A Brief History Of Solar Incentives

The ITC was first enacted as part of 2005s Energy Policy Act. Its been a major contributor to the over 10,000% growth the solar industry has experienced since, as well as the hundreds of thousands of jobs created and billions of dollars invested in the US economy along the way.

The Energy Policy Act of 2005 granted a 30% tax credit to solar installations but was only in effect for a year. At the end of 2006 it was supposed to expire. The ITC, however, proved to be very popular. So, Congress passed the Tax Relief and Health Care Act in 2006 to extend it another year.

Since then, the ITC has been extended just on the brink of cancellation several times, with a few amendations along the way. One important change was in 2008. A $2,000 cap for residential solar installations that severely limited the ITCs benefit to homeowners was thankfully removed.

Now the tax credit for residential or commercial solar systems stands at 26% and applies to the full cost of the system with no caps whatsoever.

Schedule Your Pv System Installation Now

If you want to make sure you dont miss out on the federal solar tax credit, you need to schedule your photovoltaic installation soon.

As the solar ITC nears its expiration date, homeowners and businesses will be in a hurry to get their projects completed in time and that will keep professional photovoltaic contractors busy. Plan your PV installation now, and you wont have to worry about tight schedules and longer project timelines.

Remember, there is no guarantee that the solar ITC phasedown plan wont change. The government is already planning a tax system overhaul. This makes the future of the ITC uncertain.

Now is definitely the right time to start planning your switch to photovoltaic power.

Intermountain Wind & Solar, the regions preferred residential and commercial solar contractor, offers free consultations to homeowners and businesses throughout Utah, Nevada, Idaho, Wyoming and Colorado. Contact us today to learn more about claiming the federal solar tax credit for your PV system.

Is The Solar Itc Refundable

The solar ITC is not a refundable credit it can only be used against your organizations U.S. federal income tax liability.

However, the solar ITC may be carried back one year and forward up to 20 years for companies that dont have sufficient tax liability to offset for the tax year their solar energy system was placed in service.

A deduction is allowed for 50% of any portion of the solar ITC that remains unused after the 20-year carry forward period.

You May Like: How Much Do Solid Wood Kitchen Cabinets Cost

How Long Will The Federal Solar Tax Credit Stay In Effect

As the saying goes, all good things must come to an end. And the solar tax credit is no exception.

However, the federal government recently extended the federal solar tax credit as part of a federal spending package passed in December 2020.

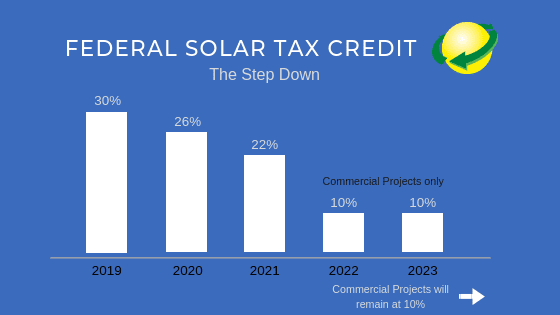

Under this new bill, residential, commercial, industrial and utility-scale solar projects that begin in 2021 and 2022 will be eligible for 26% tax credit. This number will drop down to 22% for solar projects in 2023, and it disappears completely for residential installs beginning in 2024.

Heres a quick overview showing the value of the federal tax credit over the next couple of years:

- 2020 2022: 26%

- 2023: 22%

- 2024: 0%

You can claim the credit in the same year you complete the installation, so you can claim the full 26% tax refund if you install your system before the end of the year 2022.

The tax credit plays a major part in the return on investment you see from going solar, as well as minimizing the upfront cost of the system however, youll have to wait until after filing to see the overall cost go down. Grid-tie systems pay for themselves either way, but claiming the credit allows you to realize more immediate savings. We cant recommend enough that you capitalize on the full 26% credit, because the value only shrinks after 2022.

Filing Requirements For The Solar Tax Credit

To claim the credit, you must file IRS Form 5695 as part of your tax return. Youll calculate the credit on Part I of the form, and then enter the result on your 1040.

- If in 2021 you end up with a bigger credit than you have income tax due a $3,000 credit on a $2,500 tax bill, for instanceyou cant use the credit to get money back from the IRS. Instead, you can carry the credit over to tax year 2022.

- If you failed to claim the credit in a previous year, you can file an amended return.

Currently, the residential solar tax credit is set to expire at the end of 2023. If youre thinking about adding solar energy to your home, now might be the right time to act.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Increase your tax knowledge and understanding all while doing your taxes.

