Build A Business Website

No startup is complete without a well-crafted business website. Your startups website serves not only as a resource for customers to learn important information about your business in Kentucky it is a visual representation of your brand. Depending on your experience level, you can build your business website yourself or use a website builder such as GoDaddy .

Recommended: A website builder allows you to create and maintain a professional website without the headache, or massive expense, of building one from scratch. Check out our top 5 business website builders guide for prices and other information about our favorite services.

Promote And Market Your Business

Promoting Your Kentucky Business

Its no secret that an effective marketing strategy is essential to growing a successful startup. Whether youre issuing a press release, running a Facebook ad campaign, optimizing your Google listing, or a combination of these strategies, there are many marketing strategies available to promote your business in Kentucky.

Press Releases

Press releases are a great way to communicate important information about your Kentucky business to media outlets and potential clients. One of the best ways to ensure you are sending out effective press releases is to hire a press release distribution service that will not only write your press release but will ensure timely delivery to the most impactful sources.

Our favorite press release distribution service for startups is Sitetrail for their budget-friendly pricing and full-service offerings, including the writing and distribution of targeted press releases.

Creating a Facebook page is an impactful way to reach customers and expand your brand exposure. Not only does this platform give you a chance to showcase your businesss products and services, but you can also run effective ad campaigns depending on your business needs.

Keep in mind that creating a strong social media presence, especially on Facebook, requires time and effort in order to gain traction and produce results.

Google My Business

Choose The Right Business Idea

The first step toward business ownership is deciding what kind of business to start. Look for an idea that suits your interests, your personal goals, and your natural abilities. This will help you stay motivated when the going gets tough and will greatly improve your odds of success. We have assembled a comprehensive list of small business ideas to help you get started. Need inspiration? Here were the most popular ideas among our Kentucky visitors in 2020:

Find the Right Business Idea for You

Our free Business Ideas Generator will help you identify great businesses that match your interests and lifestyle.

Recommended Reading: How Does A Sole Proprietorship Work

Business Structure And Entity Type

The application for a business license will ask whether the business will be a sole proprietorship, corporation, partnership, or limited liability corporation. Under most circumstances, additional forms may need to be completed for all types of entities except a sole proprietorship. The Kentucky Office of the Secretary can assist with obtaining these additional forms and determining which type of entity will be best.

What Is An Llc

Starting a business is an exciting prospect. If youve talked about forming a business with friends or family, then maybe youve heard the following advice: You should form an LLC! But what does that mean?

Below well cover everything you need to know about LLCs. By the end, youll have a clearer idea of whether or not an LLC is right for you.

Don’t Miss: How Many Kwh Should My Solar Panels Generate

How Serious Are You About Your Business

This may sound like a stupid question, but hear us out. We couldnt possibly keep track of all the times weve seen people form LLCs only to do nothing with them. Therefore, we think its at least worth asking yourself if youre really serious about this before you go through the hassle and expense of forming your LLC. If you are ready to do business, great! But if youve just had a spontaneous idea that you havent thought through, or if you dont know if you have the time/energy/capacity to dedicate to a serious business, you might not be ready quite yet.

Prepare An Operating Agreement

In Kentucky, an LLC operating agreement is not necessary, but it is strongly recommended. This is an organizational guide that outlines how the LLC will operate. It outlines the representatives and managers privileges and duties, as well as how the LLC will be handled.

It will even help you keep your limited liability by demonstrating that your LLC is a distinct business entity. In the absence of an operating agreement, your LLCs activities would be regulated by state LLC statute. An operating agreement does not need to be lodged with the Articles of Organization if one is established.

Don’t Miss: How To Design Solar Panel

How Much Does An Llc Cost In Kentucky

Whether youre starting a business from home or youre looking to expand your current company, you need to know how much an LLC costs in Kentucky before you sign the papers. Many people opt to hire an attorney or use one of the many online services available, but these costs can add up quickly. Fortunately, there are many options for forming an LLC. In this article, well look at the most popular options in Kentucky and provide a comparison between them.A Kentucky LLC costs $40 per year. This includes all the fees related to the formation of the business, including annual reports and registered agent services. You also have to pay $15 for filing your LLCs annual report in Kentucky. This fee isnt as expensive as you may think! Plus, with the service, you can file your annual report online or through a paper form, which requires less than 15 minutes.When it comes to filing an LLC in Kentucky, IncFile is the best choice. Besides charging only $0 plus state fees, they also provide registered agent services for the first year. Another advantage of this service is its next-day service, and theyve helped more than 250,000 companies get started. They have a good customer support team and ensure that you have all the information you need to protect your business. They also have a dashboard that allows you to easily monitor the status of your business.

