Considering A 401 Rollover Consider Your Options First

If you decide a 401 rollover is right for you, we’re here to help. Call a Rollover Consultant at .

One great thing about a 401 retirement savings plan is that your assets are often portable when you leave a job. But what should you do with them? Rolling over your 401 to an IRA is one way to go, but you should consider your options before making a decision. There are several factors to consider based on your personal circumstances. The information provided here can help you decide.

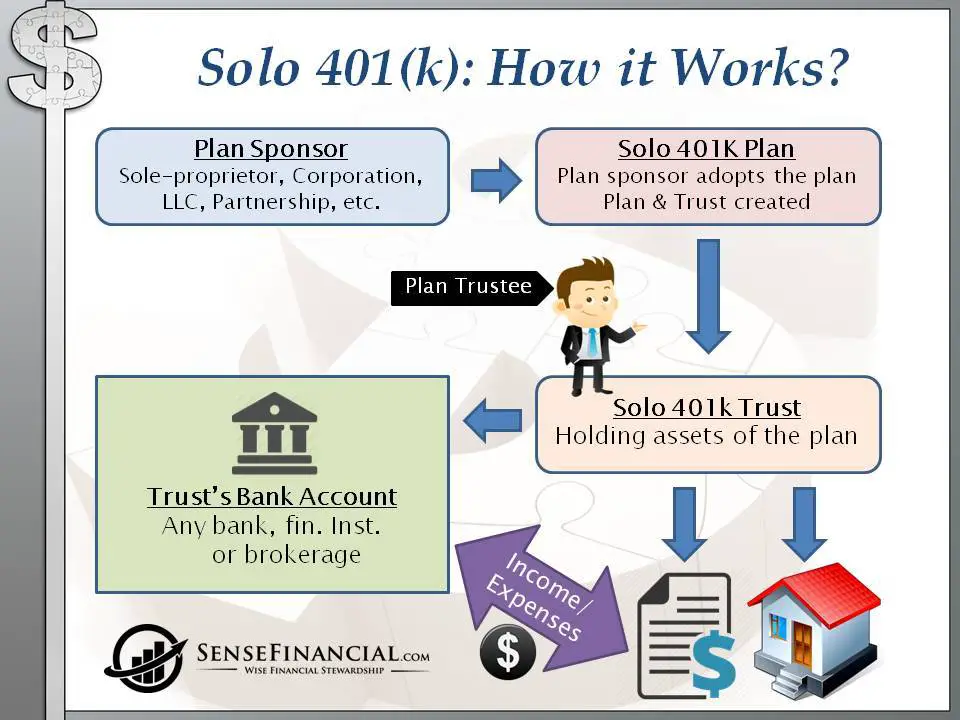

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

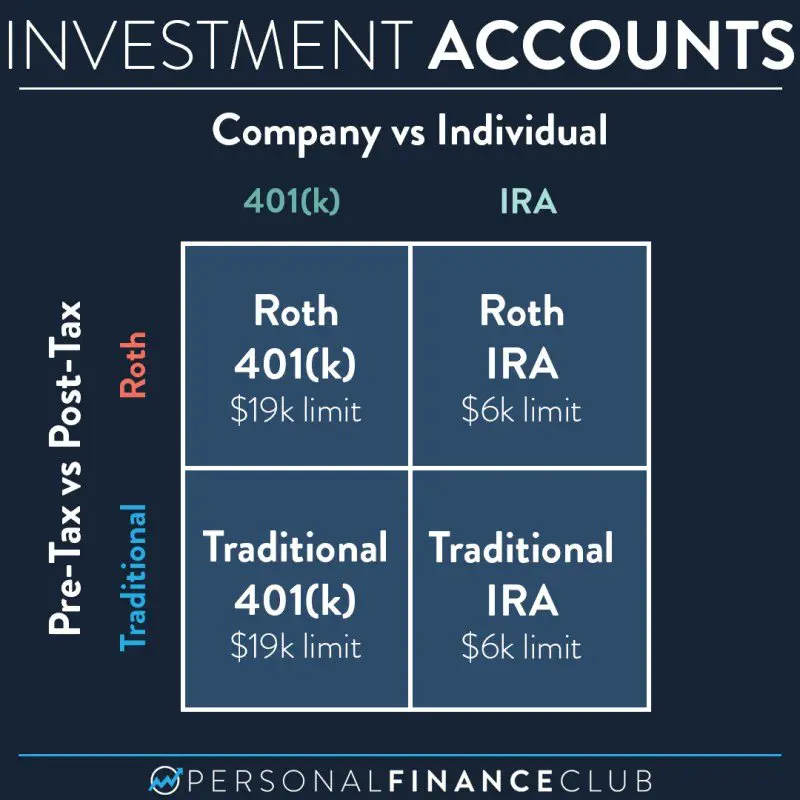

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $19,500 in 2020 and 2021.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Can You Lease Solar Panels

