Solar Tax Incentives In California

California offers an Incentive Tax Credit credit for anyone who installs a solar power system, which effectively means that the government will subsidize a portion of the cost of installation by reducing your tax bill. But the amount of the tax credit is changing, and it wont be around forever. For all solar systems that are installed and brought online in 2020, are eligible to receive a tax credit of 26% of the total cost of installation for the system, including all parts and labor costs. So if the total cost of your solar installation is $20,000, youre eligible for a tax credit of $5,200, bringing the effective cost of the system to only $14,800.

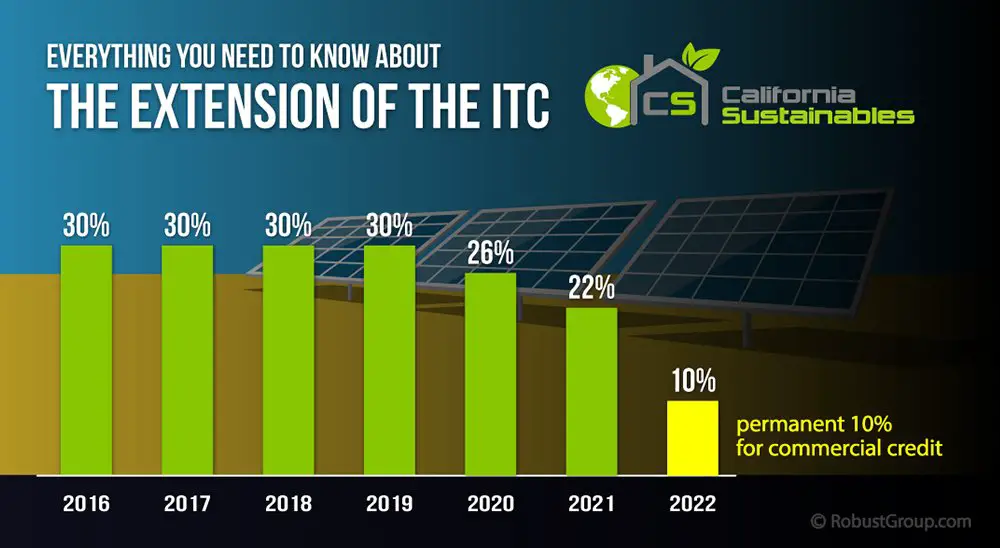

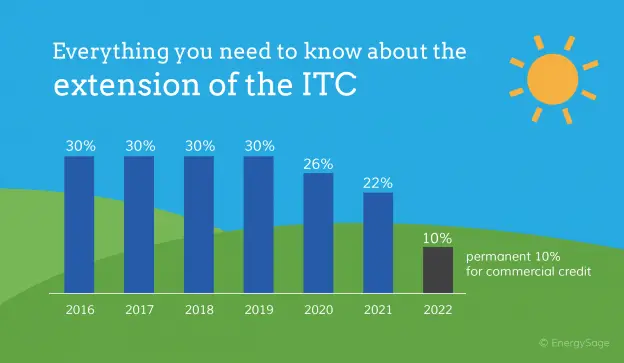

But the credit will decrease in the coming years, and it will soon expire entirely for residential systems. Heres how the tax credit will change in the next few years:

- 26% credit for systems installed in 2020

- 22% credit for systems installed in 2021

- 10% credit for systems installed in 2022

- In 2023 and after, only commercial solar systems will be eligible for a tax credit of 10%

Keep in mind that this is a tax credit, not a deduction: so rather than reducing your effective income by 26% of solar installation costs, it reduces your tax liability directly. You can take the credit all at once or spread it over different tax years, and theres no limit to the credit it amounts to 26% of the installation cost no matter how low or high it is.

Solar On Multifamily Affordable Housing

Do You Rent and Still Want Solar? If your building owner participates in the Solar on Multifamily Affordable Housing program, you as a tenant will see lower electricity bills. Learn more at tenant education materials section

As a building owner you may qualify to receive incentives for solar installation. The solar generation will provide energy credits to lower electricity bills for your common area and your tenants, as well as provide opportunities for jobs and training for your tenants. Learn more

California Renewable And Solar Energy Incentives

California has long been a leading state in the national solar power and renewable energy initiative. Favorable laws, rebates and performance payments, and high electric prices make going solar in California a very wise economic decision.

