How Much Should I Pay Myself As A Sole Proprietor

As a sole proprietor, determining how much you should pay yourself can be tricky, as there are no set rules or guidelinesâitâs up to you, the business owner, to decide whatâs appropriate.

One way to think about it is to consider how much you would need to pay someone else to do the work you do. This can help you determine fair compensation for yourself.

Another way to look at it is to calculate your businessâs net profit and then divide that number by 12. This will give you an estimate of how much money you can take out each month without affecting the overall health of your business.

Whatever method you choose, itâs important to be realistic about your expenses and income. It can be tempting to pay yourself a high salary, but if your business isnât making enough money to cover those costs, youâll soon find yourself in financial trouble. A reasonable salary would be based on how much revenue you generated from the company earnings.

A Special Tax Deduction For Pass

Sole proprietors, along with other types of pass-through businesses, can get an additional tax deduction of 20% from their business income through a Qualified Business Income tax deduction. The deduction is in addition to ordinary business deductions. There are requirements and limitations on this deduction, so check with your tax professional for more details.

See IRS Publication 535 Business Expenses for details on how to deduct business expenses, including limitations and restrictions on these deductions.

How Sole Proprietors Pay Income Tax

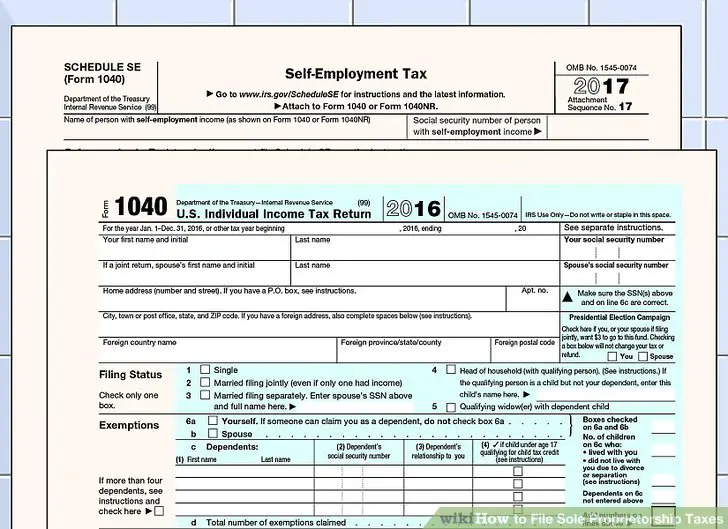

A sole proprietorship is taxed through the personal tax return of the owner, on Form 1040. The business profit is calculated and presented on Schedule C, Profit or Loss from Small Business. To complete Schedule C, the income of the business is calculated including all income and expenses, along with cost of goods sold for products sold and costs for a home-based business. The result of this calculation is the net income .

This net income or loss of the business is entered on Line 31 of the owner’s Schedule C, to be included along with other income or losses of the owner for income tax purposes. The figure is entered on Line 3 of the Form 1040 if the business has a profit. A loss may be used to reduce the total adjusted gross income of the owner on the tax return if the business has a loss.

The owner of the sole proprietorship pays income tax on all income listed on the personal tax return, including income from business activities, at the applicable individual tax rate for that year.

Also Check: What Battery Is Best For Solar System

Federal Business Income Taxes

Federal income tax for businesses is based on net profit . With sole proprietorships, partnerships, most LLCs, and S-corporations, tax on business income is paid by the owners through their personal tax returns. This is called pass-through taxation. Owners are generally required to make quarterly estimated tax payments during the tax year using Internal Revenue Service Form 1040-ES. These payments are due April 15, June 15, September 15 and January 15.

If youre a working owner of an S-corporation, you are also an employee who receives standard paychecks. You may not need to make estimated tax payments if you have enough income tax withheld from your paycheck.

Standard corporations are generally required to make quarterly estimated tax payments on the 15th day of the 4th, 6th, 9th, and 12th months of each fiscal year. If you want your corporation to be treated as an S-corporation, complete Form 2553 Election by a Small Business Corporation within 75 days of forming your business or within 75 days of the beginning of a tax year .

Limited Liability Companies are taxed like sole proprietorships if there is only one owner. If there is more than one owner, LLCs are taxed like partnerships. However, LLCs can elect to be treated as standard or S-corporations for federal tax purposes by filing an IRS Form 8832. Consult your tax professional for more information.

How Much Do I Pay Myself As A Sole Proprietor

As we said before, to determine how much to pay yourself as a sole proprietor, you need to figure out your projected business profits and the frequency with which you would draw from them.

In order to figure out your projected business profits, you need to keep accurate records of your business assets and liabilities. In other words, you can’t mix personal and business finances, as this could make it more difficult to prove which expenses were for your business.

Because, as we mentioned above, you don’t need to incorporate or register your sole proprietorship to start one, your business name defaults to your full legal name. In other words, in the eyes of the IRS, you and your business are the same entity. To differentiate between the two, you can file a DBA or “doing business as,” which will allow you to do business under a name other than your own. Once your DBA has been created, you can then open a business bank account under that name. This is the account you will use for all business income and expenses. Your business bank statements will then offer a clearer picture of how much the business earned and spent.

