Solar Battery Rebate Sa

South Australia is also offering a solar battery rebate. It has recently been updated as of April 2020 and reduced down to a subsidy of $3000.

Homeowners are able to claim this more than once if you own several homes. If you do decide to claim the solar battery rebate with an existing solar system, you will also lose your Feed-in Tariff rate of 44c per KWh.

You can claim this solar battery rebate through your solar installer. They will provide you with a link once you are happy with the quote.

Homeowners can then follow the link and apply for the subsidy. If you are looking for a finance system, you can apply for this at the same time.

Once approved, the money will be deducted from the amount quoted by your system provider and they will get paid the subsidy. The subsidy is expected to decrease over time.

Getting Your States Tax Credit

Many states also offer tax credits for solar some will continue even after the federal credit expires. Arizona and Massachusetts, for instance, currently give state income tax credits worth up to $1,000 toward solar installations. New York offers a state tax credit of up to $5,000. Marylands is $1,000 per system, plus 30 percent of the cost to install a giant battery to store the energy thats produced.

For details on your states programs, go to your states tax authority website, or to dsireusa.org, a catalog of all state energy incentives run by the North Carolina Clean Energy Technology Center.

Net Metering Bill Credits#

Understanding Net Metering Credits – Click to Enlarge

When you generate solar power, any energy you don’t use immediately flows back into the electric grid. Fort Collins Utilities pays for the energy returned to the grid through net metering credits on your monthly utility bill based on the current residential rates. Residential energy rates and billing changed to Time-of-Day pricing in 2018, which applies to both energy purchases and credits for energy returned to the grid.See the table of credit rates under the heading ‘TOD Pricing – Solar Customers.’

Energy credits are allowed to offset other charges on the monthly utility bill. Accumulated bill credits can roll forward to the next month. Installing battery storage is the only way to bank solar energy in your home.

Fort Collins Utilities’ recommends working with the members of the Participating Solar Contractor Network listed below. Contractors in the Network have committed to conduct their business according to a code of ethics and the Solar Energy Industries Association Solar Business Code.

Residential Solar Rebates are only available to customers who work with active Participating Solar Contractors through purchasing, design and installation of their solar PV system. Customers are encouraged to solicit competitive bids from two or more contractors. Use Utilities’ MyData portal to share your energy history data with contractors that have registered for this service.

Active Participating Solar Contractors

Also Check: How Big Does My Solar System Need To Be

How Long Will The Federal Solar Tax Credit Stay In Effect

As the saying goes, all good things must come to an end. And the solar tax credit is no exception.

However, the federal government recently extended the federal solar tax credit as part of a federal spending package passed in December 2020.

Under this new bill, residential, commercial, industrial and utility-scale solar projects that begin in 2021 and 2022 will be eligible for 26% tax credit. This number will drop down to 22% for solar projects in 2023, and it disappears completely for residential installs beginning in 2024.

Heres a quick overview showing the value of the federal tax credit over the next couple of years:

- 2020 2022: 26%

- 2023: 22%

- 2024: 0%

You can claim the credit in the same year you complete the installation, so you can claim the full 26% tax refund if you install your system before the end of the year 2022.

The tax credit plays a major part in the return on investment you see from going solar, as well as minimizing the upfront cost of the system however, youll have to wait until after filing to see the overall cost go down. Grid-tie systems pay for themselves either way, but claiming the credit allows you to realize more immediate savings. We cant recommend enough that you capitalize on the full 26% credit, because the value only shrinks after 2022.

Federal Solar Tax Credit Filing Step

Fill in Form 1040 as you normally would. When you get to line 53, its time to switch to Form 5695.

Step 1: Find out how much your solar credit is worth.

- Enter the full amount you paid to have your solar system installed, in line 1. This includes costs associated with the materials and installation of your new solar system. As an example, well say $27,000.

- For this example, well assume you only had solar installed on your home. Enter 0 for lines 2, 3 and 4.

