Revoking Your Solar Lease Before The Setup Process

In case you wish to get out of a solar lease because you have regrets getting one, you might be able to revoke it before the solar panel system installation. The period to revoke leasing without any costs primarily relies on the policy of the solar company. That is why you should be very keen on the terms of the contract before signing.

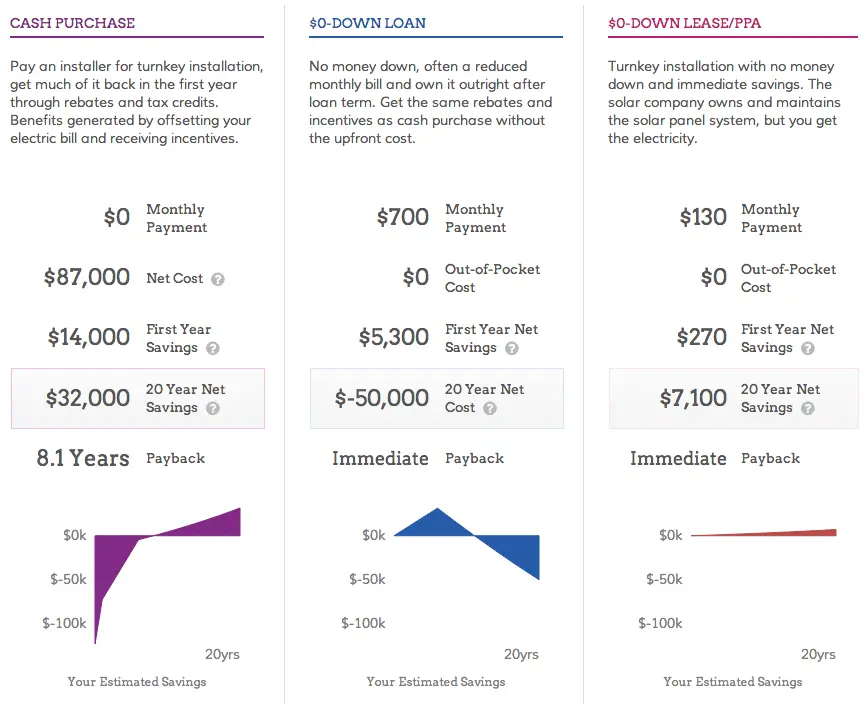

Remember that the solar system is valuable in saving you electric costs by the use of renewable energy. When purchasing, most buyers ask what is a solar lease? While you may be duped into signing a lease, wed love you to know that it is not the best long-term option. Whether to lease or buy solar should be your choice as a buyer.

While revoking your lease, the time frame is 30 days after you subscribe to the solar lease agreement.

If you have signed the solar lease agreement just to realize later that you need to fix the roofing, what do you do next? In this case, the solar firm allows the end of the contract under the stipulation of unforeseen and unanticipated additional costs.

Substantially, before signing a solar lease, it is essential to consider all the options. Be sure to thoroughly go over all the details so that you can weigh all the options and be well-informed as to whether going solar is right for you.

Consider The Age Of Your Solar Energy System

If you’re not seeking to make your home more attractive to potential buyers and instead plan to stay put for the long haul, there are some important questions to consider before proceeding with the type of lease buyout that does not include continued maintenance provided by the solar company.

Perhaps the most significant issue to research is the age and quality of your solar energy system. In particular, it’s a good idea to find out the age of the solar panels and the system’s inverter. If you have an older system, perhaps 10 years old or longer, then buying out the lease and potentially taking on the responsibility of maintenance yourself may not necessarily be a wise financial decision, says Aggarwal.

“If the system is 10-plus years old, you would have to evaluate the quality of the equipment,” continues Aggarwal. “Old inverters need to be replaced around the 10-year mark. That cost can be $2,000 to $3,000 that you may have to spend.”

