$1000 Arizona Solar Tax Credit

At the state level in Arizona, not only is there is no sales tax charged, but you can receive a state income tax credit of up to $1,000 for a solar purchase.

Like the federal ITC, in order to qualify for the Arizona solar tax incentive, your system must be installed and commissioned before the end of the tax year you wish to file for.

How To Claim Your Tax Credit

To claim the ITC you will need to file under IRS Form 5695. Youll receive your tax credit the following year when you file your taxes for the year in which you installed your panels. If you dont qualify for the entire tax credit in the first year you can roll over the amount for up to 5 years.

Now that you have your very own solar system, the solar Investment Tax Credit is yours for the claiming. How exactly do you go about it?

Well walk you through the exact, step-by-step process of filing for the federal solar tax credit.

Of course, we recommend talking to a tax professional to make sure youre not missing anything. But if youre a do-it-yourselfer who knows your way around a tax form , this guide walks you through basic filing.

What Exactly Is The Federal Solar Tax Credit

The federal solar tax credit is a credit that can be used to offset your federal income tax liability.

This means that you must owe taxes in order to utilize the tax credit.

- Having a tax liability does not mean that you have to write a check when you submit your tax return. It means that the IRS keeps some of the income tax that was withheld or paid.

- Getting a refund does not mean that you do not owe taxes. It means that more taxes were collected by the IRS than what you ended up owing.

- Not having to write a check to the IRS when you submit your tax return to the IRS does not mean that you do not owe taxes.

The amount of any federal solar tax credit that is used cannot exceed the total tax liability for that year.

- In other words, you cannot use a credit for more than what you owe.

- You may be able to use some of your tax credit now, and some later.

- You may be able to carry over the tax credit to another year and use it when you have a tax liability in a future year.

Recommended Reading: What Age To Introduce Solid Foods

Other Frequently Asked Questions

If the tax credit exceeds my tax liability, will I get a refund?

This is a nonrefundable tax credit, which means you will not get a tax refund for the amount of the tax credit that exceeds your tax liability. Homeowners may get a tax refund at the end of the year due to the tax credit, if the reduction in tax liability means there was overpayment during the year. This can often occur when employers deduct taxes for employees over the course of the year. However, such refund is still limited by the taxpayers total tax liability. However, you can carry over any unused amount of tax credit to the next tax year.

Can I use the tax credit against the alternative minimum tax?

Yes. The tax credit can be used against either the federal income tax or the alternative minimum tax.

I bought a new house that was constructed in 2020 but I did not move in until 2021.

May I claim a tax credit if it came with solar PV already installed?

Yes. Generally, you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house in other words, you may claim the credit in 2021. For example, you can ask the builder to make a reasonable allocation for these costs for purposes of calculating your tax credit.

How do I claim the federal solar tax credit?

What Do You Need To Do To Claim The Federal Tax Credit

Lets look at the steps you need to follow if youre filing your own taxes. First, we recommend that you use online tax filing to use the correct forms and not make any mistakes.

To claim the tax credit, youll need to file Form 5695 with your tax return. This is the form designed for residential energy tax credits.

Read Also: Where To Buy Solo Stove

Is There An Easy Way To Tell How Much Of The Tax Credit I Can Use

No. The easiest way is to consult your tax professional. However, SolarMax Technology has developed the Tax Credit Impact Estimator to help customers understand how the tax credit may affect them by showing how it might have affected their taxes in the previous year.

If your taxes in the year of installation are going to be the same as last year, then you may get a good idea how the tax credit affects you for this year.

Give SolarMax Technology a call or fill out the request form to get started today.

Your eBook “Federal Solar Investment Tax Credit: A Practical Guide” is available for download:

Solar Tax Incentives In California

California offers an Incentive Tax Credit credit for anyone who installs a solar power system, which effectively means that the government will subsidize a portion of the cost of installation by reducing your tax bill. But the amount of the tax credit is changing, and it wont be around forever. For all solar systems that are installed and brought online in 2020, are eligible to receive a tax credit of 26% of the total cost of installation for the system, including all parts and labor costs. So if the total cost of your solar installation is $20,000, youre eligible for a tax credit of $5,200, bringing the effective cost of the system to only $14,800.

