Is It Hard To Raise Money For A Sole Proprietorship

It is difficult to raise money. Sole proprietors often have problems raising funds. You cannot sell shares in a company, which limits the options for investors. Banks are also reluctant to lend to sole proprietorships because of the added risk of getting money back in the event of a company going bankrupt.

Create An Llc Operating Agreement

While the LLC is a great choice for those business owners looking for increased personal protection with less formality, there still is some paperwork involved. Some states require LLCs to create an operating agreement. This document is an official contract that spells out the management and ownership of the LLC. It can outline details like how much of the company each member owns, everyones voting rights how profits and losses should be distributed among the members and what happens when someone wants to leave the business.

The operating agreement can just be a few pages, and you can find some samples on the Web. Even if your state does not require an operating agreement, it can be an important document to help clarify verbal agreements and prevent misunderstandings.

When Is An Ein Required For A Sole Proprietorship

Per the IRS, A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN. Once you hire employees or file excise or pension plan tax returns, you will immediately require an EIN.

A sole proprietor with an existing EIN who becomes a sole owner of a limited liability company will require another EIN for the LLC.

Also Check: Can You Mix Pine Sol And Vinegar

Why Would A Business Choose To Change From A Sole Proprietorship To An Llc

The LLC protects your assets in case of a lawsuit. If you receive a lawsuit, your assets won’t be at risk. There is only a risk to the business’s assets. Taxation through pass-through – In essence, you don’t have to pay corporate taxes since the LLC isn’t considered a separate taxable entity by the Internal Revenue Service.

What Are The Steps To Becoming A Sole Proprietorship

Steps Make a business plan. Choose a name for your business. Fill out the W9 forms every time you sign a new contract. Collect receipts for business expenses throughout the year. Register your taxes as a sole proprietor. Pay the self-employment tax rate on your federal income tax return. Change your company name annually.

Also Check: How Much Power Can 1 Acre Of Solar Panels Produce

Sole Proprietorship Vs Llc

A sole proprietorship is an unincorporated business that one person owns. It is the easiest way to establish, maintain, and take apart , primarily because of the lack of government regulation. It allows small-scale business owners to try out the business venture. If its a small start-up business, its the only business structure that makes sense.

When mulling over an LLC ownership, keep in mind that the advantage of being a sole proprietor is that, as the owner, you pay personal income tax on the earned profits. But a business owner of a sole proprietorship is not exempt from liabilities incurred by the business. The owners personal assets and savings are at risk in case of legal challenges or if the business incurs debt.

This is where turning a sole proprietorship into an LLC comes into play. The main feature of a limited liability company is that it separates the owners personal assets from the business and, therefore, protects the property, ensuring that the business debt remains with the company. This business structure is between a sole proprietorship and a partnership, allowing for multiple owners .

The requirements for LLCs are minimal, and though they are encouraged to follow the same guidelines as some corporations, they arent legally required to do so.

| NOTE: Northwest Registered Agent is thought to be a great LLC option. In addition, it offers a Free Registered Service Agent for one year, as well as IncAuthority, Swyft Filings, and MyCompanyWorks. |

Sole Proprietorship Vs Llc: Whats The Difference

It can be hard to know if changing from a sole proprietorship to an LLC is right. Take a look at these key points on each business structure to help you decide.

Sole proprietorships are

- Easy and affordable to form

- Considered the same legal entity as the owner

With a sole proprietorship, you are personally responsible for all business losses, debts, and liabilities.

Limited liability companies are

- Owned by one person or more

- Moderately easy and affordable to form

- Considered different legal entities than the owners

LLCs combine aspects of corporations and partnerships. An LLC separates business and personal liabilities, so your assets are protected and owners not liable for business debts. There is also a shared tax responsibility between members, like a partnership.

