Sole Proprietorship: Pros And Cons

A sole proprietorship is the fastest way to start a business. Theres no state paperwork to fill out or fees to pay, which makes it a popular option for freelance contractors. It may be a good choice if youre looking to test out a service-based business.

As a sole proprietor, youre the only business owner, and youre not required to conduct shareholder meetings. And as a sole proprietor, youll have a much easier time come tax season since you dont have to file a separate return for the business. You’ll report any income you earn on your personal tax returns.

Operating as a sole proprietor will give you a lot of freedom, but there are drawbacks to consider. For instance, youre going to be personally responsible for any liabilities the business incurs. And if youre sued for damages caused by the business, your personal assets will be at risk.

If youre on the fence, it can help to consult with other business owners to learn what path they took when first getting started.

Choose A Name For Your Llc

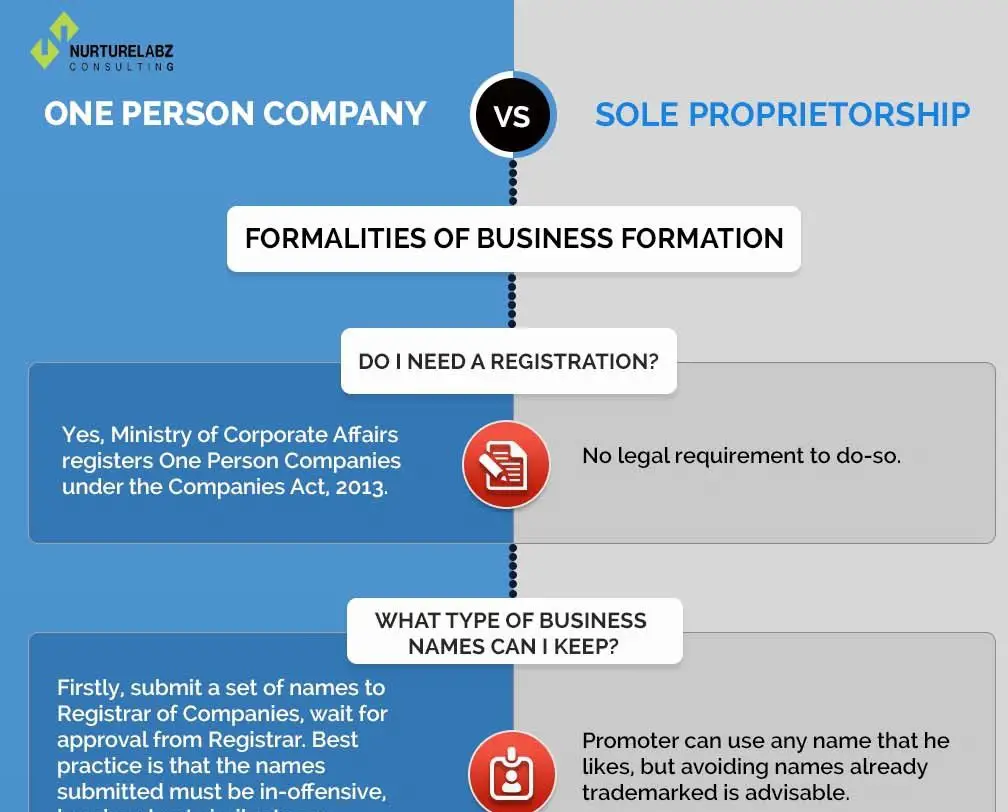

Many states do not enable two various service entities to have the same name. So you cant, as an example, have Joes Donuts, LLC and also Joes Donuts, Inc., even if theyre located in different cities. Many states additionally limit companies from making use of particular words in their names, such as financial institution. You can browse existing business names online in several states to determine whether your recommended LLC name is available. You should always check name accessibility in your state prior to filing LLC documents. Should I Start My Tax Preparation Business With A Llc Or Sole Proprietorship

Along with state law constraints, its wise to research study whether various other similar services in your area are utilizing the same name or a similar name. Choosing a special name can help avoid complication as well as trademark infringement claims. You might additionally think about whether a domain is offered that matches your service name.

