being knowledgeable about the differences between sole proprietorships and LLCs comes in handy for any aspiring business owners, especially in making the critical decision on the type of entity that is ideal for a certain business.

Can A Sole Proprietor Be An Llc

No. While you can operate your business in a very similar manner from one to the other, you cant be both at the same time. Once a sole proprietors business forms an LLC, its legally separated from the owner, a truly different entity.

How about the other way around, is an LLC a sole proprietorship?Yes, but only for tax purposes and only if the LLC hasnt elected to be taxed as an S Corp or C Corp. When it comes to liability protection, an LLC is not a sole proprietorship.

Still not sure who would win in the battle of LLC vs sole proprietorship? The final choice is something only you can make. In the end, those who choose an LLC are those who need liability protection or who want to have several owners or partners. Those who pick a sole proprietorship have basic business needs or limited budgets.

Whatever you choose, the most important step is to weigh the pros and cons of a sole proprietorship vs LLCand choose the one that meets the unique needs of your business.

Don’t Miss: How To Estimate Solar System Size

Corporation Llc Partnership Or Sole Proprietor

One of the most important decisions youâll ever make is how to legally organize your business. There⨠are several alternatives, and the form you choose will have a big impact on how youâre taxed, whether youâll be liable for your businessâs debts and how the IRS and state auditors will treat you.

What Are The Pros And Cons

In the Sole Proprietorship vs. S-Corporation debate, the answer to whether its more advantageous depends entirely on your unique needs. Setting up an S-Corporation requires that you put together paperwork and file documents with governmental agencies. S-Corporations may also have other ongoing filing requirements, like annual information statements. The requirements vary depending on the state where the S-Corporation is formed. By contrast, a Sole Proprietorship has none of these requirements. However, the pros may easily outweigh the time spent on extra paperwork. With protection from liability, the ability to raise capital, as well as the option for having up to 100 shareholders, forming an S-Corporation can be a very good business decision. Finally, it should be noted that S-Corporations may only be formed by U.S. citizens or resident aliens, whereas Sole Proprietorships, due to their nature, have no such limitations.

Ready to start your business? We make it easy to incorporate, whether you want to form an S-Corporation, LLC, Corporation, or Non-Profit.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.

Don’t Miss: How To Use Solar Energy At Home

Management Structure Of S Corporations

In contrast, S corporations are required to have a board of directors and corporate officers. The board of directors oversees the management and is in charge of major corporate decisions, while the corporate officers, such as the chief executive officer and chief financial officer , manage the company’s business operations on a day-to-day basis.

Other differences include the fact that an S corporations existence, once established, is usually perpetual, while this is not typically the case with an LLC, where events such as the departure of a member/owner may result in the dissolution of the LLC.

LLCs and S corporations are business structures that impact a company’s exposure to liability and how the business and business owner are taxed.

Should I Make My Llc An S Corp

If you’re a sole proprietor, it might be best to establish an LLC since your business assets are separated from your personal assets. You can always change the structure later or create a new company that’s an S corporation. An S corporation would be better for more complex companies with many people involved since there needs to be a board of directors, a maximum of 100 shareholders, and more regulatory requirements.

Don’t Miss: Is Solid State Drive Better

Llc Vs Sole Proprietorship: Pros And Cons

Choosing the right business structure for your new venture is a crucial decision. Many business owners lean toward two of the most popular optionsLLCs and sole proprietorships.

Each one has its fair share of benefits and drawbacks.

The right one for you and your business will depend on several factors. Youll need to consider things like the tax implications, startup costs, regulations, liability protection, and more.

If youre torn between the two, youve come to the right place. This guide will provide you with an in-depth explanation of LLCs and sole proprietorships. Youll learn more about each ones advantages, potential downsides, and the differences between the two.

Limited Liability Company Versus A Sole Proprietorship

One of the key benefits of an LLC versus the sole proprietorship is that a members liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business. This liability, however, is dependent upon following the rules associated with an LLC. If you treat the LLC the way you would a sole proprietorship, you lose the liability protections.

For example, creditors can go after a sole proprietors home, car and other personal property to satisfy debts, while an LLC that is properly maintained can protect the owners personal assets.

