Is Going Solar Worth It

The solar rebates and incentives available to Texas residents can make a huge difference in the cost of your initial investment. They not only make going solar cheaper, but provide reassurance that youre doing the right thing. Click here to find out how much you can save by going solar. The combined cost and environmental benefits make it worth it to consider installing a solar system on your home.

Texas Solar Property Tax Exemption

Texas lawmakers have come through with a solid solar property tax exemption. When you install that shiny new solar power system, the resulting increase in home value is exempt from 100% of the resulting property tax increase.

Solar panels will increase the value of your Texas home by roughly 70% of system costs. So while the value of your home will go up, your property taxes wont.

Example: If your solar system costs $20,000, your estimated property value increase of $14,000 will be tax exempt.

Texas Solar Panel Companies

There are many available solar panel companies in Texas that offer to bring solar energy to your home. Even better, many Texas solar installers can customize a solar panel system for your home to ensure it meets your energy needs. If youre ready to invest in solar panels in Texas, make sure to research the installers in your area before signing a contract. In the meantime, SaveOnEnergy is here with guides and resources to help you navigate the solar industry.

Don’t Miss: How To Use A Solar Battery Charger

Net Metering Programs In Houston And Dallas

Unlike Austin and San Antonio, where a single municipal utility sets the rules for solar power, Houston and DFW have a deregulated market where electricity consumers can choose their provider. This section will focus on the main retail electricity providers with solar buyback programs: MP2 Energy, Green Mountain, TXU and Reliant.

Is Solar Worth It In Texas

So is solar worth it in Texas? Considering all of the incentives that are available, plus the abundance of sunshine in the state throughout the year, Texas is one of the best states to invest in solar energy.

The sooner you do it, the more you’ll start saving.

Looking for more information like this? Visit our blog today to keep reading.

You May Like: How To Estimate Solar System Size

Welcome To The Smart Sourcesmsolar Pv Program

The SMART Source Solar PV Program isdesignedtohelp customers of AEP Texas meetaportion of their energy needs with solar electricsystems. The Program offers financial incentives that help offset theinitial cost of installing a solar energy system. By installing solaron your home or business, you can generate a portion of your ownelectricity and help theenvironment.

NOTICE:Only solar installation companies that are registered with theprogram can apply for and receive incentives, and anyinstallation work must begin after an incentive commitment has beenmade. Unregistered installers, or installers who claim that you will beable to apply for an incentive after the installation is complete, may beengaging in fraud, and you will not be able to receive anincentive if you work with them. Please see our list of registeredinstallers here.

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2020 but I did not move in until 2021.

May I claim a tax credit if it came with solar PV already installed?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house in other words, you may claim the credit in 2021. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

How do I claim the federal solar tax credit?

Read Also: How To Make A Solid White Background In Photoshop

Mp2 Energy Net Metering Program

MP2 energy has a net metering program for the Oncor and CenterPoint service areas. All surplus generation from solar PV systems is credited at the retail price, and subtracted from subsequent power bills. The only drawback is that you cannot bank your credits indefinitely: if there is a balance in your favor after the October bill, the account is cleared. In other words, you can reduce your yearly power bill to zero, but MP2 Energy does not pay for accumulated credit.

Texas Utility Company Rebates

Many energy companies throughout Texas offer their own rebates, which make going solar in the Longhorn State that much more attractive. Heres a rundown of solar incentives offered by various TX suppliers.

Austin Energy Austin Energy customers are eligible for a rebate of $2,500 if they install a solar system on their home. Not only that, but they also have a generous Solar Tariff buyback program which we will cover in the next section.

CPS Energy If you live in the San Antonio area, CPS Energy also offers a $2500 rebate program to help reduce the cost of solar panel installations.

Guadalupe Valley Electric Cooperative If you live in Seguin, Cuero, Gonzalez, Shertz, Shiner, or Goliad, GVEC offers a rebate of $1.00 per watt up to $4,000. So even if you get the industry average solar system size you would already be receiving the max rebate of $4,000.

