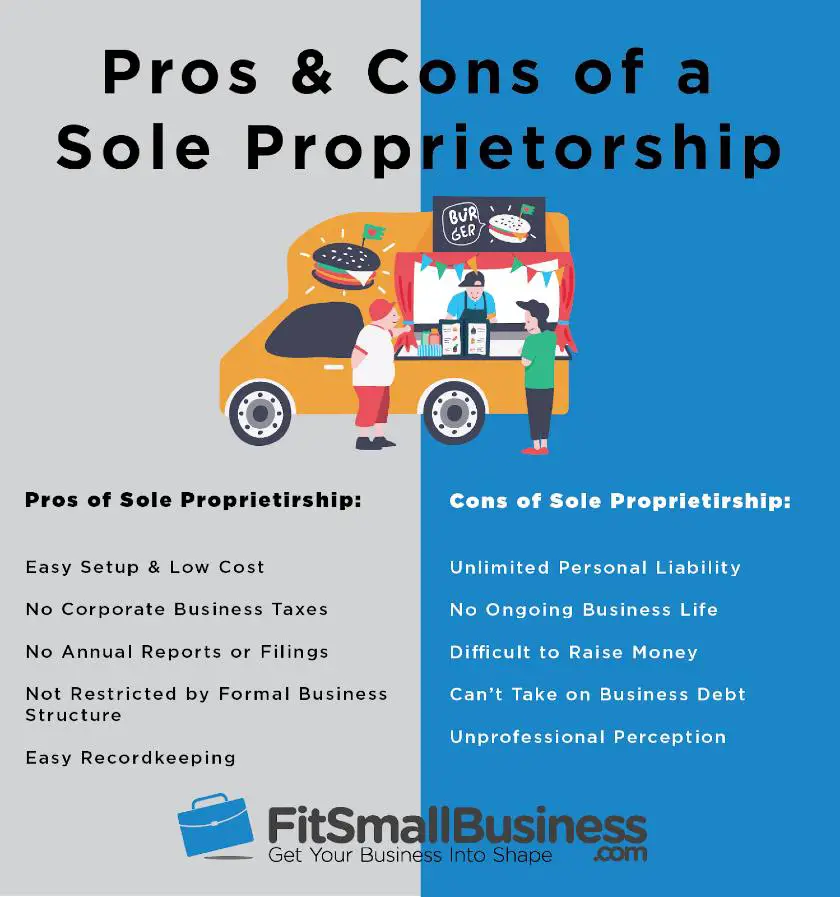

There Is No Limited Liability For Sole Proprietors

There are a lot of benefits that come with running your business as a sole proprietor, but one big drawback is that sole proprietorships dont provide owners with limited liability.

What does this mean? Well, as a sole proprietor, youre personally liable for all debts and other liabilities incurred by your business. A business creditor can go after all of your assets, including your personal assets, when you owe them money. This means that your personal bank accounts, car, and even your house could be at risk.

On top of that, sole proprietors are personally liable for business-related lawsuits. For example, if someone injures themselves in your office. Youd be personally sued for damages. Yikes!

But, wait, there is some good news here. If you still want to operate as a sole proprietor, you can give yourself some extra protection from these liabilities by investing in the appropriate business insurance.

Types Of Businesses That Do Well As Sole Proprietorships

Any one-owner business where the lack of limited liability isnt a big deal is a great candidate for a sole proprietorship.

Beyond that, businesses that incur little to no debt will also work well as sole proprietorships. Here are a few other things to consider:

- Sole proprietorships are inexpensive. That makes it a great choice for any business that expects to earn a low income, at least at first. New small businesses or side businesses are both great candidates. And, if your business ends up being successful, you can always switch to an LLC or corporation later.

- Most sole proprietorships are small operations that dont have employees. Theres no law that this needs to be the case, though, and some sole proprietors do own large companies that have employees. However, if youre ready to hire employees, its best to form a business entity like an LLC or a corporation. That way the entity, rather than you, will be the employer. This can help you avoid being held personally liable for your employees actions.

- Its easier to borrow money as an LLC. If you need to borrow a lot of money to get your business going, you might want to think about getting the limited liability status that comes with an LLC.

