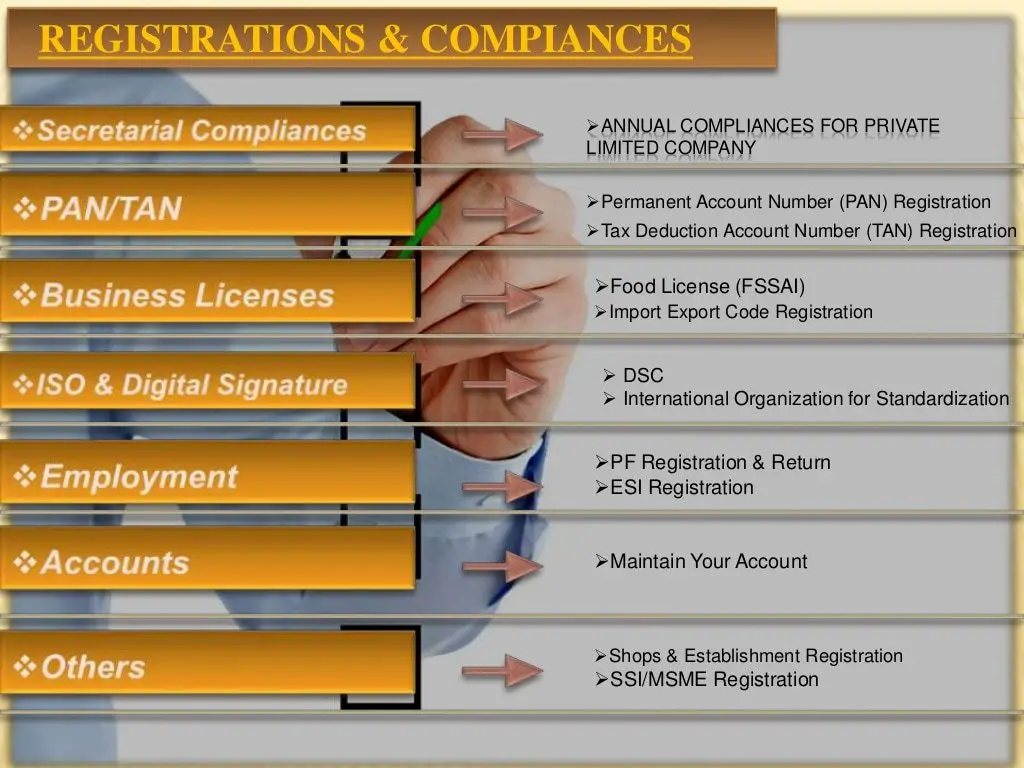

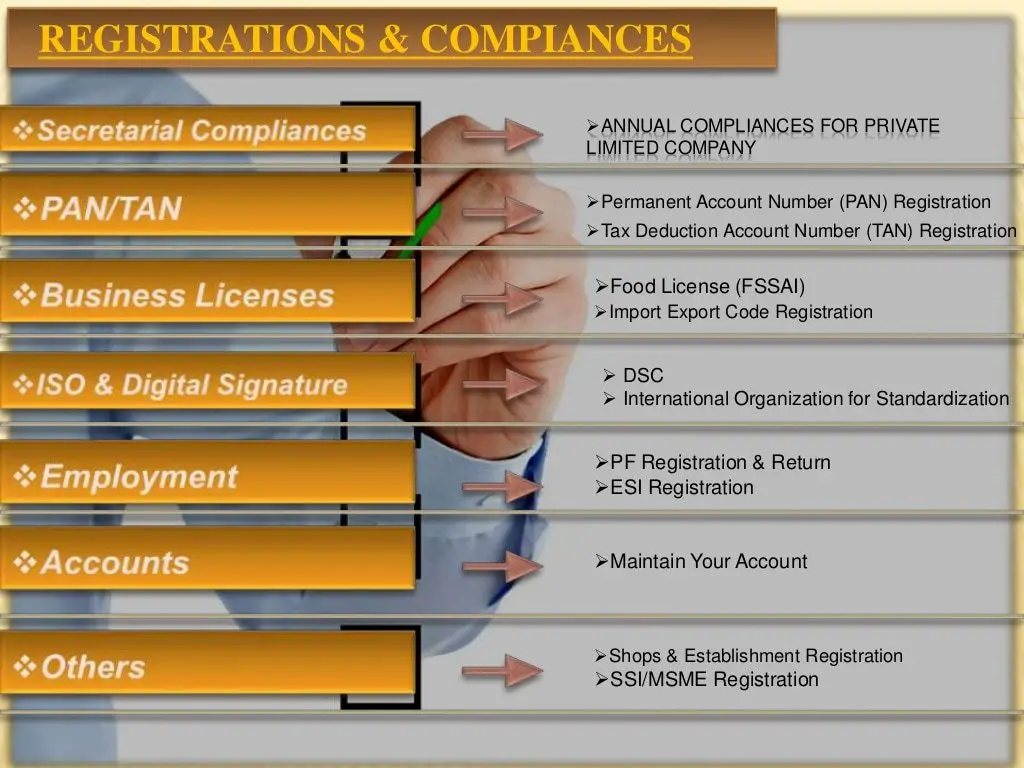

Registration And Tax Requirements

One of the first steps you should take as a new business is registering for various taxes your business must pay the state. Typically, most businesses must pay business tax and sales tax. All business types, except sole-proprietors and general partnerships, must also register for the payment of franchise and excise taxes. . Some businesses are subject to other state taxes as well. Visit the Taxes section of our website to see a comprehensive listing of various state taxes. Each tax page describes who is obligated to pay that tax.

What Is The Difference Between A Sole Proprietor And A Self

Sole proprietor and self-employed mean the same thing essentially. A sole proprietor is the only the sole person who runs his or her business. A sole proprietor is not the same as an independent contractor. An independent contractor typically works for another organization or multiple organizations, such as a creative professional a graphic artist or writer.

An independent contractor will not have taxes held from any payments. Sole proprietors are responsible for paying taxes associated with their businesses.

Types Of Business Names

There are 4 types of business names registered under the Partnership Act:

- trade name

A trade name is used when:

- an individual does business under a name other than their own personal name

- a corporation does business under a name other than its legal name

A trade name is also known as a sole proprietorship.

Read Also: How Much Does It Cost For One Solar Panel

Sole Proprietorship Vs Llc: Formation

Understanding the formation process of both business structures is essential to comprehend the difference between LLC vs. Sole Proprietorship.

No precise method exists to create a sole proprietorship you may unknowingly operate one. Selling products and services without a partner is the default for a sole proprietor, regardless of whether your enterprise is located in a location where you must obtain business licenses, zoning permits, or both.

Sole proprietorships must apply for fictitious business names, DBA or doing business as certificates, and any company that operates under a trading name. Forming a sole proprietorship reasonably quickly and cheaply is possible since it requires the least amount of paperwork.

