Disadvantages Of Forming An Llc

With an LLC, you have the following drawbacks as well:

- State-related paperwork will be required, including any specific industry licensing.

- Annual state filings will be required as well, including any specific industry licensing fees that are required.

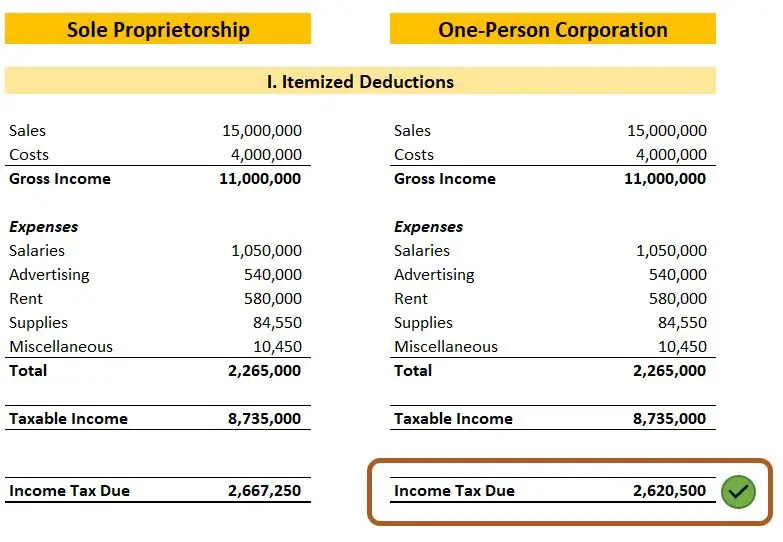

- Besides paying personal federal, state, local and the self-employed version of FICA taxes, you might also be required to pay State Business Taxes and Unemployment Taxes.

- Costs for completing the tax return of an LLC may be higher than that of a sole proprietorship.

