Solar Tax Credit Amounts

Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost. The percentage you can claim depends on when you installed the equipment.

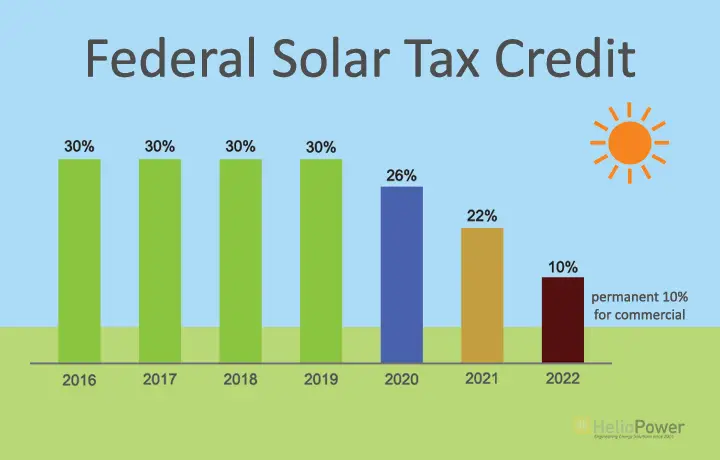

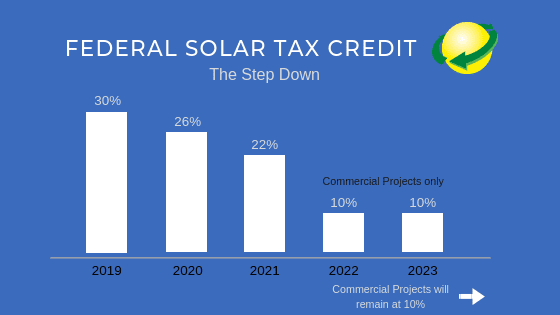

- 30% for equipment placed in service between 2017 and 2019

- 26% for equipment placed in service between 2020 and 2022

- 22% for equipment placed in service in 2023

As a credit, you take the amount directly off your tax payment, rather than as a deduction of your taxable income.

Federal And State Tax Credits

Guiding principles: Accessibility and Affordability, Consumer ProtectionBarriers addressed: Cost

Tax credits are a common form of incentive program, although one that is limited in its utility to low-income households. The primary federal solar policy is the solar investment tax credit , which provides a tax credit for solar systems on residential and commercial properties. Originally set at 30 percent with a five-year step-down and a scheduled expiration at the end of 2016, the ITC has been extended several times, most recently in December 2020. The current ITC step-down schedule is as follows:

- 2021-2022: 26%

- 2023: 22%

- 2024+: 10% , or 0%

Tax credits are also available at the state level the Database of State Incentives for Renewables & Efficiency has a comprehensive list of solar incentives by state, as well as more information and maps showing solar policies across the United States. Its also worth noting the tax credit applies to solar + storage check out CESAs great resource, Solar+Storage for Low- and Moderate-Income Communities: A Guide for States and Municipalities.

How Does The Solar Tax Credit Work

If your solar energy system is installed in 2021, then you are eligible for this years solar tax credit. Should you not have enough tax liability to claim the entire credit in one year, then you have the option to roll over the remaining credits into future years for as long as the tax credit is in effect.

It is important to note that the federal tax credit is only available to homeowners and business who purchase their systems. If the solar energy system is being leased or the user signs a PPA with the solar installer, then the user is not eligible to claim the tax credit.

Recommended Reading: Do Houses With Solar Sell For More

Q What Improvements Qualify For The Residential Energy Property Credit For Homeowners

A. In 2018, 2019, 2020, and 2021, an individual may claim a credit for 10% of the cost of qualified energy efficiency improvements and the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year .Qualified energy efficiency improvements include the following qualifying products:

- Energy-efficient exterior windows, doors and skylights

- Roofs and roof products

- Insulation

Why Should You Act Now

With the solar panel tax credit, you could save thousands of dollars on the cost of a solar system when compared with waiting a year and losing out on the chance for the incentive. In addition, switching to solar comes with many benefits. The costs of energy are lower, and you become less dependent on the power grid.

