Llc Vs Sole Proprietorship Share One Important Similarity

Every business owner faces decisions that can impact their business down the road, and choosing your business entity is an important step toward success.

When weighing your options between choosing an LLC vs. sole proprietorship, there are several factors to consider, including how risk will impact your business and personal assets.

One thing that both entities have in common is the protection they could gain from having business insurance.

If you’re curious about other ways you can protect and grow your business, head to Simply U, our blog for business owners.

Monthly payment calculations do not include initial premium down payment and may vary by state, insurance provider, and nature of your business. Averages based on January – December 2020 data of 10% of our total policies sold.

Allison Grinberg-Funes

Ive told stories since I learned to talk and written since I could hold a pen. As a small business owner myself – I’m a freelance writer and yoga teacher – I love contributing to the entrepreneurship community in different ways . When Im not drafting articles for SB, I can be found on my yoga mat, perusing an indie bookstore, and writing .

This content is for general, informational purposes only and is not intended to provide legal, tax, accounting, or financial advice. Please obtain expert advice from industry specific professionals who may better understand your businesss needs.

What Is An Llc

An LLC is a business entity thats created by filing paperwork with your state. An LLC can have one owner or many owners.

Once formed, an LLC has its own legal identity thats separate from you, the owner. Because of this, a business creditor cannot legally go after your personal assets if your business is sued or unable to pay its debts. Additionally, an LLCs bankruptcy is considered separate from the owners. If you have employees, an LLC can also help shield you from liability for your employees actions.

How To Choose Between A Sole Proprietorship And An Llc

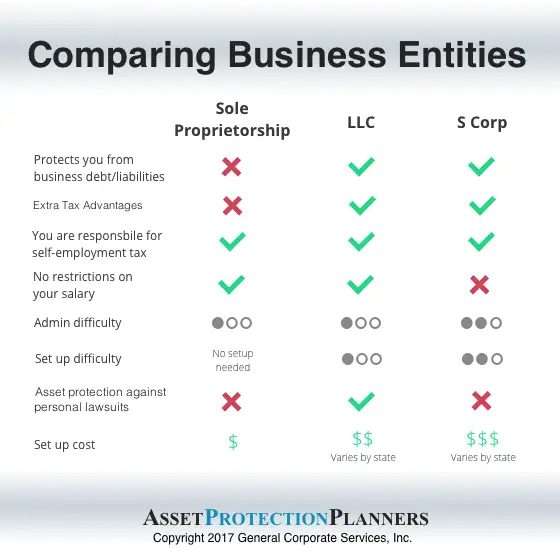

The main difference between a sole proprietorship and an LLC is that an LLC will protect your personal assets if your business is sued or suffers a loss.

Most serious business owners choose to form an LLC vs. a sole proprietorship because an LLC legally separates the owner’s personal assets from the business. This is known as personal liability protection or limited liability protection.

You May Like: How Much Solar Do I Need For My House

How Is Financing An Llc Vs A Sole Proprietorship Different

With both an LLC and sole proprietorship, you pay the fees associated with renewing your business license and paying taxes. Since an LLC has more upkeep and paperwork, a sole proprietorship is less expensive to finance.

Additionally, LLCs also need to budget for the time and resources spent creating an operating agreement, holding and keeping records of meetings, and filing an annual report . The costs of filing articles of organization vary in each state, but it generally ranges from $50 to $200.

When To Use This Structure

If you dont want to set up a business under a partnership or corporation, you can operate it as a sole proprietorship.

Many business owners use this business entity to build their business and start earning revenue. Then as the business grows, they may decide to switch to a different business entity to gain benefits such as personal liability protection and tax deductions.

#DidYouKnow

Recommended Reading: How To Calculate Batteries For Solar System

Selecting A Business Structure

The decision regarding business structure is a decision that a person should make, in consultation with an attorney and accountant, and taking into consideration issues regarding tax, liability, management, continuity, transferability of ownership interests, and formality of operation.

