Who Writes The Check

Solo 401k contributions are calculated based on your net earnings. This means as the employee/employer of your business, you can contribute a portion of what you earn. The contribution is not made directly from the business bank account. After you get paid as the employer/employee of your business, you write the check for the contribution into the plan.

Is Solo 401 Tax Deductible Solo 401 Tax Advantages

The nice thing about a solo 401 is you get to pick your tax advantage: You can opt for the traditional 401, under which contributions reduce your income in the year they are made. In that case, distributions in retirement will be taxed as ordinary income. The alternative is the Roth solo 401, which offers no initial tax break but allows you to take distributions in retirement tax-free.

In general, a Roth is a better option if you expect your income to be higher in retirement. If you think your income will go down in retirement, opt for the tax break today with a traditional 401.

Because of these tax perks, the IRS has pretty strict rules about when you can tap the money you put into either type of account: With few exceptions, youll pay taxes and penalties on any distributions before age 59 ½.

»Want more info? Heres our in-depth comparison of Roth and traditional 401s

Solo 401k Contribution Calculator Walk Thru

February 24, 2020 by Editorial Team

The Solo 401k is the most powerful retirement account on the planet when it comes to contributions. This can add up to huge tax savings for you if you own your own business. When you run your own retirement account, you need access to the best tools. Fortunately, all Solo 401k account holders with Nabers Group have access to our contribution calculator. Lets walk through how to use the calculator, determine how much you can contribute to a Solo 401k plan.

You May Like: How To Wire In Solar Panel To Home

Solo 401k Contributions For 2019

For 2019 the maximum amount a self-employed individual can contribute to their Solo 401k is $56,000 if he or she is younger than age 50. Individuals 50 years of age and older can catch-up with an additional $6,000 per year in contributions. Part of the appeal is that contributions can be made as both the employer and employee.

In 2020, the Solo 401k contribution limit will increase to $57,000 and $63,500 for individuals over 50 years old.

Mega Back Door Roth Solo 401k Contribution Limit Question:

Yes and see the following.

- The overall limit in 415C applies on a per employer basis Provided that the employers are unrelated.

- This limit is applied without consideration of contributions made to a plan sponsored by an unrelated employer

- The elective deferral limit in 402G applies only to elective deferrals and does not impact after-tax contributions

- Here is an Example:

- For 2021, an individual contributes $19,500 of the elective deferrals to a 401 plan sponsored by his W-2 employer & additional matching and profit-sharing contributions are made up to the limit of $58,000

- Individual has an S-corp side business with no employees that generates self-employment income greater than $58,000 for 2021.

- The individual can contribute after-tax contributions up to $58,000 for 2021 to the solo 401 sponsored by side business and subsequently convert the voluntary after-tax funds to a Roth IRA or to the Roth Solo 401k.

You May Like: How Much To Add Solar Panels To Your House

Deducting Retirement Plan Contributions

Total limits on plan contributions depend in part on your plan type. See the contribution limits for your plan.

A limit applies to the amount of annual compensation you can take into account for determining retirement plan contributions. This limit is $305,000 in 2022, $290,000 in 2021, $285,000 in 2020 and $280,000 in 2019 and is adjusted annually.

Plan contributions for a self-employed individual are deducted on Form 1040, Schedule 1 and not on the Schedule C. If you made the deduction on Schedule C, or made and deducted more than your allowed plan contribution for yourself, you must amend your Form 1040 tax return and Schedule C.

You should amend your Form 1040 tax return and Schedule C if you:

- deducted your own plan contribution on Schedule C instead of on Form 1040, Schedule 1, or

- made and deducted more than the allowable plan contribution for yourself.

If you contributed more for yourself than your plan terms allowed, you should also correct this plan qualification failure by using the IRS correction programs.

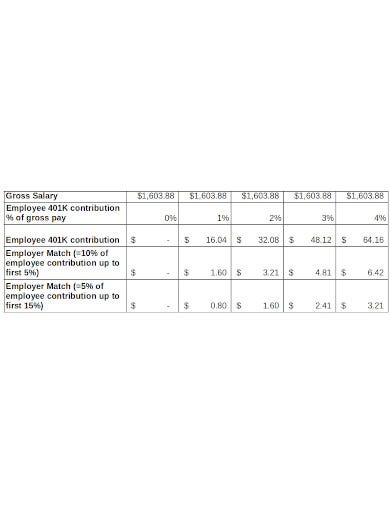

Solo 401 Contribution Calculator

Business Profit: Total self-employment income from all sources, minus business expenses.Age: Are you 50-years-old or older? If so, you can make an additional catchup contribution.Day Job?: Do you also have W2 employment? This check box enables additional day job related inputs.Day Job Income: How much did you earn at your day job? Day Job 401k: Did you contribute to your work 401 plan? If so, how much?Day Job Catchup: Did you make a catchup contribution do your work 401 plan? How much?