In addition, to qualify for the tax credit, your system must be installed by December 31, 2022. If you install it after that date, the percentage you get in tax credits will be smaller. Keep in mind, too, that installing a system can take some time.Get a Custom Quote Now

If you decide later in the year you want solar power, you may not have enough time to start the installation. In addition, other homeowners and business owners may be working to get their own panels and systems installed and it may be more difficult to find someone able to take on the work.

If you are ready to go solar and save money, contact us at KC Green Energy to talk about solar panel installation. We are a leader in the installation and design of solar electric energy systems. Started in 2008 as a division of the family-owned Kautz Construction, KC Green Energy is made up of experts dedicated to solar energy. We have accredited project engineers who will conduct a free site analysis at your property so we can custom design a system thats best suited for you.

Also Check: Does A Sole Proprietor Need A Registered Agent

New York State Real Property Tax Exemption

- Form RP 487 from New York State Department of Taxation and Finance

- File this form with your local property assessor. Some municipalities and school districts have opted out and will include the value of the solar installation in your property tax assessment without the exemption. You can call your local assessors office to find out whether your community has opted out, or reference the online list of municipalities that have opted out.

How Is The Solar Itc Calculated

The solar ITC is generally calculated by multiplying the applicable ITC percent by the cost of your organizations solar energy system, including equipment such as:

- Solar PV panels, inverters, racking and balance-of-system equipment

- Step-up transformers, circuit breakers and surge arrestors

- Storage devices

Use the calculator above to estimate your hypothetical solar ITC amount.

You May Like: How To Get The Most Out Of Solar Panels

If I Get Solar Panels On My Rental Property Does It Qualify For The Federal Solar Tax Credit

While the property doesnt have to be your primary residence, according to Turbo Tax, you cant claim the residential solar tax credit for installing solar panels at any rental units you own. However, your rental property may be eligible for the business ITC under IRC Section 48, according to the U.S. Department of Energy.

You also wont qualify for the federal solar tax credit if you are a renter and your landlord installs solar panels since you must own the solar system to claim the tax credit.

A National Interest In Solar Energy

The Solar Investment Tax Credit sparks national interest in clean energy, solar power, and the solar industry as a whole. As a federal tax credit, the ITC incentivizes everyday individuals to at least look into solar power as a viable investment and home-energy option, allowing solar energy to spread far and wide across the nation. In fact, solar energy has seen a whopping 42% annual growth since the ITCs 2006 enactment.

Read Also: Can You Sell Your Solar Panels

How It Can Help You

The FSTC accounts for many expenses. These include the solar PV panel, contractor labor costs for onsite installation, system equipment, and even energy storage devices. Anyone can claim the tax credit if they meet the following requirements: they are the homeowner or landlord, it is installed on a residence or vacation home, and is installed on the owners roof or propertynote that this is not a comprehensive list, and you should check the guidelines thoroughly before installation. The tax credit does not apply to leases or community solar programs, depending on how theyre structured.

How Does The Tax Credit Work

As long as you own your solar energy system, you are eligible for the solar investment tax credit. Even if you dont have enough tax liability to claim the entire credit in one year, you can roll over the remaining credits into future years for as long as the tax credit is in effect. If you sign a lease or PPA with a solar installer, you are not the owner of the system, and thus you cannot receive the tax credit.

Read Also: How Much For Sole Proprietorship

Why A Solar Generator Is Tax Deductible

A solar generator is tax deductible because it is considered a solar photovoltaic system. This means that it meets all of the Federal Solar Tax Credit requirements. Its battery setup stores energy created from its solar panels, which then can be used for powering home appliances.

One of the reasons that they are included in the federal energy tax incentive program is that they are made up of the following parts:

- An inverter

- A battery

A typical solar generator does not involve any moving components besides its cooling fans.

The panels capture energy from the sun and store it in the battery. This battery is built directly into the generator, providing it with the power that you need in a pinch.

