How Do I Get A Sellers Permit

A sellers permit is required for every organization making retail sales, leases, or rentals of tangible personal property or taxable services in Wisconsin, unless all sales are tax exempt. Apply for a Sellers Permit Number online using the Business Tax Registration form available from the Wisconsin Department of Revenue at 608-266-2776, . This is the same form used to get your Wisconsin Employers Identification Number . Sales to customers outside of Wisconsin may be subject to tax. This is an issue especially, though not exclusively, for mail order and/or internet based businesses. Check with the Wisconsin Department of Revenue.

When Is A New Ein Required

When you have an EIN for your sole proprietorship but you decide to turn that company into an LLC.

With a change in the type of company youre operating, you wont be able to simply pass along your current number. Instead, youll have to get a new EIN.

You would want to consider a new EIN if youre planning to change the ownership or the structure of the business entity. However, you will not need a new EIN if you are simply changing the name of your business or relocating.

What Is An Ein Number And Does Your Business Need One

Many entrepreneurs have questions about EINs and whether or not they need one. EINs arent necessarily for everyone, so its always best to do your research first to ensure your small business is set up for success.

To help steer you through any uncertainty, were going to cover what an EIN is, who needs one, and what its used for. Feel free to skip to the section of your choice using the menu below.

Read Also: How Much Does It Cost To Solar Power Your Home

Sole Proprietorship Guide: Multiple Businesses Multiple Dbas And More

When you open a new business, there are a few different ways you can organize the company from a legal standpoint.

Before selling goods or services, you’ll have to decide how to structure ownership. Depending on who’s involved, you can choose to incorporate, form a limited liability company partnership or set up a sole proprietorship.

That last option is the simplest business structure. It suggests that a single individual owns the company and is responsible for any corresponding liabilities.

Among the different types of business ownership, there is some flexibility with sole proprietorship arrangements. When youre starting out, its worth talking to an accountant or startup lawyer to figure out how you want to set up your business.

This sole proprietorship guide answers some of the most common questions you might have. Click to jump to the topic youre interested in:

How Do Self Employed Prove Income

Your federal tax return is solid proof of what youve made over the course of a year. Its a legal document that is officially recognized by the Internal Revenue Service that shows your total income and expenses for that year. You can do this by supplementing your tax return with annotated bank statements.

Is sole proprietor and self-employed the same? Yes, a sole proprietor is self-employed because they do not have an employer or work as an employee. Owning and operating your own business classifies you as a self-employed business owner. How do I know if I am a sole proprietor? A sole proprietor is someone who owns

Don’t Miss: Where Are Jinko Solar Panels Made

Getting An Employer Id Number

You may apply for a tax ID online, via telephone, by fax, or through the mail — but doing it online will save you time.

- Online: This the preferred method for obtaining a tax ID number, available for all business entities whose principal office or legal residence is in the U.S.

- Telephone: Call the Business & Specialty Tax Line at 829-4933 between 7:00 a.m. and 7:00 p.m. , Monday through Friday. International applicants must call 941-1099.

- Fax: Complete Form SS-4 and fax it to the appropriate IRS number. The IRS will send a return fax with your tax ID within four business days.

- Mail: Complete Form SS-4 and send it to the appropriate IRS address. Your EIN will be mailed to you.

Should I Form An Llc Or Sole Proprietorship

Depending on your business, it will be beneficial to create either an LLC or a sole proprietorship. A sole proprietorship is best suited to small businesses with low risk and low profits. The business will not have a wide range of customers but rather a small, dedicated group. Sole proprietorships usually start as hobbies and become a form of business. The reasons to start an LLC would be the opposite of the reasons above. The business is associated with some risks, the possibility for very large profits, a large customer base, and in a position to benefit from certain tax structures.

Recommended Reading: Does A Sole Proprietor Need A Registered Agent

Where Else Can I Learn More About Starting Managing And Growing My Business

Do You Need An Ein For A Sole Proprietor

Do you need an EIN for a Sole Proprietor?

There is no need for sole proprietors to obtain an EIN. The social security number can be used as an EIN in most cases. However, sometimes an EIN differentiates from a social security number. In some instances, having an EIN makes many processes easier. Please go on to read to learn points differentiating between an EIN and social security number.