- Line 5 Add up lines 1 through 4. Example: 27,000 + 0 + 0 + 0 = 27,000

- Line 6 Multiply the amount in line 5 by 26% Example: 27,000 x .26 = 7,020

- Line 7 Check No. Again, for this example, were assuming you didnt have any other systems installed, just rooftop solar.

- Lines 8, 9, 10 and 11 Dont apply to you in this example for the same reason. You can fill each with 0 and skip down to line 12.

Step 2: Roll over any remaining credit from last years taxes.

- Line 12 If you filed for a solar tax credit last year and have a remainder you can roll over, enter it here. If this is your first year applying for the ITC, skip to Line 13.

- Line 13 Add up lines 6, 11 and 12 Example: 7,020 + 0 + 0 = 7,020

Step 3: Find out if you have any limitations to your tax credit.

Also Check: What Battery Is Best For Solar System

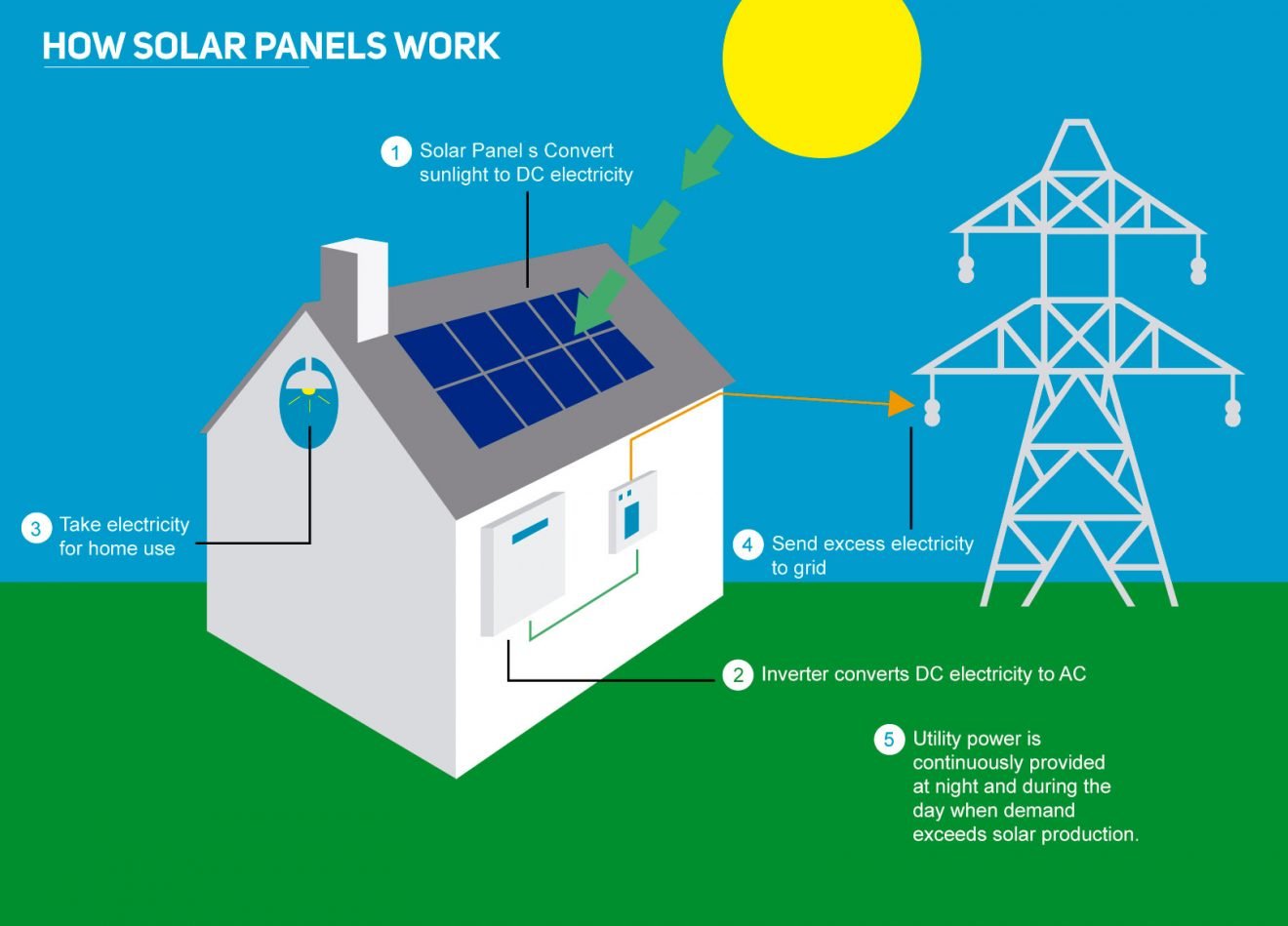

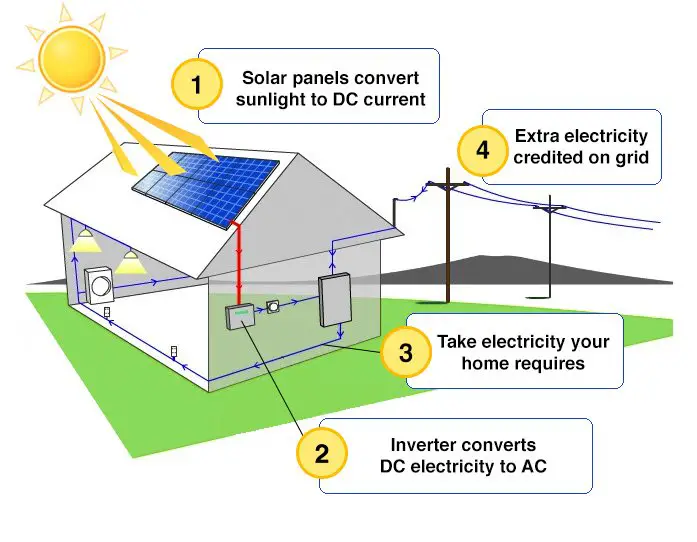

How Does A Solar Panel System Work

Now that you are familiar with all of the components used in a solar panel system, lets try to understand how a solar panel system can power your home entirely. The DC current generated by the solar panel is fed to the solar inverter, which converts it into AC current. You can either connect a large battery to this system so that it can store the electricity which you can use later on or directly power certain appliances that you can operate only in the day time.