Select An Appropriate Business Name

A sole proprietor in Kentucky can use his/her own given name or may opt for a trade or assumed business name. However, a tradename sounds more professional than the owners personal name. DBA name plays a pivotal part if you prefer to choose an assumed business name.

The state law requires the DBA must be distinguishable from the companies/businesses that are already on record.

Tidbit

Check the following government databases to make sure your fictitious or DBA name has not been trademarked already.

- Kentucky Secretary of State

- The United States Patent and Trademark Office

Also Check: What Is The Cost Of A Solar System

Get A Business License

A general business license is not needed to create an LLC inside Kentucky, however, you will need an occupational license to work in some controlled industries. Among the regulated occupations are:

- Psychologists, psychiatrists, alcohol educators, and social services are also examples of professionals.

- Engineers, developers, and landscape architects

- Cosmetologists, barbers, nail designers, and estheticians are also examples of beauty professionals.

- Electricians and plumbers

Check out the city-specific criteria for the cities in which you would be working. There may be general business licenses or industry-specific licenses. Denver, for example, does not require general licensing but does require permits for food peddlers, dry cleaners, child care centers, and other companies.

Cons Of Sole Proprietorship

- The owner is personally liable for the businesss debts and other liabilities.

- It may be more difficult to get business loans or secure funding from investors.

- Some clients and vendors may not perceive the business as credible as a company with LLC or Inc. behind it.

- The pass-through taxation may not be advantageous financially to some entrepreneurs.

Don’t Miss: What Is The Difference Between Sole Proprietor Llc And Corporation

Send Out A Press Release

Press releases are one of the simplest and most effective ways to advertise the business. They are still one of the least expensive tactics since they:

- Gives advertising

- Establish your brands online presence Boost your websites search engine optimization , drawing more customers

- Are a one-off commitment in terms of time and resources

- Have long-term advantages

Set Up An Accounting System

Setting up an accounting system for your business is one of the most important things you can do for your company to ensure long-term success.

There is just one problem youre not a numbers person.

Just thinking about financial statements, debits and credits, and accounting software makes your head hurt.

Staying on top of finances not only keeps the business on top of state and IRS tax requirements, but it can be used to track and monitor trends in the business and maximize profits.

Fortunately, understanding the numbers doesnt mean getting a finance degree. Tracking a businesss financials can be done with pen and paper , spreadsheets, accounting software, or hiring a bookkeeper.

You May Like: Where Can I Buy Solar Batteries

Free Mail Forwarding Business Address And More

At Northwest, we do everything a registered agent should do and more. You can list our address as your business address on your state filings. We include limited digital mail forwarding with registered agent service .

Plan on accepting credit cards? We also offer a Free Credit Card Processing Consultation. Our specialists work with processors to negotiate low rates and better contracts for our clients.

And now, try our in-house Northwest Phone Service for 60 days, free of charge with our formation service. Get a virtual phone number with your choice of area code, make and receive calls from any device, and morefor just $9 a month.

How To Start A Sole Proprietorship In Kentucky

Are you currently self-employed and planning to enter the arena of one-person business ownership in the state of Kentucky? If yes, you might be interested to become a sole proprietor.

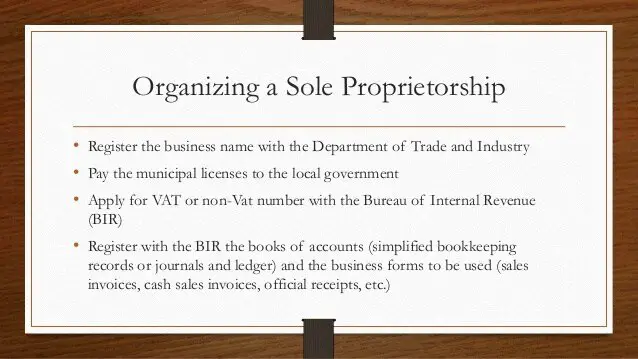

A sole proprietorship is the most straightforward and easiest business model in the United States of America. Like every other state, in Kentucky too, you do not need to file any legal document with the state government of Kentucky to establish a one-person business also known as a sole proprietorship.

Not from Kentucky? Learn to become a Sole Proprietor in any other State.

Point to Ponder! A sole proprietorship is not a formal/legal business entity like an LLC or a corporation. And there is no personal asset protection against any liability in the case of a sole proprietorship. Therefore we recommend forming an LLC, the most popular entity for small businesses. You can form an LLC by yourself or hire a service like Zenbusiness, to let them get the paperwork done for you.

A sole proprietorship is the simplest and relatively an old business model in the USA. Although there is no formal set up process required in a sole proprietorship, yet there are few steps to follow that many sole proprietors find in their best interest.

