What Do You Need To Do To Claim The Federal Tax Credit

Lets look at the steps you need to follow if youre going to file your own taxes. We recommend that you use online tax filing so you use the correct forms and dont make any mistakes.

To claim the tax credit, youll need to file Form 5695 with your tax return. This is the form designed for residential energy tax credits.

What Are The Filing Requirements For Solar Tax Credits

If you are eligible to claim a Federal solar tax credit, you will need to file Form 5695 alongside your tax returns this year. This form is used to calculate the amount of credit you are entitled to. The result will be added to Form 1040.

This is a non-refundable tax credit, so if the credit is worth more than you owe in Federal taxes, you cannot use the credit to get a tax refund. It is possible to carry the credit value over to the following tax year, however.

It remains unclear as to whether unused solar tax credits will still be able to be carried over after 2021, when the program expires.

Claiming The Solar Credit For Rental Property You Own

You can’t claim the residential solar credit for installing solar power at rental properties you own. But you can claim it if you also live in the house for part of the year and use it as a rental when you’re away.

- You’ll have to reduce the credit for a vacation home, rental or otherwise, to reflect the time you’re not there.

- If you live there for three months a year, for instance, you can only claim 25% of the credit. If the system cost $10,000, the 26% credit would be $2,600, and you could claim 25% of that, or $650.

