Can You Transform A Straightforward Individual Retirement Account To A Self

INDIVIDUAL RETIREMENT ACCOUNT Self Directed Roth Individual Retirement Account

A conversion is a taxed activity of cash money, realty or various other properties from a Typical INDIVIDUAL RETIREMENT ACCOUNT, SEP INDIVIDUAL RETIREMENT ACCOUNT, or a Financial Savings Motivation Suit Strategy for Staff Members to a Roth Individual Retirement Account

Fill Out A Solo 401 Application

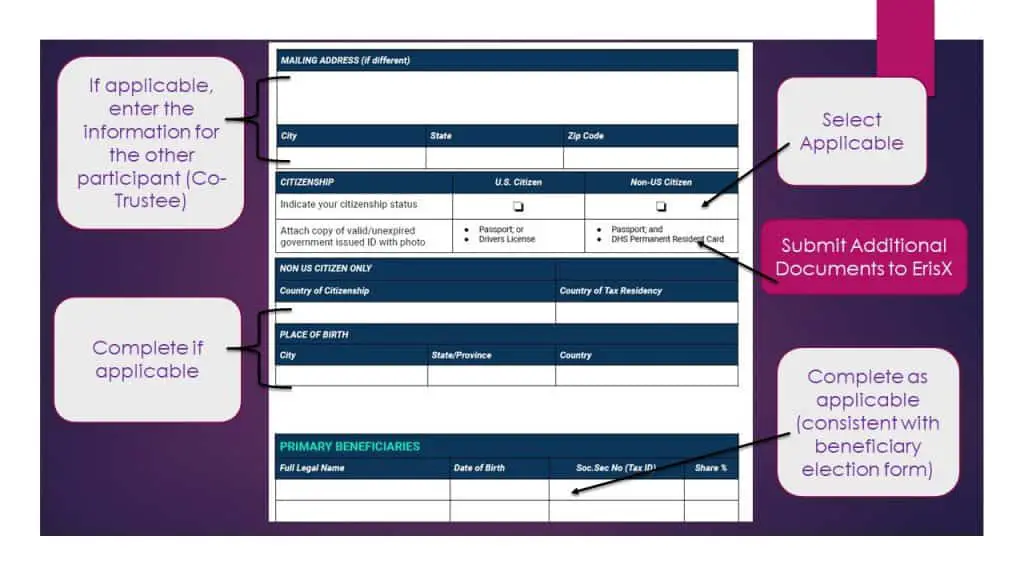

Before you can start a 401 account for yourself, youll need to give your brokerage some information about your business. A typical solo 401 application may ask for your:

First and last name

Plan administrators name and contact information

Social Security number

Citizenship status

Income information

Youll also need to disclose any professional associations or affiliations that might result in a conflict of interest with the brokerage. In completing the application, youll be asked to name one or more beneficiaries. You may also be asked to provide bank account information that will be used to make your initial contribution to the plan.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Recommended Reading: Is Home Solar Cost Effective

Account Minimums & Maintenance Fees

Note: many custodians have account minimums for Donor Advised Fund charitable accounts. However, for the purposes of this article, we will ignore those accounts.

Schwab, Fidelity, and TD Ameritrade have no minimum account balance or maintenance fees for investment accounts.

Vanguard has no minimum account balance or maintenance fees if you sign up for e-delivery services. However, if you receive paper statements, then they charge an annual maintenance fee. For most account types, this fee is $20 for each account where the total Vanguard assets you have in the account are less than $10,000.

Unfortunately, E-Trade does not clearly advertise if there is a minimum account balance for their retirement accounts, but they do advertise that there is no minimum account balance for brokerage accounts.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Don’t Miss: How Much Power Can I Get From Solar Panels

Third Party Solo 401k Providers

If you need something a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you’d consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you’re looking for with options

We’re not going to go in-depth on these providers because this section effectively becomes al-la-carte with what you can get and pay for. I just wanted to list some of the most popular third party plan providers that you can reference in your search for the best plan.

Remember, just because you go with a third party provider also doesn’t mean you can’t invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity’s investment choices, but your options are created by the plan, and NOT Fidelity.

Also, you can use these plans to execute a Mega Backdoor Roth IRA. In fact, several of these companies specifically advertise that they offer it.

This isn’t an exhaustive list. There are also local firms in most areas that can create 401k plan documentation as well.

How To Maintain Your 401

You can’t just forget about your 401 after you’ve set it up. You must regularly revisit it to determine if you need to make any changes to your contribution amount or to your asset allocation. Check on your plan at least once or twice per year or following any major life event that could affect your finances or retirement plans.

