Is Sole Proprietorship Still The Best Option For My Business

If your sole proprietorship is large enough or successful enough to hire employees, then you could be in the position to consider converting your sole proprietorship into an LLC. Forming an LLC is the next step in growing a business.

While being a sole proprietor can be an easy option to run a business with very low profit and low risk, you have zero liability protection.

There are many benefits to holding your business in an LLC, but the most impactful is liability protection. An LLC separates the business owner’s personal assets from the business. This means your personal assets aren’t in jeopardy in the event that the business is sued or can’t pay a debt.

Learn more about getting an EIN as a foreign person.

Why Do I Need A Tax Id Number For My Sole Proprietorship

A Tax ID Number is used to pay federal taxes and to hire employees, thats why its also called an Employer Identification Number. Yet many sole proprietors file as a Schedule C company, and they use their social security number rather than a dedicated tax ID. So why should a sole proprietorship get an EIN?

Well, a sole proprietorship still needs an EIN Number to:

- Hire employees. While 1099 contractors can be hired by an individual , hiring actual employees requires that you fill out W9 forms and submit W2 forms. These require that you have an EIN or Tax ID Number.

- Start a 401 and other retirement accounts. Many retirement accounts are only for businesses and business owners, including solo 401s. You cant acquire one of these accounts without an EIN.

- Incorporation of your business. If, in the future, you want to start an LLC, you will need to get an EIN number. Many businesses start as sole proprietorships but eventually incorporate for further protections.

An EIN Number is fast and affordable to get, so theres no reason not to get one, especially if you might need one in the future.

Ultimately, EIN numbers make it easier for even a sole proprietorship to separate business and personal transactions and documents. An EIN Number can be acquired through an online application, with the help of a Tax ID Service.

Sole Proprietors Arent Employees

A sole proprietorship doesnt pay payroll taxes on a sole proprietors income or withhold income tax. Because youre working as an independent contractor, your clients dont withhold taxes from your compensation.

Instead, as a sole proprietor, you pay self-employment taxes. Self-employment tax goes towards your Social Security and Medicare and is 15.3% of your net self-employment income. Youll also pay income taxes on your earnings. These taxes must be paid four times a year in the form of estimated taxes.

Anyone that pays you $600 or more within a year must file Form 1099-MISC to report the payment to the IRS.

Recommended Reading: How Much Does One Solar Panel Cost

Payment Of Taxes On Business Income

A sole proprietor pays taxes by reporting income on a T1 income tax and benefit return.

If you are a sole proprietor, you or your authorized representative have to file a T1 return if you:

- have to pay tax for the year

- disposed of a capital property or had a taxable capital gain in the year

- have to make Canada Pension Plan/Quebec Pension Plan payments on self-employed earnings or pensionable earnings for the year

- want to access employment insurance special benefits for self-employed persons

- received a demand from us to file a return

You also need to file a return if you are claiming an income tax refund, a refundable tax credit, a GST/HST credit, or the Canada Child Benefit. You should also file a return if you are entitled to receive provincial tax credits.

The list above does not include every situation where you may have to file. If you are not sure whether you have to file, call 1-800-959-5525.

If I Dont Need An Ein Why Should I Get One

Even if your business, organization or entity is not required to obtain an EIN, it is highly recommended that you obtain one when starting or forming your business/organization for many reasons:

- Use your EIN instead of your SSN on business applications and licenses to protect your personal information

- Many state and local permits require that you have an EIN

- An EIN is required to open a business bank account

- EINs help to establish business credit history

- Minimize delays when you decide to hire employees

Recommended Reading: How Much Power Does Tesla Solar Roof Generate

How Sole Proprietors Are Taxed

Taxes are simple when youre a sole proprietor in California because you and your business are one and the same for tax purposes. You dont need to pay taxes or file tax returns separately for your California sole proprietorship. California taxes you, the owner, on the income you earn from your business, instead.

