How To Do Taxes For A Sole Proprietorship

2 min read

You start a business, sell goods and services, and generate profit. All is well until that dreadful time of the year comes around and its time to fill out your tax form. As a sole proprietor, you are the sole party responsible for handling taxes and reporting your income to theInternal Revenue Service. While it may seem daunting, doing the taxes for a Sole Proprietorship is relatively easy, as long as you keep your head straight and focus on what’s important.

How Do I File My Annual Return

To file your annual tax return, you will need to use Schedule C to report your income or loss from a business you operated or a profession you practiced as a sole proprietor. Schedule C Instructions may be helpful in filling out this form.

In order to report your Social Security and Medicare taxes, you must file Schedule SE , Self-Employment Tax. Use the income or loss calculated on Schedule C to calculate the amount of Social Security and Medicare taxes you should have paid during the year. The Instructions for Schedule SE may be helpful in filing out the form.

What Makes Sole Proprietors Different

Sole proprietors are one-person owners of unregistered businesses. That means they don’t register their businesses with a state. For legal and tax purposes, sole proprietorships are the only business type that isn’t separate from the owner. The owner is liable for all the debts of the business and can be sued in connection with its actions .

For tax purposes, a sole proprietorship is considered a “pass-through” business. The profits or losses of the business pass through to the owner’s personal tax return.

You’re a single-member LLC, and you pay income taxes in the same way as a sole proprietor, including self-employment taxes. If you’re the only owner of a limited liability company . This information applies to you, too.

Also Check: How Much Does A Solar Roof Cost

Sole Proprietorship Taxation: Income And Self

As we explained, as a sole proprietor youll report and pay income tax on your businesss profitâand youll do so by filing additional forms with your personal return, Form 1040. This being said, most sole proprietors only need to file two forms with their individual return. Letâs take an in-depth look at each of these forms.

What Can You Do To Make It Through Tax Season

The simple answer: Get help. Arm yourself with as much information as you can and surround yourself with the best people and resources.

If you are a small business, most specifically a sole proprietorship, this guide has been designed to help you understand the things you need to do to file your annual return. Its also meant to help you work more closely with a tax professional, such as a tax lawyer or a chartered professional accountant .

Fact: Recommending that you work with a qualified tax professional is one of the most valuable tips we can provide. Tax laws are complicated and making mistakes only makes them worse. To put it bluntly: If you wouldnt do your own dental work, why on earth would you risk doing your own small business taxes?

Also, please read this disclaimer in your best commercial announcer voice: The information in this guide is focused on the calculation of taxable income and does not address the calculation of standard or harmonized sales tax or other business taxes in detail.

Now that weve gotten the formalities out of the way, lets get down to business

Also Check: How Much Does Solar Heating Cost For A Pool

If You Have A Sole Proprietorship When Should You Form An Llc

It is time to go from a sole proprietorship to an LLC when you are ready to grow your business and earn a profit.

Sole proprietorships are only good for very low-profit/low-risk businesses.

Example: A sole proprietorship can be a good way to start out if you are doing business on a small scale or want to try out a low-risk venture to see how successful it will be.

Forming an LLC allows business owners to grow their businesses and take on risk. This is because LLCs provide personal liability protection.

What is personal liability protection? When a business owner has personal liability protection, they cant be held personally responsible if the business suffers a loss. This means personal assets are protected.

When To Use An Llc

LLCs offer taxation benefits, increased credibility, and most importantly, personal liability protection.

LLCs are recommended for businesses with the following characteristics:

- Larger customer base

- Potential for immediate and sustainable profit

- Increased risk of liability or loss

- Would benefit from unique tax options

Advantages of LLCs

- Personal Liability Protection. LLCs provide personal liability protection. This means your personal assets are protected in the event your business is sued or if it defaults on a debt.

- Tax Benefits. LLCs and have options to customize their tax structure. This allows businesses to use the best tax strategy for their circumstances.

- Growth Potential. LLCs can grow in profit and risk because they provide personal liability protection and tax benefits.

- Credibility and Consumer Trust. LLCs generally earn more trust from both banks and consumers than do informal business structures like sole proprietorships. This can impact a business’s ability to take out loans and can affect marketability.

Ready to Form Your LLC?

Our free guide walks you through the process of LLC formation in all fifty states. In just five easy steps, you can be on your way to owning your own business.

You can also use an LLC formation service to register your LLC for you.

Read Also: Where To Buy Solo Stove

Do I Only Need To File One Schedule C

You must fill out a separate Schedule C for each distinct type of work you do. So if you work as a freelance web developer, you only need to file one Schedule C to cover all the web development you do.

But if you also drive an Uber , you would have to report your profits and losses from that business venture separately, using a second Schedule C. Youâll then have to combine all of the separate net income amounts you calculate on each Schedule C before reporting it on Form 1040.

