Business Taxes: Llc Vs Sole Proprietorship

New business owners often question whether it would better to be taxed as a sole proprietorship or a limited liability company .

Sole proprietorships and single-member LLCs are taxed in the same way by the IRS. The income from either type of business structure passes through to the owner’s tax return.

The most important question isdo you need the personal liability protection of an LLC?

Keep reading below for more details on how these business structures are taxed or visit our guide on how to choose between an LLC vs sole proprietorship.

2021-08-27

Can A Husband And Wife Have A Single

Yes, but only in some states.

If you and your spouse live in a community property state, you have the option of how you want your LLC to be taxed:

Community property states are: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

If you have a husband and wife LLC in a non-community property state, it cant be a Single-Member LLC. It must be a Multi-Member LLC and it will be treated like a Partnership for tax purposes.

How Much Tax Do I Have To Pay

The tax percentage is calculated on your total income, both from the enterprise and any other income.

For most people, the tax rate will be somewhere between 33.4 and 49.6%.

The tax will be somewhat higher for business income than for the corresponding salary income because the tax on business income includes a higher National Insurance rate . Tax must be calculated on all profits. There are therefore no separate threshold amounts which must be passed before the obligation to pay tax is triggered.

Recommended Reading: Can You Add More Solar Panels To An Existing System

Small Businesses And Self

The information on this page is for:

- sole proprietorships

- self-employed individuals, including those earning income from commissions

If you are incorporated, this information does not apply to you. Instead, go to Corporations.

If you are starting a small business, see the Checklist for small businesses. The checklist provides important tax information.

Business income includes money you earn from a:

- profession

- trade

- manufacture or

- undertaking of any kind, an adventure or concern in the nature of trade, or any other activity you carry on for profit and there is evidence to support that intention.

For example, income from a service business is business income. Business income does not include employment income, such as wages or salaries received from an employer.

Which Is Better Llc Or Sole Proprietorship

An LLC is better.

This is because there are no disadvantages to an LLC, however, there are disadvantages to a Sole Proprietorship.

Most importantly, with a Sole Proprietorship your personal assets are not protected if your business is sued.

However, with an LLC, your personal assets are protected if your business is sued.

And there are no tax advantages or disadvantages to either structure. Meaning, you can deduct the same business expenses and the taxes owed will be the same. This is because the IRS treats Single-Member LLCs and Sole Proprietorships the exact same way.

Then why would someone operate as a Sole Proprietorship?

- Some people arent aware of LLCs.

- Some people dont realize how easy it is to form an LLC.

- Some people dont have the money to form an LLC right away.

Some states have expensive LLC fees , and some people dont want to spend the money to form an LLC right away. If you dont have a lot of money, you can start your business as a Sole Proprietorship, and then transition to an LLC when youre ready.

However, LLC fees can be deducted on your taxes. And for most people, the liability protection is worth the cost of forming the LLC.

In summary, a Single-Member LLC and a Sole Proprietorship are taxed the same way. However, LLCs offer additional legal protection that Sole Proprietorships lack.

Recommended Reading: Do Solar Attic Fans Work At Night

Open A Business Bank Account

Apply for a business bank account with your new LLC name using your LLC EIN. Even if you already have a business bank account for your sole proprietorship, you should make sure that you have a new account under the name of your LLC. This will help you separate your business and personal finances and can help you build business credit apart from your own personal credit history.

How Are Sole Proprietorship Businesses Taxed In India

Simply put, a sole proprietorship is a small and independent business owned and managed by a single individual. Moreover, these are unregistered businesses and are one of the easiest to maintain. This sheer ease of operations makes sole proprietorship businesses very popular across the unorganized business sector, particularly among the small merchants and traders.

Read Also: Where Do Solar Panels Come From

Business Use Of Vehicle

If you use your vehicle solely for business purposes, then you can deduct the entire cost of operating the vehicle. If you use it for both business and personal trips, you can only deduct the costs associated with business-related usage.

There are two methods for deducting vehicle expensesâyou can choose whichever one results in a lower tax bill:

-

The standard mileage rate method, which involves multiplying the miles driven for business during the year by a standard mileage rate. Beginning January 1, 2019, the standard mileage deduction is $0.58 per mile. In 2018, it was $0.54 per mile.

-

The actual expense method, where you track all of the costs of operating the vehicle for the year, including gas, oil, repairs, tires, insurance, registration fees, and lease payments. You then multiply those costs by your vehicleâs percentage of business use to calculate your deduction.