The solar panels themselves are often under warranty and generally that warranty is longer than the one associated with an inverter, says Aggarwal. But even here, if you have to pay out of pocket for any solar panel repairs, or replace an aging panel entirely, the cost could be more than you can afford.

“If there’s some maintenance required, having a lease that covers these costs may give you peace of mind,” adds Aggarwal.

Advantages To Continuing With Lease Payments

1. Youll have more coverage if anything goes wrong.

Maintenance on your system is not always covered if you choose to buy out your system. If you continue your lease payments, SunPower will cover the cost of most maintenance.

2. You wont be responsible for replacing equipment.

Even after your product warranties expire, you wont have to replace equipment while youre leasing. Inverters, as an example, are likely to fail after 10-15 years. Replacing an inverter currently costs $2,000-$3,000 however, under a lease, a failed inverter would be replaced at no cost to you.

3. Youll still be eligible for the Power Production Guarantee.

If your solar system does not meet its estimated annual production as defined in your lease agreement, youll continue to receive a reimbursement check at the end of the year. If you choose to buy out your lease, however, this guarantee goes away.

You May Like: How Solid State Relay Works

So What Can Be Done If Your Circumstances Change Well Several Things Actually:

Move: If moving into a home with no roof access isnt a problem, you can always move your solar panels to a new house. This will mean an entirely new contract for your new home, but it will get you out of the old one.

Modify: Some leasing companies do allow modifications to contracts in certain circumstances. You can contact them and see if theyll allow you to break the lease early without incurring large fees.

Purchase: In some states, it is possible to purchase the solar system from the leasing company at any time with no penalty or fee attached. Simply determine how much less this would cost than continuing on with your lease and go from there! Of course, this option does require that you have enough funds in the bank to pay the difference, and the upfront purchase savings may be outweighed by how much electricity you end up purchasing from your previous leasing company while still paying on the lease.

Rent: If you own a house but do not have enough money to make any of these options possible or practical, dont give up yet! Some companies will allow you to rent their solar panels for a small monthly fee. This is a great way to take advantage of your roof space without having to worry about how exactly how it will get paid off. Its also an excellent way to test how well they work for your home before making such a large investment in them. Once youre happy with how everything is working out, then go ahead and buy your own system!

Is There Anyway To Get Out Of A Solar Lease

Most solar lease contracts are difficult to cancel without legal action. Lease agreements tend to last anywhere from 10 to 20 years and are ironclad in structure. If you want to cancel your lease because youre selling your property, you typically have the option to transfer your lease to the new homeowner.

Don’t Miss: How Many Solar Panels To Produce 10kw

Where Can You Get A Solar Lease

Solar leases are offered by a number of different providers and installers working with different solar project financing companies. Solar leases are available from far fewer companies than solar loans, but they are still quite common. Many large leasing companies also offer leases while working with smaller installers.

All of our providers offer the full spectrum of solar finance products, from loans to leases, PPAs and cash purchases. However, solar leases, unlike solar loans and cash purchases, are not available in all areas due to state and local regulations. By entering your zip code in the submission box on the top of the page we can show you which pre-screened lease providers we work within your area and if leases are indeed offered in your area.

There Are Typically Three Things That Will Need To Be Done For A Successful Solar Lease Transfer In Arizona

1. The seller and the buyer need to agree upon the transfer terms and sign off to initiate the process.

2. The buyer must meet minimum credit requirements to get approved. Once approved the buyer can take over the lease.

3. After the home has closed, most solar leasing companies require proof of ownership. Sending a copy of the title is usually enough.

Homeowners in Arizona that are selling homes with solar panels already are familiar with the solar system and how it works. If you are not yet familiar with how a residential solar system in Arizona is designed to operate you can read more about converting your home to solar and what you can expect from the leased equipment. Once a solar homeowner sells a home and moves into their new place, they begin to notice the energy bills seem higher than what they were used to. Our team of experienced solar specialists can help you find a new solar plan to facilitate your energy needs.