Oncor Electric Delivery Oncor, one of Texas largest electricity providers, also offers generous rebates that it calculates based on the size of a homes solar system and estimated decrease in energy usage. The average rebate is approximately $5,400 and the max is $8,500

TXU Energy TXU Energy doesnt offer installation rebates but they also have a great power buyback program that we will cover in the next section.

Garland Power & Light GP& L offers Garland area residents a rebate up to $500 which falls under their Energy Efficiency Rebate Program.

Don’t Miss: Can I Get Sole Custody Of My Child

The Net Metering Program

Available in almost every state, the net metering program allows you to sell excess solar electricity to your local utility company at a profit . With this special incentive, it’s possible to receive $0 or even negative electricity bills every month. Like the tax credit above, net metering helps to speed up the payback period of your solar PV system. Net metering also removes the need to purchase battery storage for your solar installation.

Additional Opportunities For Residential Installations

- Federal Tax Credit: The Residential Renewable Energy Tax Credit of 30% of the total project cost is available for a variety of renewable energy projects, including solar PV. This credit was extended through 2020. Systems must be powered on by the expiration date to qualify.

- Property Tax Exemption: Texas law allows a property tax exemption for solar installations so while solar increases the value of your property to a prospective buyer, your property taxes wont increase!

- Additional Utility Incentives:

Read Also: How Many Solar Panels To Power Ac Unit

Solar Buyback Programs And Net Metering Incentives In Texas

Solar power systems are a source of clean electricity, with simple maintenance needs and a typical service life of over two decades. The main challenge when using solar panels is managing their variable energy production: they generate electricity when sunshine is available, unlike a diesel generator that provides power on demand.

Electricity generation from a solar power system can exceed consumption at times, especially in homes that are empty during the day. Many energy companies have programs that reward solar PV system owners for surplus generation. These programs are varied, but their common purpose is making surplus generation more valuable for the client.

On This Page You Can:

Learn what solar incentives are available to Texas homeowners

See what Texas solar incentives you qualify for based on your utility company and city

Find out how much these incentives and/or Texas solar tax credits will reduce your cost to go solar and add batteries

Also Check: How To Get Certified In Solar Panel Installation

Net Energy Metering In Texas

With net metering in some states, you get full retail rate credit for the amount of electricity you send back into the grid with your solar panels.

Net Metering requires your utility to monitor how much energy your solar power system produces and how much energy you actually consume, and make sure you get credit for the surplus.

Net metering in Texas is spotty. While there is no statewide net metering law here, in most populated places in the state, you can find either a municipal electric company that offers net metering, or a Retail Electric Provider like Green Mountain Energy, that will buy your extra solar output for retail price, or close to it.

So, whether you’re looking to install solar panels in Houston or Dallas, you’ll get net metering credits. Green Mountain Energy offers full retail-rate credit for excess solar energy, rolled over to your next month’s bill.

