How To End A Corporation

- File California Form 100 or Form 100S for the last taxable year, check the box that indicates that it is a final return, and write “Final” on top of the return.

- File California Form 100 or Form 100S for all delinquent tax years.

- Pay all outstanding tax liabilities, interest, and penalties.

- Domestic corporations file the appropriate Certificate of Election to Wind Up and Dissolve, with the California Secretary of State.

- Foreign corporations file the appropriate Certificate of Surrender of Right to Transact Intrastate Business with the California Secretary of State.

- Notify all creditors, vendors, suppliers, clients, and employees of your intent to go out of business.

- Close out business checking account and credit cards.

- Cancel any licenses, permits, and fictitious business names.

- Consider publishing a statement in a local newspaper of general circulation near the principal place of business that the corporation is no longer in business.

- Refer to FTB PUB 1038, Guide to Dissolve, Surrender, or Cancel a California Business Entity for more information on how to dissolve a corporation.

What Is The Extent Of Liability Protection For Smllc Owners

The SMLLC is a separate entity from the owner, which differs from a sole proprietorship where the owner and business are considered one in the same. If an owner of an SMLLC makes any personal guarantees or pledges to financial institutions in an attempt to guarantee financing, a loan, or other credit, the owner will be liable. An SMLLC owner will also be liable for all negligent or deliberate personal torts.

It’s important to keep all SMLLC documents, like purchase orders, bids, checks, and contracts with the business name and LLC on them. If an owner signs a contract and it’s not clear he or she is acting on behalf of the SMLLC, the owner can be held personally liable. It should be clearly noted on any signature line that the owner is an authorized signer and is entering the agreement on behalf of the SMLLC rather than in a personal capacity.

Corporation Llc Partnership Or Sole Proprietor

One of the most important decisions youâll ever make is how to legally organize your business. There⨠are several alternatives, and the form you choose will have a big impact on how youâre taxed, whether youâll be liable for your businessâs debts and how the IRS and state auditors will treat you.

Read Also: How Much Does A Big Solar Panel Cost

Understanding Your Business Structure

Before we go any further, let’s make sure you understand this:

As an independent contractor, you are a business owner.

When you agreed to the contract terms with Grubhub, Doordash, Uber Eats, Instacart or others, you agreed to this. There was a part of the agreement that said something like I agree that I am an independent contractor and not an employee.

That means that you are performing your deliveries as a business. You are not an employee of these companies.

So what kind of business are you? That depends on whether you have created a business stucture.

Most of us, who haven’t created a structure, are known as Sole Proprietors.

A sole proprietor is somoene who owns an unincorporated business by himself or herself.

If you are doing business by yourself without any form of corporation or structure, you are considered a sole proprietor. Your profits are taxed as part of your individual income taxes. There’s no official business structure.

This is the norm for most of us in the gig economy.

Key Features Of A Sole Proprietorship:

- It is inexpensive to start a sole proprietorship.

- A sole proprietorship consists of an individual or a married couple. creates a partnership.)

- The business and the owner are one. There is no separate legal entity.

- The owner of the sole proprietorship controls the entire business.

- The sole proprietor is personally liable for all debts and actions of the business. Personal assets may be used to pay the debts of the business.

- The life of the sole proprietorship continues to exist until it goes out of business, or as long as the business owner is alive. Once the owner dies, the sole proprietorship no longer exists.

Read Also: What’s Bad About Solar Energy

What Taxes Are Associated With A Sole Proprietorship

While sole proprietors report income on their personal taxes instead of as a separate business entity, taxes can still be a big headache. Again, at the state and local levels, what you will be required to pay may vary. Generally, though, you will be responsible for:

- Federal income tax

- State income tax

- Self-employment tax

- Sales tax

Sole proprietors will also pay quarterly estimated taxes rather than just paying once a year. The estimated taxes include your income and self-employment tax. Estimated tax payments are owed if you expect to owe at least ,000 in taxes at the federal level and are due in January, April, June, and September.