- $10,000 system cost x 0.26 = $2,600 credit amount

- $2,600 credit amount x 0.25 = $650 credit amount

Don’t Miss: Do Solar Panels Heat Up The Earth

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

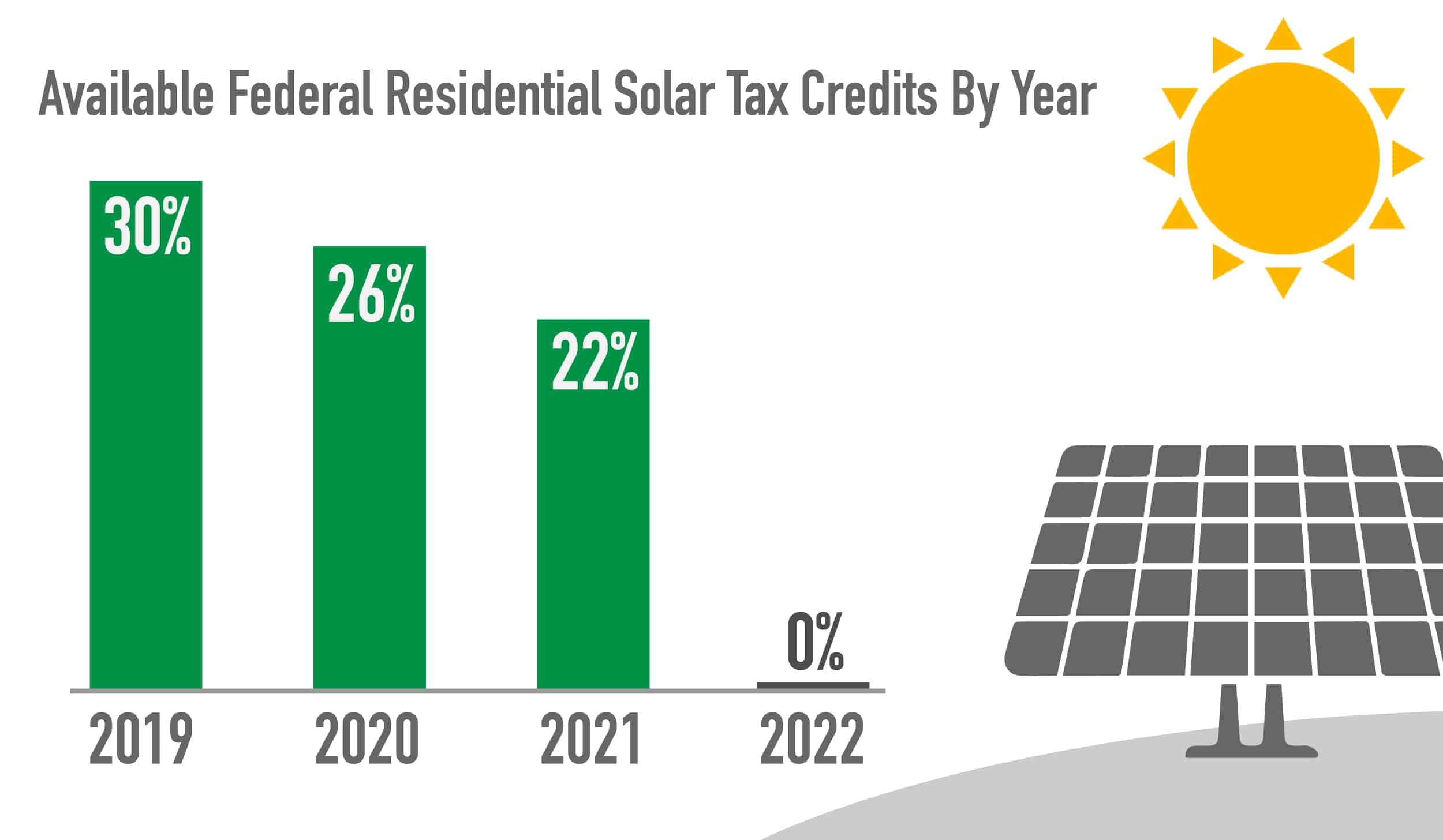

Solar Tax Credit Amounts

Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost. The percentage you can claim depends on when you installed the equipment.

- 30% for equipment placed in service between 2017 and 2019

- 26% for equipment placed in service between 2020 and 2022

- 22% for equipment placed in service in 2023

As a credit, you take the amount directly off your tax payment, rather than as a deduction of your taxable income.

Also Check: Can Mobile Homes Have Solar Panels

Can I Get Solar Tax Credit If I Do Not Own A Home

The answer is Yes! Internal Revenue Code does not provide that the house on which solar property is installed must be owned by you. The only requirement is that you must be a resident of that home. Even if you live in your parents home, if you pay for the solar system on that house, you can claim the solar tax credit.

History Of The Federal Solar Tax Credit

The solar tax credit was originally created through the Energy Policy Act, which was signed way back in 2005. As originally written, the credit was set to expire in 2007. It proved pretty popular with homeowners across the country, however, prompting Congress to renew the credit multiple times.

As it stands, the credit will be available at least through 2023. However, an act of Congress could extend it even further, allowing future homeowners and solar adopters to reap this financial benefit.

You May Like: How To Apply For Federal Solar Tax Credit

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

Solar Tax Credit Calculator

It is easy to understand the aforesaid solar tax credit calculator. Let us say, in 2021, your solar installation costs $30,000. At a rate of 26% of the tax credit, your qualified federal tax credit would be $7,800. If the income tax liability for 2021 is only $3,000. Then, the tax credit would reduce your tax liability to zero, and the other $4,800 is carried over to 2022 for adjustment ., .