In addition, the Federal Government offers a 30% tax credit for the whole installed cost of your system That’s a huge benefit available to you no matter where you live in the US! Talk to a local installer about the incentives available in your area.

Also Check: Can I Change From A Sole Proprietorship To An Llc

How Big Of A Difference Is A 26% Tax Credit Versus A 30% Tax Credit

The Investment Tax Credit is applied to your solar arrays gross system cost, so the amount you receive is dependent on the amount of solar youre purchasing. The bigger system, bigger credit.

Heres a quick example of the difference in credits in 2019 and 2021 for a $27,000 9 kW solar array.

Installed and claimed in 2019 taxes at the full 30% level, your credit would be $8,100. Installed and claimed in 2021 taxes at the 26% level, your credit would be $7,020.

Thats a savings difference of $1,080 compared to the previous year.

Tax credit difference in 2019 versus 2020 for 9 kW solar project| Year | |

|---|---|

| $7,020 | $19,980 |

While ~$1,000 may not seem like a huge difference to some, if youre already decided to go solar and just waiting for the right moment, you should move forward this year to maximize your savings.

How Long Does It Take To Get Your Sgip Rebate

After your installation is complete, and utility permission to operate is provided, we will submit more SGIP paperwork. Then, after they review, an SGIP administrator may inspect your system to confirm it is operating properly. Then you will receive your cash rebate, approximately 30 to 60 days from the SGIP approval.

Read Also: Does Pine Sol Deter Mice

The State Of California Also Offers Incentives

California supports homeowners investments in solar power by providing a wide variety of solar incentives and tax rebates. The following incentives are available through the state:

- Single Family Affordable Solar Housing 6

This program provides incentives to qualified low-income homeowners to help offset the cost of a solar electric system.

- Multifamily Affordable Solar Housing 7

This program provides incentives to qualifying customers of Pacific Gas & Electric Company , Southern California Edison Company , and San Diego Gas & Electric .

- Net Energy Metering8

You wont always consume all of the energy that is produced by your solar system. Thats why California offers solar customers the benefit of Net Energy Metering , a special billing arrangement which provides credit to customers with solar systems for the full retail value of excess electricity generated by their system.

How Can I Get Powerwall For Free

Once a customers solar referrals hit 10 and above, a Powerwall would be awarded for free. Anyone using your referral link can earn a $100 award after system activation for solar panels or Solar Roof to reduce reliance on the grid and produce clean solar energy. You will earn a $400 award for each solar referral.

Also Check: Where Are Most Solar Panels Manufactured

What Is A Tax Credit

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000. The federal tax credit is sometimes referred to as an Investment Tax Credit, or ITC, though is different from the ITC offered to businesses that own solar systems.

What Other Information Does The California Solar Incentives Calculator Provide

The calculator has a database of the electric rates charged by each utility company in California. This means that from just the amount you spent on electricity last month, the calculator can show you how much electricity you used and how many solar panels you will need to power your home.

It also uses artificial intelligence to scan your roof and lay out the solar panels in the best places for maximum electricity generation.

Also Check: Can Solar Panels Cause Cancer

Solar Incentives By State 2022

Solar power is energy converted from the sun to thermal or electrical energy. Solar power is a renewable power source that is clean, inexpensive, and readily available everywhere in the world. Because solar energy comes from the sun, it represents an infinite source of energy.

The most common way solar energy is captured is by using photovoltaic solar panels. PV panels generate electricity directly from sunlight via semiconductors. When the silicon photovoltaic solar cell absorbs solar radiation, photons strike and ionize semiconductor material on the solar panel, causing electrons to break free of their atomic bonds. Electrons are forced to flow in one direction, creating a flow of electrical current. Only some of the light spectrum is absorbed, while other parts of the spectrum are reflected, too weak , or create heat instead of electricity .

The first PV device was introduced in 1954 by Bell Labs in the United States. Interest in using solar energy increased during the 1970s due to the energy crisis however, the cost of their implementation made large-scale application impractical. Today, the price of PV devices has dropped dramatically, falling more than 59% over the last decade. Additionally, solar panels can be financed.