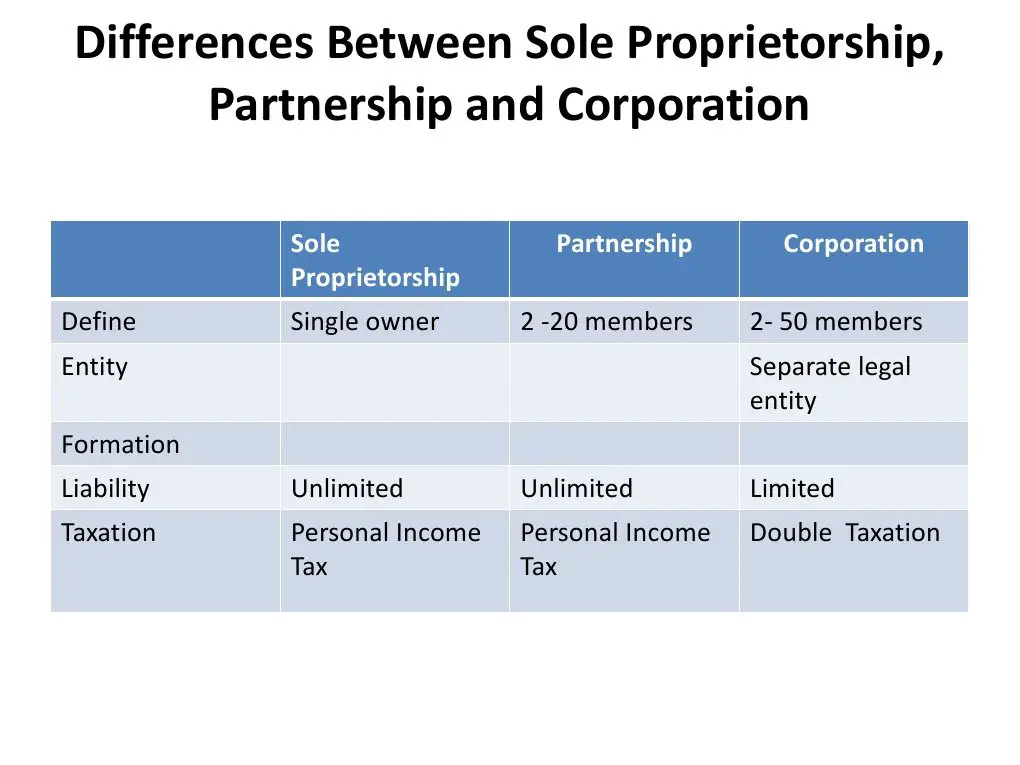

What Is The Difference Between A Sole Proprietorship And A Corporation

A sole proprietorship and a corporation are two different business structures that have different advantages and disadvantages.

Sole proprietorships are an informal business structure that offers no tax benefits or personal liability protection but allows more flexibility and freedom for business owners.

Comparatively, corporations are formal legal business structures that offer personal liability protection, tax benefits, and investor opportunities but are complicated to maintain.

Try The Incorporation Wizard

Its pretty difficult to choose which business structure is right for you. One of our favorite resources in BizFilings Incorporation Wizard, which allows you to input some information about your company to help determine what structure is right for you. Every business is different, which is why we highly recommend hiring an accountant or lawyer to help you make the decision thats right for you.

Read Also: How Many Solar Panels For 1500 Kwh

Llc Vs Sole Proprietorship: Formation

You might be surprised to learn that theres nothing specific you necessarily need to do to form a sole proprietorship. In fact, you might be operating a sole proprietorship without even knowing it. Any person selling goods and services without a partner is a sole proprietor by default. Depending on where your business is located, you might need to apply for business licenses or zoning permits to legally operate your sole proprietorship. And any business, including a sole proprietorship, that operates under a trade name, needs to apply for a fictitious business name, also known as a DBA or doing business as certificate. However, thats it as far as formation paperwork goes, making sole proprietorships the easiest and least expensive type of business to start.

An LLC might also need to file for business permits and a DBA . But the most important formation document for an LLC is called the articles of organization. This document establishes your LLCs existence and must be filed with the state in which youre operating. The cost to file articles of organization varies by state, but generally ranges between $50 to $200.

S Corp Vs Llc Vs Sole Proprietorship

Knowing the differences between Scorp vs. LLC vs. sole proprietorship can be helpful if you are considering one of these types of legal structures. There are many different ways to legally register your business. Some of the most common business structures include S corporations, limited liability companies , and sole proprietorships.

You May Like: Can You Mix Pine Sol And Vinegar

What Is An Limited Liability Company What Is A Llc Partnership

The limited liability company, or LLC, is the newest type of business form in the United States. The LLC is a unique hybrid: a cross between a partnership and corporation. LLCs have become very popular because they provide the flexibility, informality and tax attributes of a partnership or sole proprietorship, and the limited liability of a corporation.

To form an LLC, one or more people must file articles of organization with their stateâs business filing office. Although not required by all states, it is highly desirable to adopt a written LLC operating agreement laying out how the LLC will be governed. If you donât prepare an operating agreement, the default provisions of your stateâs LLC laws will apply. Operating an LLC is simpler than when you form a corporation. It is not necessary to have officers and directors, board or shareholder meetings, or the other administrative burdens that come with having a corporation.

LLCs are a clear favorite over partnerships because they offer the same tax benefits but also provide limited liability. They are also a serious alternative to corporations, because they are simpler but offer the same limited liability as corporations and have some tax advantages.

Other Considerations: State Selection

Most people opt to incorporate or form an LLC in the state in which their business operates. However, you are not required to do so you can choose from any one of the 50 states or the District of Columbia . You may want to consider which state is right for you to weigh any potential advantages or disadvantages. Remember, if you incorporate in a state other than the state where you operate your business, you may be required to register to transact business in the state where you operate, which results in paying registration and ongoing fees/taxes to both the state of incorporation and state of qualification.

