Qld Solar Bonus Scheme

To get QLD residents into purchasing solar panels and other solar products, the Queensland government introduced a solar incentive scheme known as the solar bonus scheme in 2008.

The solar bonus scheme was in existence for four years until 2012. It no longer accepts new customers. Existing customers have to abide by stringent eligibility rules to enjoy this high solar feed-in tariff until 2028.

A premium feed-in tariff of 44 cents was the basis of the Qld solar bonus schemeFeed-in tariffs refer to an amount paid to a solar panel system owner for electricity exported back to the grid. The payment is made by an electricity provider. Often, the solar feed-in tariffs offset any electricity bill amount you have to pay.

The electricity exported to the grid from your solar system is excess power produced from your solar system. You need an advanced solar system to store the power produced, consume and export the excess to the grid.

The high feed-in tariff of 44 cents/kWh offered by the QLD solar bonus scheme attracted many early adopters of solar power systems.

To maintain eligibility in the scheme, you need to keep an active electricity account and an agreement with your preferred electricity retailer. You also need to consume less than 100 MW/h of electricity per year. If you ever need to improve your solar system, you have to inform your electricity retailer. Finally, replace components of your solar system with similar parts.

Complete Guide For Solar Power Alberta 2021

Congratulations! Youve found the ultimate guide for going solar in Alberta!

Alberta is currently ranked the #3 province in the country for installing a solar power system, scoring as one of the best provinces for sunlight levels, cash rebates, and installation costs.

This page contains all relevant information about installing solar in Alberta including utility policies, system financing, solar incentives, and natural factors

This guide is sponsored by Solar YYC, a residential and commercial solar developer serving all of Alberta. to visit their website and to get a free cost estimate.

The guide begins by answering the two most common questions about solar systems, then it explores each solar ranking factor.

You can read from top to bottom, or skip to your preferred section by clicking on it below:

| 3. System Costs |

Frequently Asked Questions: Federal Solar Tax Credit

Will I get a tax refund if the solar investment tax credit exceeds my tax liability?

No, the federal solar ITC is a nonrefundable tax credit. However, if you do not use all of your tax credit, you can carry over the unused amount to the following year.

Can I use the federal solar tax credit against the alternative minimum tax?

Yes, you can use your solar tax credit either against the federal income tax or against the alternative minimum tax.

Will there be another federal solar tax incentive after the current one expires?

A new solar tax credit would require an act of Congress. While it is certainly possible, it isn’t something that can be predicted with any certainty.

Can I claim the credit if I’m not a homeowner?

Yes, but only under specific circumstances. Specifically, you must be either a tenant-stockholder at a cooperative housing corporation or a member of a condominium complex to claim the federal solar tax credit.

Can I claim the credit if I am not connected to the grid?

You do not have to be connected to the electric grid to claim the solar tax credit. You only need to have a solar power system that’s generating electricity for your home.

Can I claim the credit if my solar panels are not installed on my roof, but on the ground on my property?

Yes. The solar panels do not have to be installed on the roof in order for you to claim the tax credit, just so long as they are generating solar energy for your home.

You May Like: What Is A Solar Heated Pool

How To Calculate My Stc

Calculating the number of STCs you are entitled to and ultimately your solar rebate is quite an easy calculation.

kW solar panels x 11 x zone rating x Spot STC price

Example: Ana lives in Chester Hill 2162 NSW and wants to install a 6kw system.

Calculation: 6 x 11 x 1.382 = 91 STC

91 x $39.50 = $3,595 rebate.

How To Claim The Solar Tax Credit Using Irs Form 5695

Note: The information below can be used if filing taxes in 2021 for a solar installation that was placed into service in 2020.

Its that time of year againtax time! But this year is different, because this was the year you installed solar panels on your home , and now youre ready to get that tax credit to take 26% right off the top of that expense. And were here to help guide you through the process!

If youre reading this and havent yet installed solar, you only have a couple more years to get the tax credit. 26% off the cost for installations completed by the end of 2022, or 22% in 2023. Thats nothing to scoff at, people – and the tax credit wont be around after that so what are you waiting for?

