How Does The Owner Of A Sole Proprietorship Pay Themselves

As a sole proprietor, provided money is in the business checking account, you can take money out or pay yourself whenever you want. You simply write a check to yourself and at this time you dont have to pay tax on the money received. This isnt technically a salary or wages, but instead a draw. A draw is an amount of money you take out of the business.

The profits of the business will eventually be taxed, regardless of how much money is drawn from the business. If money is left in the businesss bank account and not paid to the owner, that money will still be taxed.

Some Restrictions On Setting Up A Dba California

You cannot add any misleading business titles such as LLC, Inc. or Corp. to the end of your name. These abbreviations give the impression that the business is structured in a specific manner, which has various legal and tax implications. There are strict requirements in becoming a corporation or LLC, as well as liability issues which could mislead the public if you use these monikers.

Note that filing a DBA California does not grant you exclusive rights to use that name. The only way to legally protect your exclusive use of a name is to register a trademark under that name.

Payment Of Taxes On Business Income

A sole proprietor pays taxes by reporting income on a T1 income tax and benefit return.

If you are a sole proprietor, you or your authorized representative have to file a T1 return if you:

- have to pay tax for the year

- disposed of a capital property or had a taxable capital gain in the year

- have to make Canada Pension Plan/Quebec Pension Plan payments on self-employed earnings or pensionable earnings for the year

- want to access employment insurance special benefits for self-employed persons

- received a demand from us to file a return

You also need to file a return if you are claiming an income tax refund, a refundable tax credit, a GST/HST credit, or the Canada Child Benefit. You should also file a return if you are entitled to receive provincial tax credits.

The list above does not include every situation where you may have to file. If you are not sure whether you have to file, call 1-800-959-5525.

Also Check: Is Solar Worth It In Maryland

Filing A Dba: Key Points To A Successful Filing

To do business under a DBA, you must complete and file the appropriate DBA forms and pay a filing fee, after which point you receive a DBA certificate. Depending on the state you may be able to file with a local or county clerks office, with a state agency, or both. Thus, be sure to verify all the relevant local governing authorities for DBA filings in the states you are, or will be, doing business in. Then confirm all the DBA filing requirements for your business or entity type.

In some states, filings are made in different offices for sole proprietors and general partnerships than they are for corporations, LLCs and other statutory entities. The forms may be different too. Upon successful completion of the filing and receiving an fictitious name certificate, you may begin using your DBA name.

Your business name is a valuable asset that you want to protect. Using a DBA name can be an important part of your business strategy. And if so, making the appropriate filing to register the DBA name, and making sure the registration does not expire are crucial steps. Now that you have some basic facts about DBA names and DBA filings, work with your business advisor and compliance partner to make sure theyre done right.File a DBA Online Now

Is It Ever Appropriate To Create An Dba For An Llc

Yes, an LLC may benefit from the ease of DBA filing when the company wants to expand into new products or services.

For example, if John Smiths cleaning company were ABC Cleaning, LLC and he decided he wanted to expand into selling cleaning supplies online, he could file a DBA for his new project ABCCleaningSupplies.com that would be protected under the original LLC.

A DBA allows an LLC to broaden its offerings without creating a new LLC or corporation for each division.

Don’t Miss: Can A Sole Proprietor Have A Dba

Getting A Business Loan As A Partnership

Again, the requirements will depend on your lender and the type of loan you need. But something will remain the same no matter what lender you approach: youll have to provide proof of how your business is structured.

We have seen in the previous section that youll need proof of DBA registration in the case of a partnership, youll need to provide your business partnership agreement. This helps to establish your ownership of the business. Remember that your lender would like to be sure that they are dealing with the correct person when they are in the process of appraising your loan application.

The table below shows a breakdown at a glance of the features explained above:

Sole Proprietorships And Partnerships

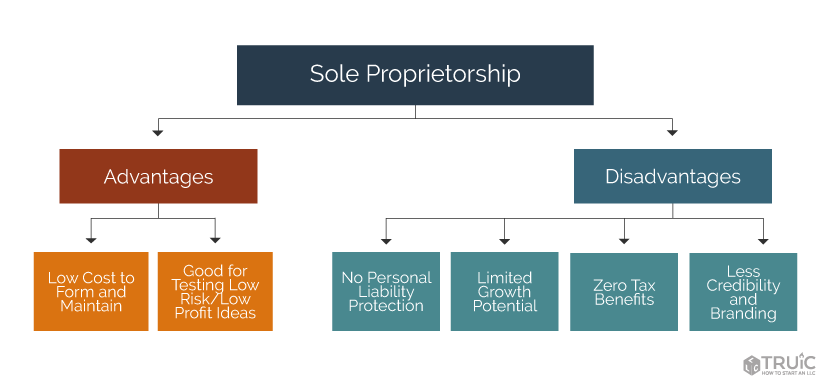

A sole proprietorship is a business with only one owner.