Don’t Miss: How To Start A Sole Proprietorship In Washington State

Is There A Better Solar Financing Option Than A Solar Lease

Solar is cheaper than its ever been, but that doesnt mean its not expensive. The average solar panel system in the U.S. will cost somewhere between $14,000 and $16,000 after the federal solar tax credit is applied. Thats not pocket change.

So, while solar is still expensive, the lower price makes it possible to take out a loan to cover costs. Taking out a loan didnt used to be feasible for solar – the cost was much too high, so it wouldnt make financial sense to finance with a loan. This is when solar leasing took off.

But now the cost of a solar power system is low enough that homeowners can easily take out a loan to pay for the installation. Solar loans, like home equity loans, allow you to install solar panels without requiring tens of thousands of dollars all at once. Instead, you make monthly loan payments until the loan is paid off. Once you finish paying back the loan, the panels are completely yours and they generate electricity for your home entirely for free.

Plus, when you take out a solar loan you are the owner of the system, which means you get to take advantage of all of the tax incentives and other solar rebates that you cant qualify for with a solar lease.

Most solar loans require zero down payment and come with reasonable interest rates.

Are Solar Ppa Worth It

A PPA is a great option for households who cannot afford to buy solar panels outright. However for those homeowners who do have the spare cash required to purchase solar panels outright, the return on investment will be much greater by buying instead of leasing or entering a Power Purchase Agreement.

Don’t Miss: When Is The Best Time To Install Solar Panels

How To Break A Solar Panel Lease

Leasing solar panels can be convenient for some people. But for others, there are times when you should seriously consider breaking your lease.

There are some important aspects of solar panel leases for you to consider. Ill be covering these and more in this article:

Breaking a solar panel lease Different forms of solar panel leasing Reasons for breaking your lease What to do instead of leasing Ways to Finance Ownership of Solar Panels

Your lease is written in black and white. Its a done deal, isnt it? Maybe not. Read on to learn more.

When Does It Make More Sense To Own Your Solar Panels

If you plan to stay in your home for more than five years and can get a traditional loan or afford the up-front cost of solar panels, it makes more financial sense to buy them yourself because you will save more money. You will be able to claim the rebates and other government financial incentives that a solar leasing company would otherwise take. Once your system is paid off, you will be getting free power for 25 years or more. You will also be able to sell renewable energy credits and potentially earn money by selling power back to the utility. With a lease, youâd keep making payments for years, but still wouldnât own the system at the end of that time. You will be locked into a long-term contract. If you sell your house and for some reason the new owner doesnât want the lease, you will have to pay a balloon payment penalty to get out of the contract.

Contact our solar specialists for a home solar evaluation to learn more about a Solar Lease

Also Check: How Much Does The Solar System Cost

Advantages To Buying Out Your Lease

1. You can pay in cash or finance your buyout either way, theres the potential for savings.

Paying in cash will result in additional and more immediate savings. This is how the math worked for one customer with a current lease payment of $97/month. They have the option to either buy out their lease or continue monthly lease payments for 14 more years. If they continue with lease payments, the sum of the remaining payments would be $16,296. If they choose to buy out the lease with cash now, the total cost will be $7,000 a savings of $9,296.

If you choose to finance your buyout through a VSECU loan, youll almost certainly lower the amount of your monthly payment. This is how the math worked for that same customer using a financing option. Taking out a 12-year loan for the $7,000 buyout, at 5.65%, their monthly loan payment would drop to $67.05 per month, a difference of about $30 per month as compared to their lease payment of $97 per month. The sum of their loan payments over the 12-year term would be $9,655.20, a savings of $6,640compared to the $16,296 sum of remaining lease payments.

To better understand the savings opportunities with your specific buyout offering, you can . Enter the following:

- Purchase amount: Your Early Buyout Quote amount from SunPower

- Down payment amount: $0

- Loan term: 5 years , or 12 years

- Interest rate: 5.15% for 5 years, or 5.65% for 12 years

Note: if you have prepaid for your lease, a buyout is not likely to be financially beneficial.

