Tax Tips For Sole Proprietors

OVERVIEW

As a sole proprietor, you are in charge of your own business. You’ll face additional taxes and reporting requirements, but you may also be eligible for certain business tax deductions.

As a sole proprietor, you are in charge of your own business. As far as the tax code is concerned, you and your business are a single entity. While this entails certain freedoms, it also creates added responsibilities. You’ll face additional taxes and reporting requirements, but you may also be eligible for certain business tax deductions.

What Is Sole Proprietorship In Canada

A sole proprietorship is an unincorporated business that is owned and operated by a single individual in Canada.

The owner of a sole proprietorship receives all the profits and claims all losses from a business.Sole proprietorship does not have separate legal status from the business. If you are a sole proprietor, you also assume all the risks of the business, personal property and your assets.

If you are a sole proprietor, you can register a business name or operate your business under your own name.

Canadian Sole Proprietorship And Self

- Agriculture

- Canadian Sole Proprietorship and Self-Employed Tax Filing Guide

In this article we will discuss self employment business income tax reporting and Canadian personal income tax return requirements for sole proprietor individuals in Canada. We have only discussed the business income reporting for sole proprietor business owners. Incorporated business owners will need to report their business income on a T2 corporate income tax return.

Read Also: Should I Set Up A Sole Proprietorship Or Llc

Irs Business Forms: Operating A Business

Although the bulk of the IRS small-business forms that youll need to complete will specifically relate to business and personal taxes, there are some other IRS forms that you may need to file that more generally apply to your business operations. Here are some of the most common forms:

-

Form 2553: Similar to Form 8832, Form 2253 is used by a corporation or other eligible entity to elect to be treated as an S corporation for taxes.

-

Form 2848: You use this form to authorize an individual, like your certified public accountant or business lawyer, to represent you before the IRS.

-

Form 4797: This form is used most generally to report the sale or exchange of business property. This form is also used to report other dispositions of assets and gains or losses from certain property dispositions.

-

Form 8822-B: Form 8822-B is used to notify the IRS if youve changed your business mailing address, business location or responsible party.

Foreign Nationals: Individual Taxpayer Identification Number

For those who do not have a Social Security Number such as nonresidents and resident aliens they may need to apply for an individual taxpayer identification number , which is also nine digits. To apply, youll need to file Form W-7: IRS Application for Individual Taxpayer Identification Number. You will be asked to provide proof of your legal resident or visitor status and will have to file it through an Acceptance Agent authorized by the IRS.

