Can I Operate A Sole Proprietorship Without A Dba In Texas

If you are a sole proprietorship operating under an assumed name in Texas, you must register your name with the office of the county clerk in the county of

You can establish a sole proprietorship in Texas without filing any legal documents with the Texas state government however, you should undertake these 4 easy

Sep 26, 2017 File the assumed business name with the county clerks office where the Texas sole proprietorship is located. Provide the sole proprietors name

If your business is structured as a a sole proprietorship or general must file a Certificate of Formation with the Texas Secretary of State.

1. Business Entity Registration · Sole Proprietorship & General Partnership · Limited Liability Company, Corporation, Limited Partnership & Others · 2. Texas Sales

Starting A Business In Texas

Apr 14, 2021 There are four primary business entities: sole proprietorship, partnership, corporation, and Limited Liability Company . A brief

Step 2: Tax Requirements When it comes to being a sole proprietor in the state of Texas, there is no formal setup process. There are also no fees involved

What Does Registering As A Sole Proprietor Mean

The most common business structure is a sole proprietorship, which is the simplest and easiest to establish. There is no distinction made between the business and the owner of this unincorporated business. The profits of your business belong to you, and you are responsible for all debts, losses, and liabilities of the business.

Also Check: How Safe Is Solar Energy

Obtain Necessary Licenses And Permits

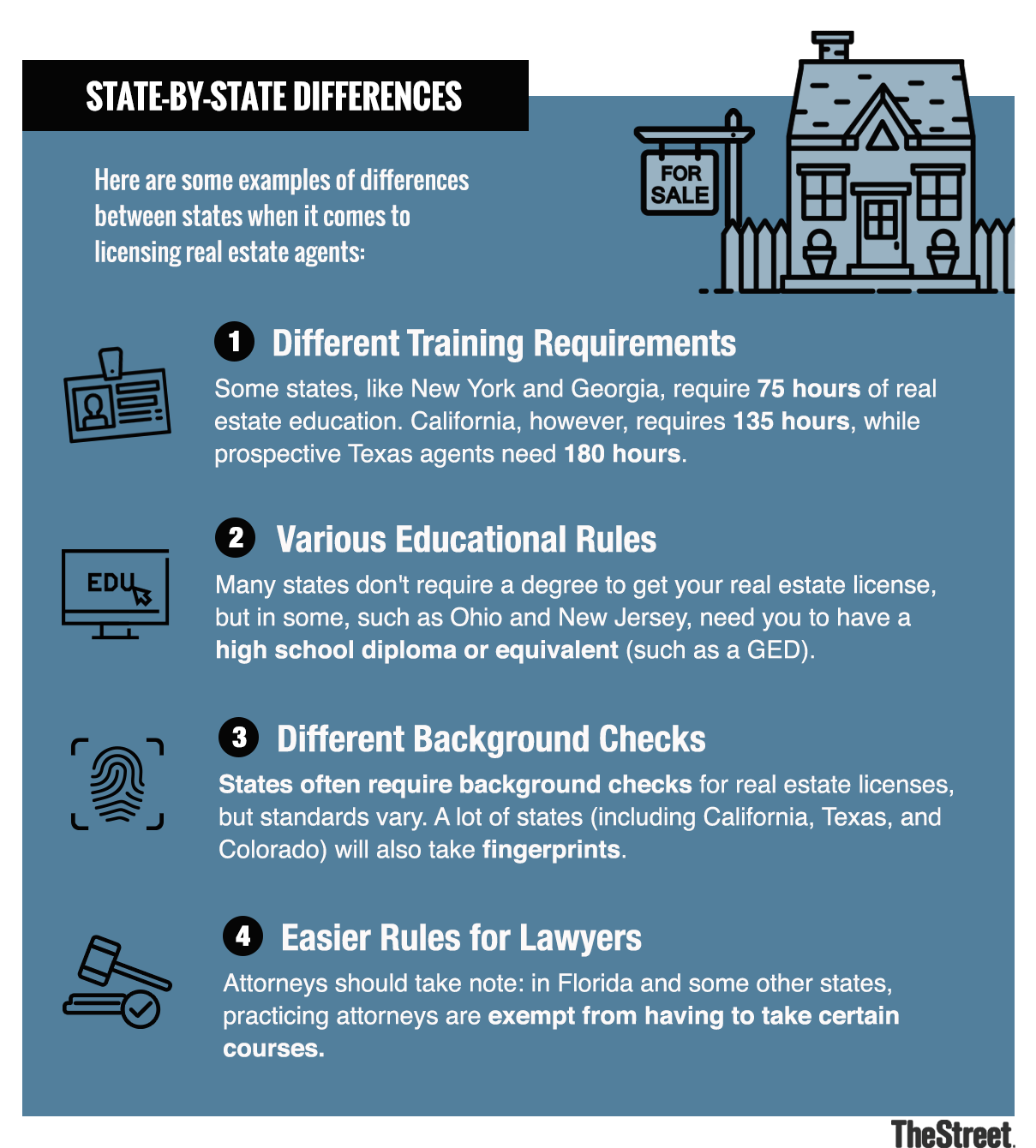

After you start a sole proprietorship in Texas, the immediate requirement would be a business license. Different states have different licensing requirements but the common factor is that without a license or permit, businesses cannot become operational. You can conduct a business activity search for sole proprietorship in Texas as the type of license and the fee varies according to the type of activity and location of the entity.

You will not only require business licenses and permits but your company needs to be compliant with local regulations and must have necessary zoning clearances. You will have to check with the city and county offices for information specific to zoning. If you are wondering how to start a sole proprietorship in Texas and obtain business licenses then you can check our Business License Research Report service. This research report contains a list of filing instructions, supporting document requirements, and fees for all business licenses and permits for your sole proprietorship business in Texas.

Register With Your Province Or Territory

Most businesses need to register with the provinces and territories where they plan to do business. In some cases, sole proprietorships operating under the name of the business owner do not need to register. See the website of your provincial or territorial business registrar for more information on their requirements.

Note: This list of links is provided for your convenience. It may not be a comprehensive list of the registration requirements in all provinces and territories. Please check with the authorities in your provincial or territorial government to determine if there is anything else you need to do.

Read Also: What Do Solar Panel Installers Get Paid

Register Your Photography Business Name