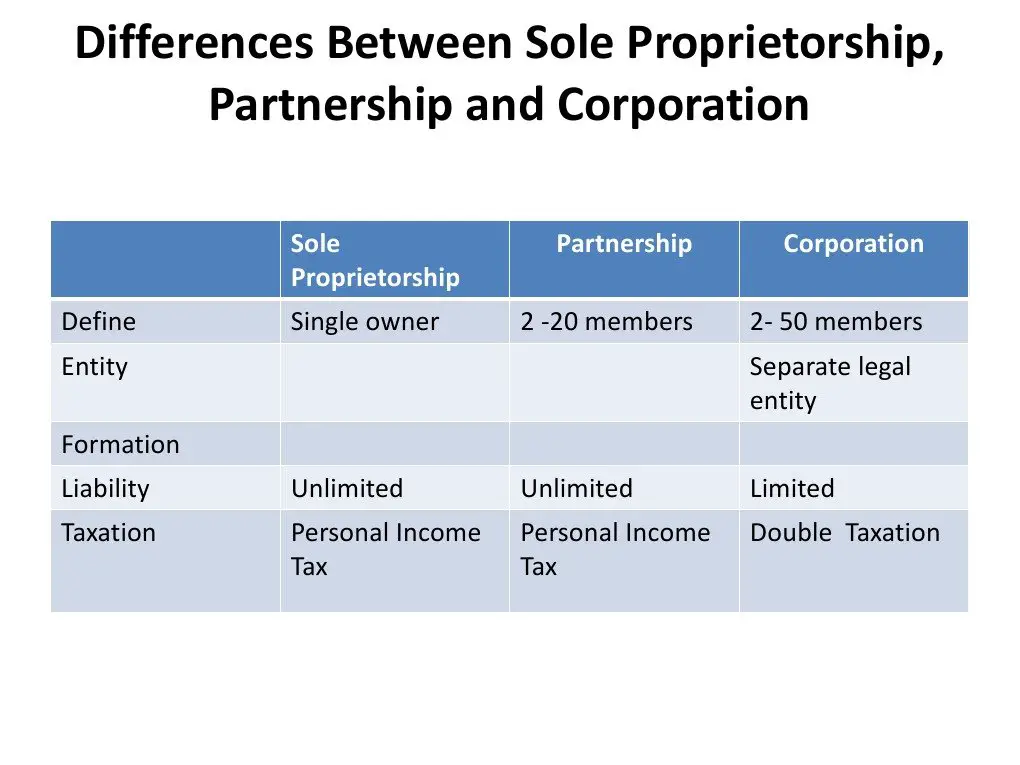

Generally, businesses are created and operated in one of the following forms:

The information on this page should not be considered a substitute for the advice and services of an attorney and tax specialist in deciding on the business structure.

Llc Sole Proprietorship Or Corporation: Which Is Best For You

For many businesses, the advantages of incorporating far outweigh the costs and creating these entities is easier than ever before. Find out more about how easy and affordable it can be and decide whether taking any of these steps is right for your business.

Legal Disclaimer: This article contains general legal information but does not constitute professional legal advice for your particular situation and should not be interpreted as creating an attorney-client relationship. If you have legal questions, you should seek the advice of an attorney licensed in your jurisdiction.

| Star Rating |

|---|

Read Also: What Voltage Are Solar Panels

Become A Flight Attendant

Flight attendants are always on the move, and they get to travel the world for free. You do not need to worry about booking flights, hotels, or accommodations youll have a place to stay at your destination.

The downside is that flight attendant jobs are notoriously difficult to land, requiring an extensive application process and interview. The upside is that many airlines hire new flight attendants yearly, so all you have to do is keep trying.

Should You Start An Llc Or Sole Proprietorship In Texas

Forming an LLC is often a great choice for businesses with employees, and for those with large incomes who wish to elect taxation. If you are just starting out with a minimal budget and want to keep your costs down, a sole-proprietorship may be a better choice.

In some states, single-member LLCs are not looked at as the same as multi-member LLCs. Texas is not one of these states, but if you wish to expand it is something to consider. Despite this, if you own assets, being a sole proprietor can be dangerous. Protect yourself and your progressing business with an LLC.

Related Topics

You May Like: Is It Better To Lease Or Buy Solar Panels

What Is The Extent Of Liability Protection For Smllc Owners

The SMLLC is a separate entity from the owner, which differs from a sole proprietorship where the owner and business are considered one in the same. If an owner of an SMLLC makes any personal guarantees or pledges to financial institutions in an attempt to guarantee financing, a loan, or other credit, the owner will be liable. An SMLLC owner will also be liable for all negligent or deliberate personal torts.

It’s important to keep all SMLLC documents, like purchase orders, bids, checks, and contracts with the business name and LLC on them. If an owner signs a contract and it’s not clear he or she is acting on behalf of the SMLLC, the owner can be held personally liable. It should be clearly noted on any signature line that the owner is an authorized signer and is entering the agreement on behalf of the SMLLC rather than in a personal capacity.

