Is It Bad To Be A Sole Proprietor

Sole Proprietorships Are Hazardous No assets are protected under a sole proprietorship. The entity does not have any separateness, which makes it impossible to call it an entity in the true sense of the word. or failing to make a decision can result in the loss of not just your business assets, but also of your personal assets.

So What Should You Do

If you decide to form an LLC, wait for your LLC to be approved, then apply for a new EIN for your LLC.

Note: In a few states, you actually need to get your EIN before your LLC is filed , however, in most states, you want to wait for your LLC to be approved before applying for your EIN. Check out our how to form an LLC page for instructions on all 50 states.

You dont have to write final return on your Sole Proprietor Schedule C. Youll just file a new Schedule C to report the LLCs income for next tax year. If your Sole Proprietorship has a DBA, you can cancel/withdraw it after your close your Sole Proprietorship.

Launching Your Business In Redmond

Moving from business idea to a real launch is more than a leap of faith. The first time is always the toughest because you are in unfamiliar territory and rookie entrepreneurs will make a lot of mistakes that prove to be very expensive later on. That is why listening and learning from others is so important.

Getting Started

The City of Redmond values the businesses within the community and understands the important role they play. Home to many, from small startups to corporate headquarters, we have several programs and services available to assist.

About the Business Licensing

A business license is required to engage in business in the City of Redmond whether you are located within Redmond, or simply conducting business in Redmond. Learn more

Also Check: What Do I Need To Start A Solar Cleaning Business

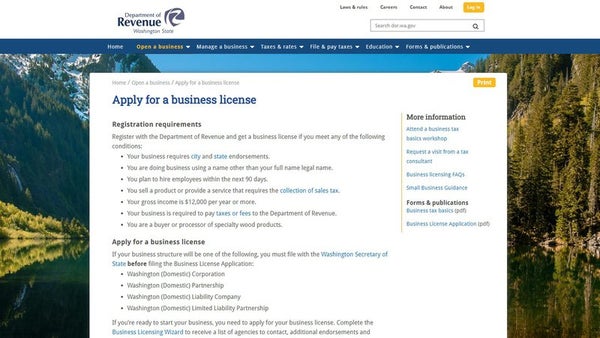

Register With The Washington Department Of Revenue

After your business is formed in Washington, youll want to register with the Washington Department of Revenue. If you applied for your Washington State Business License through BLS , then the system will automatically register you with the Department of Revenue.

We also recommend speaking with an accountant to make sure you properly file your federal, state, and local tax returns.

Washington does not have a state income tax.

However, Washington state does impose a Business and Occupation tax. Pretty much every type of business in Washington state is subject to this tax. That means Sole Proprietorships, Partnerships, Corporations, and LLCs. The B& O tax is based off the gross income of your business.

There is also a local-level B& O tax which varies by city and town.

If your Washington business will sell tangible property, youll also need to collect and pay sales and use tax. Some service-based business must pay sales tax too, as listed on the states business tax structure page.

For further questions, you can also contact the Washington Department of Revenue:

Tax Clearance And Certificate Of Account Status From The Texas Comptroller Of Public Accounts

After you have finished all of the winding up tasks required to close the LLC, then you will need to request a Certificate of Account Status from the Texas Comptroller of Public Accounts. The Certificate essentially indicates that the LLC has paid its taxes and that it can be dissolved.

To obtain a Certificate of Account Status, you will need to file Form 05-039. The Form can be submitted online or as a physical copy at a Comptroller Field Office .

Also Check: Is It Better To Lease Or Buy Solar Panels

Additional Bellevue Registration Requirements

- If you have not registered with Washington State, please visit the Business Licensing Service State business licensing application page to apply for a UBI. If you have registered at the state and you do not know your complete 16 digit UBI, please use the BLS Business Licenses search page to look up your complete UBI.

- If registering a business physically located in Bellevue, you are responsible for contacting the city’s Development Services Department land use desk to make sure your business location is zoned for the activities taking place. Home-based businesses with external indication of commercial activity should also call the Development Services Department land use desk. Please contact land use by email at or by phone at 425-452-4188.

- For publicly owned properties, approval may be granted for park sites by the Parks & Community Services Department at 425-452-4278, and/or streets, sidewalks and other public rights of way by the Transportation Department at 425-452-4599.

- For privately owned property, permission must be obtained from the property owner.

Is It Hard To Raise Money For A Sole Proprietorship

It is difficult to raise money. Sole proprietors often have problems raising funds. You cannot sell shares in a company, which limits the options for investors. Banks are also reluctant to lend to sole proprietorships because of the added risk of getting money back in the event of a company going bankrupt.

Donât Miss: How To Charge Blavor Solar Power Bank

Also Check: Is Solar Energy Bad For The Environment

Does My Washington Business License Register Me For Other Licenses

No. If you need specialty licenses, such as a contractors license, the Washington Business License does not automatically register you for these. You will still need to contact the appropriate agency and go through their application process.