Make sure the name you choose isnt already being used by someone else. You can always use your own name, but if you think you might sell your business down the road, using your own name may not be best. Find out more about registering a fictitious name here:

If you need help choosing a business name: How To Choose A Photography Business Name

Sole Proprietorship Vs Llc: Whats The Difference

It can be hard to know if changing from a sole proprietorship to an LLC is right. Take a look at these key points on each business structure to help you decide.

Sole proprietorships are

- Easy and affordable to form

- Considered the same legal entity as the owner

With a sole proprietorship, you are personally responsible for all business losses, debts, and liabilities.

Limited liability companies are

- Owned by one person or more

- Moderately easy and affordable to form

- Considered different legal entities than the owners

LLCs combine aspects of corporations and partnerships. An LLC separates business and personal liabilities, so your assets are protected and owners not liable for business debts. There is also a shared tax responsibility between members, like a partnership.

Also Check: How To Replace Roof With Solar Panels

So What Is Left To Be Done Once You Have Registered Your Sole Proprietorship To Mitigate Future Risks We Recommend That You Undertake The Following Actions:

-

Obtain general liability insurance

Since a sole proprietor will be personally liable for all the business’s debts and obligations, a business liability insurance policy may be the only financial protection one can have against unforeseen events.

-

Open your sole proprietor business bank account

With your fictitious business name and EIN, you will open your business bank account, which will help you have your personal and business finances separate and easily manageable.

-

Report accurately and pay your taxes

You may be required to report sales tax and use tax, depending on the nature of your business. More information can be obtained by registering with the Texas Comptroller of Public Accounts.

To learn more about sole proprietorship and whether this is the appropriate business form for you, please contact us today, and one of our dedicated team will be more than happy to assist you. We have the relevant experience to provide you with the appropriate business form best suited for you.

Thank you for contacting us. We will get back to you shortly.

Please complete all required fields below.

Submitting An Application For A Sole Proprietorship Texasgov

If the business is a sole proprietorship enter the required information The spouse is required to set up their own individual account as a principal.26 pages

Forming a sole proprietorship in Texas allows you to create the most common, basic type of small business without filing any state paperwork.

The Texas Secretary of State points out that a sole proprietorship is the simplest business you can set up. Its typically a one-person company with no

You May Like: Are Solar Panels Free In Nj

Become A Texas Sole Proprietor

Luckily! There is no setup fee and you would not face too much hassle while starting a sole proprietorship in comparison to the legalities and paperwork that people face in other business structures. To be a sole proprietor in Texas, you simply have to follow a few simple steps to keep things smooth. Here are those five easy steps you need to follow to become Texass sole proprietorship.

