What Does The Credit Cover

Homeowners who install and begin using a solar PV system can claim a federal solar tax credit that currently covers 26% of the following costs:

- Labor costs for solar panel installation, including fees related to permitting and inspections

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses

How Solar Tax Credits Work

A solar tax credit is the amount of money that taxpayers can subtract from the taxes they owe to the government from the previous year. If you made a solar investment that was approved by the government during that last year, you would be able to deduct that amount when you file your taxes with the government. All products that are eligible for tax credits for residential energy efficiency are labeled with an Energy Star certification.

How To Apply For Federal Tax Credit

When you file your taxes, make sure to fill out form 5695. This form can be applied only to residential properties.

Frequent Form 5695 Questions And Considerations

Q: I got a rebate from my utility company for my solar panels. Do I calculate the 26% tax credit before or after the reduction from the rebate?

A: We get this question all the time, and heres the best answer: You calculate the 26% federal tax credit based on the cost to you AFTER any rebates.

For example, if your system cost $20,000 and you received a $5,000 rebate from the utility, your federal tax credit would be 26% of $15,000, which is $3,900. Heres the tricky part: if your state ALSO gives you a tax credit, you dont need to worry about that amount to calculate your federal credit.

Both state and federal tax credits are calculated based on the amount you paid, minus rebates or grants.

Q: If I installed a solar panel system a few years ago and now I want to add new panels, can I claim the credit?

A: Yes! You can claim the credit for any new costs associated with the addition. You cant go back and claim the credit for the previously-installed equipment. Hopefully you already claimed the credit for those costs back then.

Q: If I install solar and claim the tax credit, will I have to repay the credit to the government if I sell my house within a certain number of years?

A: No! If you install a solar panel system on a home you own, you can claim the whole credit and sell at any point after.

Q: Can I get a tax credit if I install solar panels on rental property I own?

Find out how much installing solar panels will save you annually

You May Like: How Much To Add Solar Panels To House

Who Is Eligible For The Itc

If you meet the following criteria, you may be eligible to benefit from the solar investment tax credit:

- You purchased and installed your PV system sometime between January 1, 2006 and today, or plan to by December 31, 2023.

- Your PV setup is located at a residence or commercial business within the United States.

- Your solar panel system is new or has never been used before the solar tax credit can only be claimed on original equipment installations.

Can I Claim A Federal Solar Tax Credit For My Solar Energy System

If you purchase your solar system, you may qualify for the ITC. The ITC is a credit against federal income tax for qualifying solar energy systems on residential properties placed in service before December 31 of a given tax year. The credit is determined by calculating 26% of the total eligible cost of qualifying solar systems. Generally, a tax credit is a dollar-for-dollar reduction in the income taxes that a taxpayer would otherwise pay to the federal government. Credits are subject to limitations, so the IRS rules should be consulted before any benefit is represented on your tax filing. If you have questions, you should consult your tax advisor regarding the Solar ITC and how it applies to your specific facts and circumstance. SunPower does not warrant, guarantee or otherwise advise its customers about specific tax outcomes.*

Also Check: What Is The Carbon Footprint Of Making A Solar Panel

Frequently Asked Questions: Federal Solar Tax Credit

Will I get a tax refund if the solar investment tax credit exceeds my tax liability?

No, the federal solar ITC is a nonrefundable tax credit. However, if you do not use all of your tax credit, you can carry over the unused amount to the following year.

Can I use the federal solar tax credit against the alternative minimum tax?

Yes, you can use your solar tax credit either against the federal income tax or against the alternative minimum tax.

Will there be another federal solar tax incentive after the current one expires?

A new solar tax credit would require an act of Congress. While it is certainly possible, it isn’t something that can be predicted with any certainty.

Can I claim the credit if I’m not a homeowner?

Yes, but only under specific circumstances. Specifically, you must be either a tenant-stockholder at a cooperative housing corporation or a member of a condominium complex to claim the federal solar tax credit.

Can I claim the credit if I am not connected to the grid?

