When Should You Open An Llc

There are a few reasons to open up an LLC instead of operating as a sole proprietorship:

- You want to expand the company to more than one owner in the future, which is easy with an LLC

- You want to protect your personal assets from potential financial and legal liability

- You want to take advantage of any applicable local, state or federal tax benefits that come with forming an LLC

In summary, setting up an LLC could position you for growth and protect you from liability. People also consider opening up an LLC when they reach a certain income threshold in their business and the additional fees and paperwork make sense from a tax perspective. This varies by state and the type of business, so its a good idea to speak to your accountant and compare the taxes youll be paying with each business structure.

When To Use An Llc

LLCs offer taxation benefits, increased credibility, and most importantly, personal liability protection.

LLCs are recommended for businesses with the following characteristics:

- Larger customer base

- Potential for immediate and sustainable profit

- Increased risk of liability or loss

- Would benefit from unique tax options

Advantages of LLCs

- Personal Liability Protection. LLCs provide personal liability protection. This means your personal assets are protected in the event your business is sued or if it defaults on a debt.

- Tax Benefits. LLCs and have options to customize their tax structure. This allows businesses to use the best tax strategy for their circumstances.

- Growth Potential. LLCs can grow in profit and risk because they provide personal liability protection and tax benefits.

- Credibility and Consumer Trust. LLCs generally earn more trust from both banks and consumers than do informal business structures like sole proprietorships. This can impact a business’s ability to take out loans and can affect marketability.

Ready to Form Your LLC?

Our free guide walks you through the process of LLC formation in all fifty states. In just five easy steps, you can be on your way to owning your own business.

You can also use an LLC formation service to register your LLC for you.

Can A Sole Proprietor Have Employees

Yes! You can hire one employee or several. Remember that youre responsible for paying employer payroll taxes, withholding employee payroll taxes, following local labor laws, and paying your workers according to updated worker classification rules.

LLCs can have employees, too, and will pay them according to the same rules.

Pro tip: Did you know that employing your own children may have special tax benefits exclusively for sole proprietors? The IRS allows you to hire your own children and write off their wages as a business expense, just like any other employee. You can also potentially set-up retirement plans for your children to help with your savings goals.

One additional perk is that you dont have to pay Social Security or Medicare taxes, just as long as its the child of the owner sole proprietorship or the child of both partners for a partnership. The child must also be under 18. This benefit doesnt apply to corporations or LLCs with corporate tax structures.

Also Check: When Is The Best Time To Install Solar Panels

How To Start An Llc

To start an LLC, you need to name your business, file the paperwork and pay the fees, and create an LLC operation agreement.

If youd like to get help with forming your LLC, email me at

The fact that one of the advantages of forming a sole proprietorship is that it is super easy results in some people thinking forming an LLC is not so easy. The problem with this line of thinking is the process isnt as complicated as people think it is. In fact, if you follow these steps it is pretty easy too.

First, you need to choose a business name. The name has to comply with the LLC rules of your state. Obviously, you also need to make sure you are choosing a name that does not belong to another business.

Next, you have to file all of the formal paperwork. It is not uncommon for you to pay anywhere from $100 to $1,000 filing all of the necessary paperwork depending on your state rules.

Third, you have to draw up an LLC operating agreement. It may actually be helpful to have a lawyer assist in creating this document. This document will lay out all of the responsibilities and rights of all the members of the LLC. This document is basically the backbone of the company.

Depending on where you live, you may be required to publish a notice saying that you intend to form an LLC. Keep in mind, this is only required in a handful of states.

When youre ready to start your LLC, I can help you make sure everything is legal and compliant. Email me at today to get started.

How To Form An S Corporation

Also Check: How Much Power Does Tesla Solar Roof Generate

Why Is A Corporation Better Than A Sole Proprietorship

Forming a corporation offers many advantages compared to establishing a sole proprietorship, such as personal liability protection, tax benefits, and investor opportunities. In general, forming a corporation is a better choice for businesses that expect to make a substantial profit and want to protect the personal assets of its owners or shareholders.

However, a sole proprietorship could be the right choice for your business if it is a low-profit, low-risk venture. Furthermore, if you choose to restructure your business to become a corporation, the option is always available as your business grows.

Drawbacks Of Sole Proprietorships

A sole prop might not always be the best choice, depending on your business type and goals. Here are some disadvantages compared to LLCs:

- Personal liability. The owner is responsible for all debts or losses incurred by the business, including lawsuits.

- Difficulty raising capital. Banks and investors are generally less likely to provide financial support for sole proprietorships in comparison to LLCs because its a less formal business entity.

- Everything is on you. Without partners or investors, entrepreneurs are on their own when it comes to making business decisions in a sole prop. Owning and running your own business can be isolating at times.

You May Like: How Much Commission Does A Solar Salesman Make

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The Difference Between A Sole Proprietorship And A Corporation

A sole proprietorship and a corporation are two different business structures that have different advantages and disadvantages.

Sole proprietorships are an informal business structure that offers no tax benefits or personal liability protection but allows more flexibility and freedom for business owners.