Do Emails Constitute A Contract

If you have a written or even an oral exchange that documents offer and acceptance, then you likely have an agreement. The question is: What is the agreement and what are its terms?

The problem with a contract that is created by an email chain is that you are likely to wind up fighting not just about whether there was an agreement but what it includes.

A good contract addresses what could go wrong and how can it be handled.

Chasalow

Consider a simple example: Youre a graphic designer and I say, Will you please design a logo for me? Ill pay you $1,000, and you say yes. You then design a logo, and I dont like it. What should happen? We might have a contract, but the contract didnt address any of the issues that might arise. Do I need to pay for the logo I dont like? Do you need to redesign the logo at additional cost and expense to you? What if you redesign the logo, and I dont like that one either?

A good contract would address the contingencies that come up in a business and be clear about which party bears which risks and burdens. A good contract addresses what could go wrong and how can it be handled. A contract that was created by an email chain is unlikely to address many of the important issues. So, it doesnt provide the protection that many would hope.

Recommended Reading: Is Solid State Drive Better

Bottom Line: Should I Form An Llc Or A Sole Proprietorship

As a sole proprietor or a single-member LLC, the IRS would treat you as an unincorporated entity. But if youre a partnership member, the benefits of registering as an S corporation type LLC are quite a few.

Namely, you can gain legal liability for any debts made by your company. This also makes sure that your business is incorporated and formalized. So if you ever decide to expand, bring in other people as partners or transfer ownership, you can do it without much hassle. Still, switching from a sole proprietor to an LLC is quite easy, too.

Is a sole proprietorship or an LLC the best structure for your business? This is one of the first choices to make as an entrepreneur. Weigh all the pros and cons before embarking on a decision.

Pick A Registered Representative

LLCs are required to have a signed up representative. This is a private or business that consents to accept legal documents in behalf of the LLC if it is sued. The signed up agent should have a physical street address in the state where the LLC is registered. A lot of states maintain a checklist of private service firms that will certainly function as agent for service of process for a charge. An LLC member can function as registered agent for the LLC.

You May Like: Are Solar Panels Worth Buying

Llcs Vs Sole Proprietorships: An Important Decision For Business Owners

There’s no doubt that business owners face a unique and important choice in selecting a business structure – specifically a sole proprietorship versus a limited liability company.

The key in making the right decision is to do your due diligence, consult with other small business owners and learn from their experiences, and consult business and financial specialists who can guide you through the myriad issues that matter to a small business owner – issues like logistics, regulatory filings, taxes, and personal liability.

Do all that and you’re well on your way to making the business structure decision that works best for you.

Business Funds And Personal Funds

LLCs must have separate bank accounts for business activity and personal use. This includes separate credit cards, debit cards, checking accounts, and savings accounts. Mixing personal and business finances can result in serious penalties.

Sole proprietors do not have to maintain separate accounts for business and personal use. In the eyes of the law, sole proprietors and their businesses are one and the same. With that said, most accountants frown upon this practice and recommend using a separate account for your business. In the event of an IRS audit, this separation will make your life significantly easier. While this isnt a fact per se, its assumed by many that auditors are more likely to scrutinize your records if you mix personal and business finances.

Don’t Miss: Do Solar Attic Fans Work At Night

How Do I Start A Sole Proprietorship

Starting a sole proprietorship is simple, although the specific steps you take may vary depending on where you live. In most states, you need to follow these three steps to become a legal entity:

Steps to start a sole proprietorship

How To Choose Between A Sole Proprietorship And An Llc

The main difference between a sole proprietorship and an LLC is that an LLC will protect your personal assets if your business is sued or suffers a loss.

Most serious business owners choose to form an LLC vs. a sole proprietorship because an LLC legally separates the owner’s personal assets from the business. This is known as personal liability protection.

What is personal liability protection? When a business owner has personal liability protection, they cant be held personally responsible if the business suffers a loss. This means personal assets are protected.

You May Like: Does Solid And Striped Run Small

Which Is Better: A Sole Proprietorship Or Llc

As with so many questions like this, the answer is: it depends. While obtaining funding or financing can be challenging for any business, the advantages and protections you can enjoy with an LLC cant be understated.