Read Also: What Solid Food To Introduce To Baby First

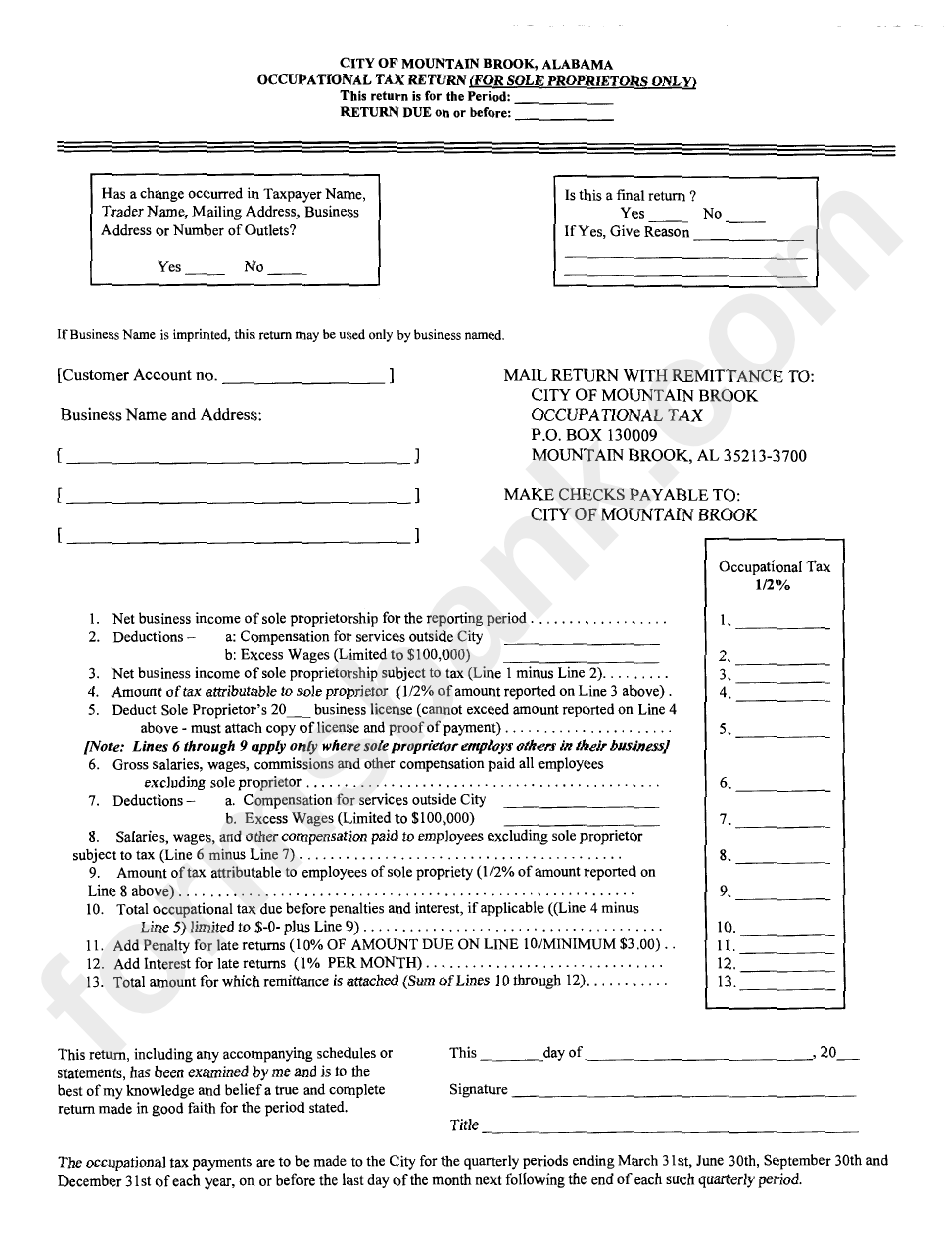

When Are Payments Due

Taxes for self-employed individuals is based on the calendar tax year. As discussed earlier a new, first-year business can pay federal taxes at the end of the first year and then may have to pay taxes quarterly . Quarterly payments are due based on the 15th the month after a calendar quarter. For instance, the first quarter is January, February and March. Those taxes would be due on April 15th. The remaining quarters are due June 15, September 15 and January 15.

Dont Miss: How Much Power Can I Get From Solar Panels

Tax Advantages Of A Sole Proprietorship

A sole proprietorship is the simplest and most common structure chosen when starting a business, and it does come with a fair share of tax advantages. As a sole proprietor, you are able to deduct the cost of health insurance for you, your spouse and any dependents. This is a large deduction from taxes, and is often looked at as one of the big benefits of being a sole proprietor. Other business expenses can be deducted as well, although sole proprietors must be careful to keep detailed documentation to prove that the costs deducted were solely for business purposes.

Many of the tax advantages are in regards to the paperwork: in a sole proprietorship, there are much simpler and straightforward tax requirements and individuals are not required to file for an EIN, employer identification number, with the IRS. Sole proprietors are taxed as a pass-through entity, which means all business gains and losses are reported on the ownerâs personal tax return, which prevents the need for complicated business filings along with unique personal filings. An added bonus is that some sole proprietors can take advantage of the 20% deduction available through the Tax Cuts and Jobs Act of 2017, which allows business owners to deduct 20% of a businessâ income from their taxes.

Recommended Reading: Where Can I Buy Solar Batteries

Which Is Better Llc Or Sole Proprietorship

An LLC is better.

This is because there are no disadvantages to an LLC, however, there are disadvantages to a Sole Proprietorship.

Most importantly, with a Sole Proprietorship your personal assets are not protected if your business is sued.

However, with an LLC, your personal assets are protected if your business is sued.

And there are no tax advantages or disadvantages to either structure. Meaning, you can deduct the same business expenses and the taxes owed will be the same. This is because the IRS treats Single-Member LLCs and Sole Proprietorships the exact same way.

Then why would someone operate as a Sole Proprietorship?

- Some people arent aware of LLCs.