The Qualified Business Income Deduction

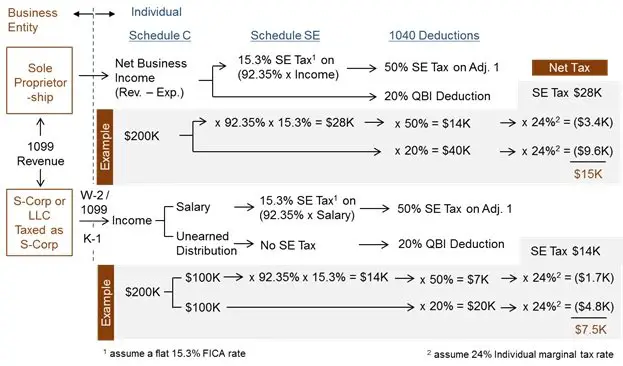

The Tax Cuts and Jobs Act of 2017 set up a new tax deduction for pass-through entities which allows you to deduct up to 20% of net business income earned as an additional personal deduction.

However, âSpecified Service Businessesâ are limited in how much they are able to apply this deduction. If youâre one of the following business owners, youâre considered a Specified Service Business:

- Lawyers

You May Like: Is Leasing Solar Better Than Buying

What Is A Sole Proprietorship

A sole proprietorship is the most common business structure and the easiest to establish. In short, a sole proprietor draws no distinction between yourself and your business for tax purposes. As a result, the IRS treats you as both. This type of business structure is unincorporated and you can receive all income from your business activities. Similarly, youre solely responsible for any debts and tax obligations the business accumulates.

The advantages of a sole proprietorship include easy setup and complete control over business decisions. Depending on the state you live and do business in, you may form a sole proprietorship without a special license. It also runs more simply if youre the only employee and dont manage payroll for others.

A Guide To Sole Proprietorship Taxes

Being a sole proprietor or independent contractor can simplify your finances. However, its important to understand how your business structure affects your taxes. There are tax laws that sole proprietors need to know. This guide explains how to prepare, file, and pay taxes when you run a business alone.

Recommended Reading: How Many Solar Panels To Power Ac Unit

Can A Sole Proprietor Turn Into An Llc

While there may be some adjustments that need to be made in the conversion, the simple answer is yes, you can convert your sole proprietorship into an LLC. There may be some contractual changes that need to happen with current clients, such as changing the contract language so it is a contract between your client and your business , not just you as an individual person.

While not a requirement, it can be helpful to check with your legal advisor or tax professional prior to making the move, just to be sure you understand the implications and are ready to make changes such as opening a business bank account or filing a business tax return.

Reporting To The Norwegian Tax Administration

Profits/deficits are reported annually through your ordinary tax return for income and wealth tax and any attachments.

- Smaller enterprises with a turnover of less than NOK 50,000 do not need to submit attachments.

- Enterprises with simple tax affairs can opt to submit the Business Tax Return.

Other enterprises must attach an income statement and form RF-1224 Personal income from sole proprietorship.If a spouse works for the enterprise, both spouses must submit a tax return for self-employed individuals, but only the spouse who has principal responsibility should submit an income statement or the Business Tax Return.

Also Check: How To Save Solar Energy

Find The Right Local Sa Accountant Now

Featured Accountant

Article by listed accountant: Rakhi Popat

With less than a week to go for provisional taxpayers to submit their returns, this past week I have had several encounters with small business owners, in particular those operating under sole proprietorships. Most small business owners have asked for an all-inclusive list of what expenses are allowed to be deducted for tax purposes, and what expenses are disallowed. Each business is engaged in unique activities with unique expenses and therefore it is impossible to give an exhaustive list of the expenses that are tax deductible. So I have decided to write this blog with the aim of explaining how taxes work for people who are running their own businesses as sole proprietors.