You can also enable the net metering option for your solar panel system. If your solar panel system is generating more electricity than you can utilize, you can transfer it back to the grid and get credits in return. Then, you can use these credits to use electricity at night or in case you are running short on power on a cloudy day.

Things You Must Doto Get Your Rebate

Claiming your solar panel rebate from the government is typically straight-forward. However, there are a few things you need to do to ensure you receive your buying incentive.

- Products must be approved by the CEC

- Your installer must be CEC accredited

- You must claim your rebate within 12 months of installation

Recommended Reading: How To File Taxes As A Sole Proprietor

Qualities Of A Retailer You Should Check

CEC Approved retailer: Is a retailer that abides by the code of conduct set by the Clean Energy Council. The Clean Energy Council is the governing body of solar and other renewable energy. The retailer also needs to pay the designated fees to get approved. Besides, the retailer should also carry out any necessary paperwork to show compliance with the essential procedures.

Considering a solar panel installation has always been a costly decision owing to not being able to change it once installed and getting the return on investment in a short time. However, government incentives, along with other rebates, make it easier to install a system. Therefore, it is our utmost duty to inform you about these incentives lest you shouldnt miss any of these opportunities. I hope this article will help you receive the maximum benefit from an investment in solar panel systems and comprehend the motive of the solar panel rebate Victoria as well.