Further reading:The Uber & Lyft Drivers Guide to Taxes

Keep Records Of Everything

In order to make paying Sole Proprietorship taxes as painless as possible, you should keep detailed and accurate records on everything your business does, with particular emphasis on income and expenses. Keeping your financial affairs in order will save you a lot of time, effort, and stress you’d otherwise spend on figuring out just how much money came through your business. It’s a good idea to run two sets of books, one for your business and one for your personal expenses, so that when the tax forms come, you can just grab the ledgers and sit down with them.

Don’t Miss: Is It Better To Lease Or Buy Solar

Keep Proper Records And Accounts

You are required to keep full and accurate records and accounts of your business transactions from the start. These records and accounts must be supported with invoices, receipts, vouchers, and other documents.

IRAS will not accept estimate and improper records. For details, please refer to Keep Proper Records & Accounts.

Understanding Sole Proprietorship Taxes

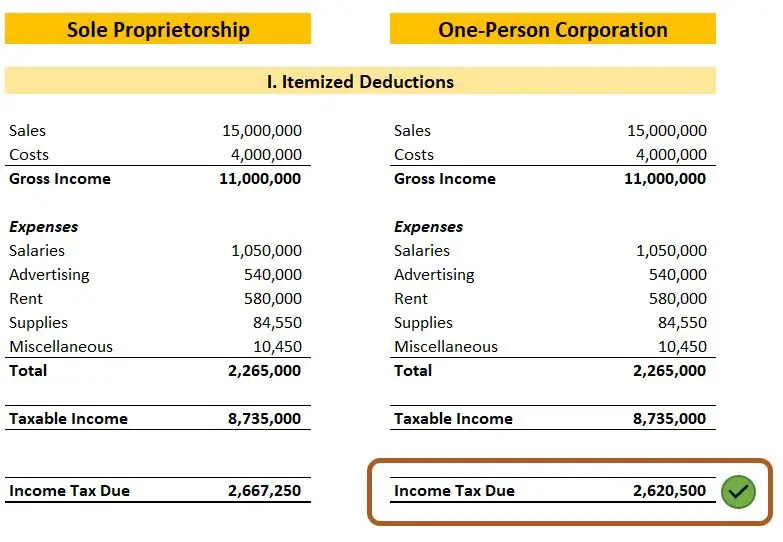

Thinking of starting a new business? The type of company you found can have a significant effect on your tax obligation in the coming years.

Of the most common business entitiesincluding partnerships, LLCs and corporationssole proprietorships are widely considered the simplest type. A sole proprietorship refers to an unincorporated business owned and operated by a single person or, in some cases, a married couple. Because all of your business revenues are considered personal income, filing taxes as a sole proprietor is relatively simple, but this doesnt mean its without its drawbacks.

Lets take a look at what a sole proprietorship taxes look like and find out how you can minimize your tax burden in the coming years.

Read Also: Does Texas Have A Solar Rebate

Which Taxes Does A Sole Proprietor Need To Know About

These taxes you should be aware of include:

- Personal and business income taxes

- These determine your net tax owing the amount you owe to the CRA after all of your qualified personal and business tax deductions.

Cherish The Little Things Like A Good Break

Youve done it. Youve read the guide. Youre either getting things in order or already have. What now? We think youve earned the right to a few diversions.

- Skip astrology and go for foodology find out what your choice of foods says about you.

- Get yourself a new recliner .

- Relax and enjoy some serious binge watching.

Business owners, sole proprietors and tax professionals if you have a resource, correction or clarification youd like to provide, please share it in the comments below. All valuable knowledge is welcome. For that matter so are any funny tax season jokes or anecdotes .

The information in this post does not constitute or replace the need for professional bookkeeping, accounting or tax advice. Wagepoint has gathered this information from several sources and has done its best to ensure accuracy. Any errors or omissions will be corrected in a timely manner. As tax laws are constantly changing, it’s important to ensure that you have the most accurate and up-to-date information.

Don’t Miss: How Much Does An 8kw Solar System Cost

How Do I Pay Myself As A Sole Proprietor

Now that we understand how sole proprietorships work, let’s learn how a sole proprietor would go about paying themselves. This will help us get a better idea of how much you should pay yourself as a sole proprietor.

In general, a sole proprietor can take money out of their business bank account at any time and use that money to pay themselves. If the business is profitable, the money in your account is considered your ownership equity and is the difference between your business assets and liabilities. This type of transaction isn’t considered a salary, but rather a “draw.” To perform a draw, you would write a business check to yourself. This check is not subject to federal income tax, state income tax, or FICA taxes.

That’s because the IRS treats the businesss profits and a sole proprietor’s personal income as the same thing. In other words, after youve deducted business expenses on Form 1040 Schedule C or Form 1065 , the remaining profit is considered personal income.

However, you only file your personal income tax return once a year, and you may want to pay yourself on a more consistent basis. To do so, you’ll need to look at financial projections or past financial performance and estimate your business’s profits. Based on that number, you can set up a consistent salary for yourself. And if your business does better than expected, you can give yourself a quarterly or annual bonus, too.