Get Necessary Business Licenses And Permits

To start a self employed business in Texas, you may need certain licenses and permits. Which are required will depend on the activities you intend on doing with your business as well as the location of your business. While the state of Texas doesnât require a general business license, some cities may require this to operate. Certain products and services may require a Sales Tax Permit that needs to be registered with the Texas Comptroller. If you will be providing services that require professional licensing, youâll need to be sure to obtain those as well.

Read Also: How Much Does Solar Window Film Cost

Get Legal Help Closing Your Sole Proprietorship

While winding down a sole proprietorship is typically straight-forward and much easier than shutting down a corporation or partnership, its still very important to follow the rules and make the process as smooth as possible. The best way to ensure that youre properly closing your sole proprietorship is to consult with an experienced business attorney near you who can guide you through the process and answer any questions you may have.

Thank you for subscribing!

Recommended Reading: Do Solar Panels Add To Home Value

If You Have Employees

You need to file additional forms for a sole proprietorship that has employees. You must check boxes on both the quarterly Form 941 and annual Form 940 that you use to file taxes for your employees. On Form 941, you will find the check box in part 3, and on Form 940 it is on the first page, as of 2010.

References

Recommended Reading: Are Solar Panels Tax Deductible

Read Also: How Much Does Solar Heating Cost For A Pool

Business Licenses And Permits By Business Type

According to Texas Wide Open for Business, the State of Texas does not require a general “business” license however, there are a number of regulatory agencies that have licensing and permitting requirements based on the type of service, or products associated with your business. To ensure that all permitting requirements are met, you should contact the local county and/or city government in which you plan to conduct business to determine if there are any additional requirements. To determine state occupational licensing and permitting requirements, please visit the Texas Department of Licensing and Regulation , specifically the TDLR Licensed Programs tab, for more information.

BizOpen: Commercial Property RequirementsBizOpen serves as a point of contact for small business owners seeking assistance navigating the Citys development process. Many small business owners are unaware of the rules and regulations that are involved in opening up a business with a physical location. This process can be quite extensive or short depending on the individual business proposal and property location.

Differences Between Llc And Sole Proprietorship

There are important differences between LLCs and sole proprietorships. The most significant difference is whether you have limited liability for the business debts and obligations, as with an LLC, or whether the business liabilities and obligations fall to you personally in the event of a lawsuit or debt collection.

An LLC has distinct advantages in the areas of legal protection and liability. While there are filing fees for setting up an LLC, that cost can be well worth it when compared to the thousands of dollars you could be liable for as a sole proprietor.

On the other hand, it costs no money to start a sole proprietorship. You can also transition into an LLC or other formation option whenever youre ready. This also means dissolving your business is as simple as stopping operations .

Finally, while sole proprietorships have very few regulatory requirements, LLCs are associated with a variety of fees and filings, both initially and ongoing. This can be difficult to manage on your own, which can lead to missing important filings and, in return, incurring penalties.

Read Also: Can Sole Custody Be Changed To Joint

You May Like: How To File For Sole Custody In Michigan

How To Become A Sole Proprietor

A sole proprietorship is the simplest entity type for new businesses, and its also a somewhat popular option for entrepreneurs in a number of different industries.

The sole proprietorship is an informal business type that does not require any sort of registration with your state government all you need to do to form one is to start working.

That said, while this business structure lacks official rules and regulations, there are still some general guidelines that you should adhere to when operating a sole proprietorship. As with any other business entity, there are pros and cons of the sole proprietorship. While its incredibly easy to form and maintain, the lack of personal asset protection is a huge drawback.

Lets discuss the various advantages and disadvantages of a sole proprietorship and discover how you can create your own sole proprietorship.

When Is An Llc Properly Formed

In order for one to properly understand the dissolution of an LLC, one must first understand what an LLC is and how it is properly formed. An LLC is a business structure that is created in order to protect the personal assets of the members in case the business entity is sued. In short, there are four main steps that one must follow in order to form an LLC:

You May Like: How To Build Your Own Solar System

How Does A Sole Proprietorship Work

A sole proprietorship springs into existence whenever its owner starts conducting business. Its not necessary to file any formation documents with the Secretary of State.

For example, lets say you sell baked goods. Technically, you formed your sole proprietorship when you sold your first bakers dozen. That said, the owner must get any licenses required in their field in order to operate a compliant business.