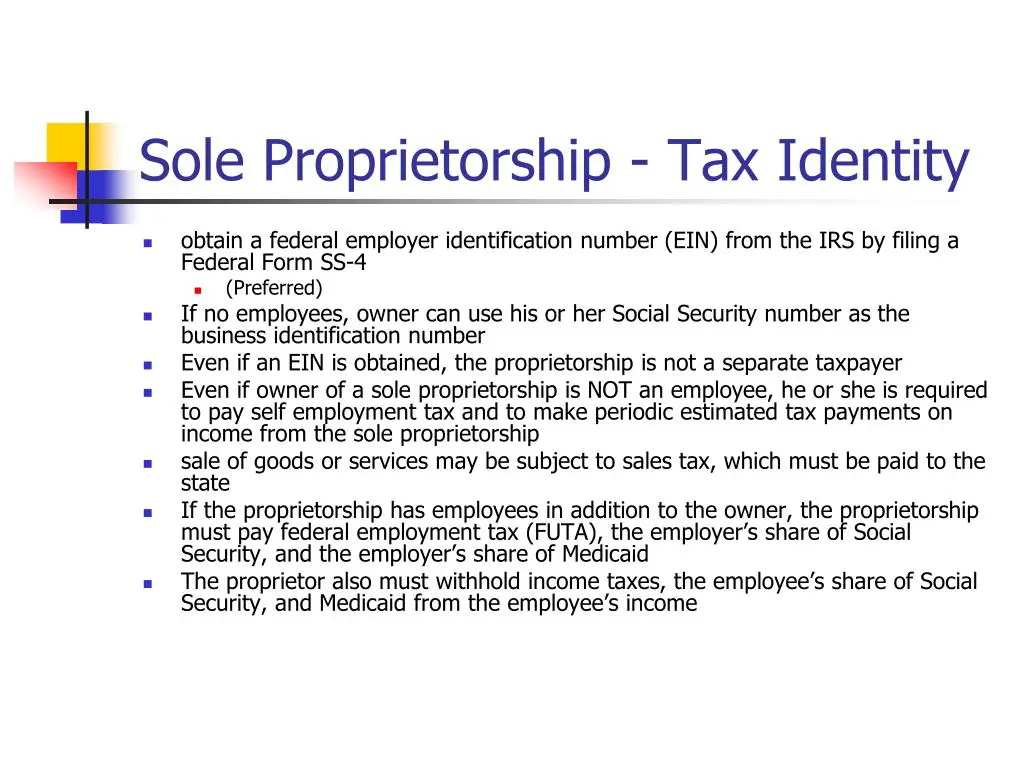

In the eyes of SARS, the individual and the business are one and the same person, so your tax return is filed in your personal capacity and the taxable income generated by the business is included in your personal tax return which is filed annually via an ITR12 . In addition to filing an ITR12, small business owners need to be registered as provisional taxpayers since they earn income other than by way of a salary. If you are a salaried employee and are also running a small business you also need to be registered for provisional tax. In summary, as a sole proprietor, one needs to file an ITR12 annually and 2 IRP6s .

Another common question asked by sole proprietors concerns home office expenses. The principle is the following :

Llc Vs Sole Proprietorship Comparison

There are four main factors to compare between a sole proprietorship and LLC:

- Liability Protection

- Cost to Register and Maintain

Liability Protection

A sole proprietorship doesn’t offer liability protection, but an LLC does. This value usually outweighs all other factors.

Branding

An LLC owner can use the business’s legal name as its brand name. A sole proprietor must use their surname as the business name or register a DBA name when available.

Pass-Through Taxation

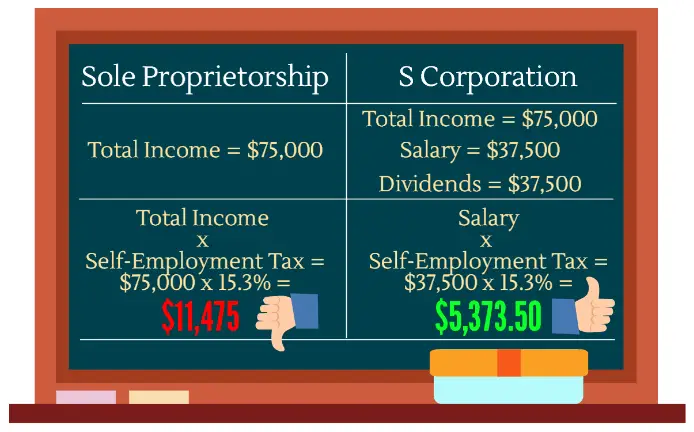

Both sole proprietors and LLCs are taxed as pass-through entities by the US Internal Revenue Service . This means that the business’s profits will pass through to its members to be reported on their personal tax returns. All profits are only taxed once, at each member’s individual income tax rate.

Cost to Register and Maintain

An LLC is a low-cost and low maintenance business structure. A sole proprietorship with a DBA is comparably priced.

Also Check: How Fast Do Solar Panels Pay For Themselves

Minimizing Your Tax Burden

While its important that sole proprietors adhere to all the tax obligations as laid out by the IRS, independent business owners should also take advantage of all possible deductions to give themselves the best shot at succeeding. As a sole proprietor, you can deduct a wide array of expenses associated with launching and running your business.

The IRS allows sole proprietors to deduct expenses that are deemed both ordinary and necessary. While ordinary expenses are those common in your specific trade, necessary expenses refer to items that are helpful but not mandatory for doing business.

Some common business expenses include office rent or mortgage payments, furniture, supplies and health insurance for you and your family members. Additionally, sole proprietors can deduct the cost of expenses related to furthering their skill sets, such as college classes, training programs, books and software. You can use Schedule C to list all of your sole proprietorships itemized deductions.