Get personalized solar quotes from our expert partner installers

Weve included an example below of how to fill out the tax forms. Weve also included a section at the bottom of this post that answers some frequently asked questions about the process of claiming the credit.

Weve prepared two posts to answer all your solar tax credit questions. If you’re interested in general information of the solar tax credit then you should go here. If you’re looking for information on how to claim your tax credit, then you’re already in the right place.

KEEP IN MIND: We are solar people, not tax people. We do not give tax advice, and anything you read on this page is merely one example of how someone might act. Please consult a tax professional before filing.

Read Also: Do I Qualify For Solar Tax Credit

How Do I Apply For A Government Solar Rebate

There is no need to apply for a solar rebate. This is something that the installer does on your behalf and is priced into the system cost.

So a typical 5kWh solar system might cost $7000 fully installed, but the installer will only advertise the system to cost $3500.

Basically what he is doing is collecting your half off you, then collecting the other half from the government.

There is no need for you to actually apply for the rebate yourself.

Solar rebates are not to be confused with solar Feed-in Tariffs. Once you have your solar system hooked up to the grid, you will need to speak to your energy company about how much money they will pay you to feed your excess power back into the grid.

A Special Note About The Stc Value

As of the time of updating this article, Greenmarkets valued STC at $39.50. The STC value in the Australian solar market is primarily determined by demand and supply forces. The STC value varies depending on the time you install your solar power system.

It will have an impact on the amount of money you save through an STC-based rebate .

The table below summarizes the federal solar tax credits you would receive in New South Wales if all three criteria are considered.

| Solar System Size | |

| $14,278 | $8,290 |

The federal government may offer different incentives in certain areas, such as postcodes surrounding zone 3 border towns.

Its crucial to learn the specifics of how much youll be able to deduct at the point of sale from your solar installer or vendor. Keep an eye on your applications current STC value and timetable, too. The following computations are based on an 11-year attribution period and a current STC value of $39.40.

You May Like: How Does Solar Panel Energy Work

What Qualifies For The Solar Tax Credit

- The entire bill for a qualified system, minus the sales tax. That includes solar panels labor costs for on-site preparation, assembly, and installation of the system and piping or wiring to connect the system to your house.

- Installation of a solar system in a primary or second house.

- Systems purchased outright or with a loan.

- Solar roofing tiles, like those being sold by Tesla.

- Solar installed in a property that you live in for at least part of the year. That could cover, for instance, a second home that you rent out when youre not there. The credit is prorated based on how much time you spend in the residence. For a multifamily home in which you live but also collect rent, you may be eligible for either the residential or business tax credit, depending on how much of the property is used for business. Check with a tax expert for details.

Impact Of The New Itc Extensions

The ITC has resulted in an extremely effective subsidy in catalyzing both rooftop and utility scale solar energy adoption across the U.S. The multi-year extension from late 2015 has caused the cost of solar to drop, while installation rates and technological efficiencies have improved. The federal solar tax credit is a great example of an innovative tax policy that encourages investment in 21st-century energy systems and technology.

Industry experts estimate a total of 27 gigawatts of solar energy had already been installed in the US by 2015, and they predict we will have nearly 100 GW total by the end of 2020. From 2015 to 2017 there was a 25% increase in the number of solar industry jobs and that number is forecasted to increase throughout the next decade. The federal solar rebate program is proof that long-term federal tax incentives can drive economic growth, technological innovation to reduce costs, and create a new generation of jobs and skillsets. We offer commercial solar in 26 states, Washington D.C., and Puerto Rico, to find out more about the ITC close to you, contact us today.

Recommended Reading: What Are The First Solid Foods For Baby

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2020 but I did not move in until 2021.

May I claim a tax credit if it came with solar PV already installed?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house in other words, you may claim the credit in 2021. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

How do I claim the federal solar tax credit?