You do not have to be connected to the electric grid to claim the solar tax credit. You only need to have a solar power system that’s generating electricity for your home.

Can I claim the credit if my solar panels are not installed on my roof, but on the ground on my property?

Yes. The solar panels do not have to be installed on the roof in order for you to claim the tax credit, just so long as they are generating solar energy for your home.

Claiming The Solar Credit For Rental Property You Own

You can’t claim the residential solar credit for installing solar power at rental properties you own. But you can claim it if you also live in the house for part of the year and use it as a rental when you’re away.

- You’ll have to reduce the credit for a vacation home, rental or otherwise, to reflect the time you’re not there.

- If you live there for three months a year, for instance, you can only claim 25% of the credit. If the system cost $10,000, the 26% credit would be $2,600, and you could claim 25% of that, or $650.

- $10,000 system cost x 0.26 = $2,600 credit amount

- $2,600 credit amount x 0.25 = $650 credit amount

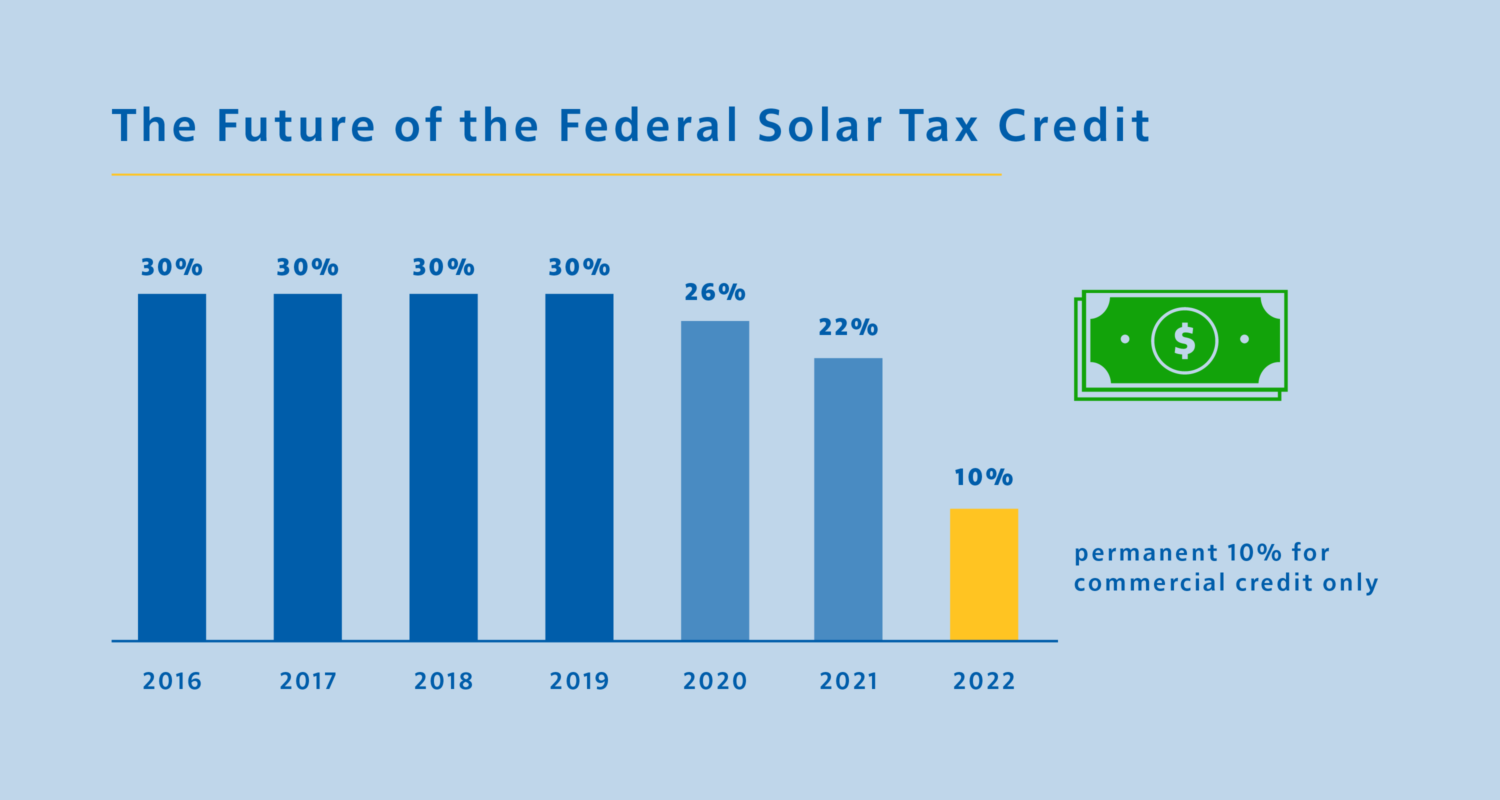

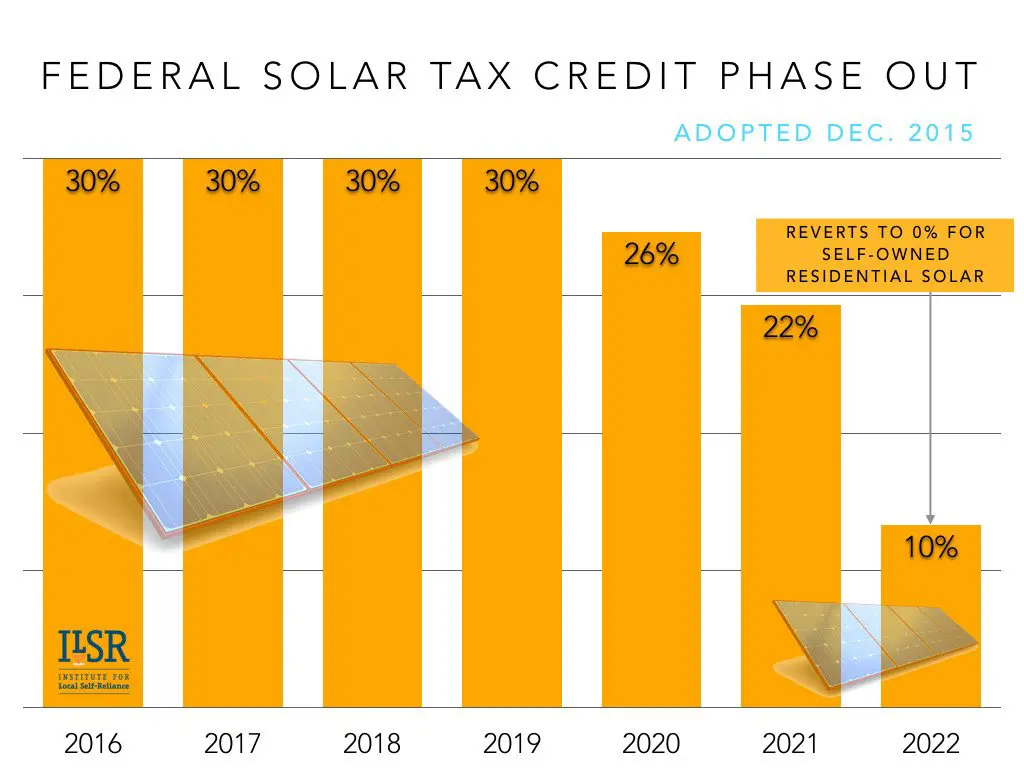

How Big Of A Difference Is A 26% Tax Credit Versus A 30% Tax Credit

Since the Investment Tax Credit is applied to your solar arrays gross system cost, the amount you receive is dependent on the amount of solar youre purchasing: bigger system, bigger credit.

Heres a quick example of the difference in credits in 2019 and 2021 for a 9 kW solar array at an average cost of $27,000.

- Installed and claimed in 2019 taxes at the full 30% level, your credit would be $8,100.