Recommended Reading: How Many Homes In California Have Solar Panels

How Much Is The Federal Tax Credit For Solar Panels

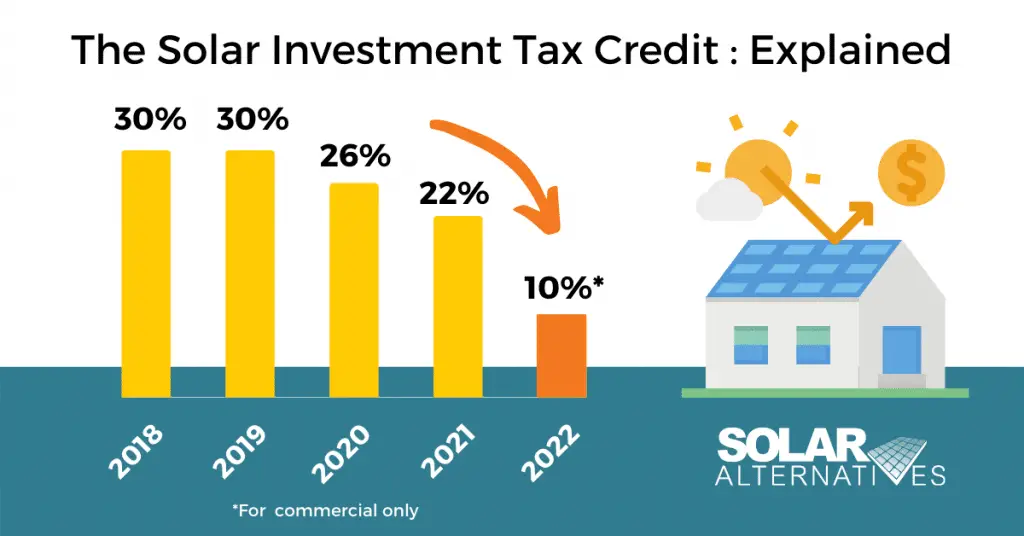

The federal tax credit for solar panels is currently at 26%, its highest available rate. That means serious savings on your tax returns when it comes time to file. For another two years, the 26% federal solar tax credit presents a huge opportunity for savings. The current rate is thanks to the newly signed legislation which removed the originally established timeline for the tax credit.

Now, instead of expiring at the end of 2020, the 26% solar tax credit will renew in 2021 and remain in place through 2022. After 2022, the tax credit will then drop to 22% in 2023.

This is an encouraging sign of things to come as more legislation is planned in the coming years that will further incentivize more homeowners to install clean, renewable energy.

What Is The Federal Solar Tax Credit

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic system.

The system must be placed in service during the tax year and generate electricity for a home located in the United States. There is no bright-line test from the IRS on what constitutes placed in service, but the IRS has equated it with completed installation.