Federal State And Local Incentives

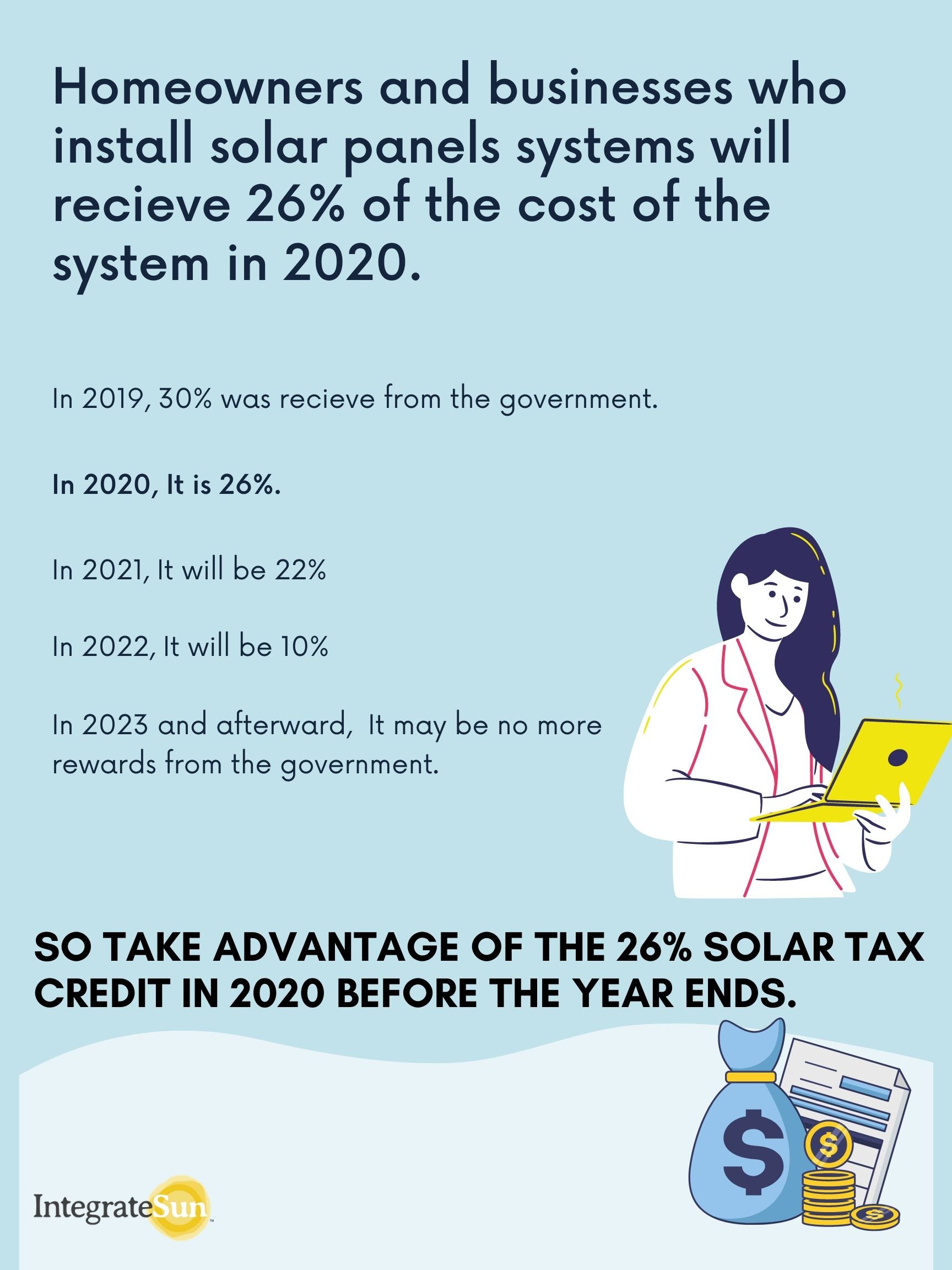

There are many Texas solar power incentives at all levels. Lets start with the federal incentive. The Solar Investment Tax Credit is a federal tax credit that is a dollar for dollar reduction on income taxes. It was scheduled to step down from 26% through 2020 to 22% in 2021, but the omnibus bill that was just passed by Congress extended the step-down by two years. If the bill becomes law as expected, the tax credit will remain at 26% for projects installed in 2021 and 2022, then decrease to 22% in 2023. In 2024 and beyond, the ITC will remain at 10% for any commercial projects will go away entirely for residential projects. The sooner you act, the more money you will save.*

The state of Texas does not offer a statewide solar tax credit, but most local utilities do offer incentives to go solar, add battery backup, or to make home improvements related to energy efficiency . The structure and availability of rebates vary across the state, but most utilities offer rebates to homeowners and business owners on a price-per-watt basis that is capped at a maximum amount per project. The funds may be available in perpetuity or released on a periodic basis for residential and/or commercial solar installations, The utilities have an application process for each project, which your solar installer will manage for you.

