Determining Your Business Structure Is A First Step In Launching A Startupheres How To Decide Whats Best For You

This Small Business Saturday, were helping small business owners navigate what kind of businessto launch, how to write a business plan, and how to set up a workspace that improves productivity.

Despite the hardships COVID-19 has brought to the economy, many people have chosen this time to become entrepreneurs. Entrepreneurship brings new ideas, greater competition, and increased job creation. However, when it comes to starting your own business, there are countless considerations that will determine your companys success, including the way its structured.

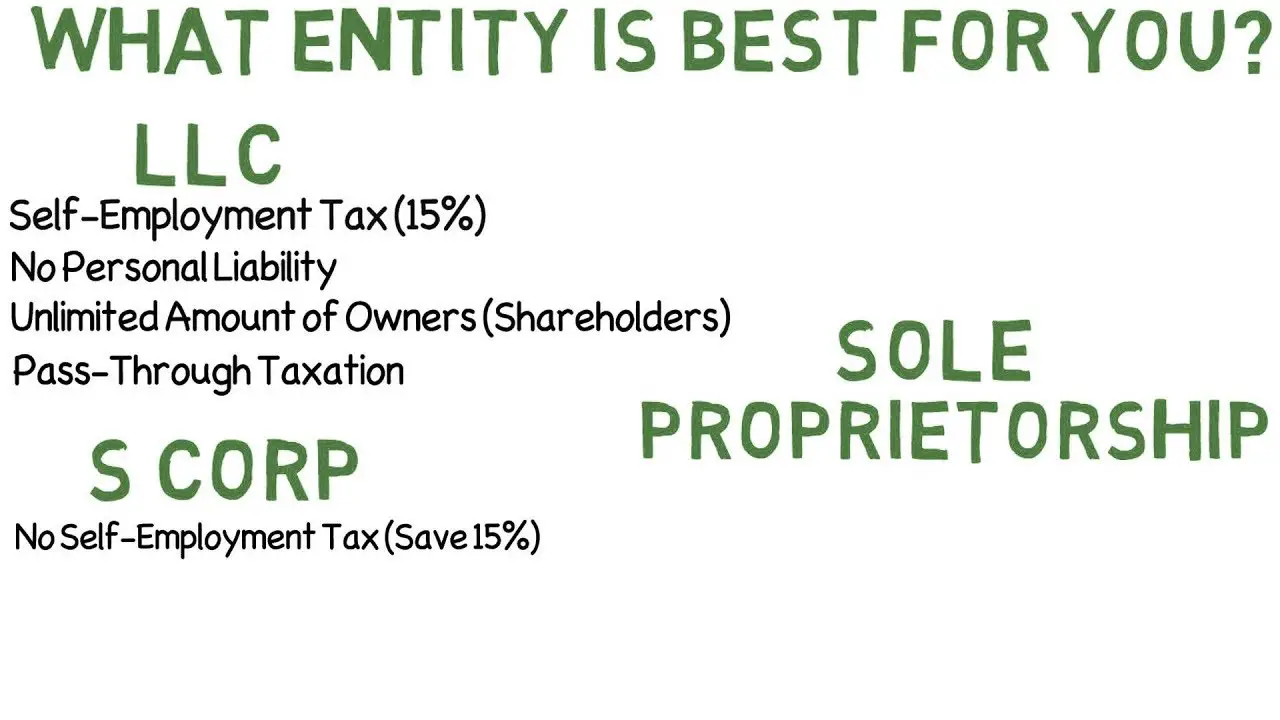

Determining your business structure, or the way your organization will be legally recognized, is a first step in launching a business. Sole proprietorships and limited liability companies are two business structures typically used by entrepreneurs as a starting point, and this article explores their differences, benefits, and drawbacks.

Costs To Renew And Maintain

A sole proprietorship requires the least amount of paperwork prior to launch. After launch, a sole proprietor only needs to keep up with federal, state, and local taxes. In addition, a sole proprietor might need to renew relevant business licenses and permits.