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

How Can I Get More Money Into My Solo 401k From My Full

In addition to having different rules than pre-tax and Roth salary deferrals on their way in to a plan, after tax contributions also have different rules for how they may come out the plan. The plan distribution rules are complicated but, for the most part, if a 401k, 403b or 457b participant is still working for the company sponsoring their plan and they are under 59 ½, access to their pre-tax salary deferrals, Roth salary deferrals and their earnings is largely limited. However, once a participant leaves their job or turns 59 ½, that changes.

Read Also: Where To Point Solar Panels

Question 5 Of : Can You Convert 401 To Roth After Retirement

How To Do A Rollover

The mechanics of a rollover from a 401 plan are fairly straightforward.

Your first step is to contact your company’s plan administrator, explain exactly what you want to do, and get the necessary forms to do it.

Then, open the new Roth IRA through a bank, a broker, or an online discount brokerage.

Finally, use those forms supplied by your plan administrator to request a direct rollover, also known as a trustee-to-trustee rollover. Your plan administrator will send the money directly to the IRA that you opened at a bank or brokerage.

Read Also: How To Install Solar Attic Fan

Can I Pay The Taxes From My Conversion From The Retirement Funds

While it is possible, it generally does not make sense to use the retirement assets to pay the taxes. If you are under age 59 1/2, the amount distributed to pay taxes may be subject to an IRS 10% additional tax for early or pre-59 1/2 distributions . Plus, those funds would no longer be potentially growing tax-free within the Roth IRA. Its suggested you use assets outside of retirement accounts to pay any taxes resulting from the conversion.

Does Separate Account Refer To The Actual Funding Vehicle Or Does It Refer To Separate Accounting Within The Plan’s Trust

Under IRC Section 402A, the separate account requirement can be satisfied by any means by which an employer can separately and accurately track a participants designated Roth contributions, along with corresponding gains and losses.

You May Like: How To Save Solar Energy

Are The Income Eligibility Limits Still In Place To Make An Annual Contribution To A Roth Ira

Yes. The income limits for annual contributions are still in effect, so its possible to take advantage of a Roth conversion but not be eligible to make an annual contribution. Since there are no income eligibility limits for conversions, however, one common strategy is to make a non-deductible contribution to a Traditional IRA then convert it to a Roth IRA. This may not be an appropriate strategy if you have other Traditional, SEP, or SIMPLE IRA balances, as the pro-rata rule would apply. Please consult a tax advisor to see if this strategy would work for you.

You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Read Also: Does A Sole Proprietor Have An Ein

Roth Ira Distribution Rules

Prior to IRS Notice 2014-54, doing a mega backdoor Roth IRA was not as attractive as there was some uncertainty as to how the after-tax 401 funds can be rolled over to a Roth IRA. Notice 2014-54 clarified this rule and allowed the pre-tax and after-tax funds that were distributed from a plan on a pro-rated basis to be separated once a distribution is made.

Therefore, the Notice opened the door to the mega backdoor Roth 401 strategy. Under the mega backdoor Roth strategy, one can maximize their 401 plan Roth contributions as well as gain investment options through flexible rollover rules. Essentially, a plan participant can contribute up to $57,000 or $63,500 in after-tax funds to a 401, immediately roll those funds to an IRA, and then convert them to a Roth IRA without tax. Even better, the individual can gain investment options through a Roth IRA and even gain the ability to use those funds immediately without being over the age of 59 1/2 or satisfying the Roth five-year rule.

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

Don’t Miss: How To File Taxes As A Sole Proprietor

Heres What To Expect:

Step 1 Contact a Wells Fargo retirement professional at 1-877-493-4727 to initiate your conversion request and get an overview of the process.

Step 2 Our team will help you open a new Roth IRA account if you don’t already have one, fill out the appropriate paperwork, and answer any questions you may have.

Step 3 An account form will be sent to you to initiate your conversion.

- Whether youre converting a Wells Fargo Traditional IRA, an IRA from another financial institution, or a qualified employer sponsored retirement plan such as 401, 403, or governmental 457, well walk you through the process to make sure all of your questions are answered.

Step 4 Return the paperwork to complete your request.

Who Is Responsible For Keeping Track Of The Designated Roth Contributions And 5

The plan administrator is responsible for keeping track of the amount of designated Roth contributions made for each employee and the date of the first designated Roth contribution for calculating an employees 5-taxable-year period. In addition, the plan administrator of a plan directly rolling over a distribution would be required to provide the administrator of the plan accepting the eligible rollover distribution) with a statement indicating either the first year of the 5-taxable-year period for the employee and the portion of the distribution attributable to basis or that the distribution is a qualified distribution.