How To Cancel A Solar Lease Post

Most solar lease contracts are difficult to cancel without legal action. Lease agreements tend to last anywhere from 10 to 20 years and are ironclad in structure. In fact, Bloomberg published a story about a prospective homebuyer who experienced difficulties buying a home that had a leased SunRun solar panel system on it the lease remained in effect even after the death of the person who owned the home and signed the leasing agreement, as the lease was tied to the title of the home.

However, even if you cannot cancel your solar lease, there are often other options available to explore. If you want to cancel your lease because youre selling your property, you typically have the option to transfer your lease to the new homeowner. Otherwise, many solar leasing contracts specify buy-out options and prices directly in their contract . If your contract doesnt specify exact dates for buyouts, many solar leasing providers offer the opportunity to back out of a solar lease contract at any point by purchasing the solar panel system at the fair market value. This value will change depending on how long your system has been operating and market prices at the time. Importantly, if you buy a previously-leased solar panel system, you may not be eligible to claim the federal investment tax credit given that it has already been claimed by the original owners of the system .

Can I purchase more solar panels if I have a leased system on my roof?

Recommended Reading: How To Remove Pool Solar Panels From Roof

Is It Possible To Get Out Of A Solar Lease

Five years ago, Daniel says he stupidly signed up for a solar power system lease for his home in Phoenix, Arizona.

Anyways, it’s not a big deal in our monthly finances as it does save us roughly $20-30/month on electricity. However, as I’ve wised up I’ve realized that there were a lot cheaper ways to do solar than that and with this lease I now have a liability hanging around if we ever go to sell the home,he explained in a message board dedicated to solar energy questions.

After reading his contract, he knows he doesnt have a purchase option but I can prepay all lease payments at any time. This would, in effect, remove the financial concerns of the lease from any future buyers as they would not have to make any payments and then in 2034 could decide whether to remove the system or pay for another lease. However, I’m wondering if it may be worth trying to negotiate a purchase deal now that I’ve passed the 5 year mark and the tax credits should all be fully realized, he wondered.

The upfront cost for the installation of solar panels on your home can make the option of leasing it more palatable: you pay little or nothing at first and save hundreds of dollars annually on electricity.

But most experts agree that buying a solar system is much more advantageous than leasing it. For one, if you purchase it, either outright or through payments, you will be able to take advantage of rebates, tax credits and other incentives you can not claim if you lease.

Transfer Of A Solar Lease

Another way to bail out of a solar lease is to transfer the lease to a new homeowner. For example, some solar companies have a Service Transfer Specialist who will help you throughout the whole process of making sure your lease is transferred to the new homeowners.

Nevertheless, some buyers may be unwilling to accept this solution, but you can always reduce the selling price of the house by the amount of the transfer and complete the sale.

Read Also: How Much Is A Solid 18k Gold Ring Worth

How Do I Get Out Of A Vivint Solar Lease

4.5/5Vivint

Furthermore, how can I get out of my solar lease?

When you’re selling a home with a leased solar panel system on the roof, there are options outside of canceling the leasing arrangement: you may be able to transfer the lease to the new homeowner, buy-out the remainder of the lease and have the system removed, or purchase the solar panel system at market-value and

Furthermore, how much does it cost to buyout a solar panel lease? Find out how much it will cost you to buy out the solar lease, because it’s possible that some potential buyers won’t even consider taking over the lease payments. That means you may be on the hook for $15,000 or $20,000 or even more.

Keeping this in consideration, how do I get out of a vivint solar contract?

Policy Cancellation. If you wish to cancel your agreement with Vivint, call 1-800-216-5232 x5020 for assistance.

What happens if you break contract with Vivint Solar?

Vivint is inflexible when it comes to canceling their auto-renewing contracts. You must pay the remainder of the contract in full at the time of your cancellation. VIvint only allows for a no-penalty cancellation in cases of death and bankruptcy. Military personnel can only cancel if they are deployed overseas.