Set Your Business Up For Success Regardless Of Business Structure

For first-time entrepreneurs, building a business will bring a host of considerations much different from those that come with full-time or part-time employment. As you grow your client base and hire employees, its helpful to have a support network of people whove been through similar experiences.

Coworking solutions like WeWork are ideal for this, offering a built-in community of collaborators and innovators at every office location. With a mix of entrepreneurs, startups, and established companies using WeWork, theres no shortage of expertise to call upon at times youre looking for guidance.

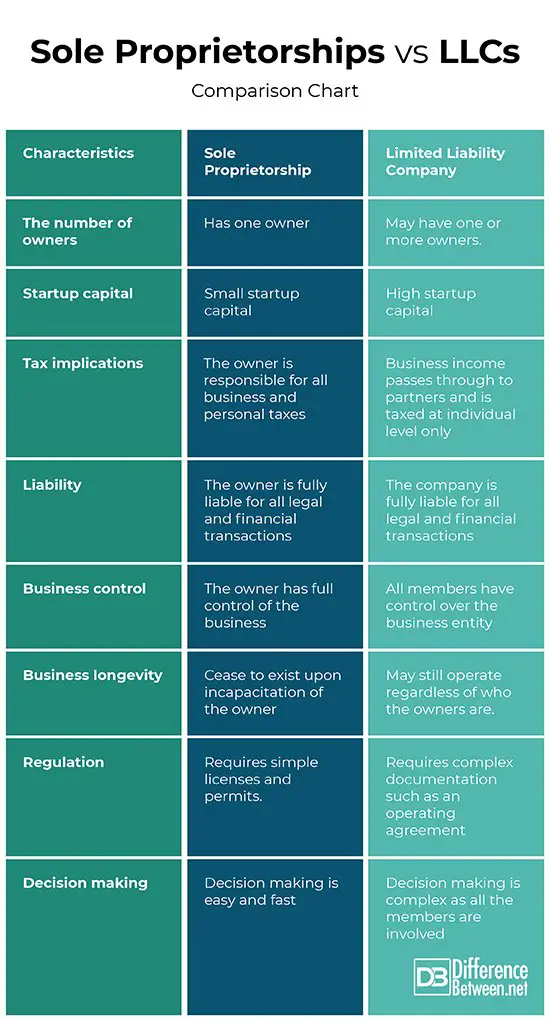

Growing a business can open new opportunities and lead to financial success and fulfillment. Yet to be successful, its important to choose a business structure that affords the appropriate balance of flexibility and protection. Sole proprietorships and LLCs are popular starting points for entrepreneurs, as they offer ownership, control, and protection if you need it.

For more tips on starting a business and growing a team, check out all our articles on Ideas by WeWork.

Caitlin Bishop is a writer for WeWorks Ideas by WeWork, based in New York City. Previously, she was a journalist and editor at Mamamia in Sydney, Australia, and a contributing reporter at Gotham Gazette.

Growing from a few to a few hundred employees takes strategy and the right space.

When Should A Sole Proprietor Become An Llc

The decision is ultimately yours. But keep in mind that as a new business, legal protection can be important to your well-being and the longevity of your endeavor. Forming an LLC early on can help protect you personally from business liability. It can also make your business appear more stable to lenders and vendors, as well as customers and business partners. In that sense, it can be an investment in your success.

Running a sole prop is as simple as getting to work and tracking your income and keeping it separate. You are the owner and the business, so all decisions are yours to make. That makes it easy to get started, but as your business grows you take on more risk.

Get your full credit picture in one spot

Nav brings your personal and business credit together in one FREE account so you can monitor your full credit picture.

Read Also: How Much To Register Sole Proprietorship

Write An Llc Operating Agreement

An LLC operating agreement sets the rules for ownership and operations. This document maps out how the business will be managed. The operating agreement includes details about the LLC members rights and responsibilities, voting power, and portions of profits and losses.

You dont have to submit an operating agreement to any government or legal organization. But if you have more than one member, its a good idea to create one. An LLC operating agreement reduces conflict between members.

Also Check: How Many Solar Panels Do I Need For A Camper

Sole Proprietorship Vs Llc: Learn The Differences

Starting a new business comes with a lot of decisions, not least of which is how to set up and run your startup. If youre seriously considering getting into business for yourself, youve probably heard about sole proprietorships and LLCs as types of business structures, but what is the difference between the two, and which would be right for you? Understanding both can help you come to the right decision.