- Some people dont realize how easy it is to form an LLC.

- Some people dont have the money to form an LLC right away.

Some states have expensive LLC fees , and some people dont want to spend the money to form an LLC right away. If you dont have a lot of money, you can start your business as a Sole Proprietorship, and then transition to an LLC when youre ready.

However, LLC fees can be deducted on your taxes. And for most people, the liability protection is worth the cost of forming the LLC.

In summary, a Single-Member LLC and a Sole Proprietorship are taxed the same way. However, LLCs offer additional legal protection that Sole Proprietorships lack.

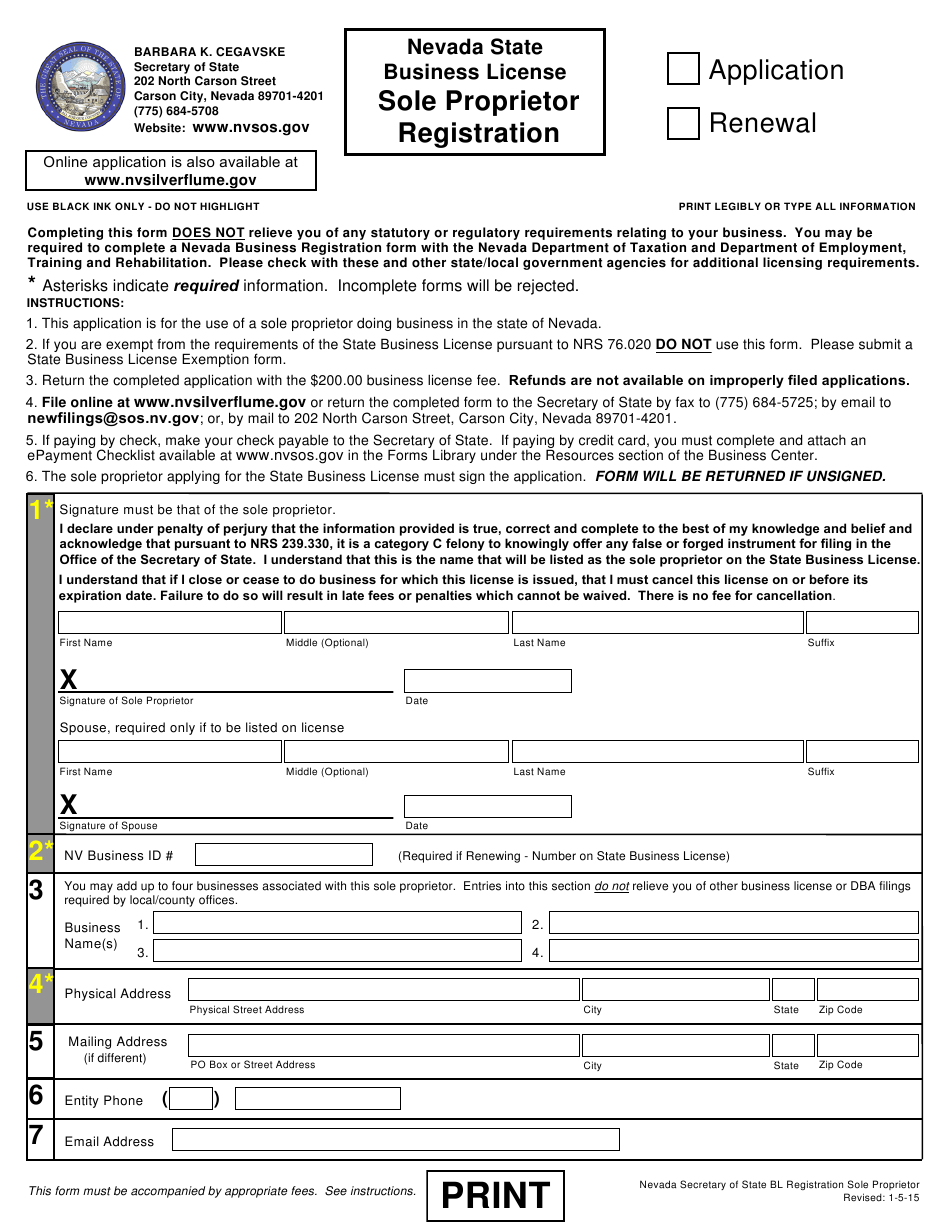

Apply For A Sole Proprietorship Tax Id Number Online

As a sole proprietor, the fastest way to apply for a Tax ID Number is online. Through an online application, a Tax ID Service will be able to collect your business and personal information, and then process it for you. You should be able to get a Tax ID Number within an hour.