Is An Smllc Right For You

Consider that it might not be worth it to pay the extra $800 annually if youre running a small side business or a business that earns little to no profit. However, an LLC does come with limited liability, which is a huge plus, so you should form an SMLLC if you absolutely want and need that protection.

Whichever form of business you decide to pursue, keep in mind that your initial choice isnt permanent. You can always start out as a sole proprietor and establish an SMLLC later, as your business grows.

No matter what, Collective can help along the way. We help you form and maintain your SMLLC so that you dont miss any important documents or deadlines.

Don’t Miss: How Does No Cost Solar Work

How To Form An Llc

Below are several of the steps involved in forming an LLC. However, please check with your local state since they may have additional forms and requirements.

It’s important to note that the above list is not comprehensive since each state may have additional requirements. Once established, many states require LLCs to file an annual report, which the state may charge a fee. These fees can sometimes run in the hundreds of dollars per year.

Sole Proprietorship Vs Llc Taxes

When it comes to sole proprietorship vs LLC taxes, not much changes. The IRS doesnt see the LLC as a separate business entity so an LLC passes its profits to the owners who file personal income taxes.

The same is true for a sole proprietorship. The two types file taxes exactly the same way, with the only difference being an LLC usually has multiple members who share the profit/loss and expenses of the business.

The only situation in which your LLC taxes will be different than taxes as a sole proprietorship is if you choose to have your LLC taxed as a corporation.

Also Check: How Much Solar Energy Do I Need For My Home

Disadvantages Of An Llc

While LLCs provide very welcome protections and flexibility for small businesses, there are some drawbacks to consider.

- Complexity: LLCs are more complicated to set up and run than sole proprietorships. To form an LLC, the business will need to conduct a name availability search to see if there are competing businesses with the same name and to ensure that the name meets any state regulations for the specific business type. The business will also need to file formation documents with the state and appoint a registered agent to receive legal notices and other official documents. In many states, the business will have ongoing filing requirements such as annual reports. Greater tax options further add to the complexity.

- Costs: To establish an LLC, you can expect to pay state fees ranging from $50 to $300, along with additional fees for ongoing filings. Youll also need to invest time in completing the filings or pay a service to handle the paperwork for you. All of this adds up to greater administrative costs to set up and maintain the business entity.

What Is A Single Member Llc

A single member LLC is similar to a sole proprietorship as there is only one owner, however unlike the sole proprietorship they will be protected with limited liability. A single member LLC will have to follow the same formation guidelines as a normal LLC, but they are not allowed to have multiple owners.

You May Like: What Is The Best Retirement Plan For A Sole Proprietor

When Should A Sole Proprietor Become An Llc

The decision is ultimately yours. But keep in mind that as a new business, legal protection can be important to your well-being and the longevity of your endeavor. Forming an LLC early on can help protect you personally from business liability. It can also make your business appear more stable to lenders and vendors, as well as customers and business partners. In that sense, it can be an investment in your success.

Running a sole prop is as simple as getting to work and tracking your income and keeping it separate. You are the owner and the business, so all decisions are yours to make. That makes it easy to get started, but as your business grows you take on more risk.

If You Have A Sole Proprietorship When Should You Form An Llc

It is time to go from a sole proprietorship to an LLC when you are ready to grow your business and earn a profit.

Sole proprietorships are only good for very low-profit/low-risk businesses.

Example: A sole proprietorship can be a good way to start out if you are doing business on a small scale or want to try out a low-risk venture to see how successful it will be.

Forming an LLC allows business owners to grow their businesses and take on risk. This is because LLCs provide personal liability protection.

What is personal liability protection? When a business owner has personal liability protection, they cant be held personally responsible if the business suffers a loss. This means personal assets are protected.