On the other hand, the procedure for forming an LLC is more involved than forming a Sole proprietorship, but it is still reasonably straightforward. Before you file, you must choose a suitable name for your company and be confident it is not used by anyone else. You must also select a registered agent. You may act as your single-member LLCs registered agent or one of your corporations partners if it is a multi-member LLC.

A business plan is essential in advancing this phase of forming an LLC. You must file Articles of Incorporation, draw up an operating contract, and pay a fee. You must obtain an EIN if you live in a state where it is required for tax purposes.

How Does The Owner Of A Sole Proprietorship Pay Themselves

As a sole proprietor, provided money is in the business checking account, you can take money out or pay yourself whenever you want. You simply write a check to yourself and at this time you dont have to pay tax on the money received. This isnt technically a salary or wages, but instead a draw. A draw is an amount of money you take out of the business.

The profits of the business will eventually be taxed, regardless of how much money is drawn from the business. If money is left in the businesss bank account and not paid to the owner, that money will still be taxed.

You May Like: How Expensive Is Solar Panel Installation

How To File The Taxes As A Sole Proprietor

As simple as it is to pay myself as a sole proprietor, similarly, filing taxes is also very easy for you. When you do a draw in the business bank account, you are not liable to pay the federal or state income tax or give money for social security and medicare taxes. The sole proprietor only needs to file a Form 1040 Schedule C tothe IRS once a year.

If you are a sole proprietor and want to calculate your deduction, then just add up the different business expenses for diverse categories you have done for your business. This can include advertising, car expenses or meals. The expenses can be a big list to add to the deductibles and hence, a sole proprietor must review what he has spent throughout the year by checking the IRS website to know what is considered deductibles.

The personal income tax return for a sole proprietor is easy as it is the remaining business profit once he has paid taxes and deducted the business expenses from the income.

Can I Start A Business Without Registering It

You are allowed to operate a sole proprietorship without registering, but you are required to register with your local government to collect and file state taxes. There is nothing wrong with running an unregistered business as long as your business is legal and meets all licensing and tax requirements.