Sole proprietors should also closely track their business deductions. These will help offset your income and result in lowering your tax obligation. A few common deductions include home office space, some retirement plans, health savings accounts , marketing, loan interest, bank fees, legal fees, and the internet.

There are ways to make the tax headache easier and let you focus more on the business. Employing a tax professional can help you with the guidance, preparation, and filing of your taxes.

Would An Llc Actually Help You With Your Taxes

A normal LLC wouldn’t, because nothing changes about your taxes. The only time that it would is if you elected to be taxed like an S-Corporation.

I won’t even try to go into the details on how it works. You really need your tax pro for this one.

But here’s what I will tell you: When you go this route, you have to pay yourself a reasonable salary first. You also put yourself at a much higher audit risk, because people will abuse this.

So the question is, are you making enough more than a reasonable wage to even be able to take advantage of this?

Consider that a reasonable wage is going to start at at least minimum wage.

For what we do, that might be kind of rare.

Part of the problem is the 57.5¢ mileage allowance . The good news is it allows most of us to deduct much more than our actual cost.

The flip side is, for a lot of us that taxable income barely comes out much above minimum wage.

Sit down with your tax pro and see what things look like for you. Will you save enough in taxes to make it worth doing this?

Also Check: What Is The Difference Between Sole Proprietorship Llc S Corp

One Spouse Is The Owner

Another solution if the single-member status is desired, is to have one spouse to be the sole owner of the LLC and be a disregarded entity. A disregarded entity is an entity that is separate from the owner legally but is not recognized as being separate for tax purposes. In this case, a single-member LLC files with the IRS as a sole proprietorship. When the LLC is set up where only one spouse is the owner, often the other spouse works in the business as an employee.

This may not be an acceptable solution for some couples, especially if both spouses are significantly involved in the operations of the business. They may feel more comfortable in having the ownership of the business more formalized.

Where Should You Form An Llc

If you determine you want an LLC, you also have to decide what state will be the home base for your business. For most people, this is a fairly easy decision as they want the company to register where they are doing business. Other people prefer to file in a different state, like Delaware, even if they are not based there. Delaware is the state of choice for many investors. While the process is a little more expensive as you need someone to act as your local registered agent, it can be an important choice if you plan to raise capital for your business. It’s also important to point out if you form your LLC in one state and plan to do business in another state, you will need to register in other ones where you do business, which will increase your startup costs.

Don’t Miss: What Can You Run Off Solar Panels

The Child Care Business Owner Institute

Many child care providers have asked me following question, Should my childcare business be incorporated?

Here is my response: The decision to incorporate your childcare business is solely up to you, however, it is recommended by tax professionals that childcare providers set up a Limited Liability Company to reduce their personal liability.

I was licensed as a home provider in 1999 and was operating as a sole proprietor. I filed a fictitious name report and was doing business as, Morgan Daycare until 2001 in the state of Missouri. In 2001 my Child Care specialist, whom at that time had over 20 years of experience as a childcare specialist recommended that I incorporate my childcare business to reduce my liability.

Moreover, she told me that if I were to be sued by a parent, in the event of a child injury I could lose my home and personal assets. That was enough to encourage me to incorporate my childcare care business.

What is a Limited Liability Company or a Single Person Limited Liability Company ?

According to the Internal Revenue Service, a Limited Liability Company is a business structure allowed by state statute. LLCs are popular because, similar to a corporation, owners have limited personal liability for the debts and actions of the LLC. An SMLLC that does not elect to be a corporation will be classified by the existing federal guidance as a disregarded entity which is taxed as a sole proprietor for income tax purposes.

How Do I File a LLC?

When Should You Open An Llc

There are a few reasons to open up an LLC instead of operating as a sole proprietorship:

- You want to expand the company to more than one owner in the future, which is easy with an LLC

- You want to protect your personal assets from potential financial and legal liability

- You want to take advantage of any applicable local, state or federal tax benefits that come with forming an LLC

In summary, setting up an LLC could position you for growth and protect you from liability. People also consider opening up an LLC when they reach a certain income threshold in their business and the additional fees and paperwork make sense from a tax perspective. This varies by state and the type of business, so its a good idea to speak to your accountant and compare the taxes youll be paying with each business structure.