- Difficult to obtain financing in the business name

- Harder to build business credit

Recommended Reading: How Does The Solar Credit Work

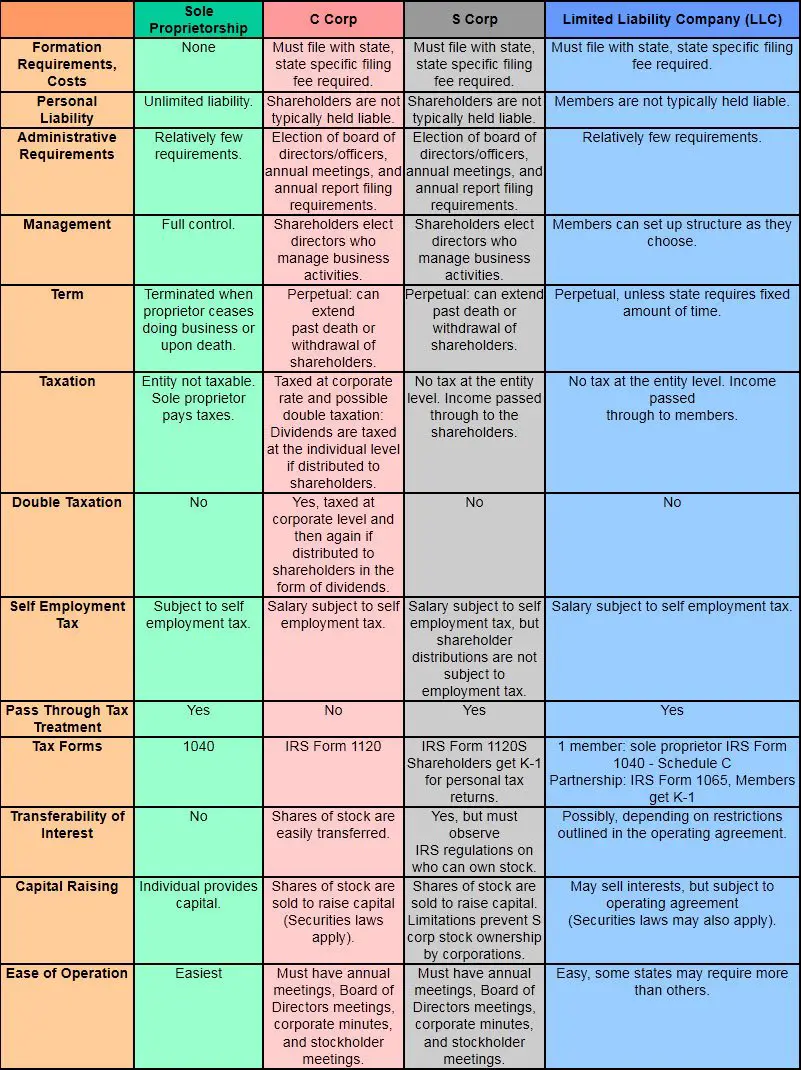

Tax Differences: What Are The Taxes Involved For All Entities

1. Pass-through Taxation

The first thing you need to understand about entity taxation is pass-through taxation.

Sole proprietors, partnerships, LLCs, and S-Corporations are taxed as pass-through entities.

This means that all income your business receives passes through to you personally.

For example, if your business made $100,000 and you owned 100% of that business, then you would be required to pay taxes on that $100,000 individually.

The exact tax you pay on that will depend on the tax bracket your total personal income falls in.

2. Double Taxation

Only C-Corporations are subject to double taxation.

Double taxation is where the company itself is taxed on all of its profits, before payments to owners are made.

And then the owners are taxed on payments they receive from the corporation.

So, youre taxed twice.

Because of double taxation, C-Corporations are not a popular choice amongst small businesses.

But lets discuss a major tax that most small businesses encounter as pass-through entities.

3. Self-Employment Tax

Self-employment tax is an extra 15.3% tax on your income.

Its the governments way of funding programs like Social Security and Medicare, which is normally deducted from your paycheck as an employee.

The only difference is, as a business owner, youre paying both the employer and employee portion of the tax, equaling a total tax of 15.3%.

Now heres the thing about self-employment tax, it does not apply to S-Corporations or C-Corporations.

Should You Form An Llc Or An S

Shutterstock

Limited liability company or S corporation ? What do these business structures mean? As a business attorney, I always get the age-old question as to which one is best for you as a budding entrepreneur, balancing issues such as liability and taxation? Simply put, an LLC is a business structure while an S-corp is not. Instead, an S-corp is a tax election.

For a thorough analysis, you will need to consult with your business lawyer and/or accountant. But for the basics, read on:

What is an LLC?

An LLC is a business structure legally separating itself from its owner .

What is an S-corp?

An S-corp indicates how a business is taxed — it is not a business structure, contrary to an LLC designation. A single-member LLC cannot be designated as an S-corp .

What should small business owners consider before forming an LLC?