Llc Vs Sole Proprietorship: Which Is Right For Your Business

Fundid is on a mission to reimagine how businesses get the capital they need to grow. We are doing this by matching business owners with grants and making them easy to be found.Next, we’re creating a better path to credit and capital. Join our waitlist to get early access.

As a small business owner, choosing your business structure is an exciting task, but it doesnt come without its challenges. Many owners wonder about the differences between each business structure and when they should make the leap from a sole proprietorship to an LLC.

In this article, well take a closer look at sole proprietorships and LLCs to find out what they are, how they differ, and how you can choose the proper business structure for your new endeavor.

Read Also: How To Clean Solar Panels On Garden Lights

What Are The Main Differences Between An Llc And A Sole Proprietorship

While its perfectly suitable for an LLC to have a single owner, it could also have multiple owners. An LLC is considered a separate legal entity from its owner or owners, which are referred to as members of the LLC. The LLCs members are not held personally liable for business debts or other liabilities incurred by the business, such as lawsuits, accidents, or injuries. Instead, the LLC is responsible.

A sole proprietorship, on the other hand, is always owned and operated by only one person. The owner of the sole proprietorship is entitled to all the profits of the business but is also responsible for all of the businesss debts and liabilities.

How To Set Up A Sole Proprietorship

Setting up a sole proprietorship is easy: simply start doing business. Thats it! So long as you obtain any necessary permits, licenses or other permissions required by state and local laws, you are a sole proprietorship. Sole proprietorship examples include:

- Individuals who make and sell goods directly

- Independent service providers

- Individuals who are home-based, independent distributors for multi-level marketing organizations

- Independent professionals

- Small businesses with a single owner that engages other independent service providers

One of the biggest sole proprietorship advantages is that setting one up requires no paperwork, no filing fees and no hassle. So, when should a sole proprietor become an LLC or S Corp? If you are thinking about forming an LLC, tax benefits are probably the first thing that comes to mind.

However, although an LLC has some immediate advantages over a sole proprietorship, those desired LLC tax benefits arent automatic. To get the most out of an LLC, you may need to register your business as an S Corp.

Read Also: How To Select Solar Panel For Home

Sole Proprietorship Vs Limited Liability Company : Advantages Of Each

Sole proprietorship vs. LLC, which is more advantageous? We will review the differences and advantages of each.

As a solopreneur, you might be wondering about the most advantageous way to establish your business. As a solo business owner, your best optionsat least in the early stages of establishing your business when you are operating aloneare likely between registering your business as a sole proprietorship or as a limited liability company . Which is more advantageous: a sole proprietorship vs. LLC? It will depend on your needs as a business owner. We will review the advantages and disadvantages of each. But first, lets define the two and see what the main differences are for a Sole Proprietorship and LLC.

Becoming A Travel Blogger/vlogger

Source link

Becoming a travel blogger or vlogger is an excellent way to get paid to travel. Bloggers and vloggers are needed in every niche, and many people dont know where to start. Choosing a topic for your blog or channel will help you determine what type of content you need to create.

For example, if youre creating an outdoors-related blog, you might want to focus on hiking, kayaking, camping, birding, rock climbing, etc. Once you decide on your topic, its time to pick the platform that best fits your needs.

Read Also: Is Solar Worth The Cost

More About Sole Props

- Management structure: The business owner manages the business and is responsible for debts, losses, and liabilities. They report taxable income earned from business activity on their personal tax return.

- How do sole props file taxes? Sole proprietors complete a 1040 personal tax return to report business earnings and pay tax on taxable income.

- Legal protections sole props: There are no legal protections when running a business as a sole proprietorship as the business owner is personally liable for all financial responsibilities.

- Do sole props need to register their business name? Depending on a states registration requirements, they should complete the paperwork to register a DBA with their county or state.

Is Mushroom Farm Business Profitable

By 2021, the mushroom farm industry was worth $50.3 billion, and the global mushroom market is expected to reach $54.9 in 2022. From 2022 to 2030, the compound annual growth rate is anticipated to be 9.7%. .

The US is the worlds second-largest manufacturer, and Europe is the primary consumer. Europe imports almost all of its mushroom foods. The most significant expansion is forecasted for mushroom processed forms such as dried, frozen, canned, pickled, and powdered, as mushrooms have a short shelf life, from 1-3 days.

The demand for specialty mushrooms is rising. Besides food items, some areas poised to grow are mushroom supplements, fungi as food additives, ready-to-fruit blocks, myco textiles, mycoremediation, and mental health.

Therefore, we can say that mushroom farming is one of the most profitable indoor farming businesses worldwide.