- Installed and claimed in 2021 taxes at the 26% level, your credit would be $7,020.

Thats a savings difference of $1,080 compared to the previous year.

While ~$1,000 may not seem like a huge difference to some, this doesnt include the amount that youll save on the rest of your project if applicable. For a new roof and home batteries, for example, the cost of both can be claimed on the tax credit, adding another $300-$1,000+ to the value lost in the stepdown. If youve already decided to go solar and are just waiting for the right moment, you should move forward this year to maximize your savings before the ITC steps down again in 2023.

How To Claim Your Irs Solar Tax Credit

Now that you know how you can benefit from the federal solar tax credit, it is important to understand how you will be receiving your rebate from the IRS.

The IRS offers this refund as a tax credit, which means you will not be receiving a check for the money you spent. You will, however, receive your savings in the form of a credit on your taxes. So, hypothetically, if you were to file your taxes and ended up owing $4,000 in federal taxes, but you qualified for $3,900 in tax credits due to the solar tax credit, then you would only have to pay the difference of $100 in federal taxes.

Some solar businesses, such as Tesla, are making it even easier to claim your IRS solar tax credit by bundling the solar roof and solar panel installation together. Check to see if your local solar provider offers bundling as an option to make it easier to keep track of your expenses and file for your ITC.

However, keep in mind that if you do not owe federal taxes, you will not receive any credits or refunds. Furthermore, you cannot apply the federal tax credit to any state taxes that you may owe. If you owe federal taxes, but in a lesser amount than your credit, you will only receive a credit up to the amount you owe. Fortunately, the remainder of any credit unused will roll over to the following tax year . And, if you previously met the criteria for claiming a tax credit, but forgot to claim it in past years, you can file an amended tax return to get your solar tax credit.

Freedom Solar Is An Installer You Can Trust

A solar panel installation is a big project, and its important to know that youre working with a reliable and reputable team. Whether youre an average homeowner or a large business such as Whole Foods or Office Depot, Freedom Solar is dedicated to making our clients switch to solar power an easy and affordable transition.

So if youre thinking about going solar, ready to make the switch to a lifetime of green energy, or interested in reducing your tax burden by lowering your electric bill, were here to help you begin the journey with our 7 Steps to Solar process.

Well find every available financial incentive, practice COVID-19-conscious installation methods, and offer lifetime service and monitoring to meet your needs! Take a look at what our customers say on how we deliver on our promises. Contact us to request a free, no-obligation virtual consultation with one of our energy consultants or, if youd like to learn more about the ITC, visit Energy Sage and the Solar Energy Industries Association .

What Else Do You Need To Know In 2021

To gain the full solar investment tax credit, you must pass one of two tests to determine construction commencement:

- Physical Work Test, meaning proof that construction was underway as specified by the Internal Revenue Service

- Five Percent Test, that illustrates you had incurred at least 5% of the total project costs by the deadline. Permits, site assessments, plans, environmental impact studies all of these costs qualify under the test.

Many businesses are pushing forward on projects, particularly those funded by Power Purchase Agreements , as the step-down percentage can negatively impact financing by as much as 10 percent for projects delayed till 2023 or beyond.

The ITC can be a great financial incentive for many commercial solar implementations. However, not everyone is eligible. Below, weve created a helpful FAQ / laymans guide to the solar federal ITC.

How To Claim The Solar Tax Credit Using Irs Form 5695

Note: The information below can be used if filing taxes in 2021 for a solar installation that was placed into service in 2020.

Its that time of year againtax time! But this year is different, because this was the year you installed solar panels on your home , and now youre ready to get that tax credit to take 26% right off the top of that expense. And were here to help guide you through the process!

If youre reading this and havent yet installed solar, you only have a couple more years to get the tax credit. 26% off the cost for installations completed by the end of 2022, or 22% in 2023. Thats nothing to scoff at, people – and the tax credit wont be around after that so what are you waiting for?