Keep in mind your business goals and what you want to achieve. Dont be scared to get advice or help from seasoned professionals.

This article was originally written on December 3, 2019 and updated on July 21, 2021.

Should I Make My Llc An S Corp

If you’re a sole proprietor, it might be best to establish an LLC since your business assets are separated from your personal assets. You can always change the structure later or create a new company that’s an S corporation. An S corporation would be better for more complex companies with many people involved since there needs to be a board of directors, a maximum of 100 shareholders, and more regulatory requirements.

Read Also: How Many Solar Panels To Power Ac Unit

What Is A Limited Liability Company For A Single Owner

One of the most common types of small businesses in the U.S. is a single-owner or single-member LLC. This is a business entity registered in the state of formation, which usually will be where the company does business.

The term single-member is used to recognize that the LLC has one owner, as opposed to an LLC in which there is more than one owner. A single-member LLC has all the same advantagesand disadvantagesof a multi-member limited liability company.

Each state has different requirements for forming an LLC.

Note that you can form your LLC in a different state than where you do business. Each state other than where you initially formed your LLC is a foreign state. You are required to foreign qualify in those states in order to do business there. This generally requires filing an application for authority with that states business entity filing office.

Advantages of a single-member LLC

There are many benefits to forming an LLC versus operating as a sole proprietorship. A single-member LLC is generally shielded from personal liability for debts associated with the business.Note: Single-member LLCs must be careful to avoid commingling business and personal assets. This could lead to what is called piercing the corporate veil and the loss of your limited liability.

However, you do have the option to be taxed differently.

Other benefits of forming a single-member LLC include the following:

Disadvantages of a single-member LLC

Limited Liability Company Versus A Sole Proprietorship

One of the key benefits of an LLC versus the sole proprietorship is that a members liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business. This liability, however, is dependent upon following the rules associated with an LLC. If you treat the LLC the way you would a sole proprietorship, you lose the liability protections.

For example, creditors can go after a sole proprietors home, car and other personal property to satisfy debts, while an LLC that is properly maintained can protect the owners personal assets.

- Difficult to obtain financing in the business name

- Harder to build business credit

Also Check: Is Leasing Solar Panels A Good Idea

Highlights Of The Two Business Structures

Heres an at-a-glance run-down of some highlights to compare a sole proprietorship vs. LLC business structure:

- Sole proprietorships are generally less expensive to establish and easier to maintain administratively.

- In a sole proprietorship, owners are taxed at the applicable individual income tax rates on profits that the business makes.

- LLCs shield their owners legally, providing a level of personal liability protection against debts of the business.

- LLCs must complete formation documents, register with the state, and pay a filing fee.

- LLCs must follow their states laws that govern the LLC entity type. They may need to pay annual fees, file annual reports, and hold annual meetings.

- LLCs must keep their company records and funds separated from those of their owners.

- LLCs have tax flexibilitythey may choose to be taxed as a sole proprietorship , C Corporation, or S Corporation.

As you can see, there are potential pros and cons to each business structure. Which will be the best option for you will depend on your specific circumstances and objectives.

Llc Vs Sole Proprietor: Which Should You Choose

Every day, aspiring entrepreneurs drop their traditional 9-5 desk jobs and set out to start a small business of their own.

Dozens of decisions must be made, though: a business name, how to advertise, securing financing, and more.

One question that demands consideration is which type of business entity to form. Most one-person businesses either choose to operate as sole proprietorships or form single-member limited liability companies . Knowing which one is right for your business can be tricky.

To make your decision easier, weve compared some of the most important distinctions between an LLC and a sole proprietorship. By the time youre done reading, we hope youll have a better grasp on which one is the right choice for you.

Rocket Tip: If you decide forming an LLC is the right route for you, compare the top LLC services to see how they save you time and get setup. Alternatively, you can form an LLC on your own with our free guide.

Also Check: How To Hook Solar Panels To Your House

Business Requirements That Apply To Sole Proprietors And Llcs

Some obligations are universally required for both sole proprietorships and LLCs.