Sole Proprietorship Vs Llc: Taxes

Sole proprietorships and LLCs are both âpass-throughâ entities, meaning they donât pay federal taxes at the business level. Instead, profits and losses from the business pass through to the ownerâs personal income tax return. That means, tax-wise, theyâre really about the same. The real advantage of forming an LLC instead of a sole proprietorship is the legal liability protection.

Hereâs how tax filing works for different types of legal entities.

You May Like: How To Set Up A Sole Proprietorship In Illinois

Payment Of Taxes On Business Income

A sole proprietor pays taxes by reporting income on a T1 income tax and benefit return.

If you are a sole proprietor, you or your authorized representative have to file a T1 return if you:

- have to pay tax for the year

- disposed of a capital property or had a taxable capital gain in the year

- have to make Canada Pension Plan/Quebec Pension Plan payments on self-employed earnings or pensionable earnings for the year

- want to access employment insurance special benefits for self-employed persons

- received a demand from us to file a return

You also need to file a return if you are claiming an income tax refund, a refundable tax credit, a GST/HST credit, or the Canada Child Benefit. You should also file a return if you are entitled to receive provincial tax credits.

The list above does not include every situation where you may have to file. If you are not sure whether you have to file, call 1-800-959-5525.

How A Sole Proprietor And Single

Establishing the Business

Sole ProprietorBy default, a business owned by a solo individual will be regarded as a sole proprietorship. When entrepreneurs include their first and last names in the business name , they dont have to register their name with the state. If they choose to use a fictitious name Some states also require that business owners run advertisements in a local and/or a legal newspaper to inform the public of the person who is responsible for the business operating under the fictitious name.

Single-member LLCDocumentation called Articles of Organization are required by the state when forming an LLC. In most states, the form is relatively simple, but to make sure youre completing it accurately, you can gain peace of mind by talking with an attorney or asking an online document filing service to assist you. When registering an LLC, the business name is automatically registered, as well, so theres no need to file for a fictitious name.

BothRegardless of the business structure, certain requirements are the same for sole proprietors and single-member LLCs. For example:

- Obtaining an EIN to open a business bank account

- Applying for any necessary licenses and permits

- Withholding payroll taxes from employees wages or salaries

Personal Liability

Income Tax Treatment

Ongoing Business Compliance

Also Check: Where To Buy Solid Gold

Choosing A State To Incorporate

Since taxes, prices and corporate laws are not the same in every state, it is important to consider your home states advantages and disadvantages when it comes to forming your business.

Some things to consider when youre shopping for states:

- Is it worth incorporating outside your home state , even if that means paying extra tax fees?

- How are corporations taxed? What are the taxes if Im foreign-qualified?

- Would there be an income tax on my corporation?

- Is there a minimum or franchise tax?

- Compare projected revenue against cost of taxes for a given state to recognize any advantages

- Ultimately, the best thing that you can do for your business is research states corporate statutes and find what works best for you.

If youre on the fence, check out our blog post about the seven best states to incorporate.

Choose A Registered Agent

When you fill out your LLC registration forms, you will also need to list your registered agent in most states. A registered agent is sometimes called a resident agent, statutory agent, or agent for service of process.

A registered agent will be responsible for receiving important legal documents on behalf of your LLC. A registered agents most important job is to accept service of process in the event of a lawsuit.

Many entrepreneurs choose to hire a registered agent service to help with this part of their business. You can also appoint a friend, colleague, or yourself. In most states, your registered agent must meet these requirements:

- is 18 years or older

- has a physical address in the state where business is conducted

- is available during normal business hours

To learn more, read our What Is a Registered Agent article.

You May Like: Is Solar Power Worth It In Michigan

Who Is Responsible For The Liabilities

Another difference between LLCs and sole proprietorships is how a small business owner is held liable in the case of an accident.

You may be thinking that if a business owner is starting out, they don’t face many risks. But unfortunately, that isn’t always the case.

A survey found 43% of small business owners reported being threatened with or involved in a civil lawsuit. LLCs and sole proprietorships are also subject to risk. How they handle the aftermath of a situation looks differently.