Get personalized solar quotes from our expert partner installers

Weve included an example below of how to fill out the tax forms. Weve also included a section at the bottom of this post that answers some frequently asked questions about the process of claiming the credit.

Weve prepared two posts to answer all your solar tax credit questions. If you’re interested in general information of the solar tax credit then you should go here. If you’re looking for information on how to claim your tax credit, then you’re already in the right place.

KEEP IN MIND: We are solar people, not tax people. We do not give tax advice, and anything you read on this page is merely one example of how someone might act. Please consult a tax professional before filing.

Impact Of The New Itc Extensions

The ITC has resulted in an extremely effective subsidy in catalyzing both rooftop and utility scale solar energy adoption across the U.S. The multi-year extension from late 2015 has caused the cost of solar to drop, while installation rates and technological efficiencies have improved. The federal solar tax credit is a great example of an innovative tax policy that encourages investment in 21st-century energy systems and technology.

Industry experts estimate a total of 27 gigawatts of solar energy had already been installed in the US by 2015, and they predict we will have nearly 100 GW total by the end of 2020. From 2015 to 2017 there was a 25% increase in the number of solar industry jobs and that number is forecasted to increase throughout the next decade. The federal solar rebate program is proof that long-term federal tax incentives can drive economic growth, technological innovation to reduce costs, and create a new generation of jobs and skillsets. We offer commercial solar in 26 states, Washington D.C., and Puerto Rico, to find out more about the ITC close to you, contact us today.

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesn’t pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

How Does The Solar Tax Credit Work In 2021

The federal solar tax credit is the most popular financial incentive for homeowners looking to go solar. The 26% tax credit is a dollar-for-dollar reduction of the income tax you owe. Many homeowners think they are not eligible for the solar tax credit because they dont have an additional tax bill at the end of the year.

This is not the case, the federal solar tax credit can get back a refund of the taxes you have already paid out of your weekly or fortnightly paycheck. Also, if you dont have enough tax liability to claim the credit in that year, you can roll over the rest of your credits to future years.

Items You Need To Claim Your Federal Solar Tax Credit

To start, you will need your solar installation receipts, along with the IRS 1040 and 5695 forms. Fill out the 1040 paper as usual, but stop at line 53 and move to form 5695. With the 5695 form, enter the cost of installation in line one. Any price related to installation is money you can claim! Reference the step-by-step process on how to file taxes to get a general idea of what to do.

If you want to update panels you installed years ago, you can still receive tax credits. You can claim the tax credit for each new cost related to the addition and wont have to pay it back to the government if you sell the house. Its possible to install solar panels and sell your building at any time yet, this is only true for residential owners, as its a more complicated process for commercial installations.

Other Incentives For Going Solar

The federal credit is the easiest solar tax incentive to qualify for but you might qualify for state and local solar tax incentives as well.

Most state and local credits and rebates wont reduce your federal credit but may increase your federal taxable income since youll have less state and local income tax to deduct. These homeowner tax benefits make it easier to recoup the upfront costs of installing solar panels.

Homeowners Guide To The Federal Tax Credit For Solar Photovoltaics

Disclaimer: This guide provides an overview of the federal investment tax credit for those interested in residential solar photovoltaics, or PV. It does not constitute professional tax advice or other professional financial guidance. And it should not be used as the only source of information when making purchasing decisions, investment decisions, or tax decisions, or when executing other binding agreements.

Well be celebrating the diverse people who are taking advantage of the suns energy and the communities that are making it easier to go solar.

Solar Tax Credit Calculator:

It is easy to give you the rate of the solar tax credit. But it is much harder to give you the dollar value for your specific home. Luckily SolarReviews.com has developed one of the most accurate solar calculators. Using data from local solar installs in your area we can give you a very accurate cost guide for your specific home.

It will show you the dollar value of the federal solar tax credit and include any state tax credits if eligible. This gives homeowners who use our calculator the opportunity to figure out if solar is worth it for their home, before talking to solar companies.

Calculate the dollar value of the tax credit