Read Also: Does My Solar Power Work If The Power Goes Out

What Is Your Risk Of Losing Everything Because Of Business Debts

Here’s the beauty of doing gig work such as delivery with Uber Eats, Doordash, Instacart, Grubhub and others.

There’s usually not much need for a business loan that would put you in debt.

You don’t have to build inventory or build up a base. The moment you go out and delivery, you’re profitable.

On top of that, you’re not very likely to get a business loan based on your delivery business. You don’t have the customer base or assets to really base a loan on.

Chances are high that if you did get a loan for your delivery business, you’d have to personally guarantee that loan. In that instance, an LLC isn’t going to protect you anyway.

There are always exceptions. You’re probably aware of any that might exist for you. Once again, sit down with your financial help to figure this one out.

Tax Return Filing Guidelines For A C Corporation

- C corporations that organize in California, register in California, conduct business in California, or receive California source income must file California Form 100, California Corporation Franchise or Income Tax Return.

- The C corporationâs return due date is the 15th day of the 4th month after the close of the taxable year.

- C corporations are taxed on their net income at a rate of 8.84 percent by California.

- C corporations are subject to a California minimum tax of $800.

- The California $800 minimum franchise tax is due the first quarter of each accounting period and must be paid whether the corporation is active, inactive, operates at a loss, or files a return for a short period of less than 12 months.

- The California $800 minimum tax is waived on newly formed or qualified corporations filing an initial return for their first taxable year. The California $800 minimum tax is also waived if the corporation did not do business in California during the taxable year, and the taxable year was 15 days or fewer.

Read Also: Are Solar Panels Worth Buying

If You Have A Sole Proprietorship When Should You Form An Llc

It is time to go from a sole proprietorship to an LLC when you are ready to grow your business and earn a profit.

Sole proprietorships are only good for very low-profit/low-risk businesses.

Example: A sole proprietorship can be a good way to start out if you are doing business on a small scale or want to try out a low-risk venture to see how successful it will be.

Forming an LLC allows business owners to grow their businesses and take on risk. This is because LLCs provide personal liability protection.

What is personal liability protection? When a business owner has personal liability protection, they cant be held personally responsible if the business suffers a loss. This means personal assets are protected.

Forming An Llc Can Be Expensive

Let’s start with the cost of having someone set it up for you.

For most of us, it’s better to have a professional set things up. Attorneys and CPA’s aren’t cheap. Some companies provide a service to walk you through.

Different states charge you differently for setup and taxes. You pay as little as $40 in Kentucky up to $870 in California. Most states have an annual fee or tax.

The cost of keeping up on the requirements can be higher as well. You have to keep better records and report your earnings in more detail, which means spending more on accounting.

Recommended Reading: How To Estimate Solar System Size

How To End A Limited Partnership

- File California Form 565 for the last taxable year, check the box that indicates that it is a final return, and write “Final” on top of the return.

- File California Form 565 for all delinquent tax years.

- Pay all outstanding tax liabilities, penalties, and interest.

- Publish notice of its dissolution requesting persons with claims against it to present them .

- Dispose of known claims by following the procedures specified in California Corporations Code Section 15908.06.

- File a Certificate of Cancellation with the California Secretary of State.

- Notify all creditors, vendors, suppliers, clients, and employees of its intent to go out of business.

- Close out business checking accounts and credit cards.

- Cancel any licenses, permits, and fictitious business names.

- Consider publishing a statement in a local newspaper of general circulation near the principal place of business that the limited partnership is no longer in business.

- Refer to FTB PUB 1038, Guide to Dissolve, Surrender, or Cancel a California Business Entity for more information on how to cancel a limited partnership.