First, look at how your investments are performing. Small losses here and there are to be expected, especially if you have a lot of your money invested in stocks. However, if you’re routinely losing money, that’s a sign something needs to change. You may also want to consider moving some of your money around if it’s underperforming major market benchmark indexes, like the Dow Jones Industrial Average and the S& P 500. In this case, switching to an affordable index fund that tracks these benchmarks may provide better, more predictable returns.

You should also evaluate how much money you’re contributing to your 401. Income usually rises over the course of one’s career, so you may feel more comfortable contributing more of each paycheck as your income grows. Some people choose to start small and increase their contributions by 1% of their salary every year until they reach their goal amount.

Read Also: How Much Do Solar Panels Cost Installed

Td Ameritrade Solo 401k

TD Ameritrade is another low cost brokerage that offers a prototype free solo 401k plan. Their plan is the hardest to dissect, but here is what we could gather. However, after discussing their plan with them, here is what we found.

The TD Ameritrade solo 401k plan does allow both traditional and Roth contributions. They also allow loans from their solo 401k plan. We couldn’t get a clear answer on what types of rollover options they allow into and out of their solo 401k plan.

Looking at their plan document, they only allow rollovers from 401, 401, 403, 403, 408, and 457 accounts.

They also offer a lot of investment choices within their 401k plan. For example, they offer Vanguard ETFs commission free.

There are no setup fees or annual account fees with TD Ameritrade’s plan. All regular trades within the 401k are subject to their standard commission which is $0 per stock, ETF, and option trade. However, even beyond the Vanguard ETFs, they offer other ETFs commission free as well.

Learn more about in our TD Ameritrade Review.

Video Result For How To Start A Ira Account

Vanguard IRA Account Setup – Step by Step Tutorial

How To Open A Roth IRA

When Should You Open An IRA? (Individual Retirement…

How To Invest Roth IRA For Beginners 2020 (Tax Free…

How to open up a Vanguard Roth IRA account in 5 Mins -…

How to open a ROTH IRA account | For Beginners

How to Open a Fidelity Roth IRA Bank Account in 10…

to a

How To Open A Roth IRA – Investopedia

Copy the link and share

a to to a to to

How To Open An IRA – SmartAsset

Copy the link and share

to a to

Open An IRA – Individual Retirement Account | Charles Schwab

Copy the link and share

hotwww.sofi.com

a

How To Open Your First IRA | SoFi

Copy the link and share

a a to a a to a

What Is An IRA? How To Open An IRA Account And IRA FAQ …

Copy the link and share

greatwww.pnc.com

how to to to

Individual Retirement Accounts IRA | PNC

Copy the link and share

hotwww.irs.gov

to a to a a to to

Establishing A SIMPLE IRA Plan | Internal Revenue Service

Copy the link and share

Why Do You Need to Create A New Kahoot Account Right Away?