Instead, you report the income that you earn, or the losses that you incur, on your personal tax return .

If your business earns a profit, youll add that money to any other income that you have. Other income can be interest income or your spouses income if youre married and file jointly. Youll get your total income that will be taxed at your personal tax rate.

If you incur a loss, you can use it to offset income from other sources.

To show whether you have a profit or loss from your sole proprietorship, file IRS Schedule C, Profit or Loss from Business, with your tax return. On the form, list all of your business income and your deductible expenses.

Just remember that, if you have more than one sole proprietor business, you must file a separate Schedule C for each.

Which Tax Forms Must Independent Contractors Fill Out

When you hire an independent contractor, you may need to give them a Form W-9 from the IRS and other forms, based on how much you pay them. You will need the information on the form when you file your taxes.

- You will not have to fill out any tax forms for a contractor if you pay an independent contractor less than $600.

- The W-9 is required if you pay contractors $600 or more. You present this form to independent contractors, so you can obtain pertinent data, like the contractors’ names, mailing addresses, and tax information. This is similar to a Form W-4 your regular employees must fill out because it allows you to obtain a contractor’s taxpayer identification number .

- When you pay an independent contractor more than $600, you must file a Form 1099-MISC with the IRS along with the W-9. You are also required to give copies of the completed forms to the contractor by January 31 of the following year.

- Physically send back those copies using Form 1096. In addition, you must send it and any companies of 1099 forms to the Social Security Administration by the end of February.