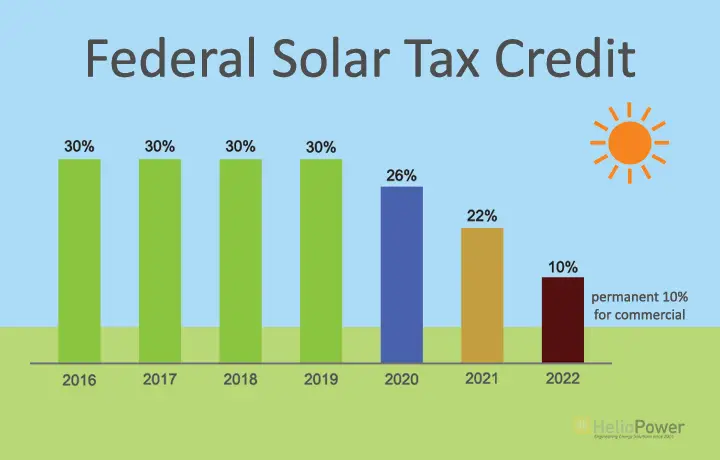

But the credit will decrease in the coming years, and it will soon expire entirely for residential systems. Heres how the tax credit will change in the next few years:

- 26% credit for systems installed in 2020

- 22% credit for systems installed in 2021

- 10% credit for systems installed in 2022

- In 2023 and after, only commercial solar systems will be eligible for a tax credit of 10%

Keep in mind that this is a tax credit, not a deduction: so rather than reducing your effective income by 26% of solar installation costs, it reduces your tax liability directly. You can take the credit all at once or spread it over different tax years, and theres no limit to the credit it amounts to 26% of the installation cost no matter how low or high it is.