Don’t Miss: Are There Any Government Incentives For Solar Panels

You Want To Increase Your Tax Diversification

Contributions to traditional IRAs are tax-advantaged, meaning you wont pay taxes on your invested funds until you begin taking withdrawals at retirement. Roth IRAs, on the other hand, are taxed up front but offer tax-free withdrawals after age 59 ½. If youre unsure how your tax and income situation might pan out in the future, having both types of accounts a traditional IRA and a Roth IRA is a smart move in terms of diversifying your future tax exposure.

Solo 401 Contribution Limits

The plan allows one-person businesses to establish a 401 with a participating brokerage and save up to $19,500 annually as elective deferrals, in the same way that participants in a regular 401 plan can deduct money from their paychecks.

The solo 401 also accepts employer matching contributions to the plan. Since the employee is also the business owner, he or she determines how much to match. The business can contribute 25 percent of its profits to the solo 401, up to a maximum of $57,000 in 2020 and $58,000 in 2021.

Business profit-sharing contributions are based on your net profits minus half of your self-employment tax and the plan contributions you made for yourself . The limit on compensation used to factor in your annual contribution is $285,000 for 2020 and $290,000 in 2021.

Keep in mind that the IRS limit on solo 401 contributions considers both employee and employer contributions per individual.

People aged 50 and older may contribute an additional $6,500 in 2020 and 2021 as a catch-up contribution, in line with bonus contributions allowed in other 401 plans. That means the total combined employee and employer contributions may not exceed $63,500 for 2020 and $64,500 in 2021.

As weve highlighted, the solo 401 combined contribution limits could add up to substantial savings, particularly for married couples.

Apart from these benefits, solo 401 contributions could make you eligible for additional tax incentives, depending on the legal structure of your business.

Recommended Reading: Can You Use Pine Sol On Wood Floors

Confusion Of The Roths

Unlike the similarly named Roth IRA, the Roth 401 is different. A Roth IRA is an individual retirement account whereas a Roth 401 is part of and offered through an employer sponsored retirement plan.

This minor confusion might be an invisible obstacle for some employees, especially high-income earners who have been told they cannot contribute to a âRoth.â

High-income earners may be pleasantly surprised to hear they can contribute because a Roth 401 does not have income limits like a Roth IRA does. This means they now have access to a savings vehicle that can grow tax-free.

Additionally, since Roth 401 accounts follow traditional 401 contribution guidelines, the amount that can be saved per year is subject to 401 maximums. For example, in 2020, employees can contribute up to $19,500 in a Roth 401 and if the employee is 50 years old or older, they may make a catch-up contribution of up to $6,500, for a potential total annual contribution of $26,000.5

Find Out If Youll Be Able To Convert Your 401

According to the IRS, in order to be eligible for a 401 conversion, the money must be vested .3 All the money you put into your 401 is immediately vested, but your employers contributions are usually vested over time. Depending on the vesting schedule set up by the company and how long youve been there, your existing 401 might not be fully vested yet.

Companies sometimes have their own additional restrictions on who can convert their 401, so ask your employer if you are eligible.

Read Also: How Did Our Solar System Form

What Is A Designated Roth Contribution

A designated Roth contribution is a type of elective deferral that employees can make to their 401, 403 or governmental 457 retirement plan.

With a designated Roth contribution, the employee irrevocably designates the deferral as an after-tax contribution that the employer must deposit into a designated Roth account. The employer includes the amount of the designated Roth contribution in the employees gross income at the time the employee would have otherwise received the amount in cash if the employee had not made the election. It is subject to all applicable wage-withholding requirements.

The law does not allow designated Roth contributions in SARSEP or SIMPLE IRA plans.

What Should I Do With An Old 401

You might have an old 401or severallying around from previous employers. Transferring the money from a 401 to your new employers Roth 401 might seem like an appealing option. But just remember, youll get smacked with a tax bill if you go that route.

Rolling your old 401 into a traditional IRA is another way to go. Youll have more control over your investments and will be able to choose from thousands of funds with the help of your financial advisor. Plus, you wont face any tax consequences since youre moving from one pretax account to another.

If you arent able to transfer your money into your new employers plan but think a Roth is for you, you could go with a Roth IRA. But just like with a 401 conversion, youll pay taxes on the amount youre putting in. If you have the cash available to cover it, then the Roth IRA might be a good option because of the tax-free growth and retirement withdrawals.

Don’t Miss: How Much Money To Install Solar Panels