The main purpose of the WBL is to register your company with the Department of Revenue, allowing your business to pay taxes, register employees, and access certain types of insurance.

Is It Legal To Run A Sole Proprietorship Without A License

You are allowed to operate a sole proprietorship without registering, but you are required to register with your local government to collect and file state taxes. There is nothing wrong with running an unregistered business as long as your business is legal and meets all licensing and tax requirements.

Don’t Miss: How To Start A Solar Panel Cleaning Business

Have You Prepared Your Business Plan

You wont want to start your business before you have completed your business plan! You may want to click the Planning box for business planning guidelines. For planning assistance and more in-depth information regarding any of the steps on this page, you may wish to check out the following resources:

Prepare Mandatory Business Information

If you need an EIN for your sole proprietorship, you need to provide the government with several details about your business. Ideally, you should gather the mandatory information before you start applying. That helps to eliminate hurdles along the way. You need the following pieces of information:

- Name of your sole proprietorship

- Doing business as name of your business if applicable

- Contact info for your business

Donât Miss: How Many Solar Panels Can I Have On My Roof

You May Like: How Many Pool Solar Panels Do I Need

Choose The Right Business Idea

The first step toward business ownership is deciding what kind of business to start. Look for an idea that suits your interests, your personal goals, and your natural abilities. This will help you stay motivated when the going gets tough and will greatly improve your odds of success. We have assembled a comprehensive list of small business ideas to help you get started. Need inspiration? Here were the most popular ideas among our Washington visitors in 2020:

Find the Right Business Idea for You

Our free Business Ideas Generator will help you identify great businesses that match your interests and lifestyle.

What Are The Risks Of A Sole Proprietorship

Owning a sole proprietorship can be risky as the personal assets of the sole proprietor can be seized to cover debts. Unlike other forms of business, which distinguish between an entrepreneur and an owner, sole proprietorships are personally liable. Thank you! The self-employment tax changes every year.

You May Like: Do Prius Have Solar Panels

You May Like: How Much Do Solar Panels For House Cost

Obtain Required Licenses And Permits

Most businesses are required to be licensed at both the state and local levels, and many need professional licenses too. You will likely need licenses in every location where you do business not just where youre based. Also, some businesses require additional permits.

The online Business Licensing Wizard is a helpful tool. Use it to learn the licensing and permitting requirements for your specific business. Enter your intended business activity, location, and other key information, and receive an online list of specific licenses and permits that are likely to be required.

- When you file your Washington Business License Application, be prepared to address the following:

- Whether you will want unemployment insurance coverage for corporate officers. Officers who provide services in Washington are automatically exempt from unemployment insurance unless the employer specifically requests to cover them. If you want to cover your corporate officers, you must submit a Voluntary Election Form. Find out more here.

- General business information including physical location and ownership.

- A rough estimate of your expected gross annual revenues.

- Whether you intend to hire employees within 90 days of start-up.

- Whether you will want optional workers compensation coverage for business owners.

Choose A Name For Your Business

Choosing a name for your Washington business is not something you want to breeze through. In fact, rushing the process of choosing your business name can be a big mistake.

You should take some time to choose a name people will remember and associate with your business.

To make sure your business is worth remembering, you should choose a name that:

- rhymes or contains alliteration

- speaks about the benefits of your business

- you can say with pride

- is easy to pronounce and spell

- has a positive connotation for your potential customers

- is available as a .com domain name

By the way, the first bullet point above refers to the phonological loop. Your brain can better remember words that rhyme and sound similar. For additional steps and some good business naming hacks, check out how to choose a good business name.

After youve selected your business name, you should search it on the Washington Database to see if its available:

Bonus Tip on Searching for a Good Domain Name: Check out TRUICs Business Name Generator for great domain name ideas. Just type in keywords relevant to your business, and the tool will come out with a list of suitable domain names.

Check out our Business Domain Name Guide for tips on picking a domain name and a step-by-step guide to buying the domain name through GoDaddy.

Recommended Reading: What To Know Before Buying Solar Panels

Do I Need A Dba In Texas As A Sole Proprietor

In most cases, a sole proprietorship does not need to register a DBA until it operates or intends to operate under an assumed name. In order to operate a sole proprietorship, the proprietor must fill out and pay the registration application and the applicable fee to the county clerk in the county where the business will be located.

What Is A Corporation

A corporation is a new legal entity. When you incorporate, your business becomes a legal entity with the same rights and obligations as a natural person under Canadian law. As the business owner, this means that you no longer have the same legal and financial liability for your business, as that liability is transferred to the new entity that has been created. The new entity, or corporation, can acquire assets, obtain loans, enter into contracts, or be sued.