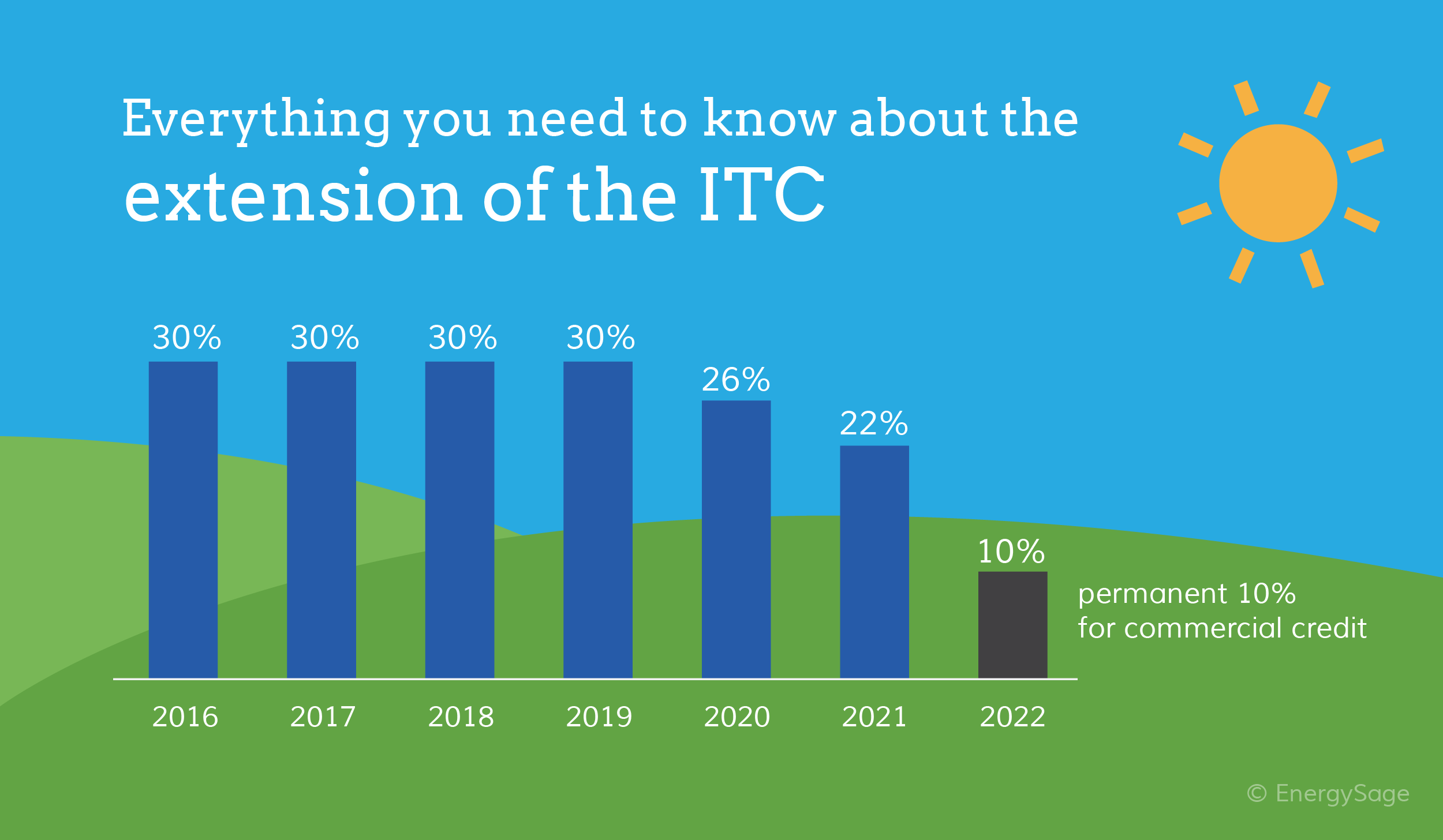

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. The tax credit expires starting in 2024 unless Congress renews it.

There is no maximum amount that can be claimed.

Don’t Miss: How Much Does Solar Cost In Arizona

The Future Of The Solar Tax Credit

As noted, the solar tax credit has been around for a while but is past its peak in value. The last extension, locking solar tax credits into the internal revenue code through 2023, was only announced in December 2020 via the Consolidated Appropriations Act.

The ITC is set to expire completely after 2023 for home solar energy systems . Since no extension has been announced, the future of the program is rather uncertain. While the current political landscape certainly looks positive for the future of solar, there is no guarantee that the same type of tax credit will exist or what the money saved would be.

Can You Claim Solar Tax Credit Twice

You cannot technically claim the solar tax credit twice if you own a home however, you can carry over any unused amount of the credit to the next tax year for up to five years. Note: if you own more than one home with solar, you may be eligible. In this case, contact your tax professional to find out more.

Read Also: How To Set Up A Sole Proprietor Business

Federal Solar Tax Credit Calculator

The good news is that the federal solar tax credit has been extended with the signing of the Federal government Omnibus spending bill. Some key extensions for the Investment Tax Credit are :

- 2-year extension for the residential commercial solar investment tax credit has been extended at 26% through 2022. Now, the phasedown to 22% will occur on January 1, 2023.

- The Sec. 45 production tax credit /investment tax credit , has been extended by one year to December 31, 2021. Projects that begin construction in 2021 will qualify for either the PTC at 60% of its full value or an 18% ITC on the total project cost in the year the project is placed in service.

- The Offshore wind will now have a 30% ITC through Sec. 48 for projects for which construction starts after 2016 through the end of 2025. This change is retroactive, so projects that already started construction after 2016 will be able to access the 30% ITC.

You should note that the federal tax credit for solar system investment not only reduces your tax liability but also can be used to reduce the alternate minimum tax, in case you fall under AMT.

Getting A Refund From The Arizona Solar Tax Credit

Arizona has a program that is very similar to New Mexicos, with some minor changes to the actual amounts. With the Arizona solar tax credit, the credit caps at $1,000 or 25 percent of the value of the system, whichever is lower. Like the other credits in this article, it will also roll over if you dont use the full amount in a single year, with a maximum of five years.

The way to get a refund on this credit is similar to the others in that youll get your withheld taxes back if the Arizona solar tax credit covers the cost of your state taxes for the year. While this amount might not be as large as the federal or New Mexico credits, its still a tidy sum of cash coming back into your account.

This tax credit, and other solar incentives available in Arizona, are some of the reasons why we consider Arizona to be one of our top states for solar this year. Armed with this information, we hope that you will be able to make an informed decision about whether going solar is right for you. Make sure to check out the other available incentives to make sure youre maximizing your savings.

Also Check: How Much Is It To Get Solar Power

What Will Happen When The Solar Tax Credit Steps Down

This is speculative, but we foresee a couple possible outcomes to the tax credit stepping down:

- States take charge

- As more and more states like California launch 100% Renewable Portfolio Standard targets, one can expect additional solar incentives to become available for homeowners residing in those areas to help the state achieve its RPS goals.

