Sole Proprietorship Guide: Multiple Businesses Multiple Dbas And More

When you open a new business, there are a few different ways you can organize the company from a legal standpoint.

Before selling goods or services, you’ll have to decide how to structure ownership. Depending on who’s involved, you can choose to incorporate, form a limited liability company partnership or set up a sole proprietorship.

That last option is the simplest business structure. It suggests that a single individual owns the company and is responsible for any corresponding liabilities.

Among the different types of business ownership, there is some flexibility with sole proprietorship arrangements. When youre starting out, its worth talking to an accountant or startup lawyer to figure out how you want to set up your business.

This sole proprietorship guide answers some of the most common questions you might have. Click to jump to the topic youre interested in:

Your Name Defines Your Brand

Your brand name is the public’s first impression of your business. Ideally, your business’s name should reflect your product or service, and give people a reason to become paying customers. If sole proprietor Laura Smith kept her businesss name as just Laura Smith, who would know what she offered until they walked into her shop? And why would they feel compelled to walk into that shop at all?

Choosing the perfect name for your business before youve even opened your doors can be hard, though. When your business is in its infancy, who knows where youll be in five years? If youre struggling to come up with an awesome name to file as a DBA, try a business name generator for a little inspiration.

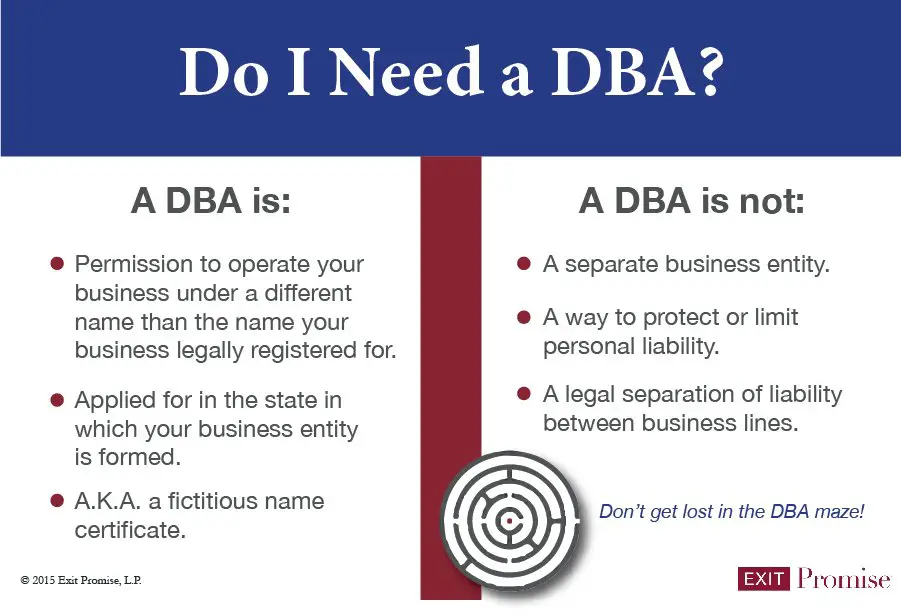

Things A Dba Won’t Do

While filing a DBA will provide your business with some benefits, don’t assume that it will do any of the following.

Provide legal protections: A DBA is not the same as an LLC. LLCs and similar corporate structures provide your business with a suite of legal protections and help remove personal assets from business liabilities. A DBA is essentially just the ability to operate under a fictitious name. DBAs do not provide additional protections.

Grant naming rights: Depending on your county or state, a DBA will not protect your business’s name. Typically, you’ll need to incorporate your business in order to protect the name of your choosing. Also, even if your local county or state protects your business’s name with a DBA, it does not mean that the name is protected outside of the county or state in which you filed the DBA.

You May Like: Do You Need Sun For Solar Panels

Dbas Llcs And Tax Strategy

When it comes to taxes, an LLC with a single owner is considered a disregarded entity. Any income your LLC makes will go straight to your individual tax return because the LLC is subject to pass-through taxation. If you are a sole proprietor using a DBA, your business is also considered a disregarded entity by the IRS. Whatever income your DBA makes will pass through to the tax forms you file for yourself.

To leverage some business-related tax strategies, youre better off looking into forming a partnership or a corporation. Select types of business structures like an S corporation might yield the perfect balance between tax strategy and liability protection for small businesses owners. However, since organizing a corporation comes with a certain set of requirements, you might want to carefully weigh what type of business entity is best for your business. There are several choices, each with their own pros and cons: sole proprietorship, limited partnership, limited liability company, and a corporation, for example.

A competent business planning and consulting firm like Anderson Advisors can give you legal guidance around how to properly file incorporation documents. Additionally, they can also offer assistance in improving the performance of other ancillary parts of your business, like small business bookkeeping.

What Is The Difference Between An Llc And A Dba

DBA is an acronym for “doing business as.” In some states, a DBA might be called a fictitious name, trade name, or assumed name. Basically, a DBA is like a nickname for your company.

An LLC is a type of business entity that allows its owners to protect their personal assets from business liability.

Some business owners use the term DBA to mean sole proprietorship. This confusion happens because many sole proprietors operate under a DBA to avoid calling their business by their personal name only.