LLCs have more compliance responsibilities. After filing initial Articles of Organization, an LLC must file an annual report in many states. LLCs with multiple members have even more responsibilities, such as drafting an Operating Agreement, issuing membership units, recording transfers of ownership, and holding member meetings.

While none of these steps are legally required, theyre all highly advisable to help LLCs preserve their members liability protection. Since an LLC is a registered business entity, dissolving an LLC takes additional paperwork. An LLC with a corporate tax status also is eligible for more tax deductions and credits.

How Do I Form An Llc

You create an LLC by filing paperwork with your state and paying a filing fee. Visit the website for your states secretary of state or other agency in charge of business filings for information, forms, and instructions specific to your state. You can also form an LLC with the assistance of an accountant, lawyer or online business formation company.

Recommended Reading: How To Find Solo Travellers

Securing Financing And Credit

When comparing an LLC vs. sole proprietorship, it’s easy to think of tax deductions and liabilities. What many business owners may not consider, though, is how the decision of a business entity impacts their ability to secure financing and build business credit.

Just as an individual you build personal credit, your business also has a .

As a sole proprietor, your business credit score and personal credit score will be harder to differentiate, since your accounts are considered the same. As an LLC business owner, however, you may find it easier to build business credit.

Having good business credit is an important consideration, as your score could contribute to your likelihood of getting financial assistance. For example, if you apply for a loan as a sole proprietor, a financial institution is likely to categorize your request as a personal loan rather than a business loan.

As an LLC, though, it will likely be an easier process to apply for financial assistance if you need it.

Limited Liability Company Versus A Sole Proprietorship

One of the key benefits of an LLC versus the sole proprietorship is that a members liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business. This liability, however, is dependent upon following the rules associated with an LLC. If you treat the LLC the way you would a sole proprietorship, you lose the liability protections.

For example, creditors can go after a sole proprietors home, car and other personal property to satisfy debts, while an LLC that is properly maintained can protect the owners personal assets.

- Difficult to obtain financing in the business name

- Harder to build business credit

Read Also: Are Solar Panels Worth It

Drawbacks Of Sole Proprietorships

A sole prop might not always be the best choice, depending on your business type and goals. Here are some disadvantages compared to LLCs:

- Personal liability. The owner is responsible for all debts or losses incurred by the business, including lawsuits.

- Difficulty raising capital. Banks and investors are generally less likely to provide financial support for sole proprietorships in comparison to LLCs because its a less formal business entity.

- Everything is on you. Without partners or investors, entrepreneurs are on their own when it comes to making business decisions in a sole prop. Owning and running your own business can be isolating at times.

What Is A Limited Liability Company For A Single Owner

One of the most common types of small businesses in the U.S. is a single-owner or single-member LLC. This is a business entity registered in the state of formation, which usually will be where the company does business.

The term single-member is used to recognize that the LLC has one owner, as opposed to an LLC in which there is more than one owner. A single-member LLC has all the same advantagesand disadvantagesof a multi-member limited liability company.

Each state has different requirements for forming an LLC.

Note that you can form your LLC in a different state than where you do business. Each state other than where you initially formed your LLC is a foreign state. You are required to foreign qualify in those states in order to do business there. This generally requires filing an application for authority with that states business entity filing office.

Advantages of a single-member LLC

There are many benefits to forming an LLC versus operating as a sole proprietorship. A single-member LLC is generally shielded from personal liability for debts associated with the business.Note: Single-member LLCs must be careful to avoid commingling business and personal assets. This could lead to what is called piercing the corporate veil and the loss of your limited liability.

However, you do have the option to be taxed differently.

Other benefits of forming a single-member LLC include the following:

Disadvantages of a single-member LLC

You May Like: Which Solar Company To Choose

Set Your Business Up For Success Regardless Of Business Structure

For first-time entrepreneurs, building a business will bring a host of considerations much different from those that come with full-time or part-time employment. As you grow your client base and hire employees, its helpful to have a support network of people whove been through similar experiences.