There are other local incentives as well. Some areas, such as Austin, offer a property tax exemption, for solar power customers.

Don’t Miss: Does The Government Pay For Solar Panels

Find Out If You Qualify For Texas Solar Incentives

Buy and install new rooftop panels in Texas in 2021, with or without a home battery, and qualify for the 26% federal tax credit. The residential ITC drops to 22% in 2023 and ends in 2024.6

Approximate average-sized 5-kilowatt system cost in TX: $13,109

Approximate system cost in TX after the 26% ITC in 2021: $9,70113

TXU Energy Renewable Buyback Plan

Weve joined forces with TXU Energy to boost the value of the solar kilowatt-hours you produce in the Lone Star State.14 TXU Energy, a Vistra Energy company, is Texass leading retail electric provider and serves more than two million customers across the state.15,16

With TXU Energys Renewable Buyback plan, you can earn Clean Energy Credits for the excess energy your Texas solar installation creates. The credits are applied to your bill when you produce more solar energy during the billing period.17 In other states, this type of arrangement is known as net metering.

Theres no cap on the credits you can earn.17 If you dont produce enough energy to power your home, like on cloudy days or at night, youll pay a simple, flat rate for 100% renewable energy from the grid thats made right in Texas. Request a free solar quote to check if you qualify.

Solar Energy Incentives In Texas Can Vary

Texas property tax exemption

Oncor Residential Solar Program

Dallas-Fort Worth area residents served by Oncor may qualify for the utilitys Residential Solar Program, which helps offset initial solar-investment costs.

If you live outside of the Oncor service area, contact your local utility or municipality to explore solar incentives and rebates.2

Don’t Miss: Can You Put Pine Sol Down The Drain

Electric Vehicle & Solar Incentives

Several states and local utilities offer electric vehicle and solar incentives for customers, often taking the form of a rebate. Rebates can be claimed at or after purchase, while tax credits are claimed when filing income taxes. Find state and local-specific incentives available in your area.

For the most up-to-date information, please review the sponsoring entitys website for details on eligibility, redemption and program details. View additional details on eligibility and redemption.

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

The solar PV panels are on my property but not on my roof?

Also Check: How To Clean Solid Hardwood Floors

State Local And Utility Incentives

Depending on your location, state and local utility incentives may be available for electric vehicles and solar systems. Most rebates can either be claimed after purchase or reflected as a reduction in the price of your purchase.

Many states also offer non-cash incentives for electric vehicles, such as carpool lane access and free municipal parking.

Some communities and utility companies also offer additional incentives through cash back, discounted rate plans and other credits.

Navigating The World Of Solar Companies

If you decide to install solar panels on your house, chances are you will be working with one of the states solar companies. Installing a solar PV system involves a lot of complex electrical wiring and is a DIY project that should be undertaken only by the most electro-educated homeowners.