A sole proprietor is self-employed, performs all business operations and assumes all liabilities.

A partnership company is operated by two or more parties.

In a general partnership, partners are responsible for all aspects of the business, including the debts of the partnership.

A limited partnership can have general and limited partners. Generally speaking, there’s a limit on the liability of a limited partner, while the general partner’s liabilities are not limited.

A limited liability partnership is has no general partners and all partners have limited liability.

Also Check: Why Use Solar Energy For Homes

Apply For An Employer Identification Number

Apply for an employer identification number with the Internal Revenue Service. This is a requirement if you want to open a bank account under your DBA or hire employees. Complete online on the IRS website.

Owning your own business doesn’t mean you have to go at it alone. An online legal service provider or business attorney can help you through the DBA, permitting, and tax filing processes.

This portion of the site is for informational purposes only. The content is not legal advice. The statements and opinions are the expression of author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law.

File a DBA for your business online.

Register An Indiana Dba For A Sole Proprietorship Or General Partnership

General partnerships and sole proprietorships are required to file their Indiana DBA with the County Recorder in the county that their business is located. Estates and real estate investment companies are also required to file with the county.

A sole proprietorship is a business owned by a single individual that isn’t formally organized. If you run a business and file taxes under your own name, you are a sole proprietor.

A DBA is only used for branding. We recommend forming an LLC to separate your business and personal assets.

Don’t Miss: How Tall Are Solar Panels

Is A Dba Right For My Business

Whether or not a DBA is right for your business depends on a variety of factors, including the type of business you own and what goals you have for your business. For example, if youre a handyman who is content to roll around town with your name painted on the side of your white van, you may not need a DBA. But again, if you have a trendy logo and a catchy business name, youll get a lot more positive attention as you roll around town.

If you operate several types of businesses which could create some confusion for potential customers and cause you to lose out on sales, you may want to set up a DBA to segment your operations and strengthen your branding. For example, parents of young children might not want their kids to see a feature film released by Touchstone Pictures, but Disney is just using a different name. Likewise, if youre selling musical instruments, motorcycles, and generators, you may want to create a DBA for each of these lines of business to avoid market confusion.

How To Pay Taxes

Since taxes dont come out of the business owners pay like they would for an employee, the sole proprietor will pay an estimated amount quarterly. As a general rule, if a self-employed person expects to incur over $1,000 in taxes for the year, they will need to pay quarterly. While the business owner could wait to pay their taxes in the last quarter, there is the potential for an underpayment penalty from their state and IRS from underpaying the taxes.

There are a few ways to avoid an estimated tax underpayment penalty by either

Owing less than $1,000 in taxes for the current year or

Pay estimated tax payments that total at least 90% of the total tax liability for the current year or 100% the total tax liability for the prior year, whichever amount is lower.

As a new business filing for the first year, since there was no tax liability from the previous year, a sole proprietor may be able to wait until the end of the year to pay these taxes.

Whichever route you go, its important to continually set aside a portion of the profits from the business to pay taxes, rather than try to scramble to come up with the funds as the penalties and fines can be substantial for underpayment.

Read Also: Are Sole Treadmills Any Good

Choosing A Name For Your Business

To choose the perfect name for your business, you should:

- Think about how to apply your businesss message to its name

- Pick something that is easy to pronounce and memorize

- Avoid using hard-to-spell or lengthy words in the name

- Ensure the name isnt already taken

- Ask your family, friends, and team for feedback on the name

Selecting a business name to operate under is a big step. It takes some trial and error, patience, and time to choose the right name. List out the business names you like and do your homework on whether they are available to use. If the name is already taken, go back to the drawing board.

After you decide what to name your business and check its availability, register the name with your state.

What Is A Dba

Before we start analyzing and understanding business structures, we need to understand the term DBA and explain that a DBA is not a legal structure.

DBA is an acronym for Doing Business As and refers to the difference between the legal name of the business and the name by which it operates day-to-day, the name by which customers and associates may know the company . Some states do require businesses to register the DBA name before they can begin using it, such as California and Florida.

A DBA is not a legal structure but rather a way to allow a sole proprietorship to have a business name without filing an LLC or Corporation. While simple and inexpensive, it comes with the same risk as being a sole proprietorship or general partnership.

Recommended Reading: How To Replace Roof With Solar Panels

Differences Between Dba Sole Proprietorship Vs Llc And Corporation

Before you start your own business, you have to decide, by law, the legal formation you want for your business. This is also called business structure and legal structure. Sole Proprietorship vs LLC, DBA, and Corporation. Which one will be the best fit for your business?

Each business structure has different features, pros, and cons. And picking the right structure for your business will allow you to manage three important elements: liability, taxes, and complexity. The good news is you dont need to be a lawyer to decide on your legal formation. It can take more or less time and cost more or less money, depending on the structure of your choice.