Coworking solutions like WeWork are ideal for this, offering a built-in community of collaborators and innovators at every office location. With a mix of entrepreneurs, startups, and established companies using WeWork, theres no shortage of expertise to call upon at times youre looking for guidance.

Growing a business can open new opportunities and lead to financial success and fulfillment. Yet to be successful, its important to choose a business structure that affords the appropriate balance of flexibility and protection. Sole proprietorships and LLCs are popular starting points for entrepreneurs, as they offer ownership, control, and protection if you need it.

For more tips on starting a business and growing a team, check out all our articles on Ideas by WeWork.

Caitlin Bishop is a writer for WeWorks Ideas by WeWork, based in New York City. Previously, she was a journalist and editor at Mamamia in Sydney, Australia, and a contributing reporter at Gotham Gazette.

Growing from a few to a few hundred employees takes strategy and the right space.

Is An Llc Always The Best Choice

Life is all about making choices and choosing to form an LLC can be a very important one. Asset protection consultants routinely market to business owners stating that an LLC is always a good idea, but I do not believe this to be true. Some entities are actually better suited for a sole proprietorship as the additional costs of an LLC do not provide any significant benefits over operating as a sole proprietor.

Also, understand that with the concept of an LLC providing liability protection against commercial acts of your business, a savvy attorney is going to try to find any loophole he can in your current setup to pierce the corporate veil and go after personal assets.

In addition, some courts may not look favorably upon sole member LLCs, and the question comes up in legal proceedings as to whose interests are you being protected against if technically, you are the only member of the LLC.

Recommended Reading: How Do I Get My Solar Rebate

How To Form An S Corporation

Sole Proprietor Vs Llc: Franchise Tax

A franchise tax is paying for the right to do business in the state. States have different requirements regarding the franchise tax. The best way to find out the requirements for your state is to talk to the local Small Business Administration. You can find local offices on sba.gov.

At the time of writing, the following states have a franchise tax: Alabama, Arkansas, California, Delaware, Georgia, Illinois, Louisiana, Mississippi, New York, North Carolina, Oklahoma, Tennessee, and Texas. In addition, Washington DC has a franchise tax.

Sole proprietors are not subject to this so they win this round.

Also Check: How To Size A Solar Pv System

What Is A Limited Liability Company

An LLC is a business entity formed and owned by one or more members. Unlike a sole proprietorship, whose owner is personally liable for any claims against the business, an LLC is a legal entity with its own income, assets, and liabilities. This is the main difference between sole proprietorships and LLCs.

Disadvantages Of A Sole Proprietorship

However, with a Sole Proprietorship, you also have the following drawbacks:

- Theres no liability protection against commercial debts, lawsuits and other obligations. This means you can be sued personally for commercial activities, putting your personal assets at risk.

- Outside of friends and family, its nearly impossible to secure equity financing for a Sole Proprietorship, as many investors choose not to invest in a Sole Proprietorship. This could limit the amount of funds available to grow, develop, and sustain your business.

- Its difficult to establish business credit to obtain debt financing for a Sole Proprietorship, as many financial institutions will categorize your request as a personal loan rather than a business loan, which brings all sorts of caps in terms of approval amount potential.

- You will have a lower amount of market credibility by not operating under a trade name. Now this could be easily resolved by creating a Doing Business As Name with your states department of revenue or the secretary of state, but this will require fees for establishment and ongoing fees to continue to use the DBA name.

Set Your Business Up for Success & Scalability

Make sure youre taking all the right steps to establish your business and build your business credit. Our course will guide you step by step so you can create a solid foundation and grow your business.

You May Like: How Much Does It Cost To Go Solar In Illinois

How Sole Proprietorships Work

A Sole Proprietorship, also called a sole trader or just a proprietorship, is an informal business structure with one owner. There is no distinction between the business and the owner, so the owner does not benefit from any liability protection like in an LLC.