If you wish to charge any business expenses, it also helps to get a separate business credit card. Finally, we recommend using business accounting software like QuickBooks to track business withdrawals and deposits, and the nature of the transactions.

Read Also: How Much Does The Solar System Cost

Federal And State Estimated Taxes

Estimated taxes arent a separate class of tax by themselves. When you pay estimated tax, youre actually paying money ahead toward what you think youll owe for income and self-employment tax at the end of the year. Normally, an employer would withhold money from your paychecks to be applied to your tax liability. But if youre a self-employed sole proprietor, youll have to do this yourself.

Federal and state estimated taxes are due in January, April, June and September. The first tax payment of the current tax year is in April. As a result, the last is due in January of the following year. Filing deadlines are typically the 15th day of their respective month, unless the 15th falls on a holiday or weekend. In that case, the filing deadline would be the next regular business day. You can file these taxes with Form 1040 ES. However, you also have to file your income taxes for the previous year in April.

Its important to make sure youre paying enough in estimated taxes each quarter. Shorting your estimated taxes could trigger an underpayment penalty if you end up owing more in taxes at the end of the year.

Understanding Sole Proprietorship Taxes

Thinking of starting a new business? The type of company you found can have a significant effect on your tax obligation in the coming years.

Of the most common business entitiesincluding partnerships, LLCs and corporationssole proprietorships are widely considered the simplest type. A sole proprietorship refers to an unincorporated business owned and operated by a single person or, in some cases, a married couple. Because all of your business revenues are considered personal income, filing taxes as a sole proprietor is relatively simple, but this doesnt mean its without its drawbacks.

Lets take a look at what a sole proprietorship taxes look like and find out how you can minimize your tax burden in the coming years.

Read Also: Are Solar Panels Getting Cheaper

Sole Proprietorship Taxes: How Are Sole Proprietorships Taxed

The decision whether to operate your small business as a sole proprietorship or corporation has some major tax implications. Do you know what they are?

Selecting the right business structure for your new enterprise can have far-reaching tax implications, so it’s important to understand how sole proprietorships are taxed. The most common business entity is a sole proprietorship business, which is owned and run by one person.

If you’re thinking of starting a sole proprietorship, here are a few things to keep in mind about sole proprietorship taxes when April 15 rolls around.

Sole Proprietor Taxes

How are sole proprietorships taxed? Sole proprietorships are not taxable entities under Internal Revenue Service guidelines. Rather, revenue passes through the business andthe sole proprietor reports all income and expenses on Schedule C Profit or Loss From Business” or Schedule C-EZ Net Profit From Business” and submits this along with their federal Form 1040 when they file their personal tax returns, also called pass-through” taxation.

One of the most common mistakes that sole proprietors make is not reporting all earned income. For example, if a freelance writer makes $600 or more from a single client in a given year, that client is required to send the writer a Form 1099-MISC. However, even if you don’t receive a Form 1099-MISC from a client, you’re still required to report to the IRS any income you receive from that client.

Estimated Quarterly Taxes

Business Deductions

What Defines A Verbal Contract

A verbal contract refers to an agreement between two parties that’s made âyou guessed itâ verbally.

Formal contracts, like those between an employee and an employer, are typically written down. However, some professional transactions take place based on verbally agreed terms.

Freelancers are a good example of this. Often, freelancers will take on projects having agreed on the terms and payment via the phone, or an email. Unfortunately, sometimes clients don’t pull through on their agreements, and hardworking freelancers can find themselves out of pocket and wondering whether a legal battle is worth all the hassle.

The main differences between written and oral contracts are that the former is signed and documented, whereas the latter is solely attributed to verbal communication.

Verbal contracts are a bit of a gray area for most people unfamiliar with contract law âwhich is most of us, right?â due to the fact that there’s no physical evidence to support the claims made by the implemented parties.

Read Also: How Can I Make A Solar Panel

Sole Proprietorship Taxes: Special Deductions

On the other hand, although there is some cash activity in your business that does not impact the taxable income for your sole proprietorship, there is also some non-cash activity that can reduce your taxable incomeâbut these activities might not appear on your profit and loss statement.

When it comes to your sole proprietorship taxes, therefore, youll want to keep these special and sometimes overlooked business tax deductions in mind, as they can make a huge impact on your tax liability. Lets explore further.

Sole Proprietors Pay Taxes On Business Income On Their Personal Tax Returns

Updated By Diana Fitzpatrick, J.D.

As a sole proprietor you must report all business income or losses on your personal income tax return the business itself is not taxed separately.

Here’s a brief overview of how to file and pay taxes as a sole proprietor — and an explanation of when incorporating your business can save you tax dollars.