We’ll help you choose between running a sole proprietorship with a DBA vs an LLC.

You May Like: How Much Will I Save With Solar

When Do Sole Proprietorships And General Partnerships Need A Dba

In general, sole proprietors or general partnerships who want to call their companies by a name other than their own names need to get a DBA. Most states allow some deviation, as long as the owner’s last name is included in the company name.

For example, if Jane Smith, a sole proprietor, wants to call her yogurt shop Jane Smith’s Yogurt Shop, she wouldn’t need a DBA. But she would need a DBA if she named her shop Jane’s Yogurt Shop, Jane Smith & Friends Yogurt, or Yummy Yogurt Shop .

Here’s why the above scenarios would not require the owner to obtain a DBA:

- The addition of “& Friends” implies that the business has additional owners, and Jane would have to register a DBA to clarify who actually owns the company.

- Yummy Yogurt Shop gives no indication of who owns the business, so Jane would need to register a DBA to use that name for her business.

What Dba Means For Businesses: Does Your Company Need It

A DBA simply stands for “doing business as,” and you’ll file a DBA when you want to conduct business under a name of your choosing. DBAs provide flexibility for both sole proprietors and larger corporations. Without a legal background, it’s tough to navigate filings and regulations, so we’ve compiled a guide that breaks down what you should know about DBAs, giving you more time to grow your business.

Read Also: Can Solar Panels Power A House During A Power Outage

Harder To Hand Over Your Business

With a sole proprietorship your business is wrapped up in your personal finances and is essentially an extension of yourself, so selling it can prove challenging.

To sell your business as a sole proprietor, youd have to sell your business assetsnot the entire business. Also, once you pass your business over, your name will no longer be attached to it unless you registered a Doing Business As or trade name. If you do plan to sell your business down the road, you may want to look into a different business structure thats more seller-friendly by design.

You May Not Be Able To Register Your Sole Proprietorship In The Entire State

There are statesColorado, Florida, and Missouri, for examplein which a single-person DBA filing would go through the Secretary of State, right alongside such organizations as corporations and limited liability companies. But this is not the case everywhere.

In many other statesTexas, California, Wisconsin, New YorkDBAs for individuals are not registered with the state at all the County Clerk is the governing office of DBA registrations in many states across the country.

What if youre located in one of these county-filed-DBA states, but you want to register with the state? In that case, it might be time to consider a more formalized business, like a corporation or LLC.

Read Also: How Do I Set Up A Solo 401k

How Do You File A Dba

The process for filing a DBA is straightforward and simpler than opening an LLC. Rules for DBA filings vary depending on your state and the type of business you have. You may be required to file your DBA with the state or with your city or county, and you may be subject to other requirements, such as publishing your DBA in a newspaper, You can expect to pay a one-time fee of under $200.

When Is A Dba Required In California

A DBA is always required in California when a sole proprietor, or any other business entity, wants to operate and sign legal documents under a different name. The only exception to this rule is if a sole proprietor incorporates his or her last name into the business name.

For example, if someone named John Smith wanted to start a business called “Smith’s Auto Repairs,” they may not need to file a DBA. However, if they wanted to call their operation “John’s Auto Repairs,” then a DBA would be required. A DBA would also be necessary if they wanted to choose a completely different name for their company, such as “A1 Auto Repairs,” or “Superior Auto Repairs.”

Many sole proprietors are required to file a DBA in the state of California. The only exception is when the owner’s last name is part of the business name. DBAs protect consumers, and at the same time, allow business owners to brand their operation appealingly.

The blog posts provided on this website do not, and are not intended to, constitute legal advice instead, all information, content, and materials available on this blog are for general informational purposes only.

Don’t Miss: How To Pigeon Proof Solar Panels

What Is A Dba Or Fictitious Business Name

A DBA is often used by sole proprietors who want to operate their business under a business name that is different from their individual name. In most states, registering a DBA name gives your business the ability to use a fictitious business name however, keep in mind that a DBA name is not the same as a legal business entity and it does not give you the same limited liability or legal protections as an LLC or other corporate structure for your business.

Get Prepared To Hire Employees

As a sole proprietor, when the time comes to hire help, you have several options.

You can hire independent contractors or employees to help you keep up with all the tasks.

If you decide to hire contractors, be sure to:

- Have a signed contract that includes details about what services they will provide and how payment will be made.

- Collect a Form W-9 before you pay them so you can send a Form 1099 in January if required.

Before hiring employees, you need to:

- Get a federal employer identification number from the IRS. You can apply for it and get it instantly on the IRS website or apply by mail or fax.

- Register with your states unemployment office to pay state unemployment tax and with your states revenue department to send tax withholdings.

- Have the employees fill out Form W-4 and Form I-9 and all other necessary employment forms.

Once your employees start working, withhold employment taxes from their wages, contribute your employer taxes, and file payroll reports.

We recommend using a payroll app like Gusto or OnPay because managing things yourself is difficult, and the cost of falling out of compliance is high.