Don’t Miss: How To Use Solar Panels During Power Outage

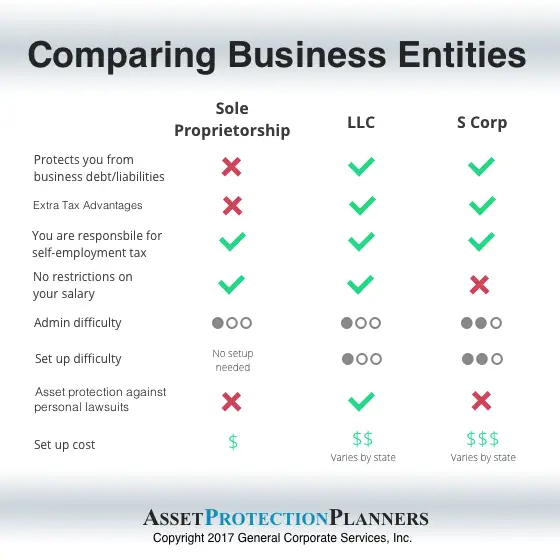

At A Glance: Sole Proprietorship Vs Llc

Sole proprietorships and limited liability companies are two of the most common business structures for individuals and small businesses. A sole proprietorship is the simplest and requires minimal paperwork. An LLC requires upfront paperwork and costs but could provide your business long-term benefits that make the investment worth it. Legal protection and potential tax advantages are two big factors to consider when choosing between a sole proprietorship and an LLC.

Who Pays More Taxes An Llc Or S Corp

It depends on how the business is established for tax purposes and how much profit is going to be generated. Both an LLC and S corp can be taxed at the personal income tax level. LLCs are often taxed using personal rates, but some LLC owners choose to be taxed as a separate entity with its own federal ID number. S corporation owners must be paid a salary in which they pay Social Security and Medicare taxes. However, dividend income or some of the remaining profits can be passed through to the owner, but not as an employee, meaning they won’t pay Social Security and Medicare taxes on those funds.

Also Check: How Often Do You Need To Clean Solar Panels

Create An Llc Operating Agreement

Creating an LLC operating agreement is the only way for you and your members to legally define your roles and lock down your LLCs management and ownership structure. Having this document in place will also give you something to return to if theres a dispute.

An operating agreement isnt filed with the state its stored in your company records. The operating agreement should outline:

- each members responsibilities.

- how new members will be admitted.

- how existing members may transfer or terminate their membership.

- how profits and dividends are to be distributed.

With The Correct Business Structure Success Awaits

Just as every small business is different, so will the best option for said business. And, yes, as your company grows and changes, you can change the business structure. Consulting a respected, trustworthy tax attorney or business advisor is a good first step in determining which business structure will be the best option for you.

Once youve decided which legal structure and name youll choose for your business, the next step is to create a brand for your company. Here you can learn how to do that:

Dont Miss: How Much Would You Save With Solar Panels

Don’t Miss: How Many Kw Does A Solar Panel Generate

How Does The Management Structure Differ

In an LLC, the business can be owned by one or more members. Its members usually manage an LLC, but they can also appoint a manager to handle the day-to-day operation.

The membership of an LLC and the way it will be run are laid out in a legal document known as an operating agreement.

In a sole proprietorship, you are truly the boss and call all the shots. There are no partners or members to deal with.

Llc Vs Sole Proprietorship Taxes

-

Sole Proprietorship

The owner of a sole proprietorship must file a personal income tax return and report all business income and losses. As the sole owner, with no employer, you have no one withholding income taxes from your own paycheck, which means that youre in charge of setting aside money to pay the estimated amount of personal income tax at the end of each year. Sole proprietors must also pay self-employment taxes, which encompasses Social Security and Medicare, with tax rates of 12.4% and 2.9%, respectively.

One of the biggest advantages of sole proprietorship businesses includes their simple tax business structure. But the self-employment tax and potentially higher income tax do come as a downfall.

-

LLCs

LLCs have a much more complicated taxation arrangement but come with greater tax flexibilities compared to sole proprietorships. Multi-member LLCs can be taxed as partnerships, a C corporation or S corporation, with each requiring different IRS filing, as well as offering slightly different benefits.

One of the most significant LLC tax benefits is that LLCs have the option to be considered a pass-through entity eligible for pass-through taxation or to be taxed as a corporation. If treated as a pass-through entity, an LLC does not have to pay federal income tax. In this case, the members are the ones that pay taxes on their share of the profits the LLC makes. If treated as a corporation, income is taxed at a lower rate specific to corporations, as set by the IRS.

