How Do I Manage Ongoing Dba Name Compliance In Washington

The state of Washington does not require a renewal for your DBA name, so it is valid indefinitely until you decide to change or cancel it.

There are two ways to change your DBA name:

- File online

- By mail: Fill out the registration form and tick the box next to Change trade name. List your new DBA name under the endorsement section. Send the form with payment of $24 to the Business Licensing Service.

There is no fee to cancel your DBA name. You can withdraw your registration through one of the following channels:

- File online

- Fax a letter requesting the cancellation to 360-705-6699

- Mail a letter requesting the cancellation to:

Business Licensing Service

How Can I Get A Washington Phone Number For My Llc

Its a conundrum: you need a local number to display on your website and give to customers, but you dont want to make your personal number quite sopublic. We get it. And weve got you covered with Northwest Phone Service. We can provide you with a virtual phone number in any stateplus unlimited call forwarding and tons of easy-to-use features. You can try Phone Service free for 60 days when you hire us to form your LLC, and maintaining service is just $9 monthly after that. No contract required.

How To Start A Sole Proprietorship In Washington

If you want to become a Sole Proprietor in Washington, youre at the right place.

Here in Washington, small business owners and entrepreneurs can establish a sole proprietorship without filing any legal documents with the Washington state government.

Not from Washington? Learn to become a Sole Proprietor in any other State.

Point to Ponder! A sole proprietorship is not a formal/legal business entity like an LLC or a corporation. And there is no personal asset protection against any liability in the case of a sole proprietorship. Therefore we recommend forming an LLC, the most popular entity for small businesses. You can form an LLC by yourself or hire a service like Zenbusiness, to let them get the paperwork done for you.

A sole proprietorship is the most straightforward and easiest business model in the United States of America. Like every other state, in Washington too, you do not need to file any legal document with the state government of Washington to establish a one-person business also known as a sole proprietorship.

A sole proprietorship is the simplest and relatively an old business model in the USA. Although there is no formal set up process required in a sole proprietorship, yet there are few steps to follow that many sole proprietors find in their best interest.

You May Like: What Is The Best Efficiency Of Solar Panels

Open A Business Bank Account

A separate business bank account and debit/credit card for your Washington business is important because:

- your personal assets are kept separate from your business assets

- accounting and finances will be easier to manage

One of the main reasons courts are able to pierce the corporate veil is due to commingling of assets. This is when business and personal finances are mixed together.

Keeping your Washington businesss assets separate from your personal assets also helps keep clean records.

To learn how to open a bank account for your Washington state LLC, you can read this lesson: LLC business bank account.

Your bank will provide a debit card after the account is open. For additional credit and to earn cash back , you can also get a business credit card.

What Should I Know About Washington Llc Taxes

Washington is one of the few states with no personal income tax. Before you jump for joy, note that this doesnt mean your LLC has no tax obligations. Most significantly, Washington LLCs are subject to a gross receipts tax called the Business and Occupation Tax. The tax rate varies depending on the type of business your LLC performs. For instance, the rate for retailing is 0.471%.

State sales tax is 6.5%, but cities and counties can add on their own sales tax, making the average total sales tax rate 8.644%.

Don’t Miss: Do I Need A Tax Id Number For Sole Proprietorship

Choose A Business Idea

The first step for starting a business in Washington is having a good business idea. Maybe you already have an idea picked out, or maybe you are still deciding on one. Regardless, you can check out our library of business ideas to get detailed industry information, trends, costs to start, tips, and lots more.

Sole Proprietorship Washington State B Square Mall

Jun 1, 2021 For example, in Washington state, a sole proprietor who grosses more than $12,000 annually or who does not conduct business under his own

They are Sole Proprietorships, General and Limited Partnerships, Limited Liability Partnerships , Limited Liability Companies , S Corporations and

Online processes are offered by the Federal and State agencies responsible for overseeing these operations. Additional assistance can always be obtained from

Youre considered a sole proprietorship if you havent formed a business entity by filing paperwork with a state and are simply running a business in your own

Sole Proprietor. General Partnership. Unincorporated Associations. Limited Partnership *. Limited Liability Partnership *.

According to the State of Washington Business Licensing Service, sole proprietorships are the most common form of business entity.