Compared to corporations, LLCs may have fewer reporting requirements and therefore be easier to manage. Typically, when individuals are deciding to form a company, they are choosing between a C corporation and an LLC. C-corps have to file a corporate tax return and the way owners derive income is either through a distribution or W-2 salary. Owners of small businesses don’t always like this because the C-corp gets taxed at a corporate level and then at an individual level. The reason small business owners choose to form an LLC is that the income flows through to a personal return, thereby avoiding double taxation.

So, what should I choose?

Don’t Miss: How Much To Add Solar Panels To House

Sole Proprietorship Vs Llc

When you decide to form your own business, the type of business entity that you choose is an important decision. The first step is to educate yourself about the two most common types of business entities chosen by small business owners a sole proprietorship and an LLC.

Can Sole Proprietors Become An S Corp

Often yes. Once youve established your LLC and found that the S Corporation taxes work in your favor, there are a few more requirements you should meet:

- You must be a U.S. citizen or resident

- LLC must be registered in the U.S.

- Have no more than 100 shareholders

- Have only one class of stock

- Owners cannot be partnerships or corporations.

There are a few more requirements you can find on the IRS website. The general theme is that these entities have much more restrictive ownership requirements. If ownership flexibility is important to you, needing lots of startup capital, for example, a partnership or C Corp could be better choices.

Don’t Miss: Does Cleaning Solar Panels Help

Differences Between Dba Sole Proprietorship Vs Llc And Corporation

Before you start your own business, you have to decide, by law, the legal formation you want for your business. This is also called business structure and legal structure. Sole Proprietorship vs LLC, DBA, and Corporation. Which one will be the best fit for your business?

Each business structure has different features, pros, and cons. And picking the right structure for your business will allow you to manage three important elements: liability, taxes, and complexity. The good news is you dont need to be a lawyer to decide on your legal formation. It can take more or less time and cost more or less money, depending on the structure of your choice.

Keep in mind that each of the legal formations takes very different approaches to taxation.

Do You Need A Sole Proprietorship An S Corp Or An Llc

Modified date: Jun. 1, 2021

Editor’s note –

Creating your own small business is a huge endeavor, which comes with a number of decisions. One of the most important decisions youll need to make is how you structure your business.

This choice will have major legal and tax implications down the road. Choosing between a sole proprietorship, LLC, and S Corp for your companys structure is not something you should take lightly. These are three common structures for small businesses and each one has its own advantages and disadvantages. Heres a rundown of all three to help you decide which is best for your business.

Also Check: How Many Solar Panels For 30 Amps

Llc Vs Sole Proprietorship Share One Important Similarity

Every business owner faces decisions that can impact their business down the road, and choosing your business entity is an important step toward success.

When weighing your options between choosing an LLC vs. sole proprietorship, there are several factors to consider, including how risk will impact your business and personal assets.

One thing that both entities have in common is the protection they could gain from having business insurance.

If you’re curious about other ways you can protect and grow your business, head to Simply U, our blog for business owners.

Monthly payment calculations do not include initial premium down payment and may vary by state, insurance provider, and nature of your business. Averages based on January – December 2020 data of 10% of our total policies sold.

Allison Grinberg-Funes

Ive told stories since I learned to talk and written since I could hold a pen. As a small business owner myself – I’m a freelance writer and yoga teacher – I love contributing to the entrepreneurship community in different ways . When Im not drafting articles for SB, I can be found on my yoga mat, perusing an indie bookstore, and writing .

This content is for general, informational purposes only and is not intended to provide legal, tax, accounting, or financial advice. Please obtain expert advice from industry specific professionals who may better understand your businesss needs.

Llc Vs Sole Proprietorship: Operations And Management

A sole proprietorship has a simple operational and management structure because theres just one person at the top. That owner can make any business decisions as they see fit, without input from any third party. Of course, most sole proprietors decide to hire employees, legal experts, accounting experts, and other individuals to help with the day-to-day management of the business. But a sole proprietor only has to ensure their business is operating safely and legally and that theres enough profit to cover business debts.

An LLCs operational and management structure is more complex and is typically outlined in an LLC operating agreement. Though only a handful of states require an operating agreement, most LLCs have one, particularly those with multiple members. The operating agreement outlines each members ownership stake in the business, voting rights, and profit share. An LLC can be collectively managed by the members or managed by an appointed manager.

Usually, LLC members decide on company matters in proportion to their ownership stakecalled membership unitsin the business. For example, a 33% owner would have a one-third vote on company matters, and a 25% owner would have a one-quarter vote. Profits generally are divided in line with ownership percentages. In the previous example, the 33% owner would receive one-third of the business profits, and the 25% owner would be entitled to one-quarter of the business profits.

Don’t Miss: Is There A Government Scheme For Free Solar Panels