Recommended Reading: How To Open A Solar Panel Business

Solo 401k Contributions Consist Of Two Components

Remember that the maximum Solo 401k contribution is comprised of two components:

- Employer profit sharing contribution

- Employee salary deferral contribution

Once the incorporated business owners compensation is determined , the maximum Solo 401k contribution may be determined as follows, based on 2019 and 2020 limitation.

pre-tax See the following IRS page for more on this:

Nership Or Multi Member Llc

Now lets say that Kyle converts his business from an S-corp to a multi member LLC, and earns $65,000. He has several business partners but no employees.

He may still defer $19,500 as an employee and $6,500 as a catch up contribution. But since he no longer has W-2 wages, he bases his profit sharing contribution on the K-1 income attributable to self-employment earnings. His total contribution limit would be $19,500 + $6,500 + $16,250 = $42,250.

Read Also: How Much Is The Government Rebate On Solar

Who Should Choose A Sep Ira Instead Of A Solo 401

When a newly minted entrepreneur or gig worker lands at Henrys door and asks whether to open an SEP IRA or a solo 401, he asks one question: Do you have any plans to hire an employee, even in the future? If the answer is maybe, he steers them toward an SEP IRA, which can be used to fund employee retirements.

Remember: Hiring just one employee for your business in the futurebeyond your spousewould eliminate the solo 401 as an option. And switching from a solo 401 to an SEP IRA at some future date can be a big hassle, Henry warns.

Entrepreneurs who go with an SEP IRA because of potential future hires have another important consideration: All employee contributions must be the same percentage of compensation. For instance, an entrepreneur who wants to put 10% of their net income into their SEP IRA must put 10% of worker pay into their SEP IRA, too.

But even in some cases where hiring employees simply isnt in the cards, Henry sometimes advises the self-employed to choose a SEP IRA. Simplified is in the plans name for a reason: They can be easier to set up than solo 401 plans, according to Henry, and theyre more widely available.

Every situation is different, and an individual should assess the option that is best for their financial goals, but there is some truth to the fact that a SEP is easier to open, says Cherill. In fact, most taxpayers can simply open a SEP account online with their brokerage firm and manage it themselves.

Solo 401k Calculator For S Corp

- Pay yourself a reasonable wage on a W2. S-Corp owners are required to pay a reasonable wage that is subject to employment tax. Make sure you and your accountant agree on the wage first.

- Make your employee deferral of $19,000 via payroll deductions. Remember that the deferral is elective and is the lower of compensation or the $19,000.

- Consider how much profit sharing you want to contribute. Remember that profit sharing is elective as well. You can take your gross compensation at 25%. But your combined contributions cant exceed $56,000 for 2019 and $57,000 for 2020.

- Many accounts are opened at the large players like Vanguard, Fidelity, and Schwab. But you may be able to self-direct the funds and be your own custodian.

- Fund your account before the deadline. Dont forget to contribute the profit sharing contributions up to the date you file your taxes including extensions.

You May Like: Is Solar Power Cost Effective

How Much Can I Contribute Into An Individual 401k

Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. Enter your name, age and income and then click “Calculate.”

The result will show a comparison of how much could be contributed into an Individual 401k, SEP IRA, Defined Benefit Plan or SIMPLE IRA based on your income and age. If you are taxed as a sole proprietorship use your NET income when using the calculator. If you are incorporated, then only use your W-2 wages when using the calculator. For example, S corporation K-1 distributions are not included when making the contribution limit calculation.

Note: Consider a defined benefit plan if you want to contribute more than the 2021 Individual 401k contribution limit of $58,000. A 401k plan and a profit sharing plan can be combined with a defined benefit plan to maximize annual contributions. Total contributions can be $60,000 to $200,000 or more. We provide more information about them on our website www.definedbenefitplan.com.

Solo Contributions Vs Other Plans

In comparison with other popular retirement plans, the solo 401 plan has high contribution limits as outlined above, which is the key component that attracts owners of small businesses. Some other retirement plans also limit the contributions by employers or set lower limits on salary-deferred contributions.