14 steps1.Heed Washingtons naming requirements. There are specific naming requirements for LLCs in each state, including Washington.. Washington law requires that 2.Choose a unique name. Your business name must be unique from the name of any other company on file with the Secretary of State. It must be a company name 3.Check name availability. You can check name availability at the Washington Secretary of State business name database. This is a free online database of all

Don’t Miss: Do You Have To Clean Solar Panels

What Is A Sole Proprietorship

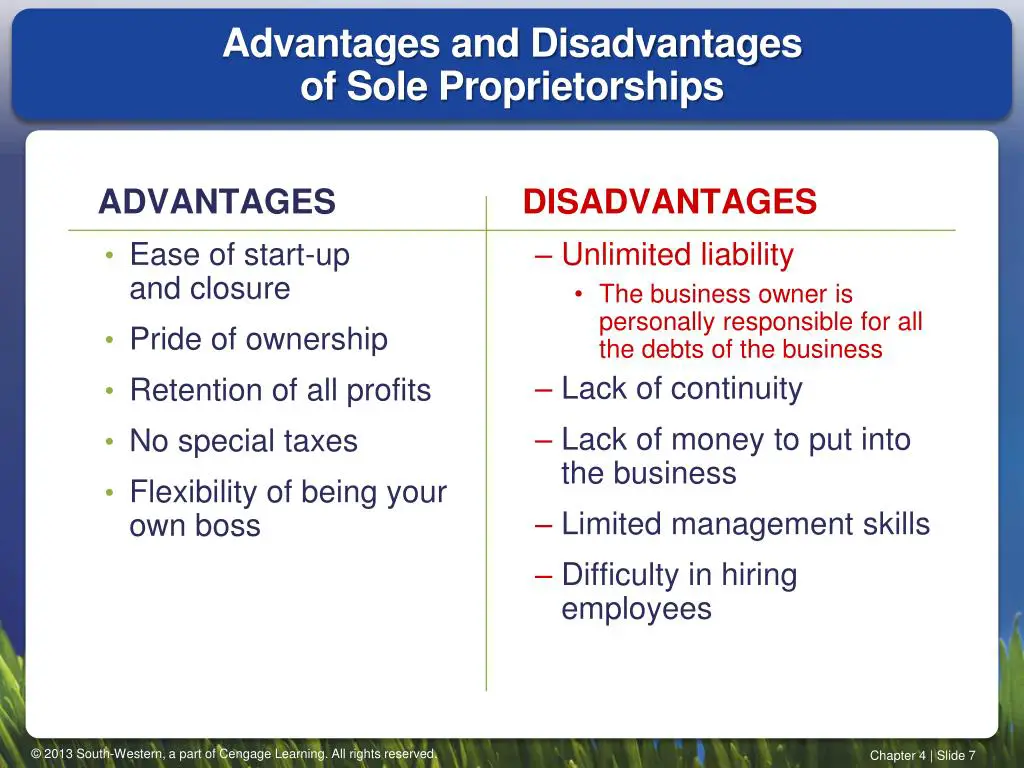

Sole Proprietorship Definition: A sole proprietorship is an informal, unincorporated business entity that isnt legally separated from its owner. Profit and losses are reported on the individuals tax return and the business owner is personally liable for all debt and risk.

Sole proprietorships are best for small businesses with the following characteristics:

- They MUST be low-profit and low-risk .

- They have a smaller customer base often friends, family, and neighbors.

- They sometimes start as hobbies like photography, blogging, or video streaming.

Sole Proprietorship Examples

Any low-profit/low-risk business that could be operated by one person could be a sole proprietorship.

For example, artists, counselors, freelancers, independent contractors, tutors, and musicians are all professions that could potentially be ran as sole proprietorships.

What Is A Washington Sole Proprietor

As opposed to a corporation or limited liability company , the sole proprietorship is not a legal business entity. The sole proprietorship is a one-person business that is not considered to be a distinct entity from the person who owns it, and it is frequently operated using the owners personal name.

Also Check: Where Are Most Solar Panels Manufactured

Do I Need To Register My Sole Proprietorship With The Irs

There are more than 22 types of sole proprietorships, which are business entities owned by one person and do not require registration with the state. Unlike corporations and limited liability companies , they dont even need to be registered with the state. U.S. businesses are owned by six million sole proprietors. The Internal Revenue Service reports that taxes were due in 2008.

Write A Business Plan

Once a solid business idea is in place, its time to start working on the business plan.

Many people only consider writing a business plan because the bank asks for one in order to get funding. While thats a valid reason, more importantly, writing a business plan gets the ideas out of the entrepreneurs head and helps create a roadmap for where they want the business to go. Just as most builders wouldnt build a house without blueprints, an entrepreneur shouldnt build a business without a business plan.

The thought of writing a business plan is overwhelming, so here are some resources to help in getting started.