Tags:

Bottom Line: What To Know About Federal Solar Tax Credits

The federal solar tax credit is a win for any qualifying individual or business installing a solar system on their property. The tax credit helps offset the cost of the system and can make renewable energy far more affordable and attainable to individuals who would like to live a more sustainable lifestyle.

- Article sources

- ConsumerAffairs writers primarily rely on government data, industry experts and original research from other reputable publications to inform their work. To learn more about the content on our site, visit our FAQ page.

Also Check: Will Solar Panels Run An Air Conditioner

Can The Credit Be Taken On A Second Home

Yes you can, if thatâs where you are mostly living that year. The IRS specifies that the credit is for your main home in the tax year. They define main home as:

Your main home is generally the home where you live most of the time. A temporary absence due to special circumstances, such as illness, education, business, military service, or vacation, wonât change your main home.

Main home isnât the same thing as primary home. For example, if youâre retired and spend most of the year in your cottage, and then decided to install solar panels on that cottage, you can claim the credit because thatâs where you lived that year.

How To Find A Solar Partner For Installation

When you start looking for solar installers to help with your home solar installation, youll likely have a lot of questions. Before diving in and working with just any old solar installer, take your time to thoroughly vet each company that you might work with. Youll want to find a company that has your best interest in mind, and thats willing to work with you. Here are a few filters to put them through and questions to ask.

- How long have they been in business? Look for five years as a good threshold.

- Do they have a clean and easy-to-use website? A professional company will put time into its online presence.

- Do they offer a warranty? Not all companies will offer workmanship warranties. A good warranty is vital.

- Do they offer professional customer service? How youre treated in the sales process will likely be how youre treated throughout the time you work with them.

- Will they be there for you in the future? Finding a company thats willing to partner with you throughout the future and not just right now is a huge advantage.

Read Also: Is It Safe To Use Pine Sol While Pregnant

Will Solar Energy Become Too Expensive

Certainly, solar power will not be unaffordable. Judging from how the price of solar power has been dropping in the last 10 years, it is unlikely that the price will remain about the same.

Taking a quick look at how the trend has been, the price of a 5Kw solar system in 2008 was $40,000, and in 2016 it was valued at $6,500. This is a huge decline in price.

Moreover, even as technology continues to improve, solar power still continues to be affordable for many people. Again, with the Australian government still encouraging people to use solar power, it is, without a doubt, that prices will not shoot to unaffordable levels. It will still be affordable to install solar power systems for most people.

How Big Of A Difference Is A 26% Tax Credit Versus A 30% Tax Credit

Since the Investment Tax Credit is applied to your solar arrays gross system cost, the amount you receive is dependent on the amount of solar youre purchasing: bigger system, bigger credit.

Heres a quick example of the difference in credits in 2019 and 2021 for a 9 kW solar array at an average cost of $27,000.

- Installed and claimed in 2019 taxes at the full 30% level, your credit would be $8,100.

- Installed and claimed in 2021 taxes at the 26% level, your credit would be $7,020.

Thats a savings difference of $1,080 compared to the previous year.

While ~$1,000 may not seem like a huge difference to some, this doesnt include the amount that youll save on the rest of your project if applicable. For a new roof and home batteries, for example, the cost of both can be claimed on the tax credit, adding another $300-$1,000+ to the value lost in the stepdown. If youve already decided to go solar and are just waiting for the right moment, you should move forward this year to maximize your savings before the ITC steps down again in 2023.

Recommended Reading: What’s The Price Of Solar Panels

Redland Road & Bulverde Road Area

In reviewing our reliability performance, we have identified several areas that tend to experience power outages affecting large numbers of customers due to the exposure of our overhead electric lines to weather , trees and animals. This program is being implemented to replace or convert portions of our overhead electric distribution system with underground lines and equipment to improve electric service reliability in these areas.