Keep in mind that each of the legal formations takes very different approaches to taxation.

Does A Dba Protect Me

The filing of an assumed name certificate or DBA does nothing to protect the business owner from the obligations and liabilities of the business. If you are a sole proprietorship that uses a DBA you will still be personally liable for the liabilities of the business.

One of the benefits of an LLC is the liability protection if provides the business owner.

Read Also: Where Can I Buy A Solar Battery Charger

Dba California: Everything You Need To Know

The law states that a DBA California filing is required when sole proprietors, partnerships, limited liability companies, or corporations want to do business.8 min read

The law states that a DBA California filing is required when sole proprietors, partnerships, limited liability companies, or corporations want to do business.

Registering a DBA California allows your company to operate under a different name than what was used at the time of formation. Your company’s reputation is everything. Your choice of a name will be the foundation of your brand and your business relationships. There are many reasons why you might want to start with a clean slate and choose a doing business as, commonly called a DBA name, other than your own name or the name you originally registered with the California Secretary of State.

Registering a DBA name allows you the right to operate a business under any name other than the legal name of the company or individual. Making this important name change can be straightforward, but there are several hoops to jump through and many considerations along the way to get there.

Understanding A Sole Proprietorship

A sole proprietorship is very different from a corporation , a limited liability company , or a limited liability partnership , in that no separate legal entity is created. As a result, the business owner of a sole proprietorship is not exempt from liabilities incurred by the entity.

For example, the debts of the sole proprietorship are also the debts of the owner. However, the profits of the sole proprietorship are also the profits of the owner, as all profits flow directly to the business’s owner.

You May Like: Is Solar A Good Career

Is Filing A Dba In Florida Necessary

If you intend to operate your Florida business under any name other than your own name or the registered name of your business, you must file a fictitious name registration.

Because a companys official legal name must include a business type designationlike LLC, Inc., or Co.businesses that do not want to use that designation in marketing must register a DBA.

Florida requires DBA registration to protect the public from business owners who might want to hide their identity behind an alias. Registration of a DBA allows consumers to search public records and determine which individual or business is behind a fictitious name.

If you fail to file a DBA in Florida, you can be charged with a second-degree misdemeanor. This could carry penalties of up to 60 days in jail, a fine of up to $500, or both.

Frequently Asked Questions About Dbas

What does it mean to have a DBA?

DBA means “doing business as,” and filing a DBA allows for a business to officially operate under a name of the owner’s choosing.

What is the difference between an LLC and a DBA?

Doing business as refers to businesses that operate under a fictitious name, while limited liability company refers to legal entities that are entirely separate from business owners. LLCs offer far more legal protections to business owners than DBAs do.

Is a DBA a legal entity?

No. A DBA simply means that a business is operating under a name of their choosing.

Can a DBA have a tax ID number?

A DBA is not a legal entity and cannot have its own tax ID number. However, a business operating under a DBA can have its own tax ID.

Can I turn my DBA into an LLC?

Yes. The business owner would need to follow the steps to register their business as an LLC, which is a more time-consuming and extensive process than filing a DBA.

How much does a DBA cost?

DBA filing costs differ by state but typically range from $10 to $200. There may be applicable renewal fees every several years as well.

Do I need a separate bank account for a DBA?

The answer is dependent on the bank that you use. Some banks require separate bank accounts for businesses with different names, but this isn’t always the case. In most cases, separate bank accounts are only required for separate tax ID numbers.

Do I need a DBA if I use my own name?

What does a DBA allow you to do?

Is DBA a business license?

Read Also: Do Solid Core Doors Reduce Noise

The Ins And Outs Of Filing For A Dba

The rules, requirements, forms, and fees associated with filing a DBA are different in each state and county. The U.S. SBA provides a chart that details DBA filings state-by-state. In some states, sole proprietors and general partnerships file in one office while corporations, LLCs, and other statutory entities file in another. The DBA forms may differ as well. The time it takes to process a DBA also varies. Its best to learn how your state or county operates.

Heres some additional information on filing a DBA:

Good Standing

If youre incorporated or have an LLC, you may be asked for proof that your business is in good standing. You can request a Certificate of Good Standing from the secretary of state. There are several businesses that will prepare and file the necessary forms for you.

You Cant Use Inc. or Corp.

Remember that you cant add Inc. or Corp. to the end of your DBA if your business is not incorporated. The same goes for an LLC.

Announcing Your DBA

You may be asked by your state or county to announce your DBA by putting an ad in a local newspaper so the public can be made aware of your filing.

Payment and Filing Methods Vary

Payment and filing methods for DBA vary by state/county. Some allow you to pay by debit or credit some require a money order or cashiers check. Filing can be carried out online in some states while others want you to mail notarized documents to their offices. Check with your state/county office to be sure.

DBAs Need to Be Renewed