Federal Solar Tax Credit

These days, one of the best incentives most people can get to help reduce the cost of installing solar is the Federal Solar Tax Credit, also known as the Investment Tax Credit . The ITC is a 26 percent tax credit for solar systems on residential and commercial properties. There is no dollar amount cap amount on the ITC, but it is important to note that it is a non-refundable tax credit, meaning the amount of credit you are eligible for is tied to your tax liability. Weve said it before and well say it again, talk to a tax expert.

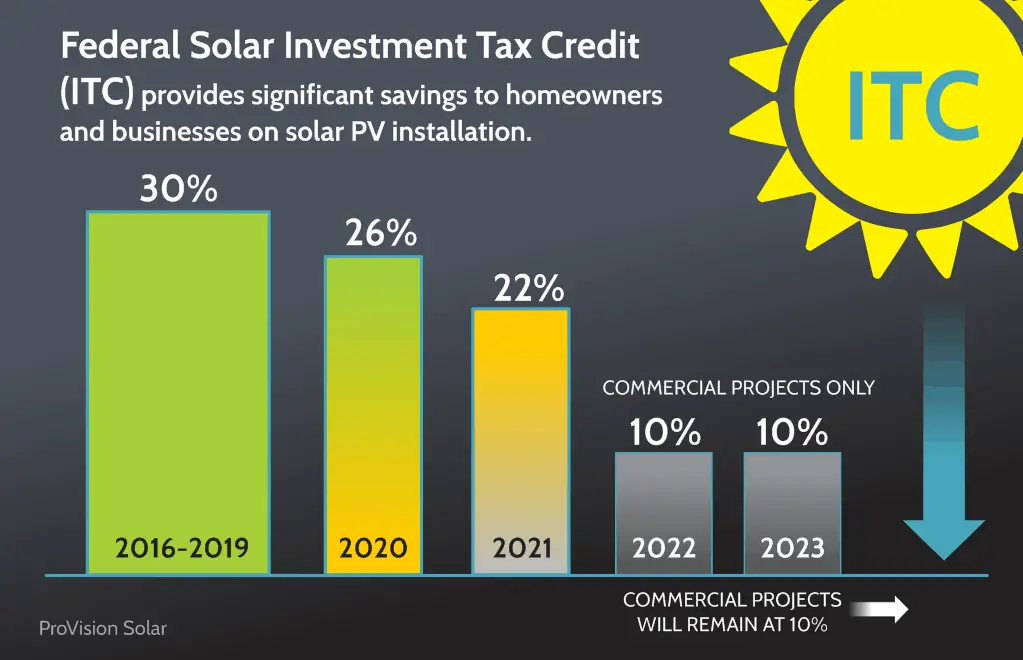

Important Dates! The Federal Solar Tax Credit is phasing down. Starting in 2023, the commercial and residential tax credits will step down.

Qualifying for the Federal Solar Tax Credit: Eligibility for the ITC is slightly different for residential and commercial solar installations. Residential solar installations must be placed in service in order to receive the tax credit, whereas commercial installations receive an incentive based on the date they commence construction. This means that installations must be complete by the end of 2019 to be eligible for the full 30% tax credit. Alternatively, commercial customers must commence construction to qualify. The Solar Energy Industry Association has a helpful outline that explains the requirements taxpayers must meet to claim the ITC.

You May Like: How Much Tax Credit For Solar Panels In California

How Long Will The Federal Solar Tax Credit Stay In Effect

As the saying goes, all good things must come to an end. And the solar tax credit is no exception.

However, the federal government recently extended the federal solar tax credit as part of a federal spending package passed in December 2020.

Under this new bill, residential, commercial, industrial and utility-scale solar projects that begin in 2021 and 2022 will be eligible for 26% tax credit. This number will drop down to 22% for solar projects in 2023, and it disappears completely for residential installs beginning in 2024.

Heres a quick overview showing the value of the federal tax credit over the next couple of years:

- 2020 2022: 26%

- 2023: 22%

- 2024: 0%

You can claim the credit in the same year you complete the installation, so you can claim the full 26% tax refund if you install your system before the end of the year 2022.