- Congress adjusts the step down

- There is a possibility that congress may delay or adjust the tax credit step down. The tax credit was initially passed under a Republican administration and extended under both Republican and Democratic administrations. There is potential bipartisan support for an extension.

- With the most recent extension, the very fact that legislators built in a step down makes us find it less likely to be extended at the current 26% level.

- Residential tax benefits are also going away entirely in 2024.

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

+ = $4,680 + $3,510 = $8,190

Read Also: How To Get Solar Rebate

How Will The Solar Tax Credit Change Over Time

As it currently stands, the federal solar tax credit is set to expire in 2022. In terms of residential customers, they’ll get 26 percent through 2020.

That number then drops to 22 percent through 2021.

Unless there is another extension, homeowners will not get to make use of the credit at all in 2022, but those with panels on their commercial properties can. That credit in 2022 will be for 10 percent.

What Happens If Theres Leftover Credit

There are some situations where the solar ITC would not bring you a full refund, however. If we take the $5,200 amount from before and apply it to someone who only owes $3,000 in taxes, they will not get the additional $2,200 of value back in their pocket. Instead, the credit will reduce the amount owed to $0, giving you that $3,000 back, and then will go roll over to the next year when you can apply the remaining amount of the federal ITC to that years taxes.

This is a big difference compared to a refundable tax credit. With a refundable tax credit, if the $5,200 took you below $0 you would get your $3,000 back, but then the IRS would send you a check for the remaining $2,200 that same year.

To maximize your returns with the federal solar tax credit, you need to owe some amount of income taxes. If you do not owe any sort of income tax perhaps because you receive social security or your main source of income is from property then the federal solar tax credit will be completely worthless to you because of its non-refundable nature.

It is for this reason that Go Solar Group discourages you from going solar if you do not owe federal income taxes. The ITC is one of the main reasons why solar has gotten increasingly affordable over the past several years. Without that tax credit, your solar installation will become much more expensive than it would otherwise be.

Don’t Miss: How Do Solar Batteries Work

Solar Tax Credits And Rebates In Colorado

Colorado is one of the sunniest states in the US, with an average of 300 days of sunshine each year. That makes it an ideal place for using solar energy. If you’ve been considering harnessing the power of this Colorado sunshine to help improve your energy independence and lower your utility bills by installing solar panels, the federal and state, and local governments are making it more affordable by offering tax credits to homeowners who invest in this equipment. These credits are easy to claim, but you have to act this year. The federal solar panel tax credit expires on December 31, 2021.

Solar Renewable Energy Certificate

A Solar Renewable Energy Certificate , sometimes referred to as a Solar Renewable Energy Credit, is another type of state-level solar incentive. After you install your solar power system and register it with the appropriate state authorities, they will track your systems energy production and periodically offer you SRECs as a benefit. You can sell your SREC to your local energy utility to provide payment thats typically considered taxable income.

Don’t Miss: How Is Sole Proprietorship Taxed

What Does The Credit Cover

Homeowners who install and begin using a solar PV system can claim a federal solar tax credit that currently covers 26% of the following costs:

- Labor costs for solar panel installation, including fees related to permitting and inspections

- All additional solar equipment, such as inverters, wiring and mounting hardware

- Energy storage devices that are powered exclusively through the solar panels, including solar batteries

- Sales taxes paid for eligible solar installation expenses

How Solar Tax Credits Work

The tax credit is a reduction in an individuals or business’s tax liability based on the cost of the solar property. Its a nonrefundable tax credit, meaning you wont get more back than the amount you owe in taxes.

Projects that begin construction in 2021 and 2022 are eligible for the 26% federal tax credit, while projects that begin construction in 2023 are eligible for a 22% tax credit. Residential tax credits drop to 0% after 2023, but commercial projects will drop to 10%.

As of 2021, the solar ITC is a 26% federal tax credit.

Homeowners who purchase a newly built home with a solar system are eligible for the ITC the year they move into the house if they own the solar system. Those who lease a solar system or who purchase electricity through a power purchase agreement are not eligible for the ITC. In this case, its the company that leases the system or offers the PPA that collects the credit.

Anyone wishing to claim the credit should first consult with a tax professional to ensure that they are eligible. It’s smart to speak with an advisor before making a major investment that you intend to claim on your taxes.

Also Check: How Does The Solar Credit Work