Read Also: How Long Do Solar Panels Last

You May Like: Why Does Pine Sol Smell So Good

Can I Pay Myself A Salary As A Sole Proprietor

In theory, yes. But it wont make a difference in how youre taxed. As a sole proprietor, all of your businesss income is considered your personal income. So even if you had a separate business bank account that you drew a salary from, all of the money your business madenot just the salary youre choosing to withdrawwould be taxed as your personal income.

The Pros And Cons Of A Dba

A DBA stands for doing business as and it allows a business or sole proprietor to operate under a different business name. Some states may refer to a DBA as a trade name, a fictitious name, or a fictitious business. You can use a DBA to obtain anonymity, build marketing power, and operate several lines of businessbut you cannot use it to legally protect yourself. Its important to keep in mind that even a legally registered DBA does not reduce your liability or offer you asset protection.

A DBA offers some easily obtainable, inexpensive benefits. Without having to shell out hundreds or thousands of dollars to file for a corporation, you can make your business appear professional and attractive to customers. Its a fairly cost-effective way to enhance your brand value.

The business that you file can help protect your privacy while complying with local laws about operating under a trade name. A DBA on file will also help you obtain some flexibility, whether youre expanding geographically or into other areas of business. If you want to open a new line of business without confusing clients and customers, or weakening trust in your brand, you can file for an assumed name certificate to branch out quickly and easily. The deal is even better if your business is already an LLCyou wont have to file for several new LLCs if you want to expand your business under a different name.

To hear what others have to say about working with Anderson, .

Bonus Video

Recommended Reading: Can My Roof Support Solar Panels

Sole Proprietorships And Partnerships

A sole proprietorship is a business with only one owner.

A sole proprietor is self-employed, performs all business operations and assumes all liabilities.

A partnership company is operated by two or more parties.

In a general partnership, partners are responsible for all aspects of the business, including the debts of the partnership.

A limited partnership can have general and limited partners. Generally speaking, there’s a limit on the liability of a limited partner, while the general partner’s liabilities are not limited.

A limited liability partnership is has no general partners and all partners have limited liability.

When To Use This Structure

If you dont want to set up a business under a partnership or corporation, you can operate it as a sole proprietorship.

Many business owners use this business entity to build their business and start earning revenue. Then as the business grows, they may decide to switch to a different business entity to gain benefits such as personal liability protection and tax deductions.

#DidYouKnow

Read Also: What Is The Payback On Solar Panels

Can You Hire Employees If You’re A Sole Proprietor

According to LegalZoom, a sole proprietor can hire employees, but you must be careful to avoid violating any local or state regulations. Further, you need to first obtain an employer identification number . The EIN is needed for tax purposes, and the sole proprietor can’t use his or her Social Security number in place of a legal EIN.

Which Is Better For My Business: Llc Inc Or Dba

If your business carries any risk or earns a profit, it is important to form a formal business entity like an LLC or corporation to protect your personal assets. A sole proprietorship with a DBA name will not offer personal liability protection.

Visit our business structure guide to find the best scenario for your business.

Also Check: How Much Does An Industrial Solar Panel Cost

You May Not Be Securing Any Sort Of Exclusive Rights To Your Name

If the fact that someone in the county over could register their own business with the same name as yours gives you pause, you may be interested to know that in many counties, there could even be a business down the street with the same name not all counties protect a business owners exclusive rights to his or her DBA name.

Still interested? Click& Inc can help you register your sole proprietorship DBA quickly, easily, and legally. Ask Click about filing a DBA today!

The Proper Way To Start Business As The Michigan Sole Proprietor

There is no algorithm for organizing the business work of an individual entrepreneur in Michigan as for LLC. In addition, the state does not charge additional service fees for the formation or management of this type of business or company. Are you looking to become an individual business owner and start a sole proprietorship in Michigan? Just start working!

Though, you still have to go through several additional legal formalities. These service stages are optional. Although many sole proprietors prefer not to neglect them, compliance with these formalities guarantees the legal protection of their interests.

Read Also: How Many Kwh Does A 6kw Solar System Produce

You May Like: What Does 4kw Solar Panels Mean

Dba Vs Llc: Similarities And Differences

Yes, a DBA and an LLC allow you to operate your business under a different name, but thats where the similarities end. Heres a closer look at where they differ.

An LLC limits your personal liability for business obligations. A DBA does not give you any additional liability protection.

The process of setting up a DBA is much more straightforward than an LLC. You pay a one-time fee and arent required to file business formation paperwork or comply with annual reporting requirements.

Registering a DBA does not typically give you exclusive rights to use your business name. Forming an LLC gives you more protection, because it ensures that another business entity cant be created in your state with the same name as your business. But neither an LLC nor a DBA gives your name the level of protection youd get with a federally registered trademark.

In addition, a DBA does not change the tax requirements of your company. If you register your sole proprietorship under a DBA, youll be subject to the same tax filings you were before registering your DBA.

As a result of establishing an LLC, you will also register your company under a separate name. For example, Sam could open up an LLC for his personal training practice called Living Well LLC. He would accept payment as Living Well LLC and he would operate under this name. As long as Sams LLC operates under its official name, he doesnt need a separate DBA.

Related:Best LLC Services