Comparatively, corporations are formal legal business structures that offer personal liability protection, tax benefits, and investor opportunities but are complicated to maintain.

You May Like: How Much Do Solar Panels Cost In Oklahoma

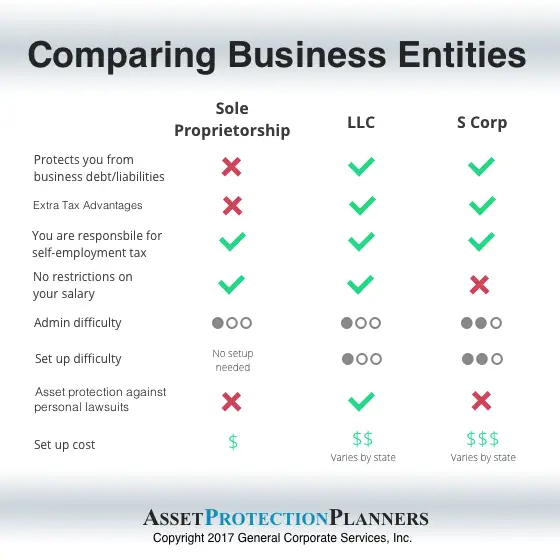

Why Would You Choose An S Corporation

An S corporation provides limited liability protection so that personal assets cannot be taken to satisfy business debts by creditors. S corporations also can help the owner save money on corporate taxes since it allows the owner to report the income that’s passed through the business to the owner to be taxed at the personal income tax rate. If there will be multiple people involved in running the company, an S corp would be better than an LLC since there would be oversight via the board of directors. Also, members can be employees, and an S corp allows the members to receive cash dividends from company profits, which can be a great employee perk.

Benefits Of An Llc Over A Sole Proprietorship

The first and most significant benefit of LLCs is your ability to protect your personal assets from any debts or losses made by the company.

The second advantage lies in a potentially effortless transfer of ownership of the company to another party. Theres also the issue of bringing new partners on board without having to change the structure of the business.

The third advantage is the option to choose how you pay taxes. As an LLC, you can pay taxes as a sole proprietorship , S corporation, or C corporation.

Also Check: Where Are Most Solar Panels Manufactured

Sole Proprietorship And Corporation Comparison

The biggest advantage of starting a corporation vs. sole proprietorship by far is the personal asset protection that shareholders have in the event the corporation is sued or owes a debt. With a sole proprietorship, the owner is completely responsible for any liabilities or debts of their business which can be an immense risk.

Moreover, corporations can claim self-employment tax savings among other tax benefits, while sole proprietorships offer no tax benefits as an informal business structure. In contrast, sole proprietorships save money with the low cost to establish this business structure, plus they arent liable for unemployment insurance.

Essentially, choosing to form a corporation vs. a sole proprietorship comes down to just a few things:

- Whether your business is small enough to act as an extension of yourself, allowing you to comfortably assume the financial responsibility of your business

- If your business can anticipate the level of growth that will benefit from tax savings, investment opportunity, and personal asset protection offered by a corporation.

Does Your Business Name Need To Be Registered

State regulation of LLCs include required words which must be included in an LLC namefor example, “LLC” or “limited liability company” might be required at the end of an LLC’s name. Registering your LLC does give your name protection within your state.

Sole proprietors don’t face the same requirements. However, if the business owner plans on operating under a company name, instead of under their own name, they will need to register for a “fictitious business name,” or DBA , in their home state.

Don’t Miss: How To Get Solar Panel For Home

Incorporation Vs Sole Proprietorship

When a taxpayer decides to start their own business, he or she must consider the type of business structure best suited to their individual needs. The most common forms of business arrangements are either a sole proprietorship, or a corporation.

Sole Proprietorship

A sole proprietorship is the most basic form of business organization and can be used in a wide variety of circumstances. They are relatively inexpensive to set up and require few legal formalities. Rather, a sole proprietorship exists whenever an individual carries on business for his or her own account without the involvement of other individuals, except as employees.

A major disadvantage of sole proprietorships is that there is no limited liability for the sole proprietor all business and personal assets may be seized in satisfaction of the sole proprietors business obligations and liabilities. That is, all obligations including losses and liability associated with the business are the sole proprietors responsibility.

If you choose to operate as a sole proprietorship under a name other than your own, you will require a Master Business License.

Corporation

Tax Benefits

A common reason not to incorporate and to operate as a sole proprietor would be that your business is expecting startup or operational losses in its initial year of business. These losses can be deducted against other sources of personal income when they are from an unincorporated business.

**Disclaimer

General Liability Insurance For Your Small Business

Whether youre a sole proprietor or the owner of an LLC, general liability insurance is crucial. General liability insurance covers company assets and is often required to sign contracts. If you are a sole proprietor, liability policies can also help shield your personal assets if you are held liable for an injury or property damage.

General liability insurance can cover the legal fees associated with a lawsuit and provide general protection for property damage and injury of non-employees, product liability, and even advertising injury protection in the event of a lawsuit for slander, libel, or accidental copyright infringement.