To apply for a sole proprietorship tax ID online, have the following information ready:

- Your basic business information, including the industry you work in, and your reason for getting an EIN number now.

- Your personal information, including your full legal name, your SSN, and your ITIN.

Getting an EIN Number online is as simple as filling out the relevant documentation. You can also acquire a Tax ID Number through mail or fax.

You May Like: How Much Electricity Does A 10kw Solar System Produce

Irs Business Forms: A Comprehensive List

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

As the owner of a small business, your tax obligations are more involved than those of individual employees in no small part because youre also responsible for completing a variety of IRS business forms. To help you navigate this complex territory, weve compiled a comprehensive list of IRS business forms and a brief explanation of each one.

» MORE: NerdWallet’s best small-business apps

Incorporating Your Business May Cut Your Tax Bill

Unlike a sole proprietorship, a regular corporation is considered a separate entity from its owners for income tax purposes. Owners of C corporations don’t pay tax on the corporation’s earnings unless they actually receive the money as compensation for services or as dividends. The corporation itself pays taxes on all profits left in the business.

The Tax Cuts and Jobs Act dramatically changed the corporate tax rate to a single flat tax of 21%. This replaced tax rates ranging from 15% to 35% that corporations paid under prior law. The 21% rate is lower than individual rates at certain income levels. The top 37% individual rate applies to income over $600,000 for marrieds and $500,000 for singles. However, corporations do not benefit from the up to 20% pass-through tax deduction established by the Tax Cuts and Jobs Act, which can cut the effective tax rate for sole proprietors by 20%.

Corporate taxation is definitely more complicated than the pass-through taxation of a sole proprietorship, and the savings — probably a few thousand dollars — may not be worth the hassle of forming a corporation and filing a corporate tax return. To learn more about how incorporating can reduce your tax bill, see How Corporations are Taxed.

Also Check: How Many Panels Needed For Solar Home

Employer’s Share Of Social Security Medicare Income Tax Withholding

Employers can elect to file Form 941 instead of 944 if they notify the Internal Revenue Service of this choice. The IRS will notify the employer if they should file Form 944 instead.

File IRS Form 941 each quarter if you are an employer for wages and tips paid, federal tax paid, and both employer and employee social security and Medicare paid.

Learn How To Lower Your Tax Liabilities

Now that you understand your tax obligations as a sole proprietor, you probably could use some tips on minimizing your tax liability. The best way to reduce your tax bill is by maximizing any small business tax deductions for which you qualify, such as:

When filing taxes for the 2018 fiscal year, sole proprietors may be able to take advantage of a new 20% pass-through deduction on their business income. The deduction is tiered by income and personal filing status and industry classification. As this is a new deduction with new rules, many professional organizations are asking for further clarification on the details. In other words, you’ll definitely want to read up on this one and get help from a tax professional before claiming this deduction.

Read Also: Why Solar Is Not Worth It

Why Register A Sole Proprietorship Or Partnership

You have decided to set up a business on your own or with partners to generate the following sources of business income:

The easiest way to start your business is to set up a sole proprietorship or a partnership . Registering your business is important for the following reasons:

| 1. | Set up a business profile which customers can access via the Companies Commission of Malaysia website |

| 2. |

| 30 June | Within 7 months after financial year end |

If you own a registered company and are interested to learn in detail about corporate tax, please to access an earlier article we have published on corporate tax.

What if you do not have a registered business, but you do freelancing to generate multiple side income? What happens to the income you generate from being a part-time Grab driver? You might think to yourself This income has nothing to do with my employment or a business, so do I still need to pay tax? The answer is yes, and we have also discussed about it in this article.

Irs Business Forms For Corporations

For corporations, the specific IRS small-business forms that youll need to complete for tax purposes will ultimately depend on whether youre an S corporation or C corporation.

If youre a C corporation, your business is legally separated from you, and therefore, youll pay income tax for your business using Form 1120. Form 1120 is an annual report of income, gains, losses, deductions and credits that determines the income tax liability of a corporation.