Taxes for a sole proprietorship are fairly straightforward you actually wont have to pay business taxes at all. Instead, a sole proprietor pays personal income tax rates, even on their business income.

This is because a sole proprietorship is not a separate business entity from its owner. You still pay taxes on the business profits, but you dont report them on a separate tax return. Instead, you report that income on Schedule C of your personal income tax return.

As a sole proprietor, youd also need to pay self-employment taxes. Normally, someones employer withholds these taxes from the employees paycheck, but if youre your own employer, then its a different story. Youll need to make payments for Medicare and Social Security taxes yourself, which comes to a 15.3% tax rate on top of your income taxes. You can find more information on these taxes here.

Name Registrations And Tax Id Round Rock Chamber

Another important step in getting a business ready for opening day involves such as sole proprietorships, register at the county clerks office in the

In New York State, sole proprietors hold all the power and bear full responsibility for their business decisions. Guided by the rules and regulations

Filing a Texas DBA, also known as an assumed name certificate, is a simple How to File a DBA in Texas for Sole Proprietors and General Partnerships.

Don’t Miss: How Many Solar Panels Would I Need

How To Become A Texas Sole Proprietor

When it comes to being a sole proprietor in the state of Texas, there is no formal setup process. There are also no fees involved with forming or maintaining this business type. If you want to operate a Texas sole proprietorship, all you need to do is start working.

However, just because its so easy to get started doesnt mean there arent some additional steps you should take along the way. While these parts of the process arent strictly required, many sole proprietors find that they are in their best interests.

Collect The Money Owed To Your Business

Once you have chosen to close your business, collect the money owed to your company so that you can pay off creditors. Consider calling the debtors to politely request the remittance of their payment. Offer a discount as an incentive for the debtor to settle what they owe to your business immediately.

Attempt to collect debts before announcing your business closure. A debtor may attempt to hold out on settling the debt if he or she has the idea that the business is closing. If you have accounts receivable, sell them to a company that purchases account receivables. Such companies will purchase your debt at a lower value and pursue the collection of the debts aggressively for their own profit. Although you will not obtain the full amount of your account receivables, you no longer need to collect any debt and will obtain access to funds quickly.

If you have any outstanding orders, fulfill them. If you are under contract to offer certain products or services, fulfill them or negotiate. It is essential to discuss matters with your clients concerning their outstanding orders and resolve such matters. If you fail to reach an agreement or compromise, you can be held accountable for breach of contract.

Recommended Reading: Do You Need Solar Panels For Tesla Powerwall

Forming A Sole Proprietorship Utah Division Of

Sole proprietorships are the most common and simple form of business organization. As the only owner, the sole proprietor has the right to make all the

Forming a Sole Proprietorship Business Sole proprietorship is a type of business structure owned and managed by a single individual who is not legally

Generally, businesses are created and operated in one of the following forms: Sole proprietorship: The most common and the simplest form of business is the sole

They are Sole Proprietorships, General and Limited Partnerships, Limited Liability Partnerships , Limited Liability Companies , S Corporations and

Dec 31, 2020 A sole proprietorship or partnership is simple to set up, and less costly to administer as compared to a company. This is a quick summary of

Learn the requirements of operating your business as a sole proprietorship, including registering with MassTaxConnect and making estimated tax payments.

How to set up a sole proprietorship: Registration Procedure The only requirement for Hong Kong sole proprietorships is to register their business with the

A sole proprietorship is the easiest and least expensive way to begin operating a business is as a sole proprietorship. However, this organization form does

Open QuickBooks. Click File on the menu bar and select Open. Browse to the folder containing your QuickBooks sole proprietorship file. Highlight the

What Is A Sole Proprietorship

Sole proprietorships are the most basic form of business structure. If you dont form a business entity, like an LLC or corporation, but start conducting business, youre automatically considered a sole proprietorship. This means your business is not an entity separate and apart from its owner and your businesss assets and liabilities are not separate from your personal assets and liabilities. This means you can be held personally liable for the debts and obligations of the business, which is one of the main differentiators from an LLC.

Advantages of a sole proprietorship

Sole proprietorships are ideal for low-risk businesses and entrepreneurs who want to test their business idea before pursuing a formal entity formation option. As such, there are many advantages.

Disadvantages of a sole proprietorship

Its important to consider the disadvantages of a sole proprietorship. While the financial savings are appealing, there are drawbacks to this business structure.

Recommended Reading: Is 14k Solid Gold Real