Apply For A Sole Proprietorship Tax Id Number Online

As a sole proprietor, the fastest way to apply for a Tax ID Number is online. Through an online application, a Tax ID Service will be able to collect your business and personal information, and then process it for you. You should be able to get a Tax ID Number within an hour.

To apply for a sole proprietorship tax ID online, have the following information ready:

- Your basic business information, including the industry you work in, and your reason for getting an EIN number now.

- Your personal information, including your full legal name, your SSN, and your ITIN.

Getting an EIN Number online is as simple as filling out the relevant documentation. You can also acquire a Tax ID Number through mail or fax.

When Is An Ein Required For A Sole Proprietor

Basically, getting an EIN allows you, as a sole proprietor, to do make more business moves. Without an EIN, a sole proprietor would not be able to:

- Hire employees

- Have a Keogh or 401

- Buy an existing business

- Form an LLC

- File for bankruptcy

In addition, theres going to be some banks that refuse to set up a business account for you unless you have an EIN.

Even if those are things you dont think youre ever going to need, there are still a number of reasons why having an EIN is a good idea.

- EINs can help you avoid identity theft. Identity thieves can steal social security numbers to file fraudulent tax returns.

- EINs can help you establish independent contractor status. Independent contractor status is distinct from employee status. Using an EIN can make you more attractive to potential clients.

How To Lookup An Ein Number

Finding your EIN or another company’s number is a simple procedure. Try the following if you lost your EIN:

- Pull your last tax return and lookup your EIN

- Search your files and find the original IRS notice with the EIN assignment

- If you assigned the EIN to your business bank account, the bank will have it on file

- Last resort is to call the IRS and recover it over the phone. Be prepared to verify your identity to the IRS customer service representative

If the company is privately owned and you have a legitimate business reason to know a company’s EIN, it’s always best to contact them first and request their number. Alternatively, you can use a legal search engine such as Lexis or Westlaw to pull up an EIN.

You can also enter the company name into a specialized search engine such as KnowX. Keep in mind that Lexis, Westlaw, and KnowX charge a fee for use.

Recommended Reading: How To Heal Solar Plexus Chakra

Sole Proprietorship Ein Requirements

The IRS provides a simple questionnaire on its website to help sole proprietors determine if they need to apply for an EIN. Businesses who have employees must file for an EIN. If a business withholds taxes on income paid to non-resident aliens for anything other than wages, it must also file for an EIN. Other conditions that require filing for an EIN include having a retirement plan and/or filing tax returns for excise, tobacco, alcohol or firearms.

When Is An Ein Required For A Sole Proprietorship

Per the IRS, A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN. Once you hire employees or file excise or pension plan tax returns, you will immediately require an EIN.

A sole proprietor with an existing EIN who becomes a sole owner of a limited liability company will require another EIN for the LLC.

You May Like: How Much Power Does A 100 Watt Solar Panel Produce

Use The Right Technology Tools To Skyrocket Your Sole Proprietorship

As a new business owner, growing your business is the number one priority. In fact, 67% of small businesses fail within the first ten years. In fact, the second leading reason for small business failure is due to inadequate business management. This can be related to poor inventory management, staffing, sales reports, etc, Whether youre a retailer or a small business owner , the importance of having a cutting-edge POS system is no longer in question to better manage your small business. Thats why were so proud to offer KORONA POS. It is a cloud-POS system that helps you with a wide variety of business operations:

- Fast transactions and user-friendly

- Employee and cashier permissions

- Promotions and point-based loyalty programs

In addition to all these features, KORONA POS has a customer support team ready to assist you 24/7. Plus, we constantly improve our software with new features based off of our customers suggestions. Try KORONA POS for free now to help your business turn from a sole proprietorship to an LLC, a chain, or a franchise!

Sole Proprietorship Vs Corporation

A corporation is a legal entity separate from the owners. This type of business structure provides legal protection against losses and liabilities, although it is rather procedural and time-consuming to create. Even if the owners cannot fulfill their responsibilities, corporations continue to operate, which is not the case with sole proprietorships. In terms of employee taxation, corporations have greater flexibility and adaptability.

You May Like: How Much Solar For A House

How To Find An Existing Ein

1

Use you Social Security number as your EIN. Although your Social Security number is not an official EIN, you may not have applied for an EIN. The IRS does not require sole proprietors to apply for an EIN if they do not have employees or pay special taxes.

2

Contact your bank. If you cannot use your Social Security number, you can try to obtain your EIN from the bank at which you opened your business checking account. Your bank may have required an EIN in order to open your business account. The IRS recommends contacting your bank before requesting its assistance.