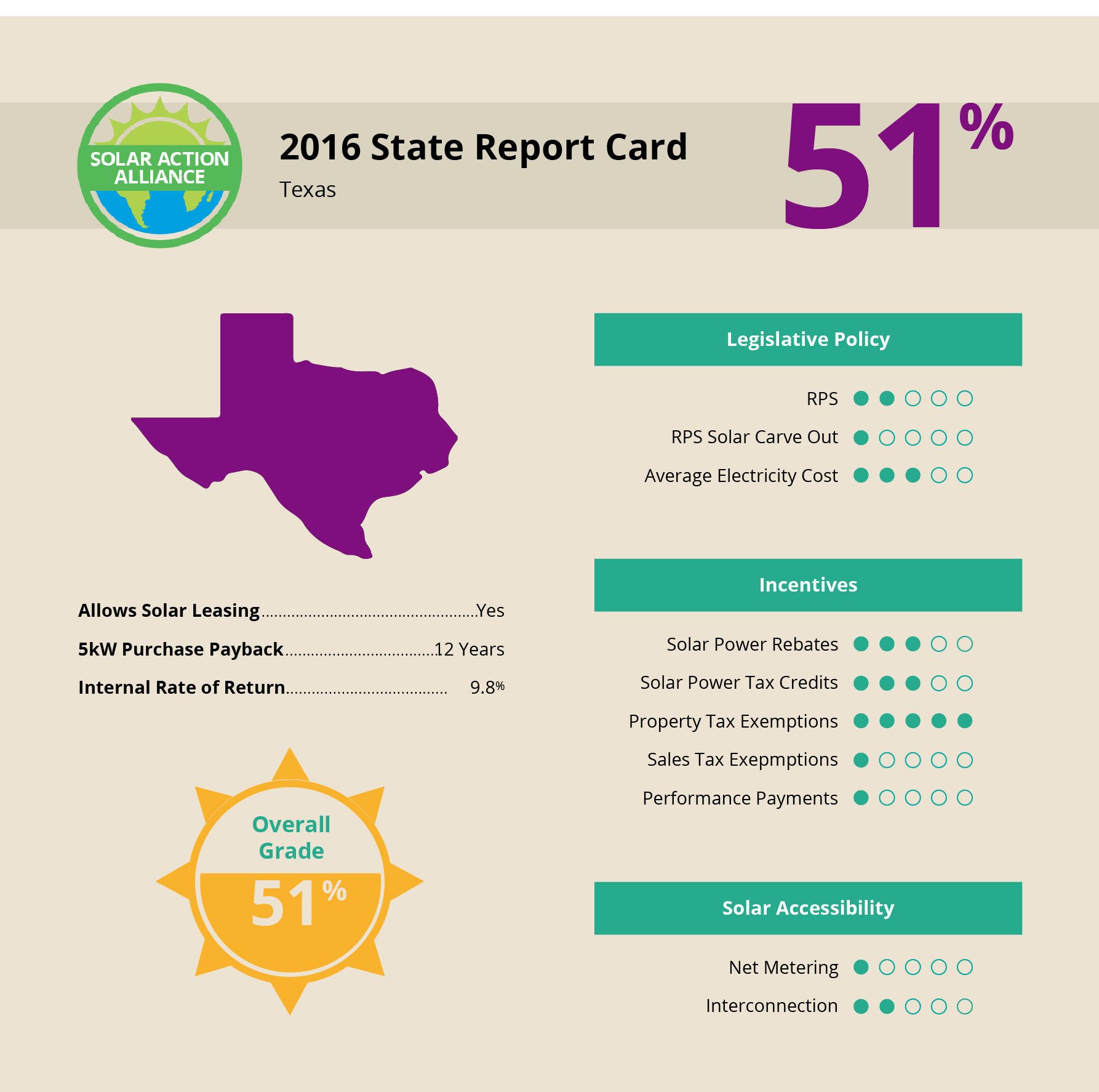

Solar companies vary in everything from customer service to quality of installation, so its important to only engage with the best ones. Here at Solar Action Alliance, we help to inform you on how residential solar works, but we also partner with trustworthy, gold-standard solar companies that will help you to get a high-quality solar PV system on your home at a low cost. They can walk you through all of the incentives and make sure that your system meets your individual energy needs.

To see if youre eligible for $0 down financing and to receive solar quotes from the best solar providers, just enter your zip code below to start the process! And remember that 2021 is essentially the last year to get huge solar energy tax incentives from the Federal Government.

Interested in Going Solar?

Solar customers save $36.44 per month on average and reap the benefits of massive return on investment.

We connect you with the best, lowest cost installers in your area.

$0 down financing available in many cases.

Don’t Miss: Does Pine Sol Get Rid Of Mice