You May Like: How Much Is One Solid Gold Bar Worth

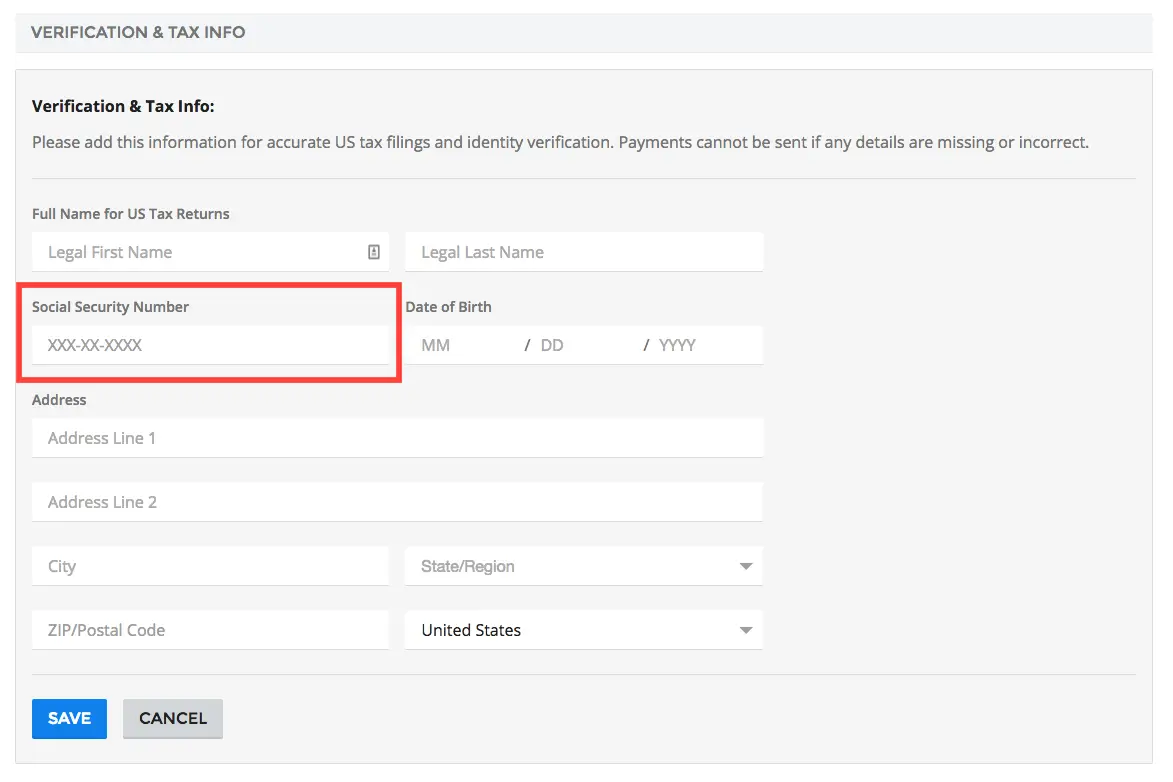

What Information Is Required For An Ein

When applying for your business EIN, youll need to provide certain information including the following:

- The legal name of the individual or entity for which the EIN is being requested, its address, and trade name

- Responsible partys name and tax ID

- Type of entity and date your business was started or acquired

- Reason for applying

- The highest number of employees you expect in the next 12 months, whether youll pay employment taxes annually or quarterly, and first date wages were paid

- If your business is an LLC, the IRS will ask for the number of members.

Youll also need to choose, from the list below, which best describes your principal business activity:

- Accommodation & food service

- Other

Find Out If Your Business Needs A Tax Id Number To Operate In Canada

The tax ID number is part of the 15-character program account number assigned to your business by the Canada Revenue Agency . The program account number consists of three parts:

- Nine-digit Business Number that identifies your business

- Two-letter identifier for the program type

- Four-digit reference number for the program account

An account number would look like this: 123456789 RT0001

Think of your Business Number as your business tax ID number because that’s why it exists. The CRA assigns your company a Business Number when you first register for any one of the four major program accounts you will need to operate your business:

The nine-digit tax ID number is the same across program accounts the numbers for the program ID and account number will change based on which of the four it’s referring to. You can apply for the number through The Canada Revenue Agency’s Business Registration Online service.

Note that in Quebec, the Business Number does not include your GST/HST accounts. You must register for a separate GST/HST account with Revenu Québec. Its General Information Concerning the QST and the GST/HST provides further clarification.

Several other tax accounts, such as Excise Tax, require a tax ID number/Business Number if they apply to you.

Don’t Miss: Is It Better To Lease Or Buy Solar

Tax Id Numbers At A Glance

A tax ID number is not required if you operate a sole proprietorship or an LLC with no employees, in which case you would simply use your own Social Security Number as a tax ID. But you must obtain an EIN if you are a sole proprietor who files pension or excise tax returns. Even partnerships without non-partner employees are required to have tax ID numbers.

Additionally, there are certain instances where you will need to obtain a new EIN :

- Existing business is obtained by someone who plans to run it as a sole proprietorship

- Business changes from a sole proprietorship to a corporation or partnership

- Business changes from a partnership to a corporation or sole proprietorship

- Business changes from a corporation to a partnership or sole proprietorship

- Individual owner dies, and business is taken over by the estate

Do I Need An Ein For A Sole Proprietorship

If you dont have employees or need to file excise or pension plan tax returns, then you arent required to have an EIN but you might need one for other purposes. Banking, business credit, and privacy are three legitimate concerns when deciding whether or not to get an EIN for your sole proprietorship.

Read Also: What Are Tesla Solar Panels Made Of

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

When To Get Your Employer Identification Number

When you first start a business or hire employees, you should get your Employer ID Number. Also, if you are incorporating or filing as an LLC, this is also a good time to get it. Without a Federal Tax ID Number, you cant get a business bank account or file your business tax returns.

If you had an EIN as a sole proprietor and now want to incorporate or file as an LLC, you will need to reapply for a new Employer Identification Number, as, essentially, you as starting a new business, at least in business status. Keep in mind you will also need a new business bank account if you originally opened one as a sole proprietor.