Read Also: How To Read Aps Bill With Solar

Register Your Business In Kentucky

Next, the time has come to actually register your company and form a new business entity. You will need to work with the Kentucky Secretary of State, either through the Kentucky One Stop Business Portal or through the mail.

There are two broad options that you can take when forming your company:

- Do the work yourself, or

- Use a professional business formation service

Services like Northwest Registered Agent,ZenBusiness,and Incfileprovide low-cost services to help you start your new company. These services walk you through each step of the process, ensuring that everything is handled correctly and efficiently. You will pay a bit extra to use one of these services, but the time you save will be well worth it.

If you decide to do the work on your own, the basic steps include:

There are different steps necessary depending on the type of business you plan to form. Here are specifics for the most common types of businesses formed in Kentucky:

Find The Perfect Name

Your LLC name must be unique in Kentucky, so youll need to check existing business names by conducting a business name search to ensure there are no conflicts. To do this, consult our Kentucky Business Entity Search page. Once you find a name thats available, move on to the next step.

Limited Liability Company Name Requirements

In Kentucky, you must add an LLC designator to the end of your official company name. This means that youll need to add a designator like LLC or Limited Liability Company to the end of your business name. You can find a full list of all acceptable designators below.

- Limited Liability Company

- LLC

- LC

Once youve decided on a name and designator, you have the option to reserve it to ensure that no one else registers it before you. Kentucky allows you to reserve a business name for 120 days for a fee. If youd rather not deal with this process yourself, we have a business name reservation service that can handle it for you. As part of the service, we also check to see if your desired name is available.

Secure a Domain Name for your New Business

Youll likely want to use your LLC name on a website, too. Double-check through a domain name search on whether its available, and have someone like us reserve your website domain name once youve made your choice.

You May Like: Can You Make Solar Panels At Home

File A Dba In Kentucky

If you want to do business under a different business name youll need to file for a DBA, or Doing Business As. Find out more about how to get a DBA, how it affects your business, taxes and more.

What is a DBA?

If the owners of a company want to do business using a name that is different from the original name used to form the business, they must register the secondary name. For sole proprietorships and partnerships the original name is the actual name of the owner or partners.

This secondary name doesnt replace the original name but acts as an additional, legal name for the business. This name is known by several terms such as trade name, fictitious business name and assumed name. The process for filing this name is often called filing for DBA registration, or doing business as.

For example, if John Smith, owner of a sole proprietorship, wants to do business as Best Carpet Cleaner rather than John Smith then he has to file a DBA.

When you need a DBA

Kentucky law requires all sole proprietorships, partnerships, limited partnerships, limited liability partnerships, corporations, limited liability companies, business or statutory trust, or limited cooperative association to file for a DBA if the owners want to do business under an assumed name in Kentucky.

In addition to being required by law, filing a DBA registration allows a company to open bank accounts with the assumed name and helps prevent other businesses from using the assumed name.

Tax Considerations

Filing A Kentucky Dba For Sole Proprietors

Sole proprietors are required to file their DBA with the appropriate county clerk’s office.

A sole proprietorship is a business owned by a single individual that isn’t formally organized. If you run a business and file taxes under your own name, you are a sole proprietor.

A DBA doesn’t offer any protection for your personal assets in the event that your business is sued. For more information on setting up a limited liability company, visit our How to Form an LLC page and select your state.

SKIP AHEAD

If you need to create a DBA for an LLC or Corporation, you can .

Recommended Reading: How Much Is The Tesla Solar Panels

Choose A Name For Your Llc

According to Kentucky statute, an LLC name must include the terms limited liability company or limited company, as well as the abbreviation LLC or LC. If you choose to shorten limited company, use the abbreviation LTD CO.

The name of your LLC may be distinct from the names of any corporate companies currently on file with the Kentucky registered Secretary of State. Check the Kentucky Secretary of State company name database to see whether a name is accessible.

When doing business in the real world, you are not forced to use the official legal name registered in your Articles of Organization. An assumed corporate name, sometimes known as a fictitious name, DBA , or trade name, may be used instead.

In Kentucky, you have to file a Certificate of Assumed Name with the Secretary of State in the state of Kentucky. You may file either by mail or online. The registration is valid for a period of five years. There is a $20 filing fee.

Open A Wage Withholding Account

Do you plan to recruit staff and deduct taxes from their pay? The state of Kentucky then allows you to open a salary withholding account, which you can do for free online. If youre recruiting W-2 workers or withholding taxes from 1099 contractors, youll need this. You will use this account to administer and reimburse deferred income tax.

Read Also: How To Register A Business Name For Sole Proprietorship