Land Care Business Organizational Structure: Which Business Organizational Structure Is Best Suited For Your Landscape Business

There are a variety of ways to legally organize a Landscape Firm. Choice of business organization should be one of the landscape professionals earliest business decisions. However, once an owner or ownership group starts operating his or her business many factors that were previously not considered may come to light. Landscape Professionals who start out as a one man band may grow into a busy firm with many employees operating across state lines with partners and or outside investors. When this occurs many need to rethink their form of business organization taking into account legal, financial as well as tax considerations. As a result, a meeting with an accountant or an attorney may be the first step in determining which structure is best for the Landscape Professional.

For the most part, there are three business structures that may be set up in different ways. The three basic structures are Sole Proprietorship, Partnership or a Corporation. A fourth choice that is an excellent fit as to the way we as Landscape Professionals carry on business would be a Limited Liability Company . For accounting purposes an LLC can be set up like either of the first three and taxed accordingly. The following discussion is meant to give the Landscape Professional enough information to seek out advice from an attorney, CPA or other business consultant qualified to provide advice on the matters of entity structure.

Read Also: How Many Solar Panels For 30 Amps

Llc Vs Sole Proprietorship: Paperwork And Compliance

The final difference between an LLC vs. sole proprietorship has to do with paperwork and compliance requirements. As we mentioned earlier, a sole proprietorship requires the least amount of paperwork prior to launch. After launch, a sole proprietor only needs to keep up with federal, state, and local taxes. In addition, a sole proprietor might need to renew business permits.

An LLC has more compliance responsibilities. After filing initial articles of organization, LLCs have to file an annual report in many states. An LLC with multiple members has even more responsibilities, such as drafting an operating agreement, issuing membership units, recording transfers of ownership, and holding member meetings. None of these steps are legally required, but are highly recommended for LLCs to preserve liability protection for members. In addition, since an LLC is a registered business entity, dissolving an LLC takes additional paperwork.

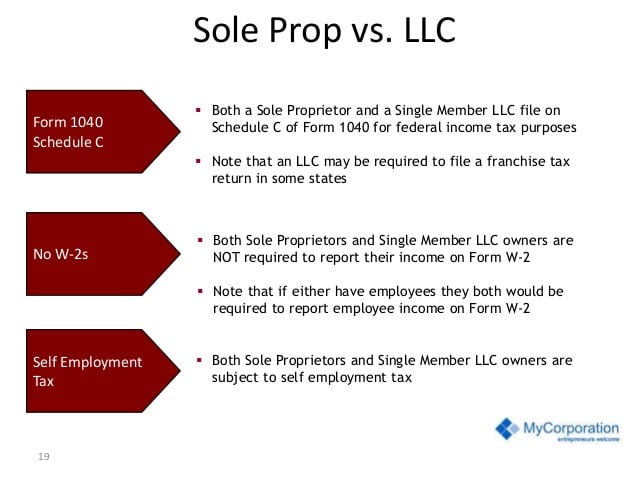

Llc Vs Sole Proprietorship: Taxes

A single-member LLC and a sole proprietorship resemble each other in terms of tax treatment. Both are pass-through entities, which means that the business itself doesnt pay income taxes. The owner reports business income on a Schedule C thats attached to their personal tax return, and the income gets taxed at the owners personal income tax rate.

Multi-member LLCs are also pass-through entities, with each owner reporting and paying taxes on their share of the businesss income. The only difference is that a multi-member LLC must file a business tax return with the IRS, Form 1065, U.S. Return of Partnership Income. In addition, each member must attach a Schedule K-1 to their personal tax return, which shows their share of the businesss income.

In addition to income taxes, both LLCs and sole proprietorships might have additional tax responsibilities. No matter which business structure you adopt, youll need to pay payroll taxes if you have employees. Youll also need to collect state and local sales taxes if you sell taxable goods or services. And finally, as a self-employed business owner, youre responsible for paying self-employment taxes to the IRS. These taxes cover your social security and Medicare tax obligations.

A few states and local jurisdictions levy additional taxes on LLCs. Depending on the state, this might be called a franchise tax, LLC tax, or business tax. Youll also have to pay state and local income taxes and payroll taxes.

You May Like: How To Convert Your Home To Solar Energy