Several examples include:

- Pay income taxes payroll taxes if the business hires employees).

- Obtain an EIN from the IRS . Fortunately, EINs are free of charge.

- Comply with the local areas zoning requirements.

- Request W-9s from independent contractors and send them 1099 forms at tax time. I recommend reading up on the importance of classifying workers as independent contractors or employees correctly.

- Obtain and renew applicable business licenses and permits.

These come with the territory of owning a business and should never be ignored. As I mentioned earlier, entrepreneurs must get professional legal and accounting insight to make sure they cover all the bases.

Starting A Sole Proprietorship

Sole proprietorships are strapped with big risks. Increased personal liability, difficulty raising capital, and a perceived lack of professionalism are a few pitfalls sole proprietors must navigate.

Still, the potential financial rewards could be more than worth the risk especially if you plan thoroughly before launching a new business and weigh the benefits and disadvantages.

Below, well look at the pros and cons in more detail.

Read Also: Can I Add More Batteries To My Solar System

Difference Between Sole Proprietorship And Llc

The difference between sole proprietorship and LLC honestly comes down to one major thing: liability.

Sure, there are other things such as taxes and fees, but liability is the only real difference between sole proprietorship and LLC.

It is the protection an LLC business is offered that a sole proprietorship is not that makes the difference. The question being do you want to put your business or personal assets at risk if something were to go wrong?

Obtain Any Necessary Business Licenses And Insurance

Ensuring your business obtains the proper licenses and insurance is a critical step in setting up your company. As a sole proprietorship with no liability protection, you have to make sure you are doing business the right way and have insurance if the worst happens.

The licenses required varies largely on your business type, but some common types of business licenses include:

- General business license

- Insurance or real estate agents

- Personal services

Because you will be a sole proprietor, you will want to make sure you have some business insurance to protect yourself. Your state may also require specific types of insurance. Even if you do not have employees and are not required to pay for things like workers compensation insurance, there may be insurance requirements for specific industries.

Unfortunately, there is no one place to check and find the full list of what you might need. There are not only federal and state licenses and permits to check on but also local licenses and permits.

Once you have obtained everything, you need to keep track of which ones expire and when. Hiring a service to do this work for you can take a lot of worry off your plate.

Read Also: How To Estimate Solar System Size

Ownership Of An S Corporation

The IRS is more restrictive regarding ownership for S corporations. These businesses are not allowed to have more than 100 principal shareholders or owners. S corporations cannot be owned by individuals who are not U.S. citizens or permanent residents. Further, the S corporation cannot be owned by any other corporate entity. This limitation includes ownership by other S corporations, C corporations, LLCs, business partnerships, or sole proprietorships.

Llc Vs Sole Proprietorship Comparison

There are four main factors to compare between a sole proprietorship and LLC:

- Liability Protection

- Cost to Register and Maintain

Liability Protection

A sole proprietorship doesn’t offer liability protection, but an LLC does. This value usually outweighs all other factors.

Branding

An LLC owner can use the business’s legal name as its brand name. A sole proprietor must use their surname as the business name or register a DBA name when available.

Pass-Through Taxation

Both sole proprietors and LLCs are taxed as pass-through entities by the US Internal Revenue Service . This means that the business’s profits will pass through to its members to be reported on their personal tax returns. All profits are only taxed once, at each member’s individual income tax rate.

Cost to Register and Maintain

An LLC is a low-cost and low maintenance business structure. A sole proprietorship with a DBA is comparably priced.

Don’t Miss: How To Apply For Federal Solar Tax Credit

What Are The Tax Implications Of Each Business Structure

To file taxes, you report your operating results, including profit or loss, by submitting Profit or Loss From Business with your personal 1040 tax return. An LLC is very flexible and can also be taxed as a sole proprietorship, a partnership, or a corporation.

A sole proprietor also benefits from pass-through taxation, so you’ll report your business’s income or loss in the same way. The difference is that you don’t have the option to file as a corporation.

You’re also not required to pay taxes on the full amount of your sole proprietorship’s income. Instead, you’ll only pay taxes on the profit of your business.