Read Also: Can A Sole Proprietor Have A Dba

Get Help With Business Formation

Do you have questions aboutbusiness formations andwant to speak to an expert?Post a project todayonContractsCounseland receive bids from LLC lawyers and corporate lawyers who specialize in business formation.

“ContractsCounsel puts on-demand legal services in the cloud. Not only is their service more convenient and time-efficient than visiting brick and mortar offices, but its more affordable tooand Ive been universally impressed by the quality of talent provided. If youre looking for a modern way for your small business to meet legal needs, I cant recommend them enough!”

“This was an easy way to find an attorney to help me with a contract quickly. It was easy to work with Contracts Counsel to submit a bid and compare the lawyers on their experience and cost. I ended up finding someone who was a great fit for what I needed.”

“ContractsCounsel suited my needs perfectly, and I really appreciate the work to get me a price that worked with my budget and the scope of work.”

“I would recommend Contracts Counsel if you require legal work.”

“ContractsCounsel helped me find a sensational lawyer who curated a contract fitting my needs quickly and efficiently. I really appreciated the ease of the system and the immediate responses from multiple lawyers!”

Time Money And Paperwork

Despite the tax savings, S Corporations have additional expenses. Most states require that each employee be provided with workers compensation and unemployment insurance coverage, and some states also require all corporations, including S corporations, to pay minimum annual state taxes, no matter how much money they earn.

Theres no paperwork involved in setting up a sole proprietorship, while S Corporations require you to file documents with governmental agencies. S-Corporations may also have other ongoing filing requirements depending on the state where they are formed, like annual information statements. The time, money, and paperwork involved in setting up and running an S Corporation needs to be weighed against the tax and liability benefits they provide.

Read Also: What Is The Current Efficiency Of Solar Panels

Sole Proprietorship And Corporation Comparison

The biggest advantage of starting a corporation vs. sole proprietorship by far is the personal asset protection that shareholders have in the event the corporation is sued or owes a debt. With a sole proprietorship, the owner is completely responsible for any liabilities or debts of their business which can be an immense risk.

Moreover, corporations can claim self-employment tax savings among other tax benefits, while sole proprietorships offer no tax benefits as an informal business structure. In contrast, sole proprietorships save money with the low cost to establish this business structure, plus they arent liable for unemployment insurance.

Essentially, choosing to form a corporation vs. a sole proprietorship comes down to just a few things:

- Whether your business is small enough to act as an extension of yourself, allowing you to comfortably assume the financial responsibility of your business

- If your business can anticipate the level of growth that will benefit from tax savings, investment opportunity, and personal asset protection offered by a corporation.

What Is A Limited Liability Corporation

A limited liability corporation, better known as an LLC, is a business structure that combines pass-through taxation with the limited liability of a corporation. An LLC is not a corporationit is a legal form of a company that provides protection and limited liability to its owners. Basically, if a corporation and a sole proprietorship had a baby, theyd name it LLC.

Also Check: Are Solar Panels Worth Buying

What About Personal Liability Protection

With an LLC, your personal assets are considered hands-off when it comes to business debt collection or other claims if your company is sued. In most cases, creditors can’t touch your home, car, or personal bank accounts.

In a sole proprietorship, there is no separation between you and the business. You are entitled to all of the profits, along with all of the debts and obligations. You can even be held responsible for liabilities caused by your employees.

What Is Better For My Business An Llc Or Sole Proprietorship

Both an LLC and a sole proprietorship offer distinct benefits for small business owners, and this makes choosing either one potentially challenging. Even though the decision may require the owner to create a personal business plan, a decision must be made as a sole proprietorship and an LLC are not one in the same.

This means that business owners will need to decide for themselves how they want to begin their business. If a business owner is looking to hire employees they will need an LLC and if a business owner wants to act for and by themselves, then a sole proprietorship would fit their needs.

A decision is not final. For instance, if a business owner decides to start out as a sole proprietorship and eventually decides to add employees and other owners, the sole proprietorship can be dissolved and transitioned into an LLC.

Knowing which type of business entity your company should use is not always simple, as each business entity has differing pros and cons.