You May Like: How Many Solar Panels Do I Need For A Camper

Sole Proprietorship Ein Number

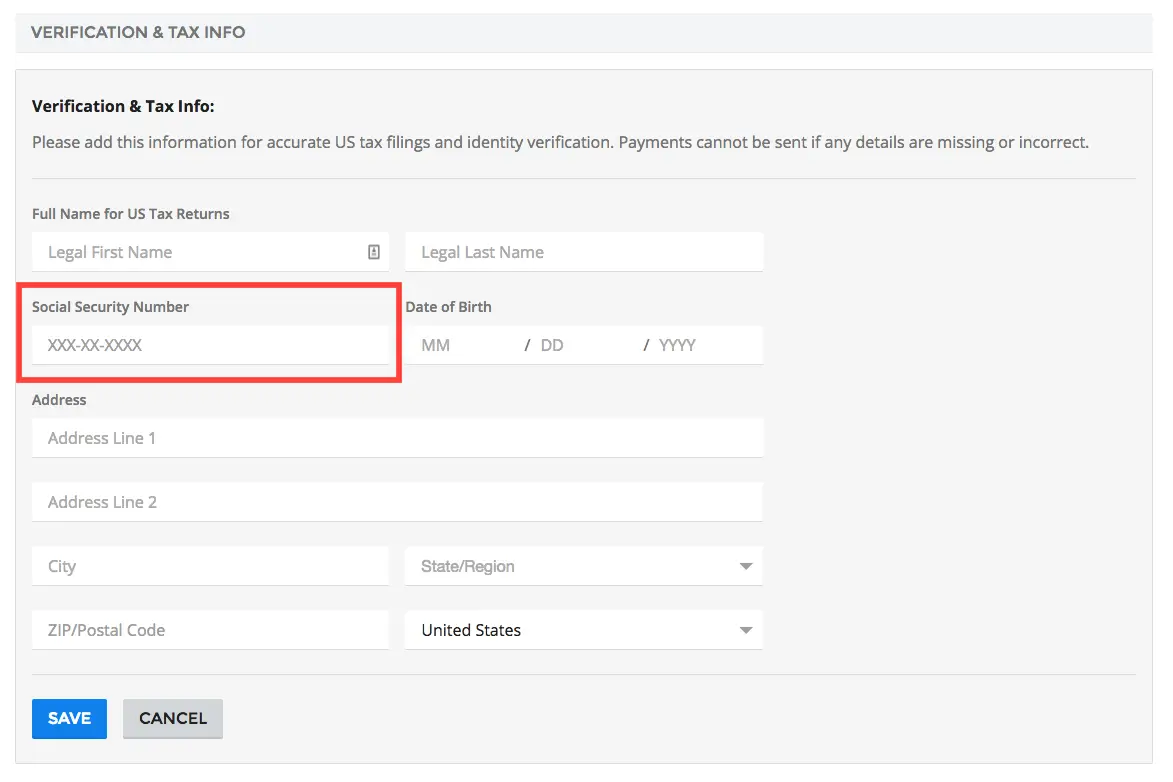

A sole proprietorship with no employees who doesn’t file a special tax or retirement plan statement doesn’t need an EIN . In this case, the sole proprietorship uses its social security number as its tax identification number. However, if the sole proprietor hires an employee or has to file a special tax or retirement plan statement, the sole proprietor needs an EIN to conduct business and cannot use its unlisted number.

Can You Change A Sole Proprietorship To An Llc

LLCs offer more protection, tax benefits, and other advantages that make them worth considering as business entities.

If you currently own a sole proprietorship and wonder whether you can change it to a limited liability company , the simple answer is yes.

A deeper question underlying this simple query involves when a change from a sole proprietorship to an LLC might be advisable. You might also want to know what procedures to follow to make the change from a sole proprietorship to an LLC, as well as what your new responsibilities include as the owner of an LLC.

Read Also: Can You Use Pine Sol On Stainless Steel

Pay And Establish Reserves For Financial Obligations

Your corporation’s formation state and the other states where it is registered do not consider your LLC completely dissolved or withdrawn until it settles all outstanding tax obligations for sales tax, franchise tax, income tax, and any state-mandated employee payroll deductions. Pay these and any federal taxes to finalize the dissolution.

State law also requires a dissolving corporation to set aside funds to pay any future corporate liabilities that are known to exist, such as a pending lawsuit or an obligation to contribute to an employee retirement plan. If the exact amount of the potential liability is uncertain, the reserved funds should represent your good faith estimate of the future payment obligations.