Net Metering In California

Net energy metering , or net metering, is an agreement you enter with a utility company. This agreement allows the utility company to track any excess energy generated by your solar panels and sends that energy back into the local power grid. The utility company takes the metered amount of excess energy and reduces your energy bill based on that amount.

Most solar PV systems generate more energy than a typical home consumes. Selling that surplus power back to a utility company provides you with savings on your electricity bills above and beyond the solar rebates and credits weve already listed. You also help your community move closer to clean, renewable energy and lower the demand for grid-supplied electricity from nonrenewable and finite energy sources.

Currently, California offers a statewide net-metering incentive for homeowners with solar panels, but the exact amount of credit you receive varies based on your local utility company. We have listed some of the major utility providers in the state of California below so you can investigate their net-metering retail rates:

Recommended Reading: What Is Soft Solid Deodorant

California Solar Incentive Battery Cover Self

As a residential homeowner in California, you are qualified for an SGIP rebate of $200-$1,000/watt-hour of storage. It increases with the level of KWh you install. If you get battery storage in a property serviced by Southern California, SCE, SDG& E, or PG& E, then you can grab the chance for the SGIP incentive.

The incentive comes in three tiers:

- Residential equity storage

- Residential equity resiliency storage

Residential Equity Storage Incentive

SGIP has an equity budget set aside for solar batteries installed in low-income areas. In addition, the federal government started the residential equity incentive to promote and encourage more battery storage in disadvantaged areas. The rebate received is $850/kWh installed.

Residential Storage

If you have a battery storage system smaller than 10kW in your residential property, you are qualified for a $200/kWh incentive. As a homeowner, you are eligible for this incentive.

Residential Equity Resilience Storage

This equity resilience incentive works for homes located in areas that have experienced more than one planned safety power shut-off or Tier 3 or Tier 4 fire district. Power outages can be an inconvenience and create a negative effect on the household.

Making A Difference In Your Community

As solar adoption and investment have increased throughout the state, low income and disadvantaged communities have lagged behind. DACs are defined as the top 25 percent most disadvantaged communities in California according to CalEnviroScreen 3.0.

We have embraced low-income solar programs by partnering with diverse stakeholders including building owners, affordable housing tenants, solar financing entities and solar installers. We are committed to providing low-income customers with solar programs to enjoy the benefits of clean energy. We look forward to using our experience and success to continue to support our customers as programs evolves.

Don’t Miss: Is Solar Right For Me

What Is The Itc

The ITC is a 26% federal tax credit for solar installations on both residential and commercial properties, reducing the tax liability for individuals or businesses that purchase qualifying solar energy technologies.

The ITC drives growth in the industry and plays a vital role in creating new high-wage jobs, spurring economic growth, ensuring U.S. global competitiveness, and lowering energy bills for consumers & businesses. As a stable, multi-year incentive, the ITC encourages private sector investment in solar manufacturing and solar project construction. The solar ITC is the cornerstone of continued growth of solar energy in the United States.

Does Sdg& e Buy Back Solar Power

With this tariff structure, SDGE charges different prices for electricity use, depending on the time of day, hence the name Time for use. They also buy back excess solar energy produced by solar systems in the home based on these prices, so solar energy is more or less worthwhile depending on the time of day it is produced.

You May Like: How Much Solar Panel Is Needed To Power A House

What Expenses Are Included

The following expenses are included:

- Solar PV panels or PV cells used to power an attic fan

- Contractor labor costs for onsite preparation, assembly, or original installation, including permitting fees, inspection costs, and developer fees

- Balance-of-system equipment, including wiring, inverters, and mounting equipment

- Energy storage devices that are charged exclusively by the associated solar PV panels, even if the storage is placed in service in a subsequent tax year to when the solar energy system is installed

- Sales taxes on eligible expenses

History Of The Solar Investment Tax Credit

In the early days of solar energy, residential systems were far more expensive than they are now. By many homeowner standards, however, theyre still expensive today. For example, in 2009, it cost $8.50 per watt to install solar panels the current cost per watt, as of publishing, is about $2.40 to $3.22.

