How To Finance Your Real Estate Investments With A Solo 401

If you create a self-directed individual retirement account by establishing a solo 401 or Roth Solo 401, you can use it to invest in real estate. This particular self-directed 401 was created by the IRS for those individuals who are self-employed, small business owners with no employees outside of themselves and a spouse, or for people who consistently generate a part of their income through self-employment. This 401 does not refer to the traditional, employment-sponsored 401 as that cannot be directly used to invest in real estate.

If this applies to you, read ahead to learn how you can make a solo 401 work for you.

What Are The Tax Benefits Of A Solo 401

Solo 401s share the same tax benefits as their traditional 401 counterparts.

You can elect to contribute pre-tax earnings to your Solo 401 and pay taxes when you distribute your funds during retirement. In turn, youâll lower your immediate income tax obligation.

Or, you can choose to contribute after-tax earnings into a Roth Solo 401, then your distributions during retirement would be tax-free.

Additionally, any matching contributions you make as your employer are tax-deductible for your business, lowering its tax obligation as well.

Drawbacks To The Solo 401

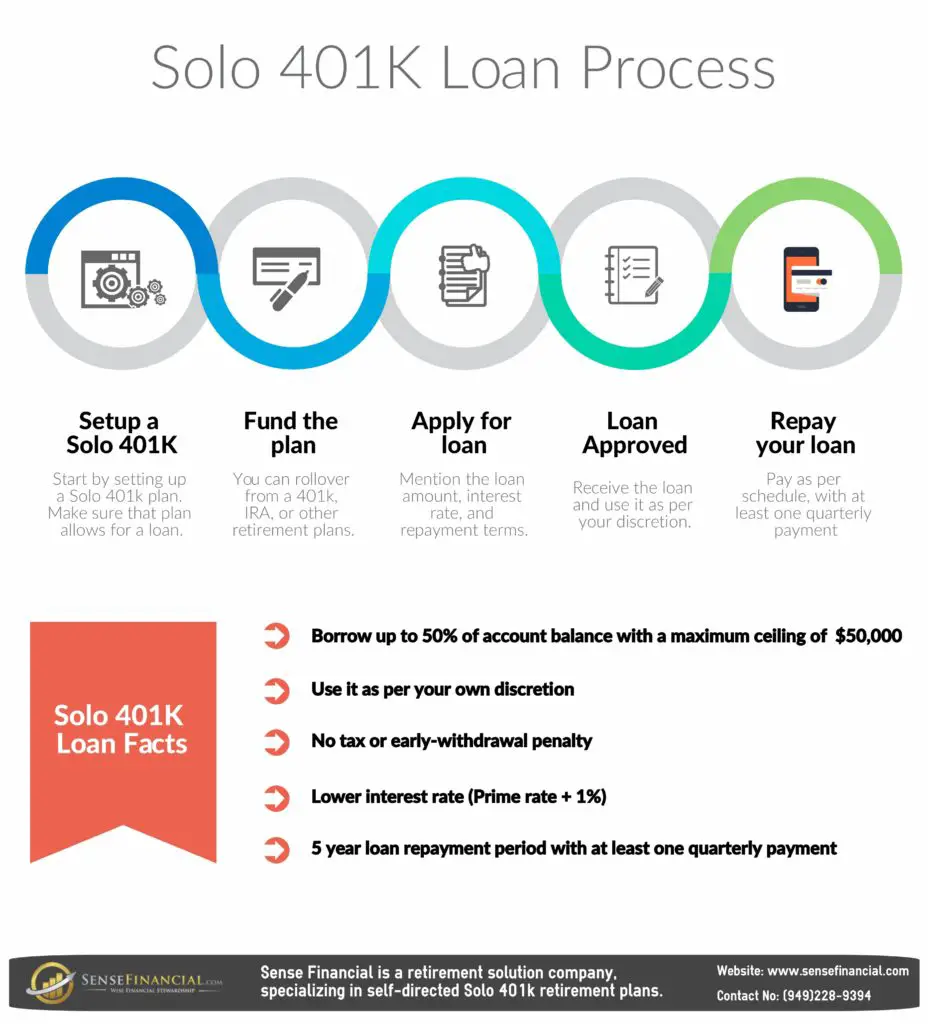

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

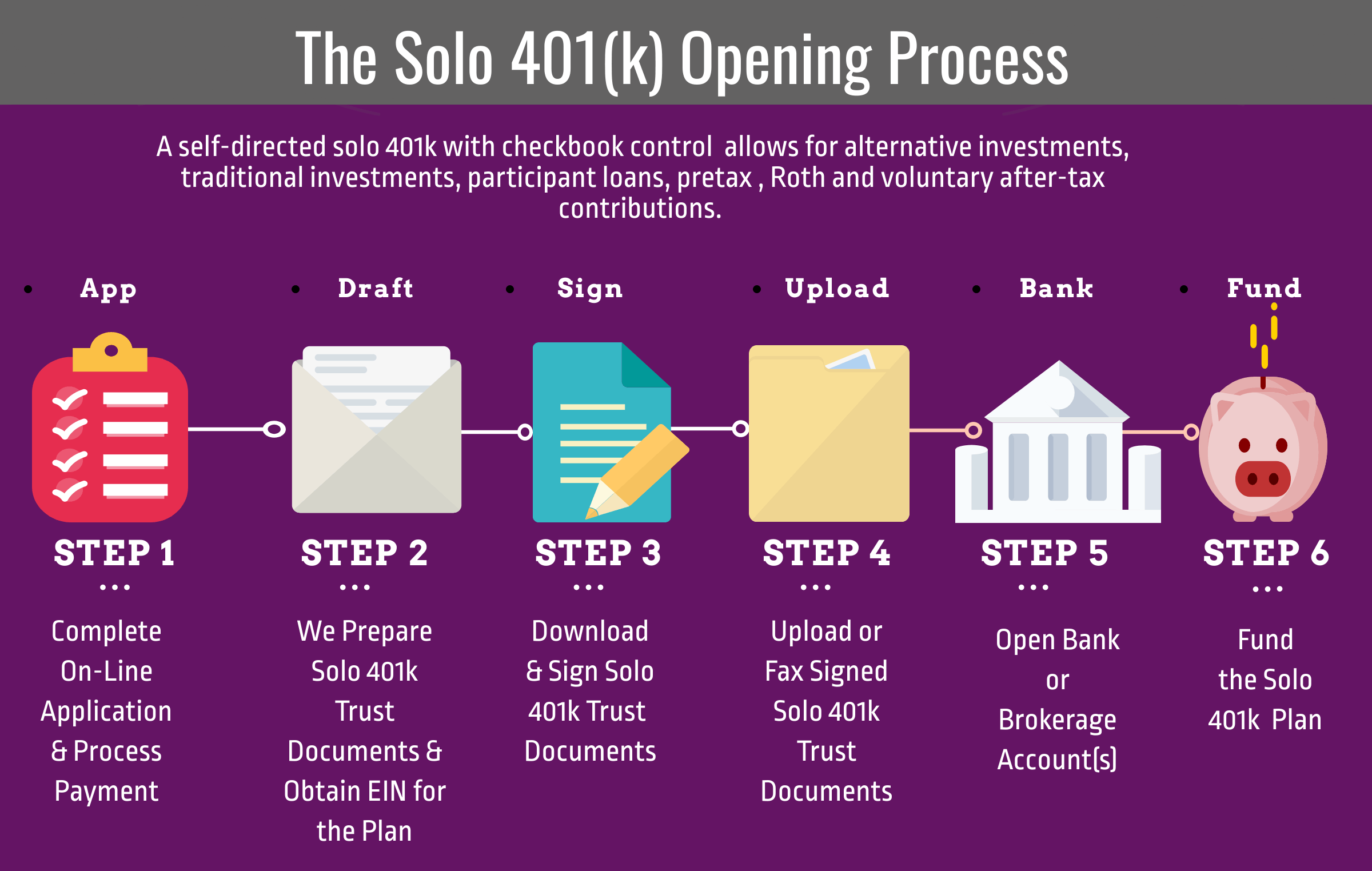

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

Read Also: Are Solar Panels Tax Deductible

What Is A Brokerage Firm

A brokerage firm is a company that helps buyers and sellers complete financial transactions. They earn money based on fees, or in some cases commissions, involved with the transaction. In many cases, special licensing is required to buy and sell financial products, which is where brokers are necessary and helpful. You might also find individual brokers who work independently, but typically brokers are connected to a larger team that can collaborate to help with transactions.

Why Start An Individual 401k

Again, the most important advantage of starting an individual 401k over other retirement accounts designed for sole owners is that you can reach your maximum contributions quicker.

You can make two types of contributions to the individual 401k. Again, these are:

There is also a catch-up contribution for participants 50 and older of $6,000. Lets take a look at what these contributions offer.

You May Like: How To Clean Solid Hardwood Floors

Contribution Limits For Self

You must make a special computation to figure the maximum amount of elective deferrals and nonelective contributions you can make for yourself. When figuring the contribution, compensation is your earned income, which is defined as net earnings from self-employment after deducting both:

- one-half of your self-employment tax, and

- contributions for yourself.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560, Retirement Plans for Small Business, for figuring your allowable contribution rate and tax deduction for your 401 plan contributions. See also Calculating Your Own Retirement Plan Contribution.