How Corporations Differ From Sole Proprietors In Terms Of Salary

If your business is not a sole proprietorship but is incorporated, things are a little different. Since you are an officer of your corporation as well as an employee on the payroll, you have to pay yourself a salary or wages, which must be reasonable compensation according to the IRSneither too much nor too little.

Some business owners use the businesss money to pay their personal expenses without taking a salary in the belief this will save them on taxes. But this tactic can backfire and lead to substantial penalties if the IRS decides the money should have been taken as a salary.

If your business is a corporation, the best way to go is to determine the average rate for CEOs in your industry, your region and for companies of similar size. You can get this information from your industry trade association, or from sites such as Glassdoor.com or Salary.com.

Keep in mind that salary and compensation can be complicated by factors such as whether your business has investors and how many shares of the businesss stock you own. Review the IRS guidelines and frequently asked questions about small business owners salaries, and consult with a business accountant before setting your salary.

You May Like: How To Make Your Own Solar Cells

Find The Right Local Sa Accountant Now

Featured Accountant

Article by listed accountant: Rakhi Popat

With less than a week to go for provisional taxpayers to submit their returns, this past week I have had several encounters with small business owners, in particular those operating under sole proprietorships. Most small business owners have asked for an all-inclusive list of what expenses are allowed to be deducted for tax purposes, and what expenses are disallowed. Each business is engaged in unique activities with unique expenses and therefore it is impossible to give an exhaustive list of the expenses that are tax deductible. So I have decided to write this blog with the aim of explaining how taxes work for people who are running their own businesses as sole proprietors.

In the eyes of SARS, the individual and the business are one and the same person, so your tax return is filed in your personal capacity and the taxable income generated by the business is included in your personal tax return which is filed annually via an ITR12 . In addition to filing an ITR12, small business owners need to be registered as provisional taxpayers since they earn income other than by way of a salary. If you are a salaried employee and are also running a small business you also need to be registered for provisional tax. In summary, as a sole proprietor, one needs to file an ITR12 annually and 2 IRP6s .

Another common question asked by sole proprietors concerns home office expenses. The principle is the following :

Making Estimated Tax Payments

Estimated tax payments are mandatory for businesses that anticipate owing $1,000 or more over the course of a year. To avoid getting hit with a hefty tax payment come April, sole proprietors need to set a portion of their income, interest and dividends aside each month in order to submit estimated tax payments four times a year. Failing to submit estimated quarterly tax payments could leave your business on the hook for fees and penalties from the IRS.

Not sure what your estimated tax payments should be? Use the previous years tax return to estimate annual income. Then, divide this amount into four even payments to be sent to the IRS in mid-April, mid-June, mid-September and mid-January. Sole proprietors who fail to make estimated payments may be subject to an IRS underpayment penalty in addition to the tax burden they already owe.

Also Check: Is My Business An Llc Or Sole Proprietorship

Health Insurance And Other Costs

In addition to insurance premiums, you can deduct other out-of-pocket medical costs, such as office co-pays and the cost of prescriptions. These costs are included as itemized deductions on Schedule A.

Sole proprietors can also deduct health insurance premiums for themselves, their spouse, and dependents on Schedule 1 of Form 1040. However, if you are eligible to participate in a plan through your spouseâs employer, then you canât deduct those premiums.

Net Income Before Adjustments

This is the good part where you get to claim your small business tax deductions. However, its somewhat nonlinear as theres a bit of back and forth with other calculations made in the following three pages , including:

- Amounts deducted from your partnership income

- Details of other partners

- Motor vehicle expenses

- Interest on or leasing costs for passenger vehicles

To learn more about claiming small business tax deductions, like professional fees, employer taxes as well as meals and entertainment, see our Comprehensive List of Small Business Tax Deductions.

Recommended Reading: How Much Power Does Tesla Solar Roof Generate

How Do I Make My Quarterly Payments

Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. You will need your prior years annual tax return in order to fill out Form 1040-ES.

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax.

Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System . If this is your first year being self-employed, you will need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated taxes for the next quarter.

See the Estimated Taxes page for more information. The Self-Employment Tax page has more information on Social Security and Medicare taxes.

How Do Sole Proprietorship Taxes Work

In a standard business, youd file separate taxes for the business entity itself. With a sole proprietorship, however, your business taxes are filed as a supplement to your personal taxes.

This type of taxation is referred to as pass-through taxation by the IRS since the tax liability belongs to you as the owner, and its passed through to your personal tax return. When you go to file, youll need to include specific forms along with your standard return.

The reason these taxes are different is that you are operating as your own business entity as an individual. That means you are left holding the bag if you owe at the end of the year or if youre under scrutiny with an audit.

When you file your annual return, youll include a form called a Schedule C. This will go along with the standard 1040 all together when you file the return with the IRS.

Read Also: How To Get A Job In Solar Energy