Having an experienced business law attorney explain the differences between your options and lead your business in the right direction is priceless.

Call JacksonWhites Small Business Law Team at to discuss your case today.

Don’t Miss: What Is Fpl Solar Now Program

Whats An S Corporation

An S Corporation is a special type of corporation formed through filing a certificate of formation with the office of the Secretary of State where the company is headquartered, as well as the necessary tax documentation with the Internal Revenue Service.

What distinguishes this from other types of corporations is the fact that the taxation of the company is similar to a partnership or sole proprietor as opposed to paying taxes based on a corporate tax structure.

Income is sent directly to shareholders annually in the form of distributions, and it is the shareholders who are taxed, not the corporation. The corporation itself remains a distinct, separate entity from the shareholders.

Sole Proprietorship Vs Llc Vs Corporation

When you form a business, you have a lot of decisions to make regarding its structure. Do you need to worry about liability? What about taxes? There’s no substitute for asking for advice from a qualified tax professional, but you should still research on your own the structure that might be right for you.

Also Check: How To Get Solar Rebate

Can A Sole Proprietor Have Employees

Yes! You can hire one employee or several. Remember that youre responsible for paying employer payroll taxes, withholding employee payroll taxes, following local labor laws, and paying your workers according to updated worker classification rules.

LLCs can have employees, too, and will pay them according to the same rules.

Pro tip: Did you know that employing your own children may have special tax benefits exclusively for sole proprietors? The IRS allows you to hire your own children and write off their wages as a business expense, just like any other employee. You can also potentially set-up retirement plans for your children to help with your savings goals.

One additional perk is that you dont have to pay Social Security or Medicare taxes, just as long as its the child of the owner sole proprietorship or the child of both partners for a partnership. The child must also be under 18. This benefit doesnt apply to corporations or LLCs with corporate tax structures.

Are There Any Alternatives

What if youre not ready to make the leap to an S corp or C corp, but youre uncomfortable with the lack of liability protection that comes with operating as a sole proprietor? If you find yourself in this situation, you might consider setting up a single-member LLC.

This type of business structure is ideal for solo business owners who want a simple and straightforward business model. As a single-member LLC, youre still considered a pass-through business, so you can continue to report the businesss income on your personal tax returns.

But unlike sole proprietors, single-member LLCs enjoy liability protection. So if the company is sued, goes into debt or goes bankrupt, your personal assets will not be at risk.

There is some paperwork involved in starting a single-member LLC, but its less tedious than incorporating as an S corp or C corp. Youll want to check with your Secretary of States office to see what the requirements are where you live.

Also Check: What Can You Run Off A 100 Watt Solar Panel

Choosing A Business Structure

-

Illinois Small Business Development CenterSouthern Illinois University

Individuals with disabilities are welcomed. Call 618-453-5738 to request accommodations.

618-536-2424

-

Illinois Small Business Development CenterSouthern Illinois University

Individuals with disabilities are welcomed. Call 618-453-5738 to request accommodations.