Rules Change Regarding Offering Solo 401k Plan To Par

QUESTION 5: Have the rules changed for 2020 regarding whether I can still fund my solo 401k if I have two part-time employees that work less than 1000 hrs/year, but more than 500 hrs/year? Would I have to open up retirement accounts for them?

ANSWER: In short yes resulting from the SECURE Act, but it would be for those part-time employees who satisfy the new rule by 2024. Effective for tax year 2021 , solo 401k plans will need to be offered to part-time employees who have three consecutive 12-month periods of 500 hours of service and who satisfy the plans minimum age requirement. Hours of service during 12-month periods beginning before January 1, 2021, are not taken into account for this rule. We are waiting for the IRS to release more guidance on this new rule in 2020. See Section 112 of the ACT for more information.

Last Weeks Most Popular Solo 401k FAQs

You May Like: What To Look For In Solar Panels

Solo 401 Features And Insights

-

The ability to support multi-owners and spouses with your plan

-

Government tax reporting including 1099R and signature-ready Form 5500 if needed

-

Roth 401 feature, Loan option, and allows for account consolidation / rollovers

-

The capability for one-time, web-based contribution and/or regular automated ACH deposits

-

Toll-free access to your ShareBuilder 401k advisor and customer care team

-

Automatic pricing discounts as your assets grow

-

Set roster of retirement appropriate, index-based investments and a money market

There is an ongoing price per month to support your plan for those with < $250,000. This amount lowers as your assets hit specific milestones and can be more than offset by the tax benefits for those regularly contributing to their account.

Find A Solo 401 Provider

Finding a provider to administer your Solo 401 is arguably the most important step in the process. Most people who want to set up a Solo 401 look for a simple, straightforward, and affordable plan. However, remember that these plans are all about your future individual goals and business plansyou want to ensure that your provider can help you with those.

When you start looking for a Solo 401 provider, its important to consider these three things:

- Costs: Many Solo 401 plans charge manageable and competitive fees

- Level of management: Not all providers will actively administer Solo 401 plans from the standpoint of annual regulatory and compliance filings some will provide you with the information thats needed to report at no cost but leave the responsibility for filing to you while other providers will offer more hands-on management for a monthly or annual fee

- Investment flexibility: Be sure to choose a provider thatll give you access to the investment options you want, in alignment with your financial needs

If you already have an investment account or IRA plan, you can ask your current advisor if they also offer a Solo 401. If your advisor is unable to help, make sure you shop around and choose a reputable company. Weve researched the best Solo 401 providers to help you in that process. These providers will offer a mix of quality services at affordable costs.

Read Also: How Much Does Solar Cost

Solo 401k Funding Option #: Cash Transfer

This is where only cash, not assets like mutual funds, are moved from former employer 401k to a Solo 401k. One has to communicate with the current 401k provider to request that their investment is sold before proceeding with the cash transfer. Partial or full investment may be processed and are also not taxable. Like In-kind transfers, cash transfers can also be processed before or after the Solo 401k establishment deadline.

Open An Account With Your Provider

Now that youve chosen your provider and obtained all required documents and disclosures, its time to open the Solo 401. This account should be formed any time prior to your tax-filing deadline and needs to be formed in accordance with any guidelines in your plan documents.

While youre allowed to set up a Solo 401 account after the year ends and make prior-year contributions in a way thats similar to how you fund an IRA, its typically a best practice to set up a new account in the year that itll be effective and make your first contributions in the same year.

You May Like: What Does A Solar Cover Do For A Pool

How To Set Up A Solo 401k Plan In 2020

The Solo 401 retirement plan, also called the self-employed 401 or individual 401, is similar to a traditional 401, except that it was designed to benefit business owners with no full-time employees .

The Solo 401k plan isnt a new type of plan, and not all plans are the same. In this article, well explain how to easily set up a Solo 401k plan to make traditional, as well as non-traditional investments.

Alternatives To Solo 401

If a solo 401 isnt the right fit, consider these four individual retirement account options that generally boast a larger selection of investment choices and lower administrative fees than 401s:

Traditional IRA

A traditional individual retirement account is another investment account that offers tax benefits. Your contributions may be tax-deductible, and you only pay taxes when you withdraw from your IRA.

The maximum annual amount you can contribute in 2020 and 2021 is $6,000 or $7,000 if youre at least 50 years old.

Roth IRA

Roth IRAs offer similar perks to traditional IRAs, except that you fund the account with post-tax money. That means your withdrawals are tax-free.

A simplified employee pension individual retirement account is an employer-sponsored retirement plan. Only employers can make contributions to the account, and the amount can vary each year.

If you use self-employed income to fund the account, youll have a higher contribution limit than a traditional or Roth IRA. The max contribution amount $58,000 for 2021.

Defined benefit plans

A defined benefit plan is a pension plan that calculates your retirement benefits based on a formula. Several factors that impact your retirement amount include your length of employment and salary.