EIN is needed for some cases as follow

- If employees are going to be hired, if Keogh/solo 401 are going to be opened, or while applying for bankruptcy protection.

- If one is on the process to buy an existing company or manage it as a sole proprietorship.

- If one is going to form a partnership or LLC

Even if the federal government does not require an EIN, most of the banks will enforce its clients to get one.

Despite all these, an EIN should be obtained to pass the legal process more easily and also to pass all bureaucratic stages without any problems.

You May Like: How Does A Solar Ppa Work

Should I Use Ein Or Ssn For A Sole Proprietorship

Using an EIN for a sole proprietorship offers more advantages than using an SSN. For example, you easily distinguish the business as a separate legal entity and guarantee yourself limited liability. Youâll also find it easier to open a business bank account and access loans and credit facilities. Thus, if youâre looking to grow the business and protect your SSN, personal assets and liability, then it makes more sense to use EIN.

Who Needs A Tax Id

An EIN is required for many reasons for businesses, taxable entities and non-profit organizations. If any of the follow apply to your business or entity you will need an EIN:

- Hiring Employees

- Operate your business as a Corporation or Partnership

- If you will file any of following tax returns: Employment, Excise or Alcohol, Tobacco and Firearms

- Have a Keogh Plan

- Plan Administrators

Also Check: How Much Is The Tesla Solar Panels

What Are The Filing Deadlines For Us Income Tax Returns

For individuals/sole proprietors: 15th day of the 6th month following calendar year-end .

For Canadian corporations with ECI, but no PE: 15th day of the 6th month following the fiscal year-end.

For Canadian corporations with ECI and a PE in the U.S.: 15th day of the 4th month following the fiscal year-end .

You can also request an extension in writing before the deadline .

Non-disclosure penalties can be levied against your business in case you dont file, even if there was no taxable income or full reduction under a tax treaty.

Make sure you file your U.S. income tax returns on time to avoid those penalties.

Do I Need To Register My Business In Wisconsin

Businesses operating as Corporations, Not-for-Profit corporations, Cooperatives, Limited Partnerships, Limited Liability Companies, Limited Liability Partnerships, Common Law Trusts, Foreign entities of the same types licensed to transact business in Wisconsin, Veterans and certain types of religious organizations must register with Wisconsin Department of Financial Institutions. 261-9555. Your business name can be a very important marketing consideration therefore, you may want to register it with your County Register of Deeds. This registration does not give name protection beyond that of common law. It does make it easier to avoid duplication.

Also Check: How Do Solar Pool Covers Work

Keeping Your Business Separate From You

Having a business EIN means that you wonât have to use your Social Security Number on business documents. Youâll use the EIN instead. By doing so, you essentially separate yourself from the business, thus establishing it as an independent entity and ensuring limited liability for yourself.

While this is important to all small business owners, it is essentially critical to independent contractors who do not want to be considered as employees for tax and liability reasons.

Does A Sole Proprietor Need An Ein

While incorporated businesses like LLCs, corporations and nonprofits are legally required to have an EIN, sole proprietorships arenât. As a sole proprietor, the federal government classifies your business as an unincorporated enterprise. Such businesses â which include sole proprietorships, general partnerships and trustees of trusts â are not required to have employer identification numbers. You can, therefore, use your Social Security Number when filing tax returns.

That said, there are conditions under which the IRS requires that a sole proprietorship gets an EIN. These conditions are:

- Before the business starts hiring employees.

- If the business has a retirement plan in place and files pension plan returns.

- If the business is required to file excise tax returns.

- In case the business files for Chapter 11 bankruptcy, which relates to reorganization.

- If the business files Chapter 7 bankruptcy, which relates to liquidation.

In case youâre not sure and are still wondering if you need an EIN for sole proprietorship, you can visit the IRS website for more information. It provides a questionnaire to help small business owners determine if they need to apply for the nine-digit number.