The inverter included with a solar generator will convert the solar energy from DC to AC power before releasing it.

A solar generator can provide more than enough energy to provide power to several household appliances.

They can also give you the energy you need to power your electronic devices when your primary source of power is cut off.

History Of The Federal Solar Tax Credit

The solar tax credit was originally created through the Energy Policy Act, which was signed way back in 2005. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

Recommended Reading: How To Care For Solar Panels

What Are Tax Exemptions For Solar

Solar tax exemptions include both property and sales tax exemptions provided by state and local governments to individuals and companies that install solar energy property. Property tax exemptions allow businesses and homeowners to exclude the added value of a solar system from the valuation of their property for taxation purposes.

You May Like: Do I Need A Tax Id Number For Sole Proprietorship

A Beginners Guide To Federal Tax Credits For Solar And Energy Storage Rebates

Are you thinking about a clean energy investment in rooftop solar? Read how residential solar installations or home battery additions, can allow you to deduct up to 26% of the cost from your federal income taxes, dollar-for-dollar! Thereâs no better time than now to invest in renewable energy for your home.

sonnen, inc.

Are you thinking about a clean energy investment in rooftop solar? Or are you considering a rechargeable home battery to get more out of the solar power you generate? For 2021 residential solar installations or home battery additions, you can deduct up to 26% of the cost from your federal income taxes, dollar-for-dollar! Thereâs no better time than now to invest in renewable energy for your home. Next year, the residential credit drops down to 22% before disappearing entirely in 2022. Hereâs some background:

HISTORY OF THE INVESTMENT TAX CREDIT

FUTURE OF THE ITC

WHAT THIS MEANS FOR YOU

Thereâs still time to reduce your 2021 tax liability up to 26% of the cost of new solar and energy storage installations, including any sonnen intelligent battery recharged with solar energy. Batteries like the sonnen eco and ecoLinx allow you to store solar power you generate by day for use when the sun goes down. With a home battery, youâll maximize your clean energy investment, become less dependent on the grid, and always have a backup power reserve for outages.

LOCAL REBATES FOR HOMEOWNERS

Don’t Miss: Where Can I Buy Shoe Soles

Are You Eligible To Claim The Federal Solar Tax Credit

In order to claim the federal solar tax credit and get money back on your solar investment, you have to meet the following criteria when filing your 2021 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2006, and December 31 of this year.

- Your system must be installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must either be brand new or have been used for the first time. You only get to claim this credit once, for the “original installation” of your solar PV equipment.

What About State Level Solar Tax Credits

Weve spent the bulk of this article covering the federal solar tax credit. As a federal tax credit, it applies to all qualified Americans regardless of which state they live in and therefore needs the most explaining. However, there are some state-level solar tax credits that qualified individuals can obtain alongside the federal tax credit. Lets cover a couple of those here.

Also Check: How To Calculate Solar Needs

How Does The Investment Tax Credit Work

The solar investment tax credit has been around in various forms since the 2005 Energy Policy Act. The ITC actually covers multiple types of renewable energy installations, including small wind turbines and geothermal heat pumps though solar energy is by far the most common investment for homeowners.

While the ITC is currently set at 26%, it was as high as 30% until 2019. A tax credit must be claimed for the year a system was placed in service, meaning that any solar system connected after December 31, 2019 qualifies for the level of credit associated with 2020 or later. Even if the products and materials were bought and most of the system was hooked onto the roof in an earlier year, the only year that matters is the official put in service date.

The ITC will stay at 26% in 2022, before dropping to 22% in 2023 after which it is set to expire completely for owners. While the ITC has been extended several times before past expiration dates, at this point it is unknown whether it will continue after 2023 and what the value could be.

Is A Solar Generator Worth The Cost

This is always something to take into consideration.

Keep in mind that the average life expectancy of a solar generator today is in the range of 5-20 years .

That is pretty impressive no matter how you look at it. In most cases, the tax deduction provides a great incentive to justify the cost for an energy source that will last over a decade on average.