3

Locate your original EIN transmittal notice from the IRS. If you can’t find it, you will need to contact the IRS directly.

4

Contact the IRS by calling the agency’s toll-free Business and Specialty Tax Line. An IRS representative will verify your identity before providing you with your EIN number.

Reasons Why You Need An Ein Number And How To Apply

Identity protection, professionalism, and business growth are some of the benefits of having an EIN number

No account yet? Register

An Employer Identification Number is an important tool every business should have. These 9-digit ID numbers separate your personal and business finances as well as provide legitimacy for your organization. For sole proprietors, the EIN may seem unnecessary, but the benefits of having one outweigh the minimal amount of time it takes to get one.

The IRS provides EIN free of charge to any business owner. The application process takes less than 10 minutes and the number is assigned immediately. The IRS issues a printable copy of EIN information you can take to the bank or provide to license boards, clients, and vendors.

No matter what the size of your business, even if its only a part-time gig, an EIN is an important tool to have. Heres why.

Also Check: Where Do Solar Panels Come From

Foreign Nationals: Individual Taxpayer Identification Number

For those who do not have a Social Security Number — such as nonresidents and resident aliens — they may need to apply for an individual taxpayer identification number , which is also nine digits. To apply, you’ll need to file Form W-7: IRS Application for Individual Taxpayer Identification Number. You will be asked to provide proof of your legal resident or visitor status and will have to file it through an “Acceptance Agent” authorized by the IRS.