Unlike 401s and IRAs, a defined-benefit plan doesnt depend on investment returns.

Recommended Reading: When Can I Introduce Solid Food To My Baby

How Does A Solo 401 Work

As a reminder, a Solo 401 plan is nothing more than an individual retirement plan for self-employed people or small businesses without any employees. Also, remember that a Solo 401 is nothing more than a vessel youll use to save for retirement. You still have to choose the investments youll use within your account to build wealth.

The biggest benefit of this account is the fact that individuals who use it can contribute considerably more than they can with a traditional 401 plan, which in turn helps these individuals save more for retirement and reduce their taxable income.

As an employer, one of the main features of a Solo 401 is that youll need to determine what your actual income is to determine your maximum employer contribution, which can be up to 25% of your compensation. According to the IRS, your compensation is earned income, defined as net earnings from self-employment after deducting one-half of your self-employment tax and contributions for yourself. But once again, this depends on the business structure for your company.

Solo 401 participants can open their account with any brokerage firm they want, although online providers have become extremely popular due to the fact you can get started at home and on your own time, and often with access to an array of helpful investing tools and resources. Online brokerage firms also tend to come with low costs overall, which is another reason investors seek them out.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

You May Like: How Much Value Does Solar Add

Other Benefits Of Solo 401s

The advantages of Solo 401s arent limited to taxes. If your spouse works with you at your companyeven part-timethey may be able to invest in a Solo 401 as well.

As long as your husband or wife works for you at least part-time, they can contribute up to $19,500 a year to a Solo 401, or up to $26,000 if theyre 50 or older. You, as their employer, can then contribute up to 25% of their compensation, up to a total of $58,000 in 2021 or $57,000 in 2020. This allows couples to invest more than $100,000 in tax-advantaged retirement accounts.

Individual 401k Retirement Plan

The individual 401k , self-directed 401, and one-participant plan) is not a new type of retirement plan. Its essentially a traditional 401, except the IRS designed it for one individual.

Prior to 2001, the individual 401k plan wasnt the most ideal retirement plan for the self-employed and small business owners. As a result, they chose the SEP IRA to avoid the administration, testing and plan document payments of the individual 401k.

Enter EGTRRA was signed into law in 2001, which gave the individual 401k more muscle. The EGTRRA gave the individual 401k:

- An employee deferral feature, like with a traditional 401 plan

- A profit sharing option, much like the SEP IRA

- The loan feature, allowing individuals to take out a $50,000 tax and penalty-free loan

- Roth features for tax-free gains

Perhaps the most significant advantage is that you can reach your maximum contribution faster than the SEP IRA, because the employee feature is dollar for dollar.

There are two eligibility requirements to establish an individual 401k:

If you previously or currently have an SEP IRA, compare this retirement account to the individual 401k. Youll see the differences right away.

Also Check: How To Charge Your Electric Car With Solar Panels

Traditional Or Roth Ira

If none of the above plans seems a good fit, you can start your own individual IRA. Both Roth and traditional individual retirement accounts are available to anyone with employment income, and that includes freelancers. Roth IRAs let you contribute after-tax dollars, while traditional IRAs let you contribute pretax dollars. In 2021, the maximum annual contribution is $6,000, $7,000 if you are age 50 or older, or your total earned income, whichever is less.

Most freelancers work for someone else before striking out on their own. If you had a retirement plan such as a 401, 403, or 457 with a former employer, the best way to manage the accumulated savings is often to transfer them to a rollover IRA or, alternatively, a one-participant 401.

Rolling over allows you to choose how to invest the money, rather than being limited by the choices in an employer-sponsored plan. Also, the transferred sum can jump-start you into saving in your new entrepreneurial career.

How To Open A Traditional And Roth Solo 401k

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Also Check: What Is The Tax Rebate For Solar Panels

Irc 401 Plans Establishing A 401 Plan

When you establish a 401 plan you must take certain basic actions. For instance, one of your decisions will be whether to set up the plan yourself or consult a professional or financial institution – such as a bank, mutual fund provider, or insurance company – to help you establish and maintain the plan.

Solo 401 Contribution Limits If You Participate In Another 401 Plan

If you have a Solo 401 but you also work for another company and participate in the companys 401, the limits on 401 employee contributions are cumulative across all your accounts. As an employee, you can only contribute up to $19,500 across all of your 401 plans.

However, employer contribution limits are based on plans, meaning two unrelated employers can contribute up to the employer maximum annually. As an employer, you can contribute up to 25% of your net-adjusted self-employment income or $58,000 in 2021 .

Note that anyone who is considering a Solo 401 to save earnings from a side job for retirement should check first with a tax professional or a CPA, who can help confirm your proper eligibility for the account, including your self-employment status.

Read Also: Can An Hoa Restrict Solar Panels