Don’t Miss: How To File As Sole Proprietor

Solar Tax Credit Step Down Schedule

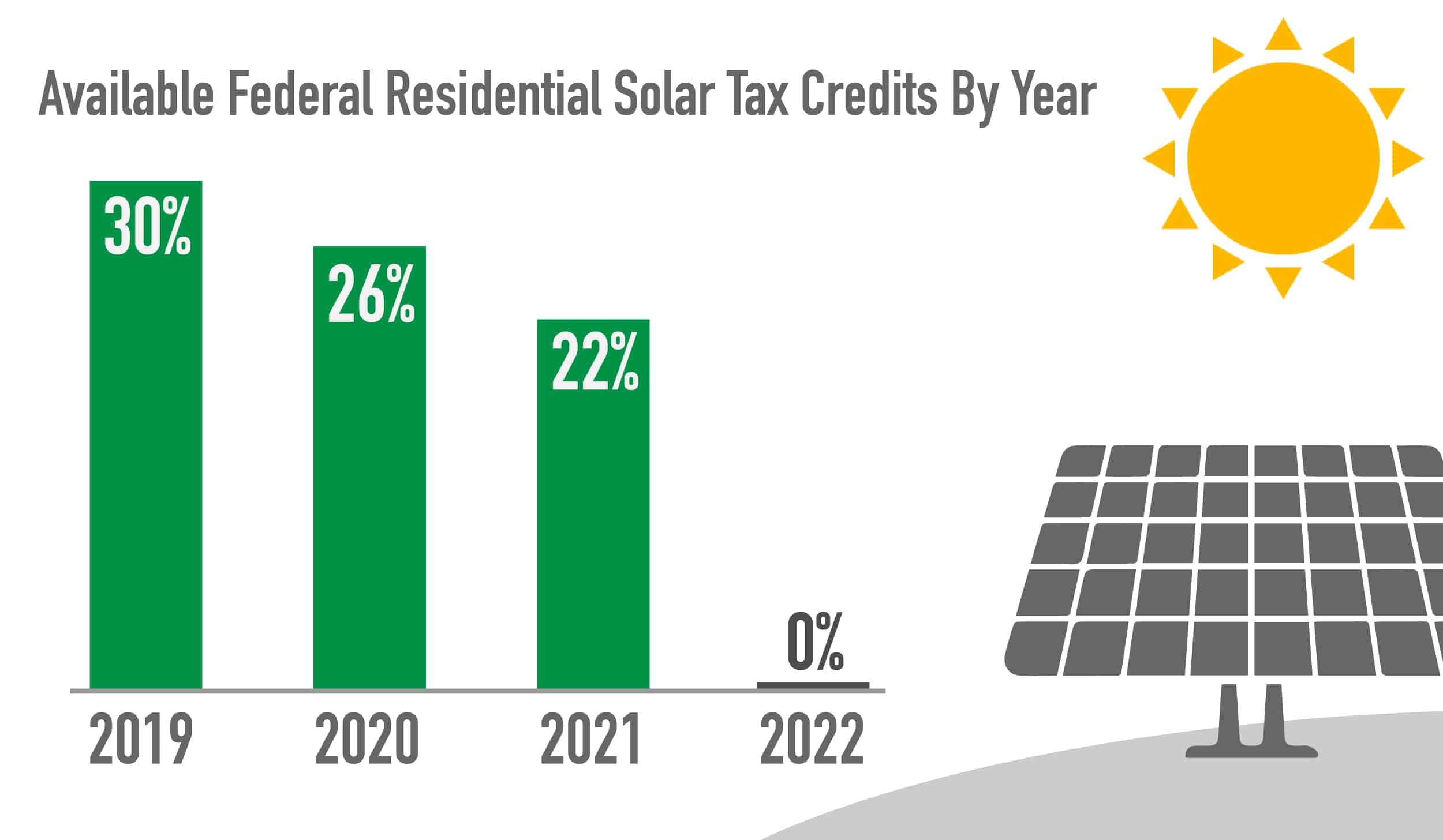

2019 was the last year to claim the full 30% credit. As of 1/1/2021, the credit has dropped down to 26%.

Heres the full solar Investment Tax Credit step down schedule:

*From 2024 onward, the residential portion of the Solar Tax Credit will be eliminated entirely. A 10% tax credit will remain for commercial, industrial, and utility scale projects only.

Residential Property Tax Exemption

All of the benefits of solar mean that installing a solar energy system on your home can increase your property value. Thats great news for homeowners who want to sell their property, but what about the impact of higher home value on your property taxes? Virginia has a law allowing localities to exempt or partially exempt solar from the property taxes residents pay. Note, however, that not all localities allow this exemption currently only 30 do. If yours doesn’t, you may wish to petition your Board of Supervisors to approve an ordinance to allow it.

Recommended Reading: How Many Solar Panels Can I Fit On 1 Acre

Solar Tax Credit History And Background

The Federal Solar Tax credit was established as a part of the Energy Policy Act of 2005 to expand the US renewable energy market.

The Energy Policy Act of 2005 created an ITC , is commonly known as the federal solar tax credit. This Federal tax credit isequal to a percentage of the total qualified costs of installing a solar energy system. The Federal Investment Tax Incentive was extended numerous times. And in 2015, the Omnibus Appropriates Act included a multi-year extension with a step-down tax credit.

This step-down extension means that the tax credit will drop over time. It dropped to 22%, starting in 2021, and will continue to fall till 2022. Starting in 2020, the Federal ITC will fall to 0% for home solar. This tax credit can be claimed when you file your Federal taxes. Even if you dont have enough Federal tax liability to claim the full amount in a single year, you have up to three years to claim the tax liabilitys total amount.

Claiming The Federal Solar Tax Credit

For commercial properties, the investment tax credit is only available if you began construction on your solar panel system in the tax year youre filing. So if you started installing your solar system in December 2020, you could claim it on the returns filed next April — even if the project isnt finished for months or years to come. This would allow you to claim the maximum benefit of 26%.

For residential properties, the system must be placed into service before you can claim the credit. In the above scenario, if you started the system install in December 2020 but didnt have it up and running until June 2021, you would claim the credit for tax year 2021 . That would mean a reduced credit of 22%.

In both cases, youll need IRS Form 5695 to claim the credit. You might also want to consult a tax professional just to be sure you qualify.

Don’t Miss: How To Connect Bluetooth To Sole Treadmill

Solar Renewable Energy Certificate

A Solar Renewable Energy Certificate , sometimes referred to as a Solar Renewable Energy Credit, is another type of state-level solar incentive. After you install your solar power system and register it with the appropriate state authorities, they will track your systems energy production and periodically offer you SRECs as a benefit. You can sell your SREC to your local energy utility to provide payment thats typically considered taxable income.

Considerations For The Solar Tax Credit

2019 was the last year for the 30% Federal solar investment tax credit for projects. The Federal ITC is reserved to improve energy efficiency and lower the carbon footprint of residential and commercial buildings. In 2020, the tax credit gets reduced to 26%, and this credit gets smaller with each passing year. In 2021, the tax credit has been reduced to 22%.

You have to keep in mind that the federal solar tax credit is nonrefundable and is only possible for the system owner. Homeowners who purchased a solar energy system with a Solar Lease or Power Purchase Agreement are not eligible for the Solar Federal ITC.

We recommend that you contact and consult your personal tax advisor for eligibility and any questions about your tax situation.

Are you looking to install solar for your home?

With the expiring solar tax credit, dont wait too long to get a quote on solar. Always seek a professionals help when considering solar for your home. A professional CPA will have the best knowledge on how to handle your home energy situation in an efficient manner. If you are in need of home solar in California? Call Forme Solar at 694-2262 and request a solar quote today!

Search

Read Also: How Much Is 1 Solar Panel Cost

Federal Solar Tax Credit Filing Step

Fill in Form 1040 as you normally would. When you get to line 53, its time toswitch to Form 5695.