Here’s how:

When a small business owner of an LLC is sued, the business’s accounts and assets are put at risk. In the case of John Doe and Doe’s Carpentry, LLC, this means that a lawsuit could impact Doe’s Carpentry LLC’s financial standing, but not John Doe’s personal assets. Being an LLC means that all liability rests on the companys shoulders.

When a sole proprietorship is sued, however, both personal and business assets are put at risk because they’re one-and-the-same. It is the sole proprietor’s responsibility to take on liabilities. This could have devastating consequences for a business owner they could potentially lose their home, car, or other valuable property.

This is why having small business insurance is a viable consideration for small business owners. There are two common types of small business insurance both LLCs and sole proprietorships may want to consider: general liability insurance and professional liability insurance.

- Bodily injury

Is An Llc Better For Taxes

An LLC can have tax advantages that arent available to sole proprietors, but any benefits will depend on your specific situation and it isnt necessarily always the case, especially when you factor in the fees associated with operating an LLC. Whether an LLC is better for taxes depends on multiple factors, including your profit, expenses, and the type of work you do.

You May Like: How To Install Solar Attic Fan

Llc Sole Proprietorship Or Corporation: Which Is Best For You

For many businesses, the advantages of incorporating far outweigh the costs and creating these entities is easier than ever before. Find out more about how easy and affordable it can be and decide whether taking any of these steps is right for your business.

Legal Disclaimer: This article contains general legal information but does not constitute professional legal advice for your particular situation and should not be interpreted as creating an attorney-client relationship. If you have legal questions, you should seek the advice of an attorney licensed in your jurisdiction.

| Star Rating |

|---|

Read Also: What Voltage Are Solar Panels

Why Sole Proprietorships And Partnerships Are The Most Expensive

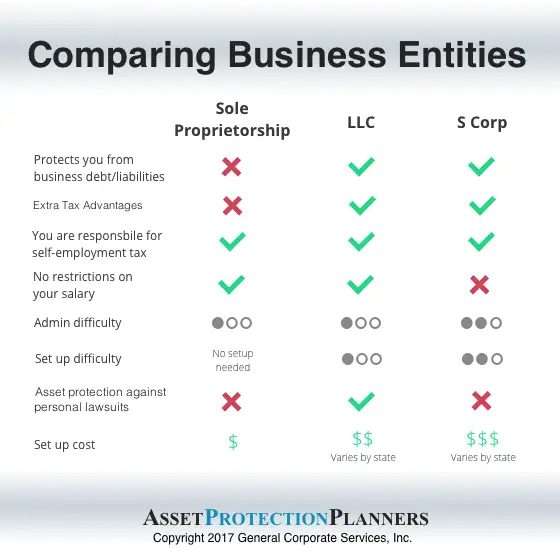

A business entity is one of the most commonly used asset protection instruments. There are different kinds of business ownership types, such as sole proprietorships, general partnerships, corporations, and limited liability companies. Sole proprietorships and general partnerships are typically the easiest and most cost-effective business entities. However, they offer little by way of effective asset protection. Thus, when someone sues the business, they are by far the most costly.

Don’t Miss: How Much Does A Solar Roof Cost

What Defines A Verbal Contract

A verbal contract refers to an agreement between two parties that’s made âyou guessed itâ verbally.

Formal contracts, like those between an employee and an employer, are typically written down. However, some professional transactions take place based on verbally agreed terms.

Freelancers are a good example of this. Often, freelancers will take on projects having agreed on the terms and payment via the phone, or an email. Unfortunately, sometimes clients don’t pull through on their agreements, and hardworking freelancers can find themselves out of pocket and wondering whether a legal battle is worth all the hassle.

The main differences between written and oral contracts are that the former is signed and documented, whereas the latter is solely attributed to verbal communication.

Verbal contracts are a bit of a gray area for most people unfamiliar with contract law âwhich is most of us, right?â due to the fact that there’s no physical evidence to support the claims made by the implemented parties.

Should You Hire An Attorney Or An Accountant

You dont need any help forming a sole proprietorshipits done for you as soon as you make your first sale. If youre forming an LLC, you can complete the entire process on your own. However, it might be nice to have a little bit of help.

Hiring an attorney to incorporate a business is not required, but it is strongly recommended. If youre concerned about tax savings and protecting your assets, youll want to consult an attorney or CPAor, better yet, consult with a tax attorney whos savvy on both regulations and finances.