The technology behind solar generators has been around for several years, but they are starting to become more mainstream as their benefits are extensive.

With this increased demand for off-grid solar power, solar generator manufacturers have improved their products technology in several areas over the last 5-10 years.

This includes improvements like:

- Upgrading from lead-acid to much lighter and better performing lithium-ion and LiFePO4 battery types

- Companies such as Goal Zero, Bluetti, and EcoFlow have created mobile applications to pair with their portable power stations

- Using MPPT charge controllers in their systems as opposed to the less-efficient PWM controllers

The best battery type for a solar generator is a LiFePO4 battery.

These batteries in almost every case last much longer than lead-acid and lithium-ion batteries.

I created an article listing six LiFePO4 solar generators that I think you may gain some insights from.

I show you which ones I recommend . Check it out here: 6 Best LiFePO4 Solar Generators .

Read Also: How Does Solar Power Work On A House

History Of The Federal Solar Tax Credit For Business

In 2005, The Energy Policy Act allowed a 30 percent investment tax credit for residential and commercial solar energy systems that were installed from January 1, 2006 through December 31, 2007. The credits were extended for one year in December 2006 by the Tax Relief and Health Care Act of 2006 .

The Emergency Economic Stabilization Act of 2008 added an eight-year extension of the residential and commercial solar ITC, and allowed utilities and companies paying the alternative minimum tax to be eligible for the credit. The ITC was extended once again at the end of 2015. It is set to expire at the end of 2021.

Form 5695 Line 14 Worksheet Reducing The Credit

Line 14 is where it gets tricky. The thing about the solar tax credit is it isnt fully refundable, meaning you can only take a credit for what you would have owed in taxes. This is different from other, fully refundable tax credits like the Child Tax Credit and the Health Coverage Tax Credit.

Thats why you use the worksheet below. You enter the total tax you owe before credits in line 1 of the worksheet, and the amounts of any fully refundable credits on the lines within step 2, adding them all on the final line.

Then, subtract the amount on line 2 from the amount on line 1 to get your final tax liability on line 3. This is the total amount you can claim for the solar tax credit.

Heres what the line 14 worksheet looks like for Mr. Exampleson, who has an initial tax liability of $3,820 this year, and can claim no other tax credits:

Because Mr. Exampleson only owes $3,820 in taxes this year, thats all the credit he can take now. He enters that number on lines 14 and 15 of Form 5695, and then enters $210, which is the difference between his total credit and the credit he can take this year , onto line 16.

Finally, he enters the amount from line 15 on Form 5695 into the box on line 5 of Schedule 3.

Thats it! Mr Exampleson owes $0 taxes this year, and will get a further credit of $210 on his 2021 tax return. He may also qualify for refundable tax credits on the second part of Schedule 3.

Now, check out the tax credit FAQ below.

Read Also: How Much Does It Cost To Switch To Solar Power

Everything You Need To Know About The Solar Tax Credit

The Federal Investment Tax Credit, also known as the Solar Tax Credit, is a tax credit that allows you to deduct up to 26% of the cost of your solar energy system from your federal taxes. By helping to offset the cost of purchasing residential solar, the tax credit is designed to get more homeowners to install solar, stimulate investment in the solar industry, and accelerate the pace of solar investment and innovation.

How Do Solar Loans Affect The Solar Tax Credit

There are two types of solar loan in relation to the tax credit. Type 1 has one monthly payment amount. These loans assume that you will submit your tax credit to the lender to buy down your principal and secure that monthly payment. If you do not put your tax credit back into your loan, this will initiate another loan, in the amount of your tax credit, at the same APR.

The second type of solar loan is one in which there is a different payment amount for year one than for the subsequent years. In this type of loan, your payments are based on the entire loan amount. When you receive your federal tax credit, youll have the option to use it to re-amortize your loan to secure lower monthly payments. You can also keep the federal tax credit, and your payments will remain the same. Solar.com can help figure out which solar financing option is best for you.

Also Check: Should You Clean Solar Panels