-

EIN

Also Check: Do Solar Panels Have To Go On The Roof

In Laymans Terms You Mean You Dont Want To Lose Your Personal Finances Or Assets Due To A Business Dispute

Right. If I operate my business as a sole proprietorship and there is a substantial claim against the business, I could lose my house and personal assets. However, assuming that the business is operated through an LLC and that LLC is properly formed and operated, then that LLC provides protection for the business owners home and other assets, even if there is a claim against the business.

Of course, this protection is not free. Whenever you form an entity, there are costs and hassles.

Whenever you form an entity, there are costs and hassles.

Chasalow

LLCs cost money to form, pay yearly fees to the state , and the owners need to follow certain rules to treat the LLC as separate from the owners personal assets.

Still, I think that almost all businesses should form an entity that provides limited liability protection. While it is important to recognize that some individuals are not ready to form an LLC , it is important to distinguish between being too early in the process to form and not wanting to spend the money. Operating a business comes with several costs. If the business cant afford those costs, it might mean painful as it is that the entrepreneur needs to reevaluate the underlying business itself.

Pros And Cons Of Llcs

LLCs are defined by their limited liability characteristic, which legally separates the owners business and personal assets without requiring separate taxation . If youve considered forming an LLC to protect your personal assets, but wondered if its worth the fees, youre not alone. Lets assess:

Don’t Miss: How Much Does A Solar Roof Cost

Llc Vs Sole Proprietorship: Which Should You Choose

Many business owners, particularly freelancers or consultants, start out as sole proprietors because its easy. Minimal paperwork is required at the outset, and theres no big outlay of cost, which is attractive for new entrepreneurs, particularly those testing a business idea. Taxes are also simple for sole proprietors, since a separate business tax return need not be filed.

The rubber hits the road as your business starts growing. A sole proprietorship structure offers no legal protection for your personal assets, so you could end up personally bankrupt if your business doesnt succeed as planned, or faces an unexpected challenge. LLC owners, on the other hand, arent personally liable for business debts, so you get more protection in the event of a business bankruptcy or business lawsuit.

On top of this, LLCs offer tax flexibility. Most LLC owners stick with pass-through taxation, which is how sole proprietors are taxed. However, you can elect corporate tax status for your LLC if doing so will save you more money. All 50 states recognize the LLC structure to encourage small business growth. The best business structure for you will depend on many factors, and its best to consult a business lawyer before making this important decision. However, due to the combination of liability protection and tax flexibility, an LLC is often a great fit for a small business owner.

A Review Of The Options

As we discussed at the beginning of the article, the choice of entity fundamentally boils down to a few key considerations:

From a tax standpoint, the S corporation offers a single layer of tax and earnings are not subject to FICA tax . Accordingly, most often the best choice for Point 1 is the S corporation.

Sole proprietorships win 1st place for Point 2. They are by far the least complex and have the lowest cost of setup and ongoing governance and administration. For multi-owner companies, a partnership or LLC wins out for simplicity.

Finally, from a liability standpoint, the LLC structure is hard to beat. It offers liability protection along with the choice of any of the four tax entity structures. A straight S corp or C corp are considered solid from a liability perspective as well.

Below is a table that hopefully lays all of the above out in a clear way.

You May Like: How Do You Recycle Solar Panels

Work As An Independent Contractor

An independent contractor is an individual or entity that agrees to undertake work for another entity. The work is undertaken not as an employee but as one who provides services independently.

Typically, an individual is considered an independent contractor where the recipient of services or the payer controls or directs only the result of the work. Such a person does not guide on what work needs to be done and how.

IRS considers professionals providing independent services like doctors, lawyers, etc as independent contractors.

Such professionals working as independent contractors are a part of the gig economy. It is where people earn income by providing work on demand.

Furthermore, the IRS considers independent contractors either as sole proprietors or single-member LLCs. This means that independent contractors are recognized as self-employed by the IRS.

Since you are considered self-employed, you do not receive a salary as an employee. Rather, you set your pay rates and payment schedules.

Accordingly, you are also not subject to pay any self-employment taxes like social security and medicare taxes, unlike employees.

An individual is considered to be a self-employed person if he:

- Carries out trade or business as a sole proprietor or as an independent contractor

- A member of a partnership that undertakes trade or business

- Carries out trade or business for himself

Recommended Reading: Why Is Solar So Expensive In The Us