Dont Miss: How To Make Your Own Solar Cells

Don’t Miss: How Much Does Solar Really Save

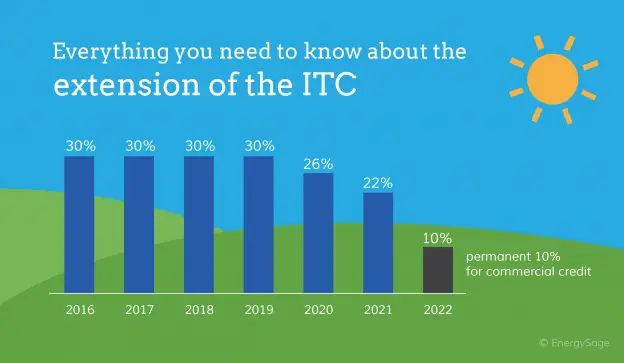

Solar Tax Credit Amounts

Installing renewable energy equipment in your home can qualify you for a credit of up to 30% of your total cost. The percentage you can claim depends on when you installed the equipment.

- 30% for equipment placed in service between 2017 and 2019

- 26% for equipment placed in service between 2020 and 2022

- 22% for equipment placed in service in 2023

As a credit, you take the amount directly off your tax payment, rather than as a deduction of your taxable income.

Using The Federal Tax Credit In Combination With Other Incentives

Aside from the ITC, there are several other solar incentives to consider like rebates, state-sponsored programs, and other tax credits depending on where you live. While some of these financial incentives may impact the ITC, others can be combined to lower the cost of going solar. Heres what you need to know about combining solar incentives with the federal ITC:

- Rebates from your utility company: As a general rule of thumb, subsidies from your utility company will be excluded from income tax returns. So, in this case, any utility rebate for installing solar would be subtracted from your system cost before you can calculate the tax credit.

- Rebates from the state:These types of rebates typically do not reduce your federal tax credit.

- State tax credit:If you get any state tax credit for your solar system, it will not decrease your federal tax credits. However, keep in mind that getting a state tax credit means that your taxable income on federal returns will be higher since you will have less state income tax to deduct.

- Payments from renewable energy certificates: Any time you receive money from selling renewable energy certificates, it will likely be considered taxable income that will increase your gross income. But, it will not reduce your tax credit.

Don’t Miss: Can Solar Panels Cause Cancer

Tax Deductions Vs Tax Credits

Itâs important to understand that the ITC is a tax credit, not a tax deduction. Whatâs the difference? We arenât accountants or attorneys, but weâll take a quick stab at the distinction:

- A tax deduction generally refers to a portion of your income that is exempt from income tax .

- A tax credit, meanwhile, is a dollar-for-dollar reduction of the total amount of income tax you have to pay.

So, if your total tax bill for the year is $14,000 but you earn a federal solar tax credit of $5,000, you can drop $5,000 off your tax bill just like that. Youâd only owe $9,000 in income tax for the year.

Generally speaking, tax credits offer more profound tax savings than tax deductions do. Too many websites and blog articles talk about the ITC as a âtax deduction.â Donât be misled. Weâre talking about a federal tax credit here â and thatâs a big deal.

Am I Eligible To Claim The Federal Solar Tax Credit

You might be eligible for this tax credit if you meet all of the following criteria:

- Your solar PV system was installed between January 1, 2006, and December 31, 2023.

- The solar PV system is located at your primary or secondary residence in the United States, or for an off-site community solar project, if the electricity generated is credited against, and does not exceed, your homes electricity consumption. The IRS has permitted a taxpayer to claim a section 25D tax credit for purchase of a portion of a community solar project.

- You own the solar PV system .

- The solar PV system is new or being used for the first time. The credit can only be claimed on the original installation of the solar equipment.

Recommended Reading: How To Add More Solar Panels

When Does The Solar Investment Tax Credit Expire

The solar investment tax credit, aka the solar ITC, or federal investment tax credit, will expire1 in several years after declining in value each year.

The federal solar investment tax credit provides a credit equal to a percentage of the installed dollar value of a commercial or residential solar system.

The percentage of the credit is currently valued at 26%.2

So, for example, if you install a $50,000 commercial solar system on a building you own, you can take a dollar for dollar tax credit worth $13,000 or 26% of the cost of that system.

The solar ITC can help defray the cost of insurance for solar energy systems both large and small.

Putting The Numbers In Perspective

With a little math, we can demonstrate the effect of the changes in the solar ITC.

Lets say a PV system comes in at a net price of $30,000. With the full 30 percent ITC, the credit would be a rather impressive $9,000.

Now, imagine that same PV system installed in 2020. The tax credit has dropped to 26 percent, so the tax liability reduction would be $7,800.

If the solar PV system isnt placed into service until 2021, when the credit drops to 22 percent, the ITC will be worth just $6,600.

After the end of 2021, the federal solar ITC for a $30,000 commercial photovoltaic installation will drop to only $3,000. And forget about a credit for a residential PV system that financial incentive will be gone.

Read Also: How Fast Do Solar Panels Pay For Themselves

When Does The Federal Solar Tax Credit End

Congress recently passed an extensive omnibus spending package that included $900 million in coronavirus relief and part of that relief included an extension for the solar tax credit. Under the new legislation, the residential solar tax credit will not expire after 2021. Instead, it will continue at a rate of 26 percent for an additional two years, helping make solar power more affordable to all.