As a shareholder of your corporation, youre taxed on your personal tax return, Form 1040, when profits are distributed as dividends. If youre a shareholder that participates in the businesss operations, youre considered an employee. Only the salary your receive as an employee, then, is subject to self-employment taxes.

For an S corporation, on the other hand, youll fill out:

Additionally, if youre an S corporation shareholder, you may be responsible for Form 1040 Schedule E as well as Form 1040-ES as part of your personal tax return.

Finally, for both types of corporations, you may be responsible for Form 1120-W. Form 1120-W calculates the estimated tax that corporations need to pay on a quarterly basis. Estimated taxes can apply to both C corps and S corps and their 1120 tax forms depending on the specific circumstances.

Also Check: How Many Solar Panels Would I Need

Sole Proprietorship Ein Requirements

The IRS provides a simple questionnaire on its website to help sole proprietors determine if they need to apply for an EIN. Businesses who have employees must file for an EIN. If a business withholds taxes on income paid to non-resident aliens for anything other than wages, it must also file for an EIN. Other conditions that require filing for an EIN include having a retirement plan and/or filing tax returns for excise, tobacco, alcohol or firearms.

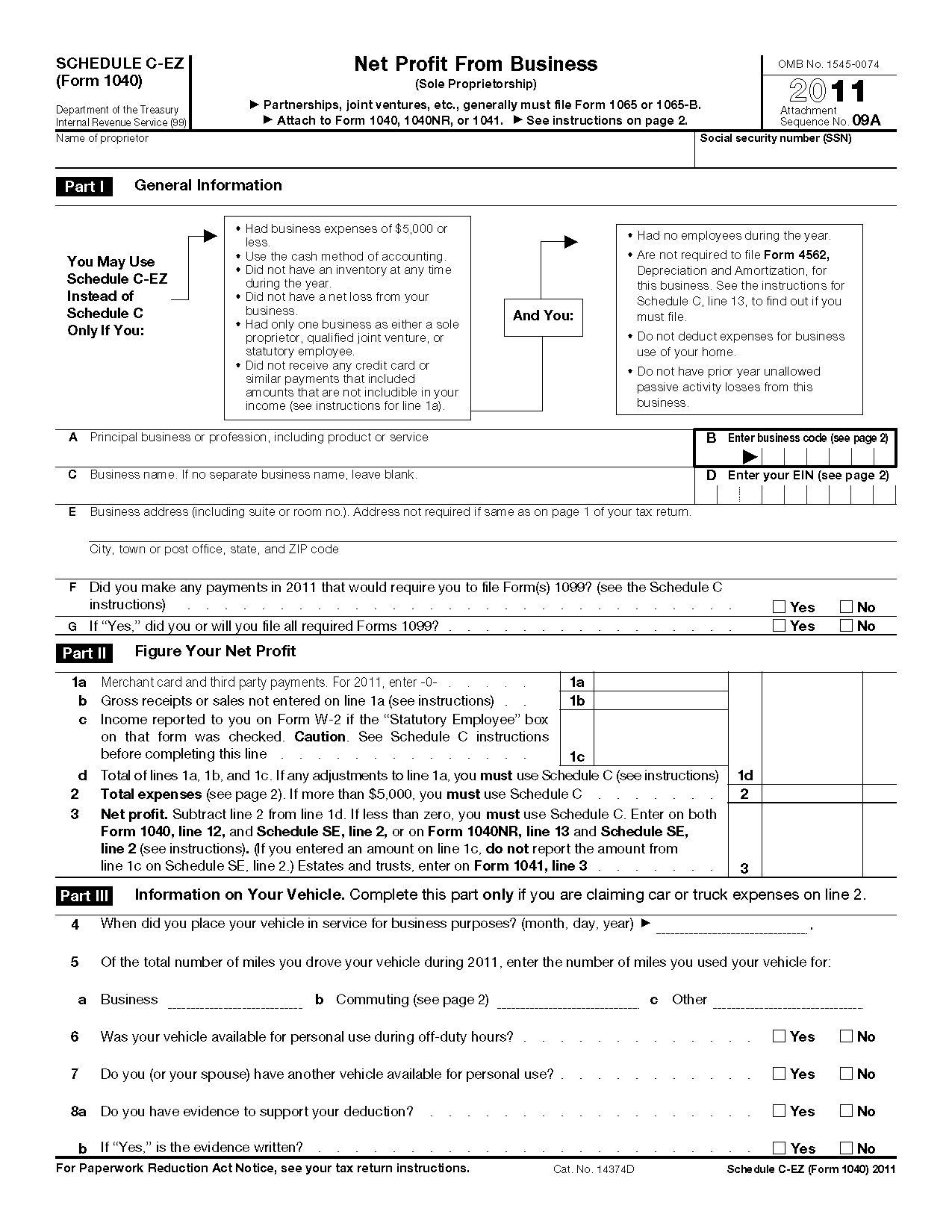

How To File Your Sole Proprietorship Tax Returns

Keeping in mind everything weve explored thus far, lets dive into the details regarding the different forms youll need to file to fulfill your obligations for sole proprietorship taxes. At this point, its important to note that although weve been first and foremost discussing your businesss income tax liability, you may be responsible for additional taxesâsuch as payroll, property, sales, and excise taxes. In this regard, the IRS provides a reference list of taxes that sole proprietorships may be liable for, as well as the respective forms you would need to complete for each tax.

Read Also: What Are Tesla Solar Panels Made Of

What Tax Forms Do I File For A Single

Typically, business income from a Single-Member LLC is reported on a Schedule C. Schedule C is part of the owners personal tax return . The owners return may also need to include these forms:

Note: Your tax return may require additional Schedules and Forms. It depends on what type of business you have and how you make money.

We recommend hiring an accountant for help with your taxes.

What Do You Need To File As A Sole Proprietor

When you are self-employed, you can choose a few different ways to structure your business and file your taxes. While some use a limited liability company or a corporation, others use a simpler method and file as a sole proprietor. When you file as a sole proprietor, you essentially file taxes on your business and personal items together.

You May Like: Does A Sole Proprietor Need A Federal Tax Id Number