Step 1: Find out how much your solar credit is worth.

- Enter the full amount you paid to have your solar system installed, in line 1. This includes costs associated with the materials and installation of your new solar system. As an example, well say $27,000.

- For this example, well assume you only had solar installed on your home. Enter 0 for lines 2, 3 and 4.

- Line 5 Add up lines 1 through 4. Example: 27,000 + 0 + 0 + 0 = 27,000

- Line 6 Multiply the amount in line 5 by 26% Example: 27,000 x .26 = 7,020

- Line 7 Check No. Again, for this example, were assuming you didnt have any other systems installed, just rooftop solar.

- Lines 8, 9, 10 and 11 Dont apply to you in this example for the same reason. You can fill each with 0 and skip down to line 12.

Step 2: Roll over any remaining credit from last years taxes.

- Line 12 If you filed for a solar tax credit last year and have a remainder you can roll over, enter it here. If this is your first year applying for the ITC, skip to Line 13.

- Line 13 Add up lines 6, 11 and 12 Example: 7,020 + 0 + 0 = 7,020

Step 3: Find out if you have any limitations to your tax credit.

How Do I Claim The Solar Tax Credit

If you purchase a solar energy system and it belongs to your business or household, you are eligible for the solar tax credit. You can claim the solar tax credit when filing your annual federal tax return.

Make sure to let your accountant know that youve installed solar panels in the past year. If you file your own taxes, youll simply use tax form 5695.

Recommended Reading: What Is The Cost Of A Solar System

What Is The Federal Solar Tax Credit

The investment tax credit, or ITC, was first put in place as part of the Energy Policy Act of 2005. The government extended the program several times over the years, and its currently set to expire at the end of 2021.

Though the credit at one point amounted to 30% of a solar power systems costs, the value is being phased down year over year. This year, property owners get a 26% credit next year, its just 22%. By 2022, only commercial property owners will qualify for any sort of credit .

Heres a quick breakdown of what the credit will look like in the next few years:

| TAX YEAR |

|---|

Data source:U.S. Department of Energy

There is no cap on the exact amount your credit can add up to, and if youre unable to claim the full credit in one year , then you can roll over the remaining credit to subsequent years.

How Do Other Incentives I Receive Affect The Federal Tax Credit

For current information on incentives, including incentive-specific contact information, visit the Database of State Incentives for Renewables and Efficiency website.

Rebate from My Electric Utility to Install Solar

Under most circumstances, subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law. When this is the case, the utility rebate for installing solar is subtracted from your system costs before you calculate your tax credit. For example, if your solar PV system was installed before December 31, 2022, cost $18,000, and your utility gave you a one-time rebate of $1,000 for installing the system, your tax credit would be calculated as follows:

0.26 * = $4,420

Payment for Renewable Energy Certificates

When your utility, or other buyer, gives you cash or an incentive in exchange for renewable energy certificates or other environmental attributes of the electricity generated , the payment likely will be considered taxable income. If that is the case, the payment will increase your gross income, but it will not reduce the federal solar tax credit.

Rebate from My State Government

0.26 * $18,000 = $4,680

State Tax Credit

For example, the net percentage reduction for a homeowner in New York who claims both the 25% state tax credit and the 26% federal tax credit for an $18,000 system is calculated as follows, assuming a federal income tax rate of 22%:

0.26 + * = 45.5%

+ = $4,680 + $3,510 = $8,190

Also Check: When Do Federal Solar Tax Credits Expire

Solar Tax Credit: Everything You Need To Know As A Homeowner

The federal solar tax credit lets homeowners offset a percentage of solar panel system installation costs through 2023. State tax credits and utility rebates can lower the cost too.

Edited byChris JenningsUpdated August 6, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

More homeowners are installing solar energy systems and other forms of renewable energy like small wind turbines and geothermal heat pumps to reduce the reliance on fossil fuels, cut down on greenhouse gas emissions, and potentially pay a lower electric bill.

In most real estate markets, homes equipped with solar panels can increase your homes value.

While there are many long-term benefits to going solar, the upfront costs can be expensive. Thankfully, you might be able to qualify for a solar tax credit to offset some of the cost.

Heres what you need to know about the federal solar tax credit:

% Federal Solar Investment Credit

When you purchase and install a solar electric system on your home, one of the biggest incentives you can receive is through the federal solar Investment Tax Credit , where you can take a tax credit off your personal income tax return for 26% of the solar system cost . This can be taken all in one year, or spread out over five years.

Recommended Reading: Can Solar Panels Power Your Whole House