Determine How Much Personal Liability You Want To Face

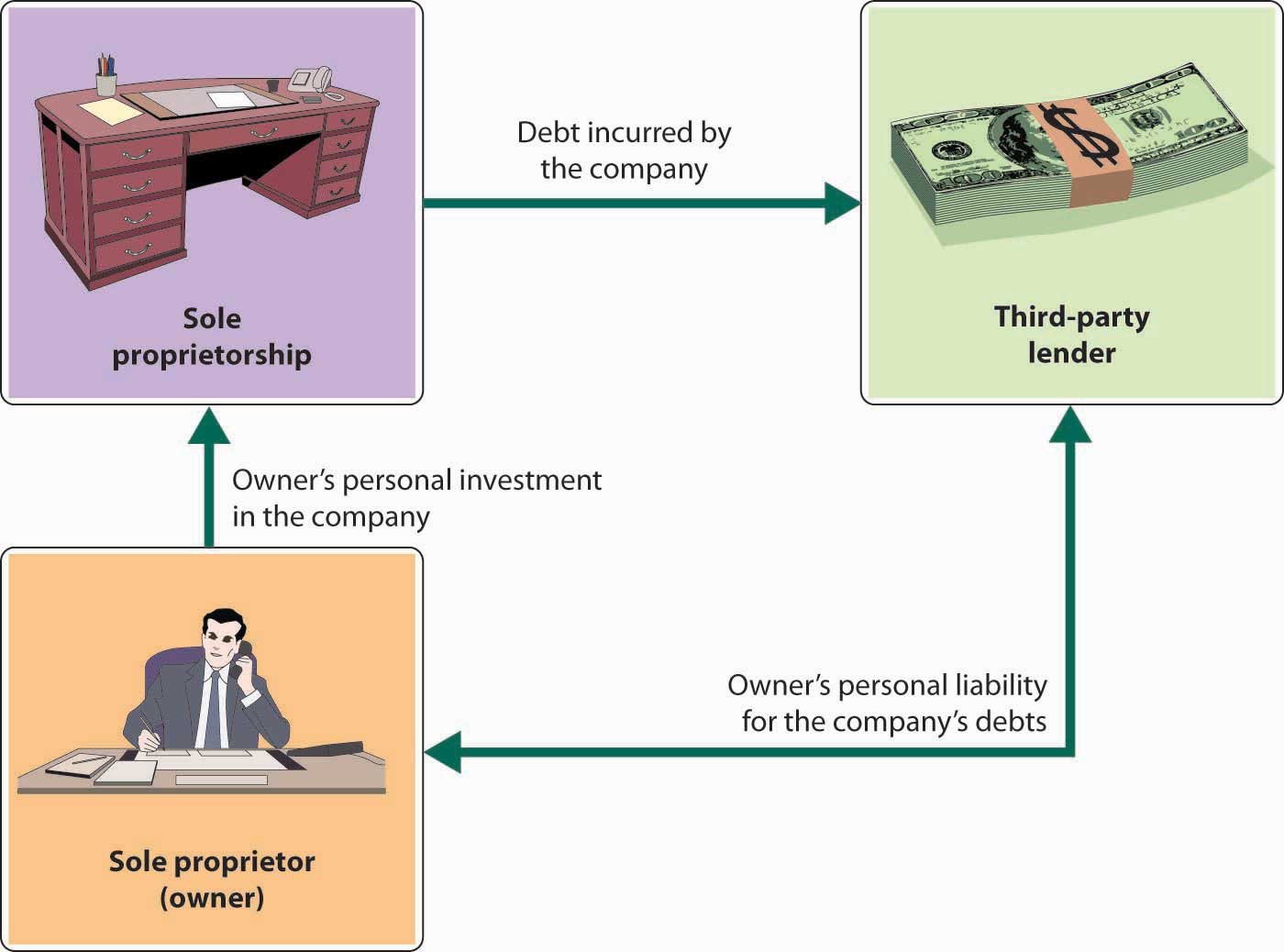

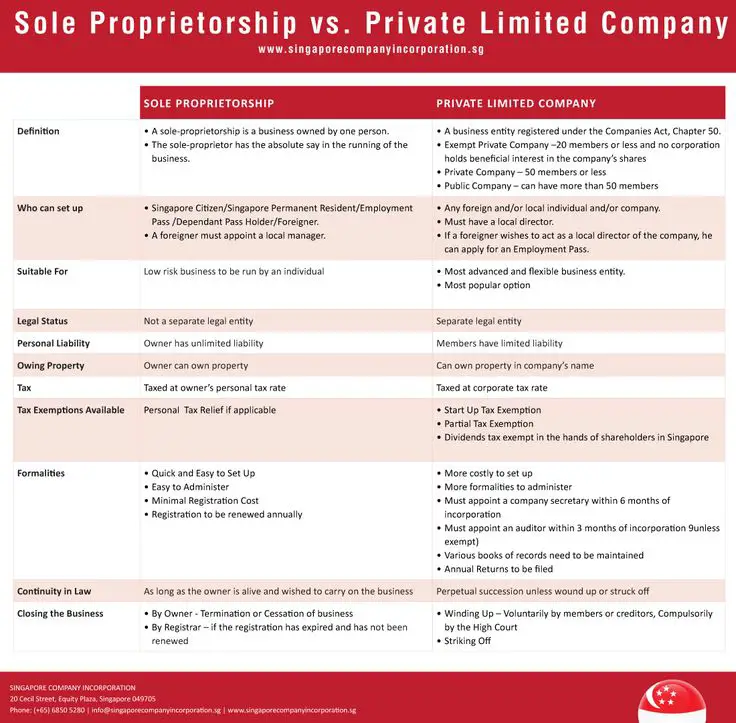

Certain business structures offer protection from personal liability for the debts of the business.

However, these businesses are often more complex and require more paperwork and more reporting.

On the other hand, if you choose a business structure that does not relieve you from personal liability.

You may be required to pay for the debts of your business out of your own pocket.

- In general, LLCs and corporations offer personal liability protection while sole proprietorships and partnerships usually do not.

Obtain Licenses Permits And Zoning Clearance

Your business may need to obtain a variety of licenses and permits depending on its business activities. California provides a comprehensive database of every license and permit that may be required by any sole proprietorship. A business can obtain this information by going to the California Governor’s Office of Business and Economic Development CalGold website. Type in your county and city to get a list of all the required permits and licenses for your business activity as well as information about required filings and laws you may be subject to, such as minimum wage laws and inspections.

Get Your Employer Identification Number

The EIN is a universal identifier, akin to a business version of a social security number. Although you are not required to apply for this ID, its advisable to have it. If you do not have one, you will need to use your social security number on tax forms and other official documents. Doing so exposes your personal information unnecessarily. You can obtain the EIN for free by filling out the proper IRS online form.

Also Check: How Does Solar Save You Money

How Does A Sole Proprietorship Get Started

A sole proprietorship is unique because it’s the only business that doesn’t have to register with a state. All other business types – partnerships, limited liability companies, and corporations – must file a registration form with each state in which they do business.