Don’t Miss: How To Check Solar Panel Efficiency

Law Accounting And Search Firms

A business entity or not-for-profit corporation may hire a firmreferred to as an intermediaryto transact on its behalf.

Currently, intermediaries can transact via authorized service provider or by mail. At this point in time, they cannot transact directly in the Ontario Business Registry, however future system updates will address online access for intermediaries.

The following qualified intermediaries can continue to transact via and email:

- lawyers and paralegals governed by the Law Society of Ontario

- Chartered Professional Accountants governed by the Chartered Professional Accountants of Ontario

- law clerks filing under the direction and guidance of a lawyer governed by the Law Society of Ontario

- members of OAPSOR who regularly file with the ministry on behalf of corporations and other entities, law firms and accounting firms

If you use a trusted, qualified intermediary to transact on your behalf, you will need to share your company key. A company key is similar to the Personal Identification Number you use at the bank or to access other online accounts or services.

To request a company key, complete and submit the Company Key Request Form.

Is Your Company Information Up

It is the responsibility of the business or not-for-profit corporation to keep their information on the public record accurate and up-to-date. Find out more and update your information now.

Please note that all information filed on the Ontario Business Registry, such as registered office or other address information, will be placed on the public record and publicly available for searches under the business statutes. Administrative information such as contact information for the filing and the official email address is not shown on the public record.

You May Like: How Much Is The Average Solar Panel

Purchase A Website Domain Name

Once youve settled on a business name and have registered it with your state, its time to purchase your website domain name. Your domain name is what identifies your site. It looks something like this: www.example.com.

Its best to set your domain name as the same name of your business to avoid any confusion. If the domain name you want isnt available, come up with a variation that is still similar to your business name. Its alright if youre not ready to build your website just yet. You can still reserve your domain to ensure no other business takes it.

Get a free Yelp Page

Promote your business to local customers.

Payment Of Taxes On Business Income

A sole proprietor pays taxes by reporting income on a T1 income tax and benefit return.

If you are a sole proprietor, you or your authorized representative have to file a T1 return if you:

- have to pay tax for the year

- disposed of a capital property or had a taxable capital gain in the year

- have to make Canada Pension Plan/Quebec Pension Plan payments on self-employed earnings or pensionable earnings for the year

- want to access employment insurance special benefits for self-employed persons

- received a demand from us to file a return

You also need to file a return if you are claiming an income tax refund, a refundable tax credit, a GST/HST credit, or the Canada Child Benefit. You should also file a return if you are entitled to receive provincial tax credits.

The list above does not include every situation where you may have to file. If you are not sure whether you have to file, call 1-800-959-5525.

You May Like: Will Solar Panels Work On A Cloudy Day

Searching For The Availability Of Your Business Name

There isnt name protection available for your Sole Proprietorships business name however, it is essential to consider if you are comfortable with other business existing owners having and operating the same business name. If you do not wish to share the same business name with other businesses, you will want to investigate your chosen business names viability. You can do browser searches at no cost and know whether your business name has already been selected by other business owners who have a web presence.

It is important to mention that once you have registered your business name, as stated earlier, there is no name protection, so another business under the same name may be registered or incorporated at any point after you have registered.

An important secondary element to searching a business name is to allow professionals to search the NUANS name search database. This data bank maintains records of most businesses registered, incorporated and trademarked throughout each Province or Territory in Canada, whether they have a web presence or not. The search results are much more thorough than what you can search for yourself online, and there are multiple variations of your business name previewed. The NUANS database is compiled from government records in most jurisdictions where individuals have registered, incorporated or trademarked.

How To Complete A Domain Search?

Registering Your Sole Proprietorship And Domain

How To Register As A Sole Proprietor In Canada

The most common and most straightforward form of business is a sole proprietorship. Simplicity and convenience are favourable when starting a business, but the tax laws in Canada can make it a thorny issue sometimes. Here are some basic tips for navigating your way through the complicated bureaucracy if you’re starting a new business endeavour. By definition, a sole proprietorship is an unincorporated business that is owned by one individual and is the most uncomplicated form for a business structure. A sole proprietor is legally identical to their business. Legal obligations about registering a sole proprietorship or its name vary from region to region in Canada.

Also Check: How Many Watts In A Solar Panel

Youre Personally Liable For Debts And Lawsuits

Sole proprietors are personally liable for any incurred business debts and arent protected if a third party wants to take legal action against your business. As such, your personal assetslike your home, credit score, or personal savingsare on the line if someone decides to sue you or your business has to file for bankruptcy.