When Does A Sole Proprietor Need An Ein

There are situations where an EIN is legally required for a sole proprietor and situations where an EIN is recommended but not legally necessary.

If your sole proprietorship needs an EIN, it is a good time to research choosing between a sole proprietorship vs an LLC.

Subscribe to our Youtube channel

You May Like: Should I Get An Ein For A Sole Proprietorship

What To Do Next

It may seem like a complex process to transfer from a sole proprietorship to LLC, but it doesnt have to be. With my help, I will make sure that you make all the right decisions and get to the point where you can start operating as an LLC within just a few business days.

All I need is to understand your business.

That is why we should hold a consultation together today to make sure that this is the right decision and that youre getting what you want out of it.

Just get in touch with me today at and well get started with converting your sole proprietorship to a brand-new LLC!

Are you ready to make the switch?

Do You Need A New Ein

Generally, businesses need a new EIN when their ownership or structure has changed. Although changing the name of your business does not require you to obtain a new EIN, you may wish to visit the Business Name Change page to find out what actions are required if you change the name of your business. The information below provides answers to frequently asked questions about changing your EIN. If, after reading the information below, you find that you need an EIN, please see How to Apply for an EIN.

Read Also: How Much Would It Cost To Get Solar Panels

Check Your Business Name

When you are converting a sole proprietorship to an LLC, you need a unique business name. Your current business name might already be registered to another LLC in your state. If thats the case, you cannot operate as an LLC under that name, even if youve been using it as a sole proprietorship.

Check if the name is available by contacting your states secretary of state office. Many states have an online database for registered business names. You can also have a legal professional help you propose a name for your LLC.

Once youre sure no one in your state uses your business name, make sure it doesnt infringe on anyones trademark. Use the United States Patent and Trademark Offices database to search trademarks.

You must include Limited Liability Company in your business name. Or, you can use an abbreviation like LLC, Ltd., or Liability Co.

Usually, you dont need to register your LLC name. The name is automatically registered when you file paperwork to form the LLC. State rules differ, so double check with your state.

Understanding A Sole Proprietorship

A sole proprietorship is very different from a corporation , a limited liability company , or a limited liability partnership , in that no separate legal entity is created. As a result, the business owner of a sole proprietorship is not exempt from liabilities incurred by the entity.

For example, the debts of the sole proprietorship are also the debts of the owner. However, the profits of the sole proprietorship are also the profits of the owner, as all profits flow directly to the business’s owner.

Also Check: How Much Do Commercial Solar Panels Cost

Only Llcs Can Choose Corporate Tax Status

A key difference between LLCs vs. sole proprietorships is tax flexibility. Only LLC owners can choose how they want their business to be taxed. They can either stick with the defaultpass-through taxationor elect for the LLC to be taxed as an S-corporation or C-corporation. An S-corporation is a pass-through entity. If taxed as a C-corporation, the LLC will pay a flat 21% corporate income tax at the federal level .

LLCs can sometimes save money by electing corporate tax status. When a company is taxed as a corporation, dividends from the business are usually taxed at a lower rate than ordinary business income. Plus, retained earnings in a corporation arent subject to income tax. In contrast, LLC members cant treat income as dividends and must pay taxes on all profits of the business, whether retained in the company or not. A corporation is also eligible for more tax deductions and credits.

New Ein For Sole Proprietors

The Employer Identification Number is one of the most important forms of Taxpayer Identification Numbers as it is mandatory for a wide variety of businesses including corporations and LLCs. As a sole proprietor, you can use your Social Security Number for filing tax returns or you can obtain a new EIN and use the same.

Recommended Reading: Should You Clean Solar Panels

Choose A Name For Your Llc Business

To begin the process of conversion, you need to select a name that is already not on the database of business names in the Secretary of States records. As a sole proprietor, you may operate under a doing business as name now and may want to operate under a new LLC legal name.