Don’t Miss: What Do Solar Panel Installers Get Paid

Vigilance In Issues Of Taxes And License Issues

When it comes to filing license or permits request, dealing tax issues or even the name of your sole proprietorship you are required to be very vigilant and make sure nothing is overlooked. You need to protect yourself from identity theft and there is less room for mistake at the business place as your personal and business assets both are at stake.

How To Start A Business In Washington:

Washington is the birthplace of some of the world’s greatest brands, including Amazon, Starbucks, and Microsoft. Its highly-skilled, innovative workforce, low-cost energy, and central location make Washington the perfect place for your start-up.

While Washington State does not have personal or corporate income tax, business owners may still be subject to business and occupation tax, and retail sales/use tax. Depending on the city, businesses may also be required to pay local B& O tax and licensing.

New businesses enjoy several tax incentives that reduce costs, such as deferrals, reduced B& O rates, tax exemptions, and credits.

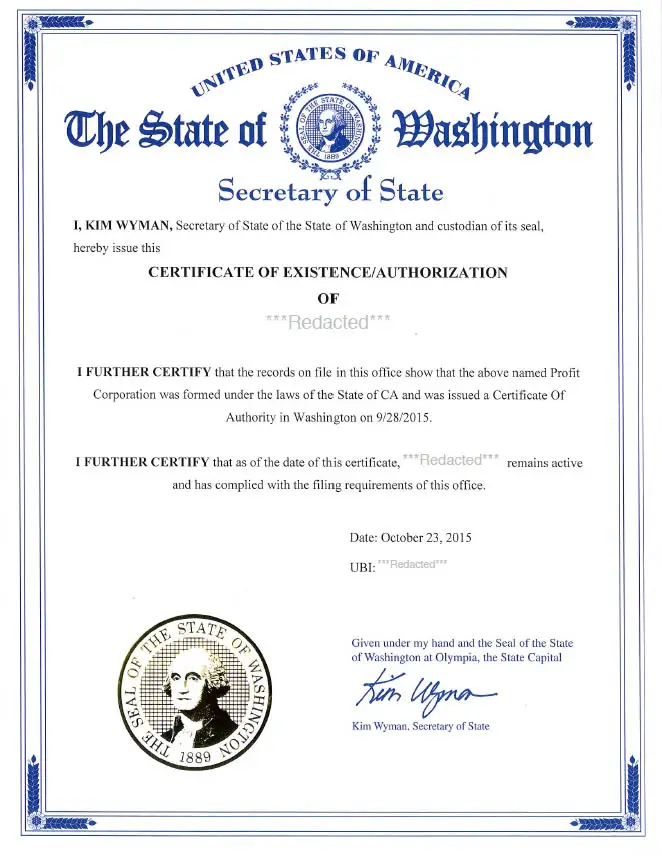

To do business in Washington, you will have to obtain a UBI if you meet the requirements.

Review Washington formation options.

Washington offers seven ways of forming your business. Review these closely and pick the one that fits your business best.

Name your business.

Before you decide on a name for your business in Washington, you’ll need to visit the Secretary of State’s website and run a search to make sure your desired name is available.

It’s a good idea to do some industry research and look at the names of your competitors before choosing your business name. Analyze the existing names of similar businesses and look for patterns in how they are named, and try to find ways to distinguish your name and brand from theirs.

If you need help finding a business name, be sure to check out NameSnack’s free business name generator.

Recommended Reading: How Much Does It Cost To Switch To Solar Power

Business Licenses What Artists Need To Know

State Business Licenses

City and County Business Licenses

- City business licenses may be required for business activity within the city limits of any city. You should contact any incorporated city in which you will be conducting your business to determine if a license is required. Contact information can also be found on the WALI website.

- Seattle The license is issued by the city for a calendar year and must be renewed every year by Dec. 31. INFO: 206/684-8484 or www.seattle.gov/business-license-tax

- Vancouver INFO: 360/487-8410 or

Most cities will prorate a business license fee based on the time of year purchased.

Counties may also issue business licenses to businesses that are not located within incorporated city limits. Again, you should contact any county in which you will be conducting your business to determine if a license is required.

For information on how to obtain a city or county business license, look under the City and/or County Government Pages in your telephone book. Locate business under the heading of licenses for information. The Washington State Department of Licensing website also provides this information.

How To Start A Business In Washington

There are many good reasons to start your business in Washington. The Evergreen State is one of only seven that do not pay income taxes, and over 43% of Washingtonians have a higher degree, which means an abundance of talented workers to choose from. Washington also uses low-cost, renewable energy and is ranked as one of the healthiest states.

Enter words related to your business to get started.