Read Also: What Can A 100 Watt Solar Panel Power

Advantages And Disadvantages Of A Sole Proprietorship

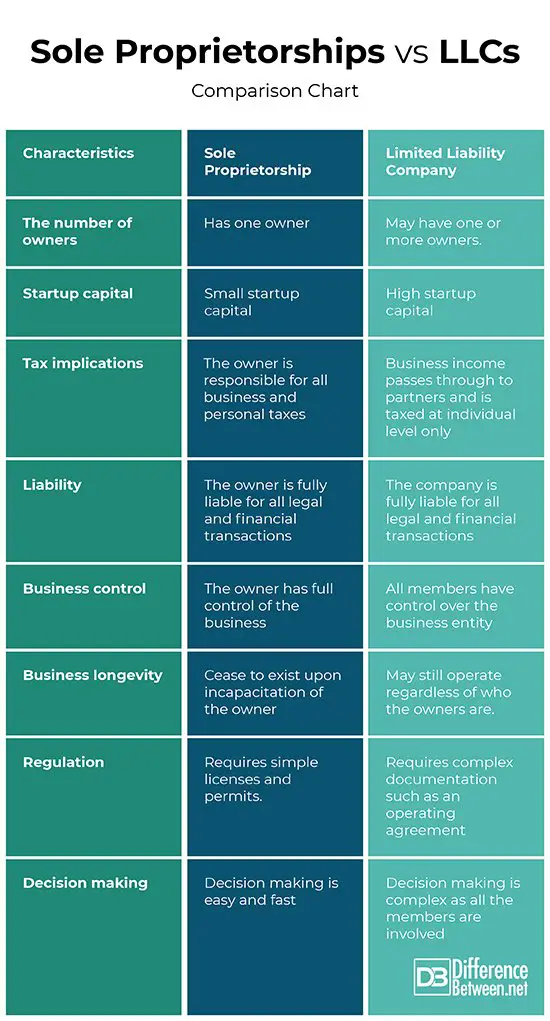

There are “pros and cons” in having your business structures as a sole proprietorship or a limited liability, but that’s not the complete picture.

The real issue is how best to select a business model depending on a company’s internal factors, like the number of owners, the unique goals of the company, and how the founder wants the company to operate.

You also need to weigh the more logistical elements of structuring a company – how you’ll do it, what it costs, what the tax picture looks like, and how the day-to-day side of the business will be run. Let’s take a look at all of those issues, and see where the upside and downside fall for sole proprietorships and limited liability companies:

Llc Or Sole Proprietorship How To Make The Right Choice For Your Business

What is a sole proprietorship? A sole proprietorship is the easiest type of business to start, as it requires no formal registration. This business structure is tied to you as an individual, and you have complete control over its direction and growth. This freedom comes with responsibility as the owner of a sole proprietorship, you are personally accountable for paying taxes on the business, and youre also legally liable if any contingencies should arise.

What is a limited liability company? An LLC reduces the risk of its owners, shielding them from liability in the case of legal action or bankruptcy . An LLC must be registered with the state, and the expenses and paperwork involved in registration vary according to state law. Individuals, groups of people, and corporations can form LLCs, and all members must declare income and losses on their personal tax returnsLLCs do not pay taxes themselves. Owners of LLCs have more freedom than owners of corporations, who have to go through a board of directors to make drastic changes.

There are several considerations in determining the best business structure for your startup, including:

Also Check: Are Tesla Solar Panels Available

Which Business Structure Is Right For You

Choosing a business structure is an important decision every entrepreneur needs to make. And the right choice for you will depend on your goals and the type of business you run.

If youre looking to hit the ground running, operating as a sole proprietor is the quickest way to get started. Theres no paperwork for you to fill out, and you can focus solely on finding clients and generating revenue. However, you will lose out on the liability protections that LLC members enjoy.

If youre on the fence, it can help to consult with other business owners to learn what path they took when first getting started. And it can be beneficial to seek out the guidance of an attorney or CPA that has experience working with small businesses.

Get Help With Business Formation

Do you have questions aboutbusiness formations andwant to speak to an expert?Post a project todayonContractsCounseland receive bids from LLC lawyers and corporate lawyers who specialize in business formation.

“ContractsCounsel puts on-demand legal services in the cloud. Not only is their service more convenient and time-efficient than visiting brick and mortar offices, but its more affordable tooand Ive been universally impressed by the quality of talent provided. If youre looking for a modern way for your small business to meet legal needs, I cant recommend them enough!”

“This was an easy way to find an attorney to help me with a contract quickly. It was easy to work with Contracts Counsel to submit a bid and compare the lawyers on their experience and cost. I ended up finding someone who was a great fit for what I needed.”

“ContractsCounsel suited my needs perfectly, and I really appreciate the work to get me a price that worked with my budget and the scope of work.”

“I would recommend Contracts Counsel if you require legal work.”

“ContractsCounsel helped me find a sensational lawyer who curated a contract fitting my needs quickly and efficiently. I really appreciated the ease of the system and the immediate responses from multiple lawyers!”

Also Check: What Different Types Of Solar Panels Are There