Would you like to increase your mushroom farm business? To generate more sales, you should expand the range of items you provide. These items include:

1. Fresh Mushrooms: There is no need to spend time creating a value-added mushroom product like the other items on this list. Just harvest your mushrooms and package them up.

2. Dried Mushrooms: Dried mushrooms are the way to go if you have more fresh mushrooms than you can use in a given week. Because fresh mushrooms have a brief shelf life, drying them can preserve them for weeks or months.

You May Like: How Do I Get My Solar Rebate

Ease Of Raising Money

Sole proprietorships have more difficulty raising money than an LLC. For starters, a sole proprietorship may be viewed as having less credibility, since the business owner did not take the time or pay the expense to incorporate or form an LLC. Lack of credibility makes it harder for a sole proprietorship to get loans, and could force the business owner to rely on business assets and personal credit history to raise funds for the business.

LLCs may offer ownership interest in the business in exchange for money which will help finance the company’s expansion. When a sole proprietor offers ownership in the business to another business or person, the company will no longer be treated as a sole proprietorship.

Llc Vs Sole Proprietorship: What Solo Entrepreneurs Should Consider

6 min read

One of the first hurdles youll face as a new business owner is identifying which business entity is right for your future venture. As you begin your research, you might come across two options: a sole proprietorship and a limited liability company . You might wonder, what is the difference between an LLC vs. sole proprietorship?

Read on to better understand the difference between a sole proprietorship and LLC so you can decide whats the best option for you as you start your business. Each comes with its own nuances.

Don’t Miss: How Does No Cost Solar Work

Management Structure Of S Corporations

In contrast, S corporations are required to have a board of directors and corporate officers. The board of directors oversees the management and is in charge of major corporate decisions, while the corporate officers, such as the chief executive officer and chief financial officer , manage the company’s business operations on a day-to-day basis.

Other differences include the fact that an S corporations existence, once established, is usually perpetual, while this is not typically the case with an LLC, where events such as the departure of a member/owner may result in the dissolution of the LLC.

LLCs and S corporations are business structures that impact a company’s exposure to liability and how the business and business owner are taxed.

Types Of Sole Proprietorships

A sole proprietor may operate as an independent contractor , a business owner, or a franchisee.

- Independent Contractor: An independent contractor is a self-employed sole proprietor who takes on projects on a contract basis with clients. They have the freedom to choose which clients they take on, but they are often subject to the processes and methods that the client requires.

- Business Owner: Business owners can also be self-employed sole proprietors, but unlike the contractor, there is much more autonomy in how the work is completed for clients, and the operation itself may even be more complex with employees and/or intellectual property.

- Franchisee: Franchise owners may also be sole proprietors. The franchisee benefits from the guidance, brand, business model, etc. in exchange for royalties paid to the franchisor.

Don’t Miss: How Much Sun For Solar Panels

Pros Of Sole Proprietorship

- Inexpensive to form: There are few costs to becoming a sole proprietor. Its an easy way to turn your hobby into a real profession.

- Simple tax filing: As a sole proprietor, youll report your business income and expenses on the Schedule C form of your personal income tax return. You pay federal and state income tax on any business profits and pay self-employment taxes.

Sole Proprietorship Vs Single Member Llc

A sole proprietorship vs. single-member LLC refers to the difference between those two corporate structures.7 min read

A sole proprietorship vs. single-member LLC refers to the difference between those two corporate structures. As with all business structures, there are advantages and disadvantages to both. The main distinction between the two is that a sole proprietorship and the owners are one and the same, while a single-member LLC provides a divide between the two in both legal and tax matters.

Read Also: Do You Get Paid For Solar Panels

Why Choose Legalshield To Structure Your Business

Its hard to know what your needs are for a business entity, and even harder to try and work through the entire process yourself. Cost is the main reason most would try to do it themselves, but with LegalShield, cost isnt a barrier to getting the legal help you need. You can work with a lawyer to ensure which business formation process is right for you and that the process is done correctly the first time. Start your business now with LegalShield.

Related Content

Region

This website gives a general overview of legal plan coverage. The benefits and prices described are not available in all states and Canadian provinces. See specific details on terms, coverage, pricing, conditions and exclusions in the Personal Legal Plans or Small Business Legal Plans sections of this website. LegalShield provides access to legal services offered by a network of provider law firms to LegalShield members and their covered family members through membership based participation. Neither LegalShield nor its officers, employees or sales associates directly or indirectly provide legal services, representation or advice. Case studies are actual LegalShield member experiences. Names and identities have been changed for attorney-client privilege requirements. For statistics on actual earnings please review the Income Disclosure Statement here