Sole Proprietors Pay Taxes On Business Income On Their Personal Tax Returns

Updated By Diana Fitzpatrick, J.D.

As a sole proprietor you must report all business income or losses on your personal income tax return the business itself is not taxed separately.

Here’s a brief overview of how to file and pay taxes as a sole proprietor — and an explanation of when incorporating your business can save you tax dollars.

What Is A Sole Proprietor Tax

If you are a sole proprietor and do not withhold taxes from your check, you are obligated to pay income taxes on the money.

It’s very similar to Social Security taxes and Medicare deducted from employee paychecks. In the standard employee-employer relationship, the Social Security tax is split. However, when you are self-employed, you’re left to foot the bill yourself.

Before determining whether you should pay self-employment tax, you should figure out your net loss or net profit from your business. Begin by subtracting all business expenses from the income. If you have a net profit, it should be transferred to the income section on the 1040 form. Likewise, net losses should be claimed on the form as well.

These estimated taxes are due every quarter and are based on your business’s net income, dividends, interest, alimony, profits from investment sales, prizes, and awards. Simply put, you must pay taxes on any income you haven’t paid taxes on.

One great rule of thumb is if you expect to owe at least $1,000 in taxes, it’s best to file quarterly taxes.

You May Like: How Much Does A Solar Sales Rep Make

Tax Disadvantages Of A Sole Proprietorship

As a sole proprietor, you are both an employer and the employee. As such, it is necessary to pay both employee and employer taxes each year. As an employee, typically you pay for only half of Social Security and Medicare portions of your taxes and the employer pays for the other half. But self-employed sole proprietors must pay both portions of these taxes.

Since the line between necessary expenses for a business and general living expenses can blur easily when one is self-employed, the IRS tends to take extreme care when reviewing sole proprietor tax returns. This scrutiny can cause issues if sole proprietors have included any personal expenses as a tax-deduction, or have deducted business expenses without keeping proper documentation that the cost was solely for a business purpose. The need to keep detailed documentation can be seen as a disadvantage for business owners, and the possibility of an audit can make any sole proprietor wary. Many owners of sole proprietorships recommend opening up a bank account that is dedicated solely to the business: using the expenses here to determine costs for the business as opposed to personal costs, as well as keeping receipts for any and all business expenses, will help keep documentation clear and concise, should the time come when this documentation is needed.