Theyll help you know when its time to tax your business as an S-corp, and they can help you stay up on your quarterly tax estimates.

Some attorneys will charge a minimal rate to give you the know-how to form an LLC on your own, while others will complete the entire process for you with flat-rate packages. Figure out how much hand-holding youd like, and shop around to get some estimates.

Need help finding an attorney or a trusted CPA? Talk to your friends in the entrepreneur worldchances are they have someone they could trust.

You May Like: Can You Install Solar On Townhouse

How Do I Form A Sole Proprietorship

Unlike an LLC or other forms of business entities, no legal documents need to be filed with the Arizona Secretary of State to create a sole proprietorship. Rather to create a sole proprietorship, a business needs to do the following: choose and file a business name with the Arizona Secretary of State, obtain licenses and permits and finally obtain an employer identification number.

Even though no legal documents need to be filed with the Arizona Secretary of State to create a sole proprietorship, documents will need to be filed to efficiently and legally run the business. This means that obtaining state licensure as well as required permits are a necessity to ensure your business runs smoothly.

Asset Protection And Liability

With this particular business structure, you wouldnt get the liability protections. Even if the business incurs losses or goes to bankruptcy due to multiple debts, it will be you who needs to handle the responsibility of these issues. Here, your personal liability wouldnt remain separate from the business assets.

Don’t Miss: What Makes Solar Panels So Expensive

Determining Your Business Structure Is A First Step In Launching A Startupheres How To Decide Whats Best For You

This Small Business Saturday, were helping small business owners navigate what kind of businessto launch, how to write a business plan, and how to set up a workspace that improves productivity.

Despite the hardships COVID-19 has brought to the economy, many people have chosen this time to become entrepreneurs. Entrepreneurship brings new ideas, greater competition, and increased job creation. However, when it comes to starting your own business, there are countless considerations that will determine your companys success, including the way its structured.

Determining your business structure, or the way your organization will be legally recognized, is a first step in launching a business. Sole proprietorships and limited liability companies are two business structures typically used by entrepreneurs as a starting point, and this article explores their differences, benefits, and drawbacks.

When Are Verbal Agreements Not Enforceable

There are some types of contracts which must be in writing.

The Statute of Frauds is a legal statute which states that certain kinds of contracts must be executed in writing and signed by the parties involved. The Statute of Frauds has been adopted in almost all U.S states, and requires a written contract for the following purposes:

- The sale of real estate or vehicles

- Real estate leases lasting longer than one year.

- Property transfer following the death of the owner.

- The case of a party agreeing to pay debt for someone else.

- Any contract that requires more than a year to fulfil.

- A contract involving and exceeding a specified amount of money .

Typically, a court of law won’t enforce an oral agreement in any of these circumstances under the statute. Instead, a written document is required to make the contract enforceable.

Contract law is generally doesn’t favor contracts agreed upon verbally. A verbal agreement is difficult to prove, and can be used by those intent on committing fraud. For that reason, it’s always best to put any agreements in writing and ensure all parties have fully understood and consented to signing.

Recommended Reading: Do You Need Permission To Install Solar Panels

Pros Of Sole Proprietorship

- Inexpensive to form: There are few costs to becoming a sole proprietor. Its an easy way to turn your hobby into a real profession.

- Simple tax filing: As a sole proprietor, youll report your business income and expenses on the Schedule C form of your personal income tax return. You pay federal and state income tax on any business profits and pay self-employment taxes.

What Is A Corporation

- A corporation is an independent legal entity that exists separately from the people who own, control and manage it.

- It does not dissolve when its owners die because it is considered a separate person.

- A corporation can enter into contracts, pay taxes, transact business, etc.

- The owners have limited liability.

- Contact an attorney or an accountant to determine if this structure works for you.

Recommended Reading: What’s The Cost Of Installing Solar Panels

Llc Vs Sole Proprietorship Vs Corporation

Both sole proprietorships and limited liability companies are relatively simple to form and maintain. But some companies need a more formal structure than either of these entity types can provide. In that case, the business might consider incorporation.

When you incorporate your new business, you have the option of structuring your business as a C corporation or an S corporation. You may also elect to have your LLC taxed like a C corporation or an S corporation.