The following is a summary of contribution comparisons for the employer plans generally used by small businesses.

| Account |

| $3,000 for 2021 and 2022 |

Also Check: How Do You Make A Solar System

Learn More About The Benefits Of The Solo 401k

- Solo 401k Information, Rules and Frequently Asked Questions about the Solo 401k.

- Solo 401k Eligibility Learn about the eligibility rules and find out who is eligible and who is ineligible to establish a Solo 401k plan.

- Solo 401k Loan A 401k loan up 50% of the total value of the 401k up to a maximum loan of $50,000 is permitted with a Solo 401k plan.

- Solo Roth 401k There is an option to make Roth 401k contributions with the salary deferral portion of the Solo 401k. Contributions into a Roth 401k are not tax deductible, but withdrawals are tax free after age 59 ½.Solo 401k Rollover You can rollover your 401k, 403b, 457, TSP and Defined Benefit Plan from a previous employer. You can also rollover a Traditional IRA, SEP IRA, Rollover IRA, SIMPLE IRA and Keogh plan.

- Solo 401k Providers Learn about the 3 main types of Solo 401k providers and the investment options available with each Solo 401k provider.

- Self Employed Retirement Plan Comparison Compare the Solo 401k, SEP IRA, Defined Benefit Plan and Simple IRA.

How Are The Solo 401k Contribution Limits Calculated

The 2020 Solo 401k contribution limits are $57,000 and $63,500 if age 50 or older . The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit.

Don’t Miss: How Many Solar Panels Does My House Need

Change In Business Name Affect On Contributions Question:

You can still setup the solo 401k in 2021 under your sole proprietor business. Next year in 2022, we can update the plan to list the new self-employed business. All else would remain the same . The 2022 annual solo 401k contributions would be based on your new self-employment income and you would have until 2023 to make those contributions.

Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Don’t Miss: How To Start A Sole Proprietorship In Washington State

Who Is Eligible For Individual 401 Plans

A common misconception about the solo 401 is that it can be used only by sole proprietors. In fact, the solo 401 plan may be used by any small businesses, including corporations, limited liability companies , and partnerships. The only limitation is that the only eligible plan participants are the business owners and their spouses, provided they are employed by the business.

A person who works for one company and participates in its 401 can also establish a solo 401 for a small business they run on the side, funding it with earnings from that venture. However, the aggregate annual contributions to both plans cannot collectively exceed the IRS-established maximums.

The Results Can Be Pretty Incredible

Of course, many self-employed people don’t have the ability to contribute the maximum amount allowed to a solo 401. However, even modest contributions add up over time.

For example, let’s say that you’re self-employed and that you’ll have $80,000 in net self-employment income for 2021. You decide to set aside a total of 10% of your net self-employment income in a solo 401. Not only could this reduce your taxable income by $8,000 for the year, but if you repeat the process every year, you could end up with a retirement nest egg of more than $928,000 after 30 years — and that assumes just 2% annual income increases and a historically conservative 7% annual rate of return.

Imagine if you decided to invest even more. With a solo 401, you can dramatically reduce your taxable income while building up a million-dollar nest egg.

You May Like: How Much Is The Cheapest Solar Panel

Solo 401k Worker Contribution Limits

Once more, as beforehand famous, the Solo 401k has two elements: the employer contribution half and the worker contribution half.

The worker contribution portion of a Solo 401k is just about like a standard 401k. Youre restricted to the identical quantity that you simplyre allowed to contribute to different 401k plans, $18,500 as of 2018. This restrict applies throughout your whole 401k accounts, which implies that the whole quantity of your worker contribution is proscribed to $18,500 whole between any 401k accounts that you simply may need. If you happen to contribute $18,500 to your 401k at work, for instance, you can not make an worker contribution into your Solo 401k.

Thats fairly easy and straightforward to know. Lets take a look at the instance the place we now have $10,000 in internet income . There are mainly three conditions doable:

- If we now have no worker contributions in any 401k plans, wed be capable of contribute the complete $9,293.52 as an worker contribution to our Solo 401k.

- If we already maxed out our 401k at work, wed not be eligible to make any worker contribution to our Solo 401k.

- If we put some cash into our work 401k plan, then wed have a smaller worker contribution restrict in our Solo 401k. For instance, if we had contributed $17,500 to our work 401k plan, wed solely be capable of contribute $1,000 as an worker contribution in our Solo 401k.

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

Read Also: Can I Convert My Sole Proprietorship To An Llc

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $20,500 in 2022 , or $27,000 in 2022 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $61,000 for 2022 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.