Sole proprietorships are common for individual business owners, sub-contractors, and consultants. This business formation is best if the business has the following qualities:

- A low-risk business with a low chance of liability

- A low profit business with a low chance of financial loss

- A company with a small customer base

Whats The Difference Between A Sole Proprietor And An Llc

A sole proprietor is defined by the IRS as a person who owns an unincorporated business. Any person who does business but isnt registered as a corporation, partnership, or limited liability company is a sole proprietor by default.

A sole proprietor is personally liable for any debt accrued by the business, including lawsuits and other business obligations. If a sole proprietor owes money from a lawsuit judgment or any other debt and the business assets are not enough to cover it, creditors could go after personal assets.

A person who owns a business alone can also file for LLC status. If an LLC owes money that it cant pay, the owners personal assets are protected and creditors wont be able to reach them.

Read Also: What Tax Forms Do I File For A Sole Proprietorship

Bring On Investors Or Business Partners

If youre doing business as a sole proprietorship, by definition, your business cannot really grow youre in business for yourself, and mostly by yourself. Forming an LLC gives you the legal ability to expand your business by bringing on a business partner or bringing on investors who can buy a share of ownership in your business.

If you have already been doing business on an informal basis with other business partners while being a sole proprietor, forming an LLC is an even better idea: it gives you a formal business entity with a flexible management structure. You can run your LLC as a single-member LLC, or set it up as multi-member LLC. And you can change your LLCs structure and Operating Agreement over time as your business evolves.

The bottom line is that doing business as a sole proprietorship can be too risky during uncertain economic times. By forming an LLC, you can benefit from various legal protections and financial advantages. Forming an LLC makes your business official, real and legitimate in the eyes of the law. It lets your business participate in the financial system with a separate business bank account and business credit. Doing business as an LLC helps protect your personal assets from the worst-case scenarios while opening up additional opportunities for your business to grow.

Ben Gran

What Are The Advantages Of An Llc Over A Sole Proprietorship

One of the key benefits of an LLC versus the sole proprietorship is that a members liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business.Jul 21, 2021

Also Check: Is There An Income Limit For Solar Tax Credit

Compliance Differences Between A Proprietorship And Llc

A sole proprietorship is the simplest form of organization. Formalities are few, because the owner and business are the same entity. Some people are already proprietors without knowing: For example, a graphic designer or writer runs a profitable proprietorship.

Legalizing a sole-proprietor business is not an intricate process. The only legal requirements youd have to fulfill are acquiring permits and licenses for your line of business and registering your business name . The exact requirements vary by location, but theyre never too extensive.

This ease of compliance is one of the greatest pro-proprietorship arguments in the single-member LLC vs. sole proprietorship debate.

After all, limited liability protection comes with a list of compliance requirements, which is why many potential business owners turn to LLC services for help. The process is less convoluted for single-member LLCs than multiple-member LLCs, but compliance responsibilities still include special levies not included in the sole proprietor tax list. LLCs also renew their permits and licenses annually, so the legal cost of having all the required documents is higher compared to a proprietorship.

LLCs are also encouraged to keep careful records, such as reports, minutes, and recordings from meetings. Most of this information is evidence for business operations should the company ever come under review. They can absolve the organization and its owners if they are ever implicated in illegal activities.

Owner Control In A Sole Proprietorship And Llc

A sole proprietorships owner has absolute control over the business. They decide how to utilize the company’s resources, determine which business ideas to implement, and direct business operations.

They do not need to consult another entity for any business trajectory. If the owner dies, the organization – assets and liabilities – becomes part of the deceaseds estate and therefore subject to inheritance when there is a written will.

In contrast, when an LLC has multiple business owners, they share management responsibilities according to the stipulations in the operating agreement signed at the LLCs creation. The leadership is collectively responsible for all operational decisions, although they can delegate the decision-making to subordinates.

For single-member LLCs, the business owner has total control over the company, although they can hire experts to run it on their behalf. The main difference between the two business types here is that the assets of a single-owner LLC are separate from the owners private assets, unlike in a sole proprietorship.

Read Also: How Much Power Does A 7kw Solar System Produce