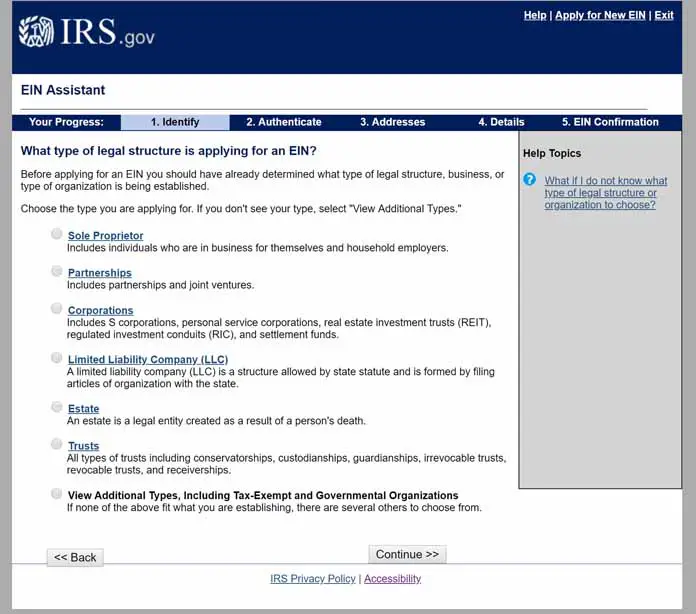

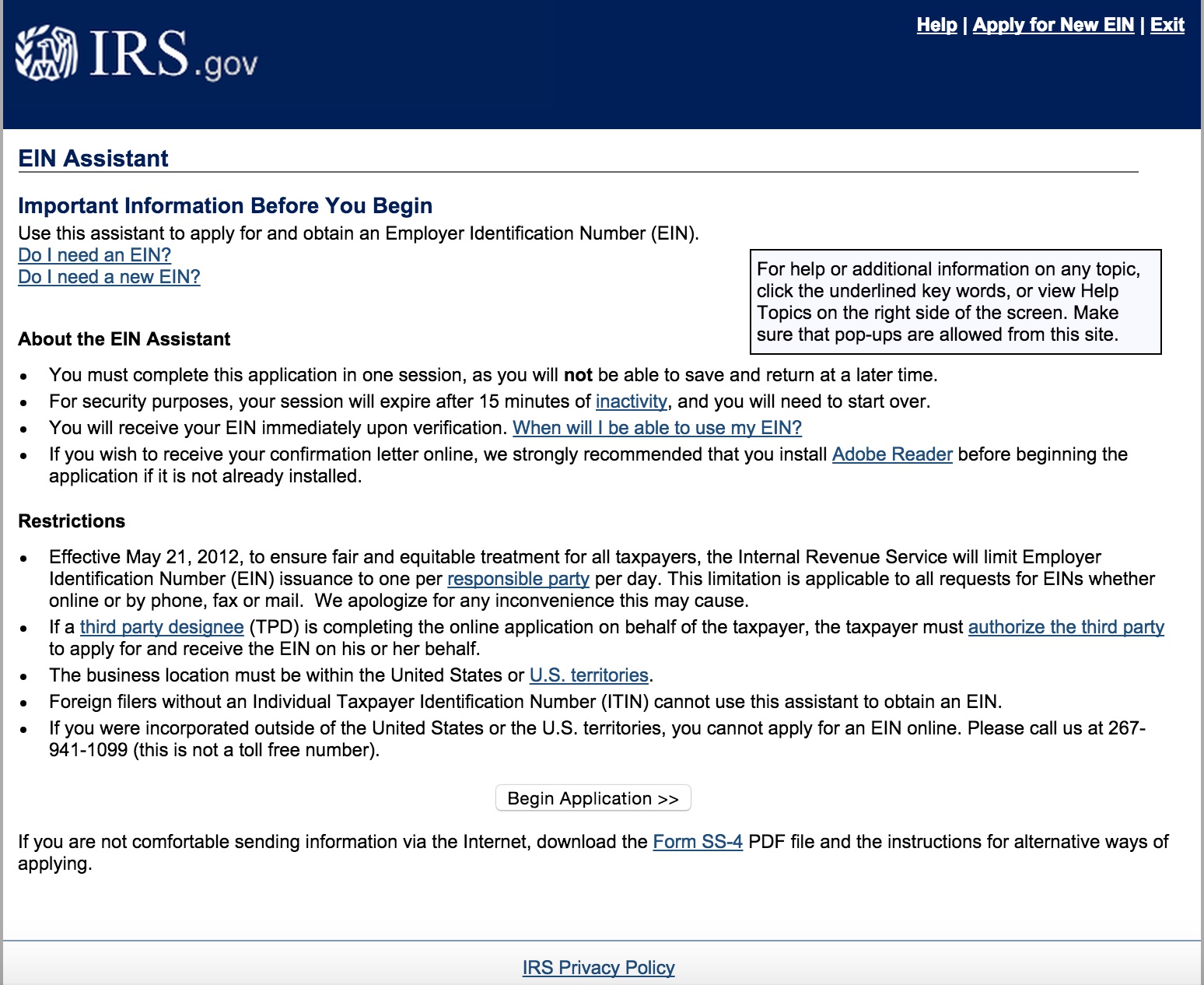

How To Apply For Ein

So you need to get an EIN, do you? If so, youve come to the right place.

Applying for an EIN does not cost anything. And when it comes to how to get an EIN, you have optionsthree options to be exact. You can apply online, via fax, or through the mail. If you are an international applicant, you can apply over the phone.

Keep in mind that you cannot apply for more than one EIN number per day if you own multiple businesses.

Regardless of the method you choose, the information you provide the IRS is the same. Youll need to disclose things like:

- Legal name

There is no way to save your application and return to it. Online EIN application sessions expire after 15 minutes of inactivity, so plan your time well or risk losing your progress.

| Alert: If you previously obtained an EIN online, you cannot apply online again. Instead, you must apply via fax or mail. |

Read Also: How Fast Do Solar Panels Pay For Themselves

Why Might You Need An Ein

You may need to obtain an EIN for a number of reasons, including business, estate, or trust banking, and hiring employees. Businesses also need EINs when they are required to file employment tax returns excise tax returns or alcohol, tobacco, and firearms returns. The following are reasons why you may need an EIN:

- Banking and finance In many cases, banks and credit unions require a valid EIN in order to open a bank account for any type of business, an estate, or non-grantor trusts. Having an EIN may also be helpful for a business seeking to obtain financing or working capital.

- Employees If you are hiring employees , you will need an EIN. This is the number the IRS will use to track your payroll tax remittances. Business owners establishing a form of business other than a sole proprietorship will also need an EIN, regardless of whether or not the business will have any employees. Your EIN will be used to track your business income taxes.

- Self-employed retirement plans A self-employed person who decides to establish a Keogh or Solo 401 plan will need to obtain an EIN in order to facilitate those types of plans federal tax treatment.

- Situations where sole proprietors may need an EIN Sole proprietors who are filing for bankruptcy for their business will need an EIN, as will those who purchase or inherit an existing business that they intend to run as a sole proprietorship going forward.

Why Do I Need A Tax Id Number For My Sole Proprietorship

A Tax ID Number is used to pay federal taxes and to hire employees, thats why its also called an Employer Identification Number. Yet many sole proprietors file as a Schedule C company, and they use their social security number rather than a dedicated tax ID. So why should a sole proprietorship get an EIN?

Well, a sole proprietorship still needs an EIN Number to:

- Hire employees. While 1099 contractors can be hired by an individual , hiring actual employees requires that you fill out W9 forms and submit W2 forms. These require that you have an EIN or Tax ID Number.