Recommended Reading: How Much Can A Solar Farm Make

Filing As A Partnership

A partnership does not file income tax on its earnings and is not required to pay tax. The income earned from a partnership is divided between the partners, and each respective partner files her own return. The income, deductions and any other credits or losses are divided according to the partnership agreement in place. Each share of income must be reported whether it was received in cash or as a credit. Special rules apply to a partnership concerning capital gains and losses and recapturing cost allowance. If a partnership is dissolved or an interest is sold or disposed, CRA has special guidelines in place.

Tax Forms Required With W

Here are the additional forms you need to file with your tax return:

- IRS Form 941: File quarterly to report FICA taxes withheld from employee paychecks

- IRS Form 940: File annually to report FUTA withheld

- State unemployment tax form

- IRS Form W-3: File annually to report total wages paid to all employees

You must also distribute the following forms to your employees:

- IRS Form W-2: Distribute to employees by January 31. Provides them with wages paid and information on FICA taxes withheld.

You must collect IRS Form W-4 from each W-2 employee you hire, which tells you how much tax that employee wants you to withhold from their paycheck.

Also Check: How To Start A Sole Proprietorship In South Carolina

Sole Proprietorship Payroll Schedule

If you are the owner of a business entity that’s organized as a sole proprietorship, you can choose a payroll schedule that works for you. As the proprietor, you answer to nobody but yourself.

Income can be sporadic when you are first getting started with your business, but that doesn’t mean you shouldn’t pay yourself regularly. It’s a good idea to think about the work you’re doing as an employee and pay yourself what that work is worth if you can. Not only does paying yourself regularly show that your business is legitimate, but it minimizes your stress.

We suggest looking at your budget and expenses and deciding on a payroll schedule that works for you. Even if you’re not drawing a salary, you will need to pay for Social Security and Medicare. Paying into these programs is essential because that money will come back to you in the form of regular checks and healthcare.

Make This Tax Year Simplewith Wise Numbers

- Fill out your tax forms for your business based on your financial statements.

- Fill out your personal tax forms claiming any personal tax credits you are eligible to.

- Ensure all of your business expenses and business tax deductions are recorded on your tax return.

- File your taxes with the Canada Revenue Agency.

- Provide you with the final balance you can expect to pay or be refunded by the CRA.

Recommended Reading: How Long To Pay Off Solar Panels

Independent Business Owner Vs Sole Proprietor: Whats The Difference

When you hear someone say independent business owner, they may be referring to one of two things:

Let me explain

An independent business is any business that is privately owned and not publicly traded on the stock market. It can have one owner or many. It can be a massive operation with thousands of employees and a board of directors, or it can be a solo venture.

For example, Sir James Dyson is the one and only owner of Dyson, the company that makes those awesome vacuums and fans. Although it has an annual revenue of $8.2 billion and more than 13,000 employees worldwide, Dyson is a privately owned business that is not publicly traded.

So, you could technically call Sir Dyson an independent business owner.

Thats not the type of independent business were talking about today.

Were focusing here on businesses run, owned, and operated by one person. Youre about to learn how to tell if that one person is a sole proprietor or an independent owner of a business.

Running Your Business In Bellevue

At the core of any successful business is a focus on creating value, effectively leading people to do quality work and managing the work to optimize costs. Because small business is closer to the customer, they are more sensitive and responsive to market changes. Because they tend to solve value problems, not cost problems they tend to be more innovative.

-

Taxes

Businesses pay several different kinds of taxes, including income tax and property tax. Taxes for businesses can be federal, state, and local. There are also different types of taxes depending on various business activities, like selling taxable products or services, using equipment, owning business property, being self-employed versus having employees.

Read Also: Do Solar Panels Lower Home Value

Making Estimated Tax Payments

Estimated tax payments are mandatory for businesses that anticipate owing $1,000 or more over the course of a year. To avoid getting hit with a hefty tax payment come April, sole proprietors need to set a portion of their income, interest and dividends aside each month in order to submit estimated tax payments four times a year. Failing to submit estimated quarterly tax payments could leave your business on the hook for fees and penalties from the IRS.

Not sure what your estimated tax payments should be? Use the previous years tax return to estimate annual income. Then, divide this amount into four even payments to be sent to the IRS in mid-April, mid-June, mid-September and mid-January. Sole proprietors who fail to make estimated payments may be subject to an IRS underpayment penalty in addition to the tax burden they already owe.

What Makes Sole Proprietors Different

Sole proprietors are one-person owners of unregistered businesses. That means they don’t register their businesses with a state. For legal and tax purposes, sole proprietorships are the only business type that isn’t separate from the owner. The owner is liable for all the debts of the business and can be sued in connection with its actions .

For tax purposes, a sole proprietorship is considered a “pass-through” business. The profits or losses of the business pass through to the owner’s personal tax return.

You’re a single-member LLC, and you pay income taxes in the same way as a sole proprietor, including self-employment taxes. If you’re the only owner of a limited liability company . This information applies to you, too.

You May Like: How Much To Add Solar Panels To Your House