Tax Benefits Of Going Solar

Tapping the sun for power offers several benefits. For example, solar power:

- Doesnt pollute

- Reduces our use of coal and other fossil fuels

- Reduces your individual carbon footprint

But since the installation of solar power equipment can be costly, the solar tax credit can help you offset some of the costs.

Also Check: How Do You Clean Solar Panels On Garden Lights

Don’t Miss: How To Stop A Solar Farm

% Solar Tax Credit Extended Through 2022

The $1.4 trillion federal spending package signed into law at the end of 2020 contained some good news for Americans looking to convert to solar energy. The 26% solar investment tax credit that was just a few days away from expiring got extended for another two years. So, any solar installation that begins construction before 2023 will still be eligible for the full 26% tax credit.

Though a lot of folks dont know about the ITC, its one of the most important actions congress has taken to encourage the growth of clean and renewable energy. And youll definitely want to factor it in when calculating your return on investment for going solar.

So, what is ITC and how does it work?

What Is The Federal Solar Tax Credit

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic system.

The system must be placed in service during the tax year and generate electricity for a home located in the United States. There is no bright-line test from the IRS on what constitutes placed in service, but the IRS has equated it with completed installation.

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. The tax credit expires starting in 2024 unless Congress renews it.

There is no maximum amount that can be claimed.

Read Also: How To Add Solar Panels To Your House

Yes The Whopping 30% Federal Tax Credit Is Going To Expire

Did you know that if you install a residential solar energy system in your home, youre eligible for a whopping 30 percent tax credit? Thats on top of any other incentives offered by your state! But when does the federal tax credit end? How long will it be around? Heres what you need to know:

Federal Tax Credit? What?

The Energy Policy Act of 2005 initially stated the federal tax credit for residential energy could be applied to solar electric and water heating systems. Then in 2008, the tax credit was extended to geothermal heat pumps. Afterwards, the credit was extended another eight years.

Now, the credit is due to end December 31, 2016. Taxpayers can claim a credit of 30 percent of systems owned and used by a residence, including the cost on the system, installation, and other labor. However, to take advantage, all solar systems must be in service by the 2016 expiration date to count. Other requirements apply depending on the type of solar energy system you install.

How Does the Credit Work?

Instead of a deduction from your taxable income, the credit is applied off your tax payment. Claim it for your primary residence, vacation home, or a new home under construction. The best part is that there is no limit to the dollar amount of the credit! All you have to do is file your tax return and figure out the credit on the form. You wont get money from the IRS if the credit exceeds your taxes due, but it will roll over into the following tax year.

Get A Professional Solar Power Design For Your Next Construction Project

Solar power systems are much more affordable than two decades ago, but losing the tax credit would make them more expensive in terms of net cost. After the new Congress bill, the 26% solar tax credit stays available through 2021 and 2022. In addition, the reductions to 22% and 10% have been postponed until 2023 and 2024.

Other than having low cost and low environmental impact, solar power has created many jobs in the US economy. There were already 12,000 solar installer jobs in the US in 2019, and this will increase by 6,100 by 2029, according to the US Bureau of Labor Statistics. Only two occupations are growing faster: wind turbine service technicians and nurse practitioners.

Don’t Miss: How To Switch From Sole Proprietor To S Corp

The Department May Award The Tax Credit Once The Following Documents Are Provided:

How Big Of A Difference Is A 26% Tax Credit Versus A 30% Tax Credit

The Investment Tax Credit is applied to your solar arrays gross system cost, so the amount you receive is dependent on the amount of solar youre purchasing. The bigger system, bigger credit.

Heres a quick example of the difference in credits in 2019 and 2021 for a $27,000 9 kW solar array.

Installed and claimed in 2019 taxes at the full 30% level, your credit would be $8,100. Installed and claimed in 2021 taxes at the 26% level, your credit would be $7,020.

Thats a savings difference of $1,080 compared to the previous year.

Tax credit difference in 2019 versus 2020 for 9 kW solar project| Year | |

|---|---|

| $7,020 | $19,980 |

While ~$1,000 may not seem like a huge difference to some, if youre already decided to go solar and just waiting for the right moment, you should move forward this year to maximize your savings.

Also Check: Can Solar Panels Work On Cloudy Days

What Is The Federal Solar Investment Tax Credit

Is your organization considering commercial solar?

If so, heres some great news: The Internal Revenue Code provides an Investment Tax Credit for investments in commercial solar.

That means your company may be able to qualify for an ITC that can be used as a dollar-for-dollar reduction to its U.S. federal income tax.

So, if you or your organization is interested in investing in solar and would like to take advantage of the solar ITC, the time to act is now.

Keep reading to learn more about the solar ITC and how your business may be able to qualify for it.