Starting a sole prop business is fairly simple. To start a sole proprietorship, all you need to do is:

- Create a business name and decide on a location for your business

- File for a business license with your city or county, and get permission from your locality if you want to operate your business from home.

- Set up a business checking account so you don’t mix up business and personal spending.

In addition, your sole proprietorship may have to register with federal or state entities :

- If you plan to sell taxable products or services, you must register with your state’s taxing authority.

- If you plan to hire employees, you’ll need an Employer Tax ID Number from the IRS. Your bank may also require this tax number.

Register Your Business In The Mayors Office

After claiming the barangay clearance/permit, the next step is to secure business clearance/permit from the Mayor or Municipal Office.

If you are a freelancer, self-employed or practicing professional, you may skip below steps. Instead, secure and pay either Occupational Tax Receipt , if non PRC licensed self-employed/freelancer, or Professional Tax Receipt , if PRC licensed self-employed/freelancer.

Here are the steps in registering with the Mayors or Municipals Office

After completing all the steps above, you can now focus in operating and growing your business.

Good luck.

Note: This article has been originally written in 2013 and updated 20 July 2021.

Also Check: Do I Need A Tax Id Number For Sole Proprietorship

Sole Proprietorships And Partnerships

A sole proprietorship is a business with only one owner.

A sole proprietor is self-employed, performs all business operations and assumes all liabilities.

A partnership company is operated by two or more parties.

In a general partnership, partners are responsible for all aspects of the business, including the debts of the partnership.

A limited partnership can have general and limited partners. Generally speaking, there’s a limit on the liability of a limited partner, while the general partner’s liabilities are not limited.

A limited liability partnership is has no general partners and all partners have limited liability.