618-536-2424

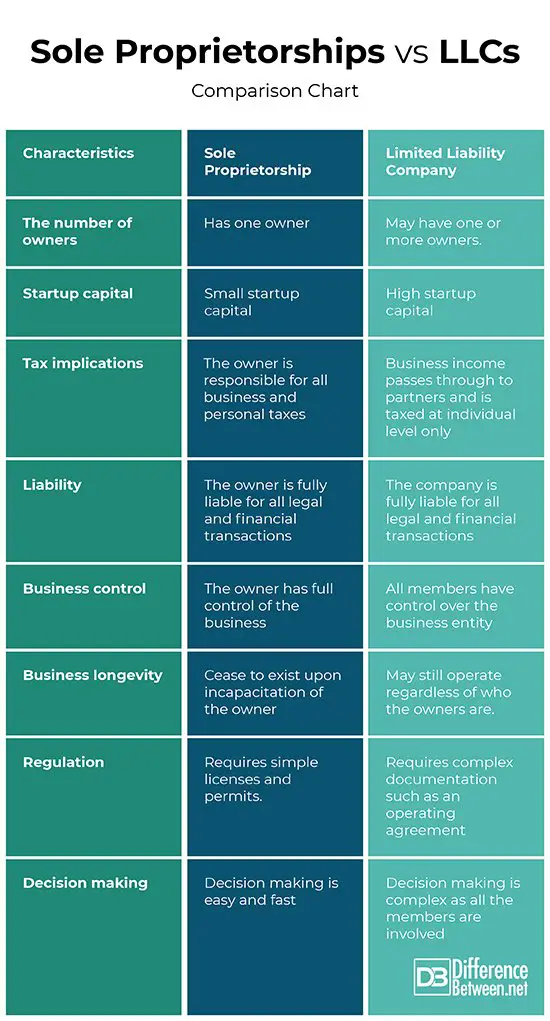

What Is The Difference Between An Llc And Sole Proprietorship

A Limited Liability Company, or LLC, and a sole proprietorship are both legal entities that can be formed to operate a business. Both structures allow a business owner to legally run their companies, however they each have unique features, advantages, and disadvantages.

The main ways that an LLC differs from a Sole Proprietorship are:

- Liability protection for the business owner

- Ownership structure

- Government regulation

- Taxes

Asole proprietorship is an unincorporated business that is not legally separated from the business owner. There is only one owner, and that owner reports the businesss profits and losses on their individual tax return. The owner is liable for all debt and risk associated with the business.

An LLC on the other hand provides personal liability protection to a business owner because the business is considered a separate entity from the individual owner. LLCs can have multiple owners and have the option to choose how they are taxed. They can opt to be taxed like a sole proprietorship or as a corporation.

Recommended Reading: Is Leasing Solar Panels A Good Idea

Maximize Your Llc Protection

To maximize these asset protection features, it is important to maintain your LLC as an independent entity. Keep LLC records and finances completely separate from your personal records and finances. Not having this clear line of distinction may be enough to convince a court that the LLC is nothing more than your alter ego. This commingling of assets means the court may permit a judgement creditor to reach into your personal assets to settle a claim against the LLC.

So, for example, dont pay your personal light bill with LLC money. Pay yourself a salary from your LLC by moving money from your LLC bank account into your personal bank account. Then, pay your light bill from your personal account.

Additionally, whenever possible, avoid personally guaranteeing any loan or liability your LLC takes on. In most states, you are responsible for any debts you personally guarantee for an LLC or any other type of business entity. It can be difficult for your LLC to independently obtain a large loan if your company is just starting out. This is often the reason most business owners personally guarantee loans. However, as soon as it is financially feasible, you should establish a separate line of credit for your LLC. In this way, the LLC alone is responsible for the debts it incurs as a business entity. Creditors cannot touch your personal assets should the LLC prove to be insolvent.

Llc Vs Sole Proprietorship: Operations And Management

A sole proprietorship has a simple operational and management structure because theres just one person at the top. That owner can make any business decisions as they see fit, without input from any third party. Of course, most sole proprietors decide to hire employees, legal experts, accounting experts, and other individuals to help with the day-to-day management of the business. But a sole proprietor only has to ensure their business is operating safely and legally and that theres enough profit to cover business debts.

An LLCs operational and management structure is more complex and is typically outlined in an LLC operating agreement. Though only a handful of states require an operating agreement, most LLCs have one, particularly those with multiple members. The operating agreement outlines each members ownership stake in the business, voting rights, and profit share. An LLC can be collectively managed by the members or managed by an appointed manager.

Usually, LLC members decide on company matters in proportion to their ownership stakecalled membership unitsin the business. For example, a 33% owner would have a one-third vote on company matters, and a 25% owner would have a one-quarter vote. Profits generally are divided in line with ownership percentages. In the previous example, the 33% owner would receive one-third of the business profits, and the 25% owner would be entitled to one-quarter of the business profits.

Also Check: What Battery Is Best For Solar System