Generally, even if your business is allowed to operate without it, you stand to gain more in having an EIN than not having one. As you may have noticed, without an EIN, a sole proprietor is not able to:

Also Check: Do Solar Panels Work In Blackouts

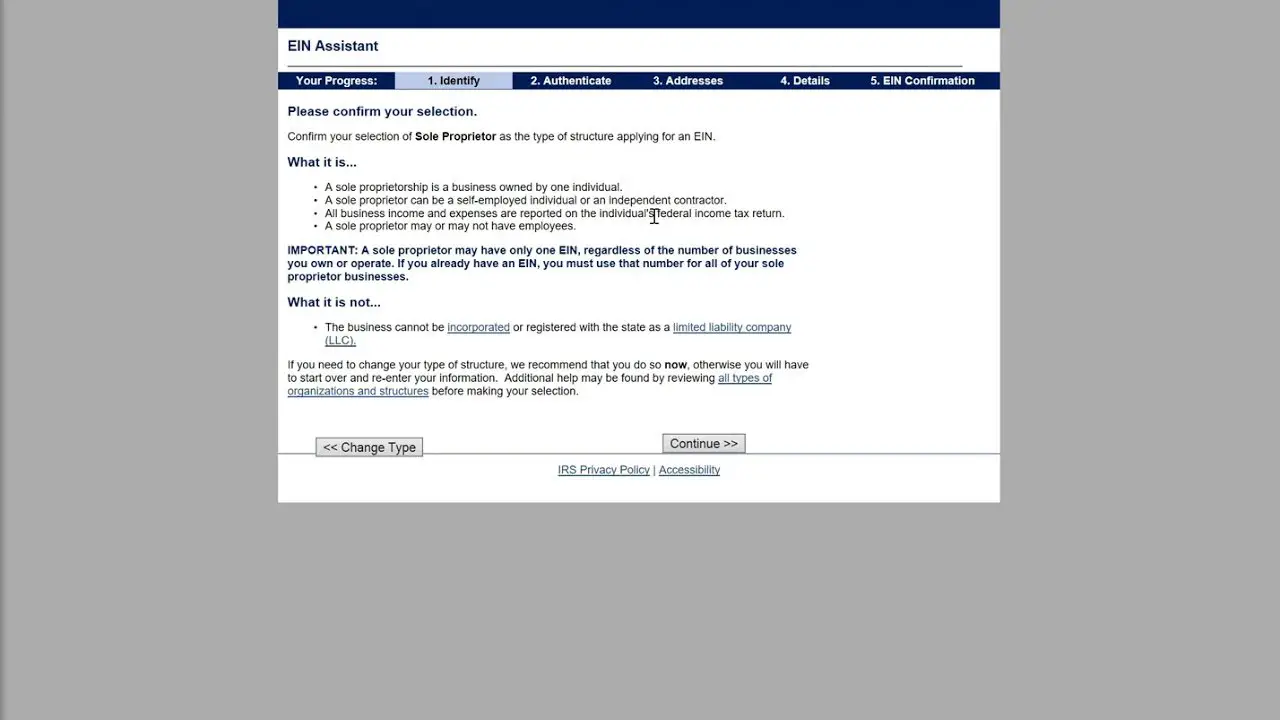

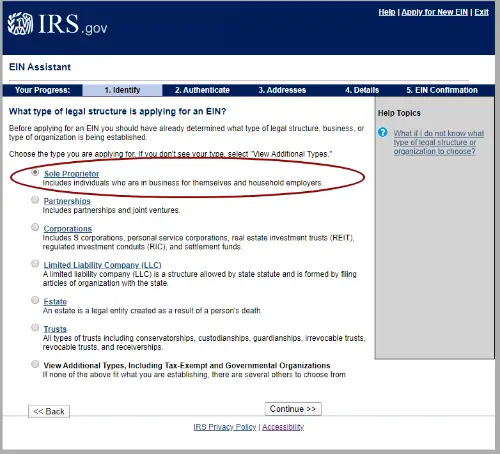

How To Get An Ein

Dont be fooled by online services that charge you to apply for an EIN. The IRS allows you to apply for free on its website, where it devotes an entire page to EIN application procedures and allows you to get employer ID numbers through EIN online.

The application process is relatively easy, and very few applicants need expert help to complete the form. In most cases, if you apply online Monday through Friday between 7 AM and 10 PM. local time, youll receive your EIN immediately. You may also apply by fax or mail with Form SS-4. Heres a summary of what to expect when filing:

There is certain information you will need to complete the EIN application, such as:

- The legal business name

- The legal name of the person applying

- The trade name

- The address, including country and state where the business will be

- The name and Social Security number of the responsible party

How Do You Start A Sole Proprietorship

To start a sole proprietorship you need to for the most part just start your business. It does not require registering with your state. It is recommended to come up with a company name and then apply for a permit or license with your city and state if needed. If you plan to hire employees then you will need an employee identification number from the IRS and if you are going to sell taxable products you will need to register with your state.