Looking for an additional tax write-off this year? As a sole proprietor, you can deduct contributions to a 401 retirement plan. Not only is opening a 401 a great way to minimize your tax burden, but it also helps sole proprietors safeguard their financial futures.

Consider Incorporating Your Business For Tax Reasons

Finally, it pays to compare how a sole proprietorship is taxed to how other business forms are taxed to make an intelligent decision about how to run your business. The primary difference in tax treatment is that sole proprietorship profits are treated as personal income, whereas corporations are taxed separately.

Because sole proprietorship income is taxed as personal income, the tax amount depends on your personal income tax bracket. Corporations, however, are not only taxed separately, but also typically have lower tax rates than personal income. You will often end up paying fewer taxes by incorporating your business than running it as a sole proprietorship.

Despite the fact that many businesses would owe fewer taxes as a corporation, balance that against the added time and expense of having to prepare corporate taxes. For smaller businesses, any tax savings may be outweighed by the cost and complexity of filing a corporate tax return.

Also Check: Can I Convert A Sole Proprietorship To An Llc

Advantages Of A Sole Proprietorship

Despite its simplicity, a sole proprietorship offers several advantages, including the following:

1. Easy and inexpensive process

The establishment of a sole proprietorship is generally an easy and inexpensive process. Certainly, the process varies depending on the country, state, or province of residence. However, in all cases, the process requires minimum or no fees, as well as very little paperwork.

2. Few government regulations

Sole proprietorships adhere to a few regulatory requirementsSecurities and Exchange Commission The US Securities and Exchange Commission, or SEC, is an independent agency of the US federal government that is responsible for implementing federal securities laws and proposing securities rules. It is also in charge of maintaining the securities industry and stock and options exchanges. Unlike corporations, the entities do not need to spend time and resources on various government requirements such as financial information reportingFull Disclosure PrincipleThe Full Disclosure Principle states that all relevant and necessary information for the understanding of a companys financial statements to the general public.

3. Tax advantages

Unlike the shareholders of corporations, the owner of a sole proprietorship is taxed only once. The sole proprietor pays only the personal income tax on the profits earned by the entity. The entity itself does not have to pay income tax.

Potential disadvantages include the following:

Can I Pay Myself A Salary As A Sole Proprietor

In theory, yes. But it wont make a difference in how youre taxed. As a sole proprietor, all of your businesss income is considered your personal income. So even if you had a separate business bank account that you drew a salary from, all of the money your business madenot just the salary youre choosing to withdrawwould be taxed as your personal income.

Read Also: What Is The Difference Between Sole Proprietorship Llc S Corp

Fact : Almost All Businesses Are Small

The vast majority of U.S. businesses are small, whether they are pass-through businesses or C-corporations. Figure 2 shows the share of businesses with $10 million in receipts by type of business. Receipts generally mean sales, but can include income from legal services, rent received, or portfolio income of a financial firm. In 2014, almost 99 percent of all businesses were small by this standard .4 Almost every sole proprietorship was a small business but 95 percent of C-Corporations were small as well.

Whether a business is a pass-through partnership or an S-corporation, or whether it is a C-corporation is not a good indicator for the size, complexity, or even number of shareholders of a business.

Change The Advance Tax

The Norwegian Tax Administration uses the information about your business income from the previous tax assessment to calculate your advance tax.

If your business income is higher or lower than expected, you should change your advance tax to avoid paying too much or too little advance tax.

You must estimate the amount of business income you expect to have this year as best you can.

In the form, you can find the category Business. Other business is most common. Youll find the expected business income there and you can change the amount. Remember to make the change in both Profits from other business” and Personal income – other business”.

If you receive sickness benefits from NAV, you must include this in a separate field. Youll find sickness benefits for self-employed persons/businesses under the category “Business.

Don’t Miss: What Are Tesla Solar Panels Made Of

How Corporations Differ From Sole Proprietors In Terms Of Salary

If your business is not a sole proprietorship but is incorporated, things are a little different. Since you are an officer of your corporation as well as an employee on the payroll, you have to pay yourself a salary or wages, which must be reasonable compensation according to the IRSneither too much nor too little.

Some business owners use the businesss money to pay their personal expenses without taking a salary in the belief this will save them on taxes. But this tactic can backfire and lead to substantial penalties if the IRS decides the money should have been taken as a salary.

If your business is a corporation, the best way to go is to determine the average rate for CEOs in your industry, your region and for companies of similar size. You can get this information from your industry trade association, or from sites such as Glassdoor.com or Salary.com.

Keep in mind that salary and compensation can be complicated by factors such as whether your business has investors and how many shares of the businesss stock you own. Review the IRS guidelines and frequently asked questions about small business owners salaries, and consult with a business accountant before setting your salary.