Read Also: How To Use Sole E25 Elliptical

Do You Need A Business License To Freelance

The majority of freelancers do not need more than one business license, which is a license issued by the city where they work. There are a variety of licenses that you might need. If you live in a city with different business license filing requirements, you may need to file your application differently.

Which Is The Best Form Of Business Organization In Ontario

Sole proprietorships and corporations are the most popular forms of business organizations. To learn more about sole proprietorships and corporations in Ontario and which ones right for you, keep reading. Starting a sole proprietorship in Ontario is the easiest business structure to organize. Its also the most affordable.

Also Check: How To Switch From Sole Proprietor To Corporation

Launching Your Business In Kirkland

Moving from business idea to a real launch is more than a leap of faith. The first time is always the toughest because you are in unfamiliar territory and rookie entrepreneurs will make a lot of mistakes that prove to be very expensive later on. That is why listening and learning from others is so important. A member of the Innovation Triangle and Startup 425, Kirkland prides itself on being a center of innovation. The Innovation Triangle is a partnership of Bellevue-Redmond-Kirkland that is focused on inviting technology and innovation-intensive businesses to experiment, develop and prosper in our Eastside communities. Startup 425 is an initiative of five communities on Seattles Eastside , in partnership with the Port of Seattle. Our mission is to provide the tools that experienced workers, students, and entrepreneurs need to go from idea to working business in a successful, sustainable manner. Learn more

-

Business License Requirements

- Business License: Business licenses are authorizations issued by local and state government agencies that allow individuals or companies to conduct business within the government’s geographical jurisdiction.

Differences Between Llcs And Sole Proprietorships

Now its time to compare the differences between LLCs and sole proprietorships. There are more differences between these business structures than similarities. Rather than just listing bullet points, well take a closer look at various categories you should evaluate. This will make it much easier for you to decide which one is right for your business.

You May Like: How Much To Add Solar Panels To Your House

You May Like: What Type Of Battery For Solar Panel

Do I Need A Business License For A Sole Proprietorship

A sole proprietorship is considered one of the easiest types of businesses to start. Unlike corporations or LLCs, you dont have to register with the state. However, you must acquire appropriate permits and licenses to operate legally, and you are personally liable for debts, lawsuits, or taxes your company accrues.

Do I Need Documentation For A Sole Proprietorship

Owners of sole proprietorships must pay all debts and taxes incurred by their businesses. In order to get a business up and running, setting up a sole proprietorship is the least expensive and easiest option. In most cases, you do not need to file any forms or documents other than a business name that differs from yours.

You May Like: Do You Have To Register As A Sole Proprietor

If Selecting A Corporation Or Llc Structure Get Registered

If the business structure youve chosen is a corporation, limited liability company, or limited partnership, you will need to create the entity or have your attorney do it for you.

- You may have heard that registering your business entity in a state other than Washington is the way to go. Do your homework before acting on that advice! If youre operating your business in Washington, youll need to be registered in Washington. If you do the initial registration in another state, youll need to register in Washington as a foreign entity. You wont save anything in state registration, licensing, and tax costs for your Washington operation, but youll have the added costs of the other state.

- Determine who will be your registered agent, the Washington-based person who will receive your official service of process and business entity notifications. It can be you, your attorney, or an outside party.

- Create Articles of Incorporation or Certificate of Formation , and file them with the Secretary of States office. Filing with the Secretary of State can be done at .

- Create the governance document for your entity: Bylaws Operating Agreement or Partnership Agreement .

What Is A Tax Id Number

An EIN Number stands for Employer Identification Number. Most people consider an EIN Number like a Social Security Number for a business. The IRS requires most businesses to obtain an EIN in order to identify the business for tax purposes. Some advantages of getting your Tax ID / EIN Number include: the ability to open a business bank account or line of credit, to hire employees or to apply for certain business licenses.

You May Like: How Many Panels Needed For Solar Home

Is A Sole Proprietor A Business Owner

Starting a business is usually done via a sole proprietorship, which is the most straightforward and common structure. A single individual owns and runs this unincorporated business, with no distinguishing features between owner and business. The profits of your business belong to you and you are responsible for all the debts, losses, and liabilities that the business has incurred.

Get A Business Phone Number

Instead of giving out your actual cell phone number , we recommend getting a virtual business number for your Washington business. Youll be able to customize the number so it forwards to your cell phone.

Our favorite company is Phone.com. They have the cheapest plans and the best customer support.

You can get a local Washington telephone number or you can get a 1-800 number for your business. Phone.com lets you easily setup call forwarding to any number you like, create pre-recorded messages, and you can even get your voicemails sent right to your email.

Getting a separate phone number for your Washington business is also a good idea if youd like to keep your actual phone number off of those annoying public record websites .

I hope this guide has been helpful for you.

Don’t Miss: Is Solar A Good Investment