Don’t Miss: Does California Require Solar Panels On New Homes

Llc Or Sole Proprietorship

What is the difference between a sole proprietorship and a LLC? Perhaps the biggest difference between a sole proprietorship and an LLC is the issue of liability protection. Sole proprietors have unlimited liability for business debts, lawsuits and other business obligations. This means that sole proprietorships are personally liable for all debts they incur in the course of their business activities.

Also Check: How Much Does A Solar Hot Water Heater Cost

Who Needs An Ein

The guidelines used by the IRS for determining if an EIN is required suggest that most businesses must have an EIN. Besides, acquiring an EIN is an important step to establishing your business and will help you keep your legal and financial matters in order.

As soon as you launch your business, youll need to apply for an EIN . You can wait until youve registered your company in the state where you plan to do business, but youll need an EIN before you can open a business bank account. According to the IRS, your business must have an EIN if:

- Your company has employees

- Your business is a partnership or corporation

- You have filed or will file tax returns for any of the following: alcohol, tobacco, firearms, employment, or excise

- You withhold taxes on income paid to a nonresident alien

Or if youre involved with any of the following:

- Trusts , grantor-owned revocable trusts, IRAs, or estates

- Plan administrators

- Real estate mortgage investment channels

- Nonprofit organizations

Beyond filing taxes, you may also need an EIN to:

- Open a bank account in the name of your business

- Apply for a credit card in the name of your business

- Apply for a business license

- Apply for a business loan

- Furnish independent contractors with a Form 1099

Another reason you may need to apply for an EIN is for your privacy. For example, if youre a contractor who works with a large number of clients, disclosing your Social Security number may expose you to identity theft.

Don’t Miss: Are Dirty Solar Panels Less Efficient

Is Revenue Id The Same As Ein

State tax ID numbers are issued by the department of revenue or similar agency in the state where the business is located. This number is associated only with the state that issues it. The IRS is a national agency, so even if a business relocates and has to get a new state tax ID, its EIN will stay the same.

When Does A Sole Proprietorship Need An Ein

Featured In. A federal employer identification number, or EIN, is a nine-digit number the IRS assigns to businesses for tax filing and reporting purposes. The IRS uses the EIN to identify the taxpayer. EINs must be used by business entities corporations, partnerships, and limited liability companies.

Don’t Miss: How To File For Sole Custody In Nj

Does Each Partner In An Llc Need An Ein

wondering whether all partners need a Tax Increment Financing Identification Number, or does each member obtain one from the partnership? A single EIN is all that is needed for a business. Your business is formed as a single entity when you choose to form an EIN partnership. you are applying for an EIN as an entity, not as the companys independent partners.

When Do You Need An Ein

Single-member LLCs may not need an EIN. If you are the owner, manager, and director of your home-based business, you do not need an EIN. Instead, you can use your social security number . However, once you decide to hire employees, you must have an EIN.

LLCs can choose how they want to be taxed from these options:

- As a corporation

You May Like: How To Start A Sole Proprietorship In South Carolina

Advantages And Disadvantages Of A Sole Proprietorship

The main benefits of a sole proprietorship are the pass-through tax advantage mentioned before, the ease of creation, and the low fees of creation and maintenance.

With a sole proprietorship, you do not need to fill out a tremendous amount of paperwork, such as registering with your state. You may need to obtain a license or permit, depending on your state and type of business. But less paperwork allows you to get your business off the ground faster.

The tax process is simpler because you do not need to obtain an employer identification number from the IRS. You can obtain an EIN if you choose to but you can also use your own Social Security number to pay SSN taxes rather than needing an EIN.

In addition, because you are not required to register with your state, you do not need to pay any fees associated with renewing your registration or any other fees associated with the process. This saves you a lot of money, which is important when starting your own business.

With a sole proprietorship, you don’t need a business checking account, as other business structures are required to have. You can simply conduct all your finances through your own personal checking account.

There are 32.5 million small businesses in the United States.

Thus, entrepreneurs begin as an entity with unlimited liability. As the business grows, they often transition to a limited liability entity, such as an LLC or LLP, or a corporation .