This point-of-entry cost into the world of renewable residential solar power dramatically limited the number of homeowners who could take advantage of solar for their home.

The solar investment tax credit was established by the Energy Policy Act of 2005, which established standards for renewable fuels, mandated an increase in the use of biofuels and established renewable energy-related tax incentives.

Under this law, the original policy was set to expire at the end of 2007. However, the solar ITC has been so popular that its expiration date has been extended multiple times.

Solar panel costs have decreased dramatically in the last 20 years, but the ITC can still save individuals and businesses a great deal on their federal taxes.

Today, solar systems are far less expensive due to changes in the industry and the manufacturing of certain parts that make up the solar system. Solar panels, lithium batteries and inverters are all far less expensive to make and buy now than they were in those early days.

You May Like: Does Pine Sol Leave A Sticky Residue

Incentives Offered By The State Of California

Currently, the state of California does not offer incentives or refunds to install a solar panel system. The good news is that there is a discount to install an energy storage system called the Auto generation Incentive Program ! This can be claimed along with the California solar tax credits. California Governor Brown SB recently signed 700. This adds some $ 800 million of additional funds to SGIP and expands the program until 2025.

The California energy storage reimbursement program was established in 2001. Until recently, the application of SGIP has been a difficult process, especially for residential customers. The previous reimbursement worked by providing program funds on a specific day. With most of the funds allocated to large industrial energy storage projects. Leaving little available for homeowners looking to store their solar energy. For homeowners who are customers of GDS & E, PG& E, SCE and SCG are eligible for an incentive of up to $ 400 per kilowatt hour when sending a domestic battery. This great incentive has the potential to cover most of your battery costs. The battery size will determine the value you will get per kilowatt.

Before you go, I hope this summary about the question, California have a solar tax credit? is helpful for you.

California Solar Tax Credit

While some states still offer their own state tax credits for solar energy, California doesnt anymore.

However, Golden State policymakers have enacted a property tax exemption for solar PV which is still going strong. This is a great perk, since solar panels will increase the value of your home by roughly 70% of system costs. So while the value of your home will go up, your property taxes wont.

Example: If your solar system costs $20,000, your estimated property value increase of $14,000 will be tax exempt.

Don’t Miss: How To Give Baby First Solid Food

Extra Eligibility Requirements For Solar Water Heating:

The solar water warming hardware must be execution affirmed by the Solar Rating Certification Corporation or another source supported by the overseeing state where the property is introduced.

- At any rate half of the vitality used to warm the water must be solar created.

- The solar speculation tax credit applies for water utilized inside the house or building inside the abode.

How To Claim Solar Tax Credit

Those who are eligible and who wish to claim the credit should file IRS Form 5695 with their tax return. Part I of the form calculates the credit. The final amount is listed on the 1040 form. Individuals who failed to claim the credit when they were supposed to can file an amended return later.

Residential solar energy investors claim this tax credit under Section 25D, while commercial solar investors claim it under Section 48. Individuals claim the residential tax credit on their personal income taxes, while businesses that claim the credit do so on their business taxes.

Also Check: When Does The Solar Tax Credit End

Can I Claim The Credit Assuming I Meet All Requirements If:

I am not a homeowner?

Yes. You do not necessarily have to be a homeowner to claim the tax credit. A tenant-stockholder at a cooperative housing corporation and members of condominiums are still eligible for the tax credit if they contribute to the costs of an eligible solar PV system. In this case, the amount you spend contributing to the cost of the solar PV system would be the amount you would use to calculate your tax credit. However, you cannot claim a tax credit if you are a renter and your landlord installs a solar system, since you must be an owner of the system to claim the tax credit.

I installed solar PV on my vacation home in the United States?

Yes. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit. However, the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own, though it may be eligible for the business ITC under IRC Section 48. See 26 U.S.C. § 25D, which specifies that eligible solar electric property expenditures must be for use at a dwelling unit located in the United States and used as a residence by the taxpayer .

I am not connected to the electric grid?

Yes. A solar PV system does not necessarily have to be connected to the electric grid for you to claim the residential federal solar tax credit, as long as it is generating electricity for use at your residence.

The solar PV panels are on my property but not on my roof?