Read Also: Is Leasing Solar Panels A Good Idea

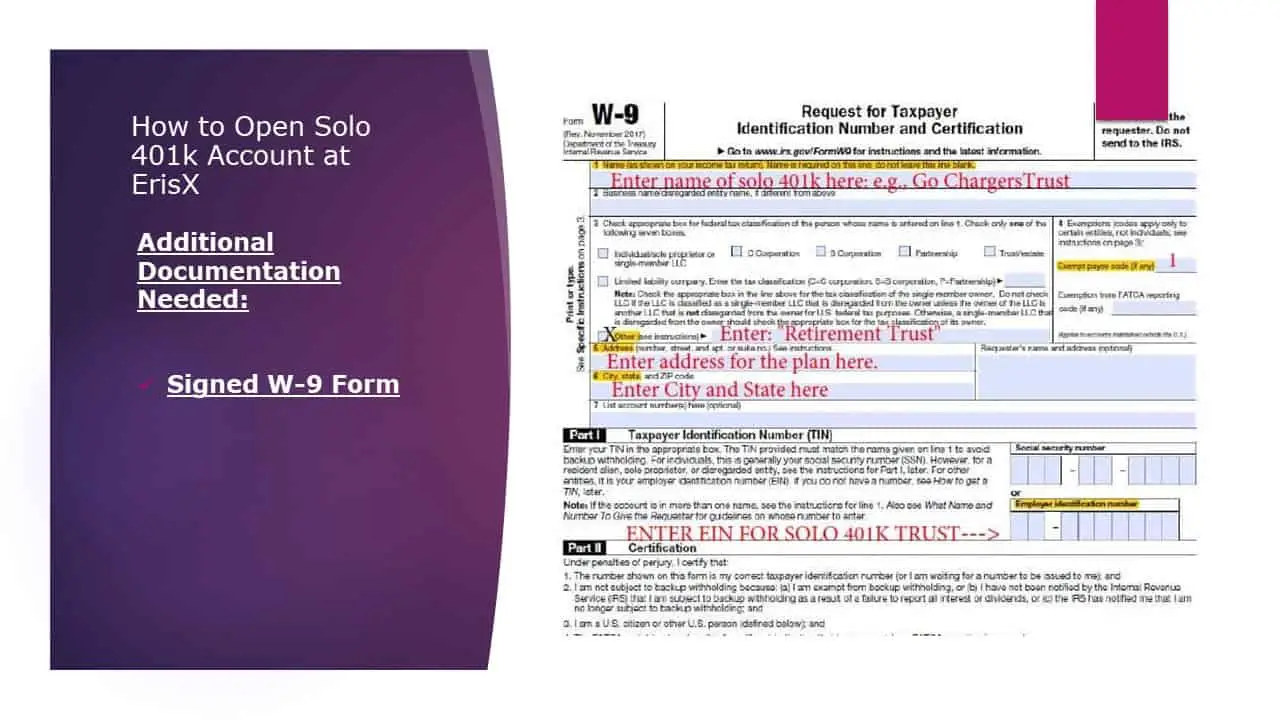

Open An Account With Your Provider

Now that youve chosen your provider and obtained all required documents and disclosures, its time to open the Solo 401. This account should be formed any time prior to your tax-filing deadline and needs to be formed in accordance with any guidelines in your plan documents.

While youre allowed to set up a Solo 401 account after the year ends and make prior-year contributions in a way thats similar to how you fund an IRA, its typically a best practice to set up a new account in the year that itll be effective and make your first contributions in the same year.

About Individual 401 Plans

An Individual 401 Plan allows a self-employed individual , to make highest possible retirement contributions.

Please review the Individual 401 Profit Sharing Plan Basic Plan Document before completing the Adoption Agreement and Employer-Sponsored Retirement Plan Information and Services Agreement.

Keep the original Adoption Agreement and send a copy to T. Rowe Price. Original Adoption Agreements submitted will not be retained. We will only retain an electronic copy.

This form allows you to transfer money from another Individual 401 plan to your T. Rowe Price Individual 401 Plan.

This form allows you to roll over assets from a former employer’s 401 or other eligible retirement plan.

A unique Operator ID will be mailed to you once your application has been processed. It should arrive within 7 to 10 days.

Once you’ve received your Operator ID and temporary password, you can access Plan Sponsor Web, which allows you to administer your plan online.

Once you’ve established your Plan Sponsor Web site, you can begin contributing.

Also Check: Where Are Most Solar Panels Manufactured

Where Should An Individual Investor Open Accounts

Nine years ago in 2013, we wrote an article that evaluated where an individual investor should open an investment account. At that time, Vanguard and TD Ameritrade were the only major custodians that had no minimum balance requirement to open an investment account and Vanguard was the only custodian that offered exchange-traded funds with no transaction costs.

Since then, the options for custodians with no-transaction-fees and no minimum account balances has increased tremendously. Today, Charles Schwab, Vanguard, Fidelity, TD Ameritrade, and E-Trade all offer no minimum balance to open a brokerage account and no transaction fees for online trades of U.S. equity stocks, U.S. exchange-listed ETFs, and no-transaction-fee mutual funds.

The expanded opportunity for consumers to trade securities without transaction fees and open investment accounts with no minimum balance increases the amount of money contributing to the return on their investment. We are pleased to leave in the past the days of sacrificing account value to high trading fees and other expenses.

If you are just getting started with investing and have not yet selected a custodian, in the past we would have recommended Vanguard because of their no-transaction-fees on Vanguard mutual funds and no account minimums. However, Charles Schwab, Fidelity, and TD Ameritrade now all have no-transaction-fees for ETF trades and account opens with no minimum deposit.

Is The Year To Take Your Maximum Tax Savings

Setting up a Solo 401k is a powerful tax planning tool. Solo 401ks are fully compliant with the IRS rules. With Nabers Group, the Solo 401k setup process is simple and straightforward.

Although it is the end of the tax year, as soon as you setup your Solo 401k, you will be entitled to make full employee and employer contributions up until your tax return date in 2022, plus extension dates.

Contribution limits to a Solo 401k are remarkably high. For 2021, the max is $58,000 and $64,500 if you are 50 years old or older. This is up from $57,000 and $63,500 in 2020. This limit is per participant. If your spouse is also earning money from your small business that means they can also contribute up to the same amount into the Solo 401k. If you are both 50 years old or older, your joint contributions could be up to $129,000 per year!