You will need to perform an LLC name search to see if the desired name is available. Reserve a name if you are not quite ready to file an LLC application yet. I can also conduct a trademark search of the desired name to prevent problems with intellectual infringement or confusion in use. Contact me about the search at .

Why Change A Sole Proprietorship To An Llc

One of an LLC’s main benefits is that this type of business entity offers its owners limited liability. from the business, you protect your own property and ensure that the business’s debts remain those of the LLC. That is, you are not personally liable for them.

Because of the limited liability concept, you may consider switching from a sole proprietorship to an LLC if you’re concerned about your personal property being subject to a lawsuit against your business. If you do not want your personal car or bank account to be potentially at risk in lawsuits against your business, for example, an LLC could be a better option.

That said, not every sole proprietorship can elect to become an LLC. In some states, certain licensed professionalssuch as attorneysare prohibited from forming LLCs and instead must organize their businesses as different types of entities. In other states, although those professionals may form an LLC, their personal property may not be protected from malpractice claims.

Also Check: How Much Does A Solar System Cost

Why You Need To Select A Registered Agent When Converting A Sole Proprietorship To An Llc In California Or Another State

Next, you need to select a registered agent if you wish to convert a sole proprietorship to an LLC in California or elsewhere. Doing so will help you receive important legal notices and tax paperwork while you form your LLC and after its creation.

A registered agent, also known as an agent for service of process, receives and conveys all the documents related to your LLC, including any communications mailed by the Secretary of States office.

You should choose a registered agent other than yourself to ensure that any time-sensitive materials are received and handled. The registered agent you choose should possess a physical address in the state the LLC is formed, and not a PO box.

Apply For Business Licenses And Permits

Dont forget about any of the licenses and permits that are required to legally run your business such as a professional license, resellers permit, or health department permit. Some states require that you reapply for a license when your business structure changes. You can contact your local office or a site like BusinessLicenses.com to find out about your specific licensing requirements.

Thats it. With those six basic steps, youve now formalized your business activities into a formal business structure.

If youre wondering what comes nextyou can opt to be taxed as an individual and still fill out the Schedule C and Schedule SE like you did as a sole proprietor. Or check with your CPA/tax advisor to see if theres a better tax strategy, since you now have more options as an LLC than you did as a sole prop.

Lastly, youll need to maintain your LLC, or you could end up losing your personal liability protection. Check to see what your states maintenance requirements are, as youll typically be required to file an Annual Report and pay a nominal fee.

Best of luck on your business venture, and congratulations on taking this important step toward creating a solid foundation for your new business.

You May Like: How To Install Solar Attic Fan

I Changed My Name Do I Need A New Ein

Most businesses have an EIN for financial and tax purposes. When you decide to make changes to your business, you might wonder what additional filing and paperwork you may need to do. If you change your name and business enity structure, you will need to file for a new EIN. File for a new EIN here. If you purchase a business and are keeping the same name and entity structure, but are a new business owner, you will need a new EIN. If you are changing the business name but keeping the same business structure and owner, you may not need to obtain a new EIN. However, you might need to file a document for changing the business name with the IRS and/or state and local government.

However, if you change your entity classification, you will need a new EIN.

Changing Your Name

When you change your business name, you generally do not have to file for a new EIN. Instead, you submit an EIN name change. The process you take depends on your entity type. Sole proprietorships need to send a signed notification to the IRS. An authorized representative or the owner of the business must sign the document.

When You Need a New EIN

In some cases, you might be making additional changes to your business. If you change addresses, you do not have to apply for an EIN. There are other circumstances where you also do not need to apply for a new number. However, you must obtain a new EIN when you:

- Have a new charter as a corporation

- Are a sole proprietor subject to bankruptcy proceedings

What Is A Business Ein Number

As a business owner, you have likely already applied for an Employer Identification Number, or EIN for short. This federally issued tax ID is used to track the tax obligations of legal entities , and, depending on the type of business you establish, you may have been required to get a business EIN number.

As your business grows, you may want to take advantage of different tax benefits, and to do this you can change the formation of your business. However, upon these changes, you may be required to obtain a new EIN.

Recommended Reading: Can A Sole Proprietor Have A Dba