The tax credit plays a major part in the return on investment you see from going solar, as well as minimizing the upfront cost of the system however, youll have to wait until after filing to see the overall cost go down. Grid-tie systems pay for themselves either way, but claiming the credit allows you to realize more immediate savings. We cant recommend enough that you capitalize on the full 26% credit, because the value only shrinks after 2022.

What Will Happen When The Solar Tax Credit Steps Down

This is speculative, but we foresee a couple possible outcomes to the tax credit stepping down:

- States take charge

- As more and more states like California launch 100% Renewable Portfolio Standard targets, one can expect additional solar incentives to become available for homeowners residing in those areas to help the state achieve its RPS goals.

- Congress adjusts the step down

- There is a possibility that congress may delay or adjust the tax credit step down. The tax credit was initially passed under a Republican administration and extended under both Republican and Democratic administrations. There is potential bipartisan support for an extension.

- With the most recent extension, the very fact that legislators built in a step down makes us find it less likely to be extended at the current 26% level.

- Residential tax benefits are also going away entirely in 2024.

Also Check: How Fast Do Solar Panels Pay For Themselves

Preferred System Size Installed In New South Wales

The larger the solar power system, the greater the rebate, but its not worth overdoing it.

A 6.6kW solar panel installation is the most popular solar system in NSW. This is adequate for the average houses energy demands.

That is, while it may appear that you will be at a disadvantage in terms of refunds if you purchase a smaller solar kit, this isnt always the case. Refunds are based on the overall cost of your solar equipment, and smaller kits will almost certainly get an equal discount to cover the initial expenditure.

How Big Of A Difference Is A 26% Tax Credit Versus A 30% Tax Credit

Since the Investment Tax Credit is applied to your solar arrays gross system cost, the amount you receive is dependent on the amount of solar youre purchasing: bigger system, bigger credit.

Heres a quick example of the difference in credits in 2019 and 2021 for a 9 kW solar array at an average cost of $27,000.

- Installed and claimed in 2019 taxes at the full 30% level, your credit would be $8,100.

- Installed and claimed in 2021 taxes at the 26% level, your credit would be $7,020.

Thats a savings difference of $1,080 compared to the previous year.

While ~$1,000 may not seem like a huge difference to some, this doesnt include the amount that youll save on the rest of your project if applicable. For a new roof and home batteries, for example, the cost of both can be claimed on the tax credit, adding another $300-$1,000+ to the value lost in the stepdown. If youve already decided to go solar and are just waiting for the right moment, you should move forward this year to maximize your savings before the ITC steps down again in 2023.

Also Check: How Much Is A 4kw Solar System

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

Federal Solar Tax Credit Filing Step

Fill in Form 1040 as you normally would. When you get to line 53, its time to switch to Form 5695.

Step 1: Find out how much your solar credit is worth.

- Enter the full amount you paid to have your solar system installed, in line 1. This includes costs associated with the materials and installation of your new solar system. As an example, well say $27,000.

- For this example, well assume you only had solar installed on your home. Enter 0 for lines 2, 3 and 4.

- Line 5 Add up lines 1 through 4. Example: 27,000 + 0 + 0 + 0 = 27,000

- Line 6 Multiply the amount in line 5 by 26% Example: 27,000 x .26 = 7,020

- Line 7 Check No. Again, for this example, were assuming you didnt have any other systems installed, just rooftop solar.

- Lines 8, 9, 10 and 11 Dont apply to you in this example for the same reason. You can fill each with 0 and skip down to line 12.

Step 2: Roll over any remaining credit from last years taxes.

- Line 12 If you filed for a solar tax credit last year and have a remainder you can roll over, enter it here. If this is your first year applying for the ITC, skip to Line 13.

- Line 13 Add up lines 6, 11 and 12 Example: 7,020 + 0 + 0 = 7,020

Step 3: Find out if you have any limitations to your tax credit.

Don’t Miss: How Much Can Solar Panels Produce