When Does The Solar Feed

Feed-in tariffs are set to end on 31st, December 2030. As they are not a government incentive but something offered by power companies, this will most likely continue after 2030.

Power companies buy the energy from you at a wholesale price and sell it for the retail price to local residents. Although they are only making a few cents per kW of power, they do not have to burn more coal or buy and install their own systems, so it is of a large benefit to them also.

Read Also: How To Charge Blavor Solar Power Bank

Where Does The Energy Go First

Before we get too far into this, its important that we refer back to some of the information that we covered above. When sunlight first hits your solar panels, its captured as DC electric current. This current then flows through the wiring to specialized inverters located near your homes electrical panel. The inverters transform the electrical current from its DC form into AC current so that it can be used, stored, or sent off to the grid.

After its transformed from DC to AC, the next place that it goes depends entirely on how you have your solar energy system installed. If you have a battery bank installed on your home, the current will travel in a different path than if you dont have one installed.

Property & Salestax Exemption For Solar

Even though solar increases the value of your home and allows for greater marketability, that extra value isexempt from property taxes in New Mexico. A property tax exemption makes it more economically feasible for a taxpayer to install a solar system on a residential or commercial property you get the financial benefits of generating your own power, without having to worry about a higher tax bill!

New Mexico also offers state sales tax exemptions for solar panel installation. A sales tax exemption means that homeowners and businesses would not have to pay any additional state sales tax on their solar panel system.

AVERAGE SAVINGS VALUE OF PROPERTY TAX EXEMPTION: Variable

AVERAGE SAVINGS VALUE OF SALES TAX EXEMPTION: $1,750

Recommended Reading: When Do Babies Eat Solid Food Only

What Are Solar Rebates

In general, solar rebates and incentives are government-initiated programs that are used to encourage citizens to use solar technology. There are many ways to take advantage of these incentives.

They may come from your government in the form of tax credits, from your utility, one-time rebates, or even performance-based rebates. Most governments support solar technology as it makes the environment cleaner. It also lowers general energy prices, makes your energy grid more stable, and affects the level of fossil fuel emissions per area in the country.

How Do Solar Loans Affect Solar Tax Credit

There are two types of loans in solar as it relates to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to them for this monthly payment. If you do not, this will initiate another loan in the tax credit amount at the same APR.

The second type of solar loan is where youll have a different payment for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit youll have the option to submit your federal tax credit which will re-amortize your loan to lower monthly payments. You can also keep the federal tax credit and your payments will remain the same. Solar.com can help you figure out which of these options are best for you.

Also Check: How Does No Cost Solar Work

How Do I Use The Tax Credit To Pay Down My Loan

Mosaics solar loan programs are built to be flexible, simple and affordable and, in the case of CHOICE loans, the monthly payments are specifically structured with the federal tax credit in mind. However, whether you opt for a CHOICE or a PLUS loan, you have the option of reducing your monthly loan payments by using your federal tax credit or your own savings. Heres how it works:

CHOICE: Mosaics CHOICE loan product is structured with the federal tax credit in mind, with lower monthly payments you can lock in by applying the full amount of your credit. Heres how it works:

- If you make the voluntary CHOICE prepayment before the end of month 18, it can reduce your monthly payment beginning in month 19

- The earlier the CHOICE payment is applied, the lower future payments will be

- If you pay down your loan by less than the specified CHOICE target loan balance, your monthly payment goes up

Its your CHOICE!

PLUS: Mosaics PLUS loan product which can be used to finance other home improvements, in addition to solar and batteries has monthly payments that do not assume the use of the federal tax credit. However, if you opt to use either the tax credit or personal savings to make voluntary prepayments to reduce your loan principal in the first 18 months, your monthly payments will be reduced for the remainder of the loan term just like CHOICE. However, unlike CHOICE, if you choose to not make any extra pre-payments, your monthly payments will not increase.

Logo