For instance, say you run a lawn care business and one of your employees accidentally damages a clients property. Your personal assets are at risk of seizure if the client decides to sue your company for damages.

Sole proprietorships can be a risky choice, especially if your company is in an industry where injury or property damage may occurand while insurance coverage can help protect you , its not foolproof.

When Are Payments Due

Taxes for self-employed individuals is based on the calendar tax year. As discussed earlier a new, first-year business can pay federal taxes at the end of the first year and then may have to pay taxes quarterly . Quarterly payments are due based on the 15th the month after a calendar quarter. For instance, the first quarter is January, February and March. Those taxes would be due on April 15th. The remaining quarters are due June 15, September 15 and January 15.

Recommended Reading: How To File As A Sole Proprietor

Why A Sole Proprietorship

It is the easiest business form. In my very specific case, it gave me several advantages as I am a technical person.

- I was able to write off all the IT-related expenses.

- Rent and some household expenses can be written off.

- No need to hire accountants to do the business tax return, it was really easy and I just needed to read to do it right.

However, there is also a catch here. I was the business. This means that the income hits directly my personal tax return. Some government benefits, such as child support may be affected. Also, not my case, but if I was thinking of helping someone to come to Canada, as a sole proprietorship it was almost impossible .

Market Your Mushroom Farm Business

Even though building a successful mushroom farm is nearly impossible without being able to promote and sell mushroom produce, it is essential to develop a strong marketing strategy. Therefore, establishing an online presence is crucial. Create a website and set up a business page on social networks like Facebook. Post the latest mushroom products and events on your social media accounts regularly.

In addition, contact local retailers, distributors, local eateries, and supermarkets and offer your mushrooms. You can take help from online marketing tools and social media tools for small businesses that help to promote and grow your business.

Recommended Reading: How To Sell A Sole Proprietorship

How Do You Register As A Sole Trader

To register as a sole trader, you need to:

Theres no need to register with Companies House as a sole trader.

How Do I Register For Self Assessment

If youre a sole trader youll need to register for Self Assessment. Ensure you register by 5 October in your second tax year. How you register depends on your circumstances:

-

New sole trader whos not sent tax returns before

Let HMRC know you want to be a sole trader by registering as a new business. Youll register your business and also register for Self Assessment tax returns and Class 2 National Insurance at the same time.

-

New sole trader whos sent tax returns before

You may have previously sent Self Assessment tax returns as an individual, e.g. for income from rental property or investments. You now need to register as self-employed and for Class 2 National Insurance using form CWF1. You can keep your existing Self Assessment account but youll need your existing Unique Taxpayer Reference that will be on your previous tax returns and your online account or other documents. If you cant find it, call the Self Assessment helpline on 0300 200 3310 .

-

Former sole trader who wants to start up again

You need to re-register using form CWF1. As youll have registered when you were previously a sole trader, you can keep your existing Self Assessment account but youll need your existing Unique Taxpayer Reference . This will be on your previous tax returns and your online account or other documents. If you cant find it, call the Self Assessment helpline on 0300 200 3310 .

You May Like: How To Improve Solar Panels

Types Of Sole Proprietorships

A sole proprietor may operate as an independent contractor , a business owner, or a franchisee.

- Independent Contractor: An independent contractor is a self-employed sole proprietor who takes on projects on a contract basis with clients. They have the freedom to choose which clients they take on, but they are often subject to the processes and methods that the client requires.

- Business Owner: Business owners can also be self-employed sole proprietors, but unlike the contractor, there is much more autonomy in how the work is completed for clients, and the operation itself may even be more complex with employees and/or intellectual property.

- Franchisee: Franchise owners may also be sole proprietors. The franchisee benefits from the guidance, brand, business model, etc. in exchange for royalties paid to the franchisor.

How To Start A Sole Proprietorship

This article was co-authored by Madison Boehm. Madison Boehm is a Business Advisor and the Co-Founder of Jaxson Maximus, a mens salon and custom clothiers based in southern Florida. She specializes in business development, operations, and finance. Additionally, she has experience in the salon, clothing, and retail sectors. Madison holds a BBA in Entrepreneurship and Marketing from The University of Houston.There are 13 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status. This article has been viewed 76,274 times.

A sole proprietorship is the easiest type of business to set up. Unlike corporations or limited liability companies, you dont have to file with your state. Instead, you should pick a business name and register it, if necessary. Also obtain all necessary permits and licenses in order to operate. Before operating your business, you should open a bank account and draft a business plan.

Also Check: How Much Solar Power Do I Need