- Start a 401 and other retirement accounts. Many retirement accounts are only for businesses and business owners, including solo 401s. You cant acquire one of these accounts without an EIN.

- Incorporation of your business. If, in the future, you want to start an LLC, you will need to get an EIN number. Many businesses start as sole proprietorships but eventually incorporate for further protections.

An EIN Number is fast and affordable to get, so theres no reason not to get one, especially if you might need one in the future.

Ultimately, EIN numbers make it easier for even a sole proprietorship to separate business and personal transactions and documents. An EIN Number can be acquired through an online application, with the help of a Tax ID Service.

Recommended Reading: Is Solar Worth It In Maryland

Does A Sole Proprietor Need An Ein

The EIN or Employer Identification Number is a unique identifying number with the Internal Revenue Service for a business. A sole proprietor is not required to have an EIN unless they have employees. A sole proprietorship without employees will simply use the owners social security number .

Some sole proprietors will get an EIN even if they are not required to as some of their clients will require the business to supply an identifying number which will be used to issue a 1099 at the end of the year. They could choose to use their SSN, but dont want to share it for privacy reasons.

Applying for an EIN for a sole proprietorship with the IRS takes about 5 minutes and there is no cost.

When Are Payments Due

Taxes for self-employed individuals is based on the calendar tax year. As discussed earlier a new, first-year business can pay federal taxes at the end of the first year and then may have to pay taxes quarterly . Quarterly payments are due based on the 15th the month after a calendar quarter. For instance, the first quarter is January, February and March. Those taxes would be due on April 15th. The remaining quarters are due June 15, September 15 and January 15.

Don’t Miss: How Much Power Can I Get From Solar Panels

Apply For A Sole Proprietorship Tax Id Number Via Mail Or Fax

If you dont need your tax ID number urgently, you can print out your form and send it in via mail or fax. If you send it in via mail, the form may take anywhere from four to six weeks to process: it depends on the time of year and how busy it is. If you send it in via fax, you will usually get a response faster: normally within three to five business days.

Either way, you wont be able to receive your EIN Number as quickly as sending in the form online, and you will need the same information. An online form is usually the fastest and most convenient option.

How Do I Obtain A Tax Id Number For My Sole Proprietorship

You can apply for a Tax ID Number online, through mail, or through fax. By using a Tax ID Service, you can have your application prepared for you and send in you can usually receive an EIN Number within an hour, as long as all of the information on the application is correct.

A Tax ID Service will collect your personal and business information and submit it for you, making sure that the process is smooth and fast. If you need an EIN Number quickly, you can get one online fast.

Also Check: How Feasible Is Solar Energy

How Long Does It Take To Get An Ein

Your EIN processing time depends on how you apply for it. According to the IRS, this is how long it could take to get your number:

- Online: Immediately. Download, save, or print your EIN confirmation notice for your records.

- Fax: Four business days if you provide a return fax number about two weeks if you do not.

- Mail: Four or five weeks. Be prepared to wait, as mailing your application has the lengthiest processing times.

If you dont receive your Employer Identification Number in time to file your tax return, write Applied For in the EIN space.

Can I Use My Social Security Number Instead Of An Ein

In some cases, you can use your Social Security number instead of an EIN, but using an EIN provides a level of personal protection against identity theft. An EIN separates your personal finances from your business finances. Once you have an EIN, you dont have to provide your Social Security number to clients or vendors who you do business with. In the case of foreign nationals starting businesses in the U.S., an EIN can come in handy when applying for a business credit card or opening a business bank account before they get a Social Security number.

Read Also: How Much To Register Sole Proprietorship

So What Should You Do

If you decide to form an LLC, wait for your LLC to be approved, then apply for a new EIN for your LLC.

Note: In a few states, you actually need to get your EIN before your LLC is filed , however, in most states, you want to wait for your LLC to be approved before applying for your EIN. Check out our how to form an LLC page for instructions on all 50 states.

You dont have to write final return on your Sole Proprietor Schedule C. Youll just file a new Schedule C to report the LLCs income for next tax year. If your Sole Proprietorship has a DBA, you can cancel/withdraw it after your close your Sole Proprietorship.

Why You May Want An Ein Even If It Is Not Required

Even though most sole proprietors will not need to obtain an EIN, it can be beneficial to obtain one in some cases.

First, sole proprietors who act as independent contractors can help protect their identities by obtaining and using an EIN with their clients, rather than providing their own Social Security Numbers.

Having an EIN may also make an independent contractor or sole proprietor appear more professional to potential clients. Some sole proprietors find this helps them land and solidify client relationships more easily.

Don’t Miss: How Many Solar Panels For 5000 Watts

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.