Don’t Miss: Do Solar Pool Covers Heat The Water

Also A Business Selling Batteries And/or New Tires Should Register To Collect And Remit A Fee To The Department

A state tax identification number is a unique number assigned to a business or organization by the state where the business operates, and is used for filing taxes and hiring employees. A business should also register with the department if it is a corporation responsible for filing and paying corporate and/or franchise tax or if it has employees and is required to remit withholding tax. Also, a business selling batteries and/or new tires should register to collect and remit a fee to the department.

Also, a business selling batteries and/or new tires should register to collect and remit a fee to the department. A state tax identification number is a unique number assigned to a business or organization by the state where the business operates, and is used for filing taxes and hiring employees. A business should also register with the department if it is a corporation responsible for filing and paying corporate and/or franchise tax or if it has employees and is required to remit withholding tax.

The Federal Employer Identification Number

The federal employer identification number is a 9-digit number assigned to corporations, partnerships, sole proprietorships estates, trusts and other entities for tax filing and other purposes. As a business, an EIN is necessary before you can hire employees, pay taxes and even open a bank account. Moreover, the federal employer identification number is often easier to get than a social security number and some foreign nationals use it instead of a social security number. Although not approved by the government, it is sometimes used as a way around the difficulty that non-citizens who are self-employed and cannot obtain social security numbers.

The federal employer identification number is your business form of identification with the government. It is the number listed on the federal tax return for your business. It is also listed on the employee payroll reports the business files with the federal government, if you have employees. And you may wish to give this number rather than your social security number to the bank to associate with your business bank accounts.

A business entity needs only one EIN, no matter how matter different types of business it does or locations it has. However, if a sole proprietor or partnership incorporates, it needs to obtain a new EIN.

The federal employer identification number is obtained through the Internal Revenue Service . There are three ways to get the EIN: on line, by fax or by mail.

The hours of operation are 7 am until 10 pm.

You May Like: Where Are Rec Solar Panels Manufactured

Can I Use My Social Security Number Instead Of An Ein

In some cases, you can use your Social Security number instead of an EIN, but using an EIN provides a level of personal protection against identity theft. An EIN separates your personal finances from your business finances. Once you have an EIN, you dont have to provide your Social Security number to clients or vendors who you do business with. In the case of foreign nationals starting businesses in the U.S., an EIN can come in handy when applying for a business credit card or opening a business bank account before they get a Social Security number.

Do I Need An Ein For A Dba

An Employer Identification Number, or EIN, is a nine-digit number that identifies your business for federal tax purposes. Find out what you need if you have a DBA.

Just as individuals have Social Security numbers that identify them for tax purposes, businesses have nine-digit Federal Tax ID Numbers, also known as Employer Identification Numbers, or EINs. Many, but not all, businesses must obtain an EIN to make federal tax payments and file returns.

But what if you conduct business under a trade name, or DBA? Maybe youre a sole proprietor named Joseph Jones who uses the DBA Joes Taco Truck. Or maybe your business is incorporated as JT Truck, Inc. and you operate under two DBAs: Joes Taco Truck and Tacos Unlimited.

Do you need an EIN? And if so, should you get one for the official name or for the DBA, or both?

Read Also: How Much For Sole Proprietorship

If You Are A Business Do You Have To Have A Tax Number

Many small businesses get along fine without ever obtaining a federal tax number. As long as your business is a sole proprietorship with no employees and it meets certain other criteria, you can use your Social Security number as your tax number when filing your income tax return. Requirements vary at the state level, but generally state tax numbers are required only for businesses that report sales taxes. Even if you aren’t required to have a federal tax number, obtaining one is easy and allows you to get bank accounts and credit cards under your business name.

Register With Your Province Or Territory

Most businesses need to register with the provinces and territories where they plan to do business. In some cases, sole proprietorships operating under the name of the business owner do not need to register. See the website of your provincial or territorial business registrar for more information on their requirements.

Note: This list of links is provided for your convenience. It may not be a comprehensive list of the registration requirements in all provinces and territories. Please check with the authorities in your provincial or territorial government to determine if there is anything else you need to do.

Read Also: Why Use Solar Energy For Homes