Solo 401k contributions are much higher than all other retirement plans. Traditional and Roth IRA limits are just $6,000. The catch-up contribution is $1,000 more if you are 50 years old or older. The IRS increases contribution limits frequently as a cost of living to keep up with inflation. Therefore, its a good bet youll see Solo 401k contribution limits continue going up over time .

Also Check: How Many 100 Watt Solar Panels Do I Need

Ira Or Solo 401k Question:

They both allow for investing in alternative investments including real estate, but the solo 401k is generally more advantageous. For example, the contributions limits are higher for a solo 4o1k plan, you can borrow from a solo 4o1k plan, and the ongoing fees are also generally much less. See the following link for more on this.

Charles Schwab Solo 401k

Schwab is another discount brokerage that offers a prototype solo 401k plan for free. Since Schwab is continually working to improve their image in the low-cost brokerage space, I was interested to see what they offered.

I was disappointed to learn that Schwab only offers traditional 401k contributions – they do not have a Roth option on their plan. They also do not offer loans under their plan.

It appears that you can rollover a 401k into your Schwab solo 401k, but you cannot do an IRA rollover.

Schwab does offer a lot of investing options, including Vanguard mutual funds and commission free ETFs.

There are no fees to open the solo 401k, and there are no yearly maintenance fees. Inside the 401k, traditional Schwab pricing applies – $0 per stock trade, with $0 on Schwab funds and ETFs.

Learn more about Charles Schwab in our Charles Schwab Review.

You May Like: Do Solar Panels Break Easily

Solo 401 Pros And Cons

At some point in everybodys life, you contemplate the dilemma of what retirement plan best suits your needs. Today, there are over 50 million individual retirement accounts. However, that doesnt necessarily mean the IRA is the right retirement strategy.

Determining whether you can enhance your retirement savings with a Solo 401 or self-directed 401 plan) completely depends on whether you are self-employed and have a business.

There are a number of significant advantage to establishing a Solo 401 over an IRA.

How A Solo 401 Works

Solo 401s are available only to self-employed workers with no employees, with an exception for business owners who employ their spouses. To open one of these accounts, you must have an employer identification number , which you can get from the U.S. Internal Revenue Service .

You’re allowed to make two types of contribution to your solo 401: an employee contribution and an employer contribution. Your employee contribution limit is the same as the 401 contribution limit for any traditionally employed worker — $19,500 in 2021, or $26,000 if you’re 50 or older. These rates increase in 2022 to $20,500, or $27,000 if you’re 50 or older.

If you’d like to contribute more than this, you can make additional contributions as an employer, but this calculation is a little more complicated. You may contribute up to 25% of your net self-employment income for the year. That is all the money you’ve earned from your business minus any business expenses, half of your self-employment taxes, and the money you contributed to your solo 401 as an employee contribution.

Only the first $290,000 in net self-employment income counts for the year, and the total amount you may contribute to your solo 401 as employee and employer in 2021 is $58,000, or $64,500 if you’re 50 or older. In 2022, those increase to $61,000, or $67,500 if you’re 50 or older.

You May Like: How Many Pool Solar Panels Do I Need

Best For Active Traders: Td Ameritrade

TD Ameritrade

Most retirement-focused investors would do well to stick with a passive investment style. However, if youre into active investing, TD Ameritrade offers industry-leading platform options and tools.

-

Choose between multiple web, mobile, and desktop platforms

-

Access the advanced thinkorswim trading platform with no added costs

-

Roth contributions and 401 loans are supported

-

Accounts will move to Charles Schwab in the future

-

Advanced platforms may be overwhelming for newer traders

TD Ameritrade is another renowned discount brokerage and our choice as best for active traders. It offers an individual 401 account with no recurring fees and commission-free stock and ETF trades. Its solo 401 also supports Roth contributions and 401 loans, although you might want to check with the company if loans are still available. Its standout feature for active traders, though, is the thinkorswim active trading platform, which is available on desktop, mobile, and the web.

Before diving into other details, its important to note that this brokerage has been acquired by Charles Schwab. TD Ameritrade accounts will become Schwab accounts at some point in the future. However, as you can see from its review on this list, were fans of Schwab as well and look forward to seeing the combined capabilities once the integration is complete.

Read our full TD Ameritrade review.

Not Owning A Small Business Today Is A Big Mistake

Many people today dont own a business because of certain misconceptions that used to be true in the Industrial Era.

For instance, owning a business used to involve substantial capital investment, risk, and time commitment. This is no longer the case. Today, downloading and using an app on your smartphone can make you a business owner.

Becoming a business owner can, in many cases, immediately lower your taxes by making some of your expenses tax-deductible. The biggest lifetime expenses of an American is taxes, and most people overpay their taxes.

Recommended Reading: Does Going Solar Really Save Money