Also Check: How Does A Residential Solar System Work

Market Your Washington Business

Opening your doors is one thing, but how will you make customers aware of your company? Even more importantly, how will you convince people to try your products and services over your competitors?

- Utilizing SEO on your company website and your online profile in directories such as Google My Business

- Engaging with people on social networks like Facebook, Twitter, and Instagram

- Posting articles or videos to your website, YouTube, email list, and social media

- Asking customers to refer you

- Advertising online, in print, or via broadcast

Start A Business In Washington Today

Costco. Microsoft. Boeing. Amazon. From Seattle to Spokane, companies big and small make green in the Evergreen State. With business applications jumping from 17,963 in the third quarter of 2019 to 23,611 in the third quarter of 2020, a growing number of entrepreneurs are figuring out how to start a business here.

Use our guide to find out how to open your own business in Washington.

Don’t Miss: Do Solar Pool Covers Heat The Water

How To Start An Llc In Washington

To start an LLC in Washington, youll need to do three things: appoint a registered agent, choose a name for your business, and file Certificate of Formation with the Washington Secretary of State, Corporations & Charities Division. You can file the document online, by mail or in person. The certificate costs $180 to file. Once filed with the state, this document formally creates your Washington LLC.

According to Washington Revised Code § 25.15.021 , every Washington LLC must appoint a registered agent. You dont need to hire a registered agent, but if you do, make sure your registered agent will list their address on your filings wherever possible to ensure maximum privacy.

If youre starting a new business, you probably already know what you want to name your LLC. But youll need to know if your preferred name is available. To find out, visit the Washington State Business Name Search and search until you find the perfect name for your LLC.

Once you know who your registered agent will be and what your LLC name is, youre ready to file your Washington Certificate of Formation. Follow along with our filing instructions below:

Are There Separate City Or County Business Licenses In Washington State

Depending on the type of business activity, you may need to apply for more than one business license in the State of Washington. You may need to apply for a specialty license as well as a Washington State Master Business License. Most cities in Washington may also require a city business license. Contact your city to find out what forms may be needed. You can either do this in person or by visiting the local cities website under their Business section.

Also Check: Can Hail Break Solar Panels

What Should Be In An Operating Agreement

An operating agreement should explain how the business will handle big picture situationseverything from allocating profits and losses to dissolving the business. Below is a list of common topics that operating agreements should cover.

-

Initial investments

-

Voting rights, decision-making powers, and management

-

Transfer of membership interest

-

Dissolving the business

Your operating agreement can cover pretty much anything as long as it isnt contrary to Washington law. Topics not allowed to be changed in the operating agreement are listed in WA Rev Code § 25.15.018 , which forbids actions such varying the LLCs power to sue, be sued or defend in its own name.

Obtain Required Licenses And Permits

Most businesses are required to be licensed at both the state and local levels, and many need professional licenses too. You will likely need licenses in every location where you do business not just where youre based. Also, some businesses require additional permits.

The online Business Licensing Wizard is a helpful tool. Use it to learn the licensing and permitting requirements for your specific business. Enter your intended business activity, location, and other key information, and receive an online list of specific licenses and permits that are likely to be required.

- When you file your Washington Business License Application, be prepared to address the following:

- Whether you will want unemployment insurance coverage for corporate officers. Officers who provide services in Washington are automatically exempt from unemployment insurance unless the employer specifically requests to cover them. If you want to cover your corporate officers, you must submit a Voluntary Election Form. Find out more here.

- General business information including physical location and ownership.

- A rough estimate of your expected gross annual revenues.

- Whether you intend to hire employees within 90 days of start-up.

- Whether you will want optional workers compensation coverage for business owners.

Don’t Miss: How To Get Sole Custody In Texas

Choose A Business Structure

A business is a legal entity. It can own property, hold bank accounts and is required to pay taxes. There are different types of business entities, each with unique benefits and limitations.

The right choice for you depends on your interests and needs. Youll need sound counsel to understand your obligations regarding your business. Get to know the business structure options and discuss them with your advisors to determine which will be optimal for you. Find legal, tax and business advisors. Good decisions are based on:

- The number of owners now and planned for the future.

- The types of owners – are they all individuals or are they entities ?

- Liability concerns.

- Registration and tax filing requirements and costs.

- Paperwork and entity management considerations.

Sole Proprietorships are owned by a single person or a married couple. These businesses are inexpensive to form and there are no special reporting requirements. The owner is personally responsible for all business debts and for federal taxes.

Washington State Business and Organization Structure Considerations:

NOTE: This information is for reference only, for detailed considerations contact your trusted legal or tax advisors.