Sole Proprietorship Vs Corporation

A corporation is a legal entity separate from the owners. This type of business structure provides legal protection against losses and liabilities, although it is rather procedural and time-consuming to create. Even if the owners cannot fulfill their responsibilities, corporations continue to operate, which is not the case with sole proprietorships. In terms of employee taxation, corporations have greater flexibility and adaptability.

Read Also: Can You Write Off Solar Panels On Your Taxes

Registering A Business Name With Your County Or City

Registering a business name isn’t the same as filing a fictitious name statement . A DBA is filed with your locality to let people know who owns your business.It’s required when the official business name is different from the owner’s name. For example, a DBA is needed for a business owned by Sam Weeks is doing business as “Happy Hot Dogs.”

If your business name is different from the name you are using for advertising and public purposes , you will need to file a “fictitious name” statement, sometimes called a “d/b/a” or “doing business as” statement. This statement is filed in the county where your business is operating. The process of filing a d/b/a or fictitious name statement is one of the first things you should do if you are going to use a trade name that is different from the name you have registered.

Register A Business Name At Department Of Trade And Industry

As a business, we use a Trade Name as our brand that is easily remembered by our target customers. If you will use a Trade Name for your business, you may register it in the Department of Trade and Industry .

If youre a self-employed, freelancer or professional who do not intend to use a Trade Name, you may skip this part.

To register in Department of Trade and Industry , follow these steps:

- Visit DTIs Business Name Registration System here:

- Read the Terms and Conditions and click Accept

- Fill-in your personal information

- Choose the nature or industry of your business such as: Restaurant

- Come-up with a business name such as: Shodo Japanese Restaurant

- Search if business name is available or has passed the criteria

- Once proposed name is passed, fill-in other required information

- Pay registration fee

- Print DTI Certificate of Registration

After acquiring a DTI Certificate of Registration , you may now proceed and register with Bureau of Internal Revenue

You May Like: How Do You Put A Solar Cover On A Pool

Key Steps To Setting Up An Establishment Or Sole Proprietorship

- Speak with one of Dhanguard’s advisors about the best legal structure for your business based on the activities you plan to do in the UAE and your target markets. A client may also get legal advice to confirm Dhanguard’s recommendations.

- Appoint a National Service Agent , who must be a UAE national or a corporation with 100% UAE ownership.

- Connect with our experts to learn more about the documents needed to start a sole proprietorship.

- All needed documentation must be given to Dhanguard, which will then oversee the entire application procedure.

When Are Payments Due

Taxes for self-employed individuals is based on the calendar tax year. As discussed earlier a new, first-year business can pay federal taxes at the end of the first year and then may have to pay taxes quarterly . Quarterly payments are due based on the 15th the month after a calendar quarter. For instance, the first quarter is January, February and March. Those taxes would be due on April 15th. The remaining quarters are due June 15, September 15 and January 15.

Recommended Reading: Will Solar Panels Run An Air Conditioner

Registering Your Business Name In Ontario

Business names are registered with the Central Production and Verification Services Branch of the Ministry of Government and Consumer Services and are placed on the Public Record maintained by CPVSB for public disclosure. Anyone may search business name information contained on the Public Record for a fee to find the owners or principals behind a business name.

How Do I Renew My Current Master Business Licence

You can renew your current Master Business Licence and move to the new Business Name Registration seamlessly. The information required would include the details of your current registration the BIN, which we can look up for you if you dont have it, and the optional company key. If you have applied for your company key, it will be required. The renewal is still mandatory within 60 days of the expiry date of your current registration. If you have passed the 60 days renewal requirement, you will need to complete a new Business Name Registration.

Also Check: How Much Electricity Does A 100 Watt Solar Panel Produce

Who Must Register Under The Business Names Act

Business Names Act administered by the Central Production and Verification Services Branch applies to:

- sole proprietorships carrying on business under a name other than the individuals full name

- partnerships carrying on business under a firm name other than the full names of the partners

- corporations carrying on business under a name other than their corporate name

- an existing general partnership or limited partnership registering a business name different from the registered firm name

- limited liability partnerships

- extra-provincial limited liability partnerships and

- extra-provincial limited liability companies

How To Register A Sole Proprietorship In The Philippines

Since the law treats the owner and the business as the same, the sole proprietor only needs to register his or her name with the Department of Trade and Industry and secure local licenses and permits to commence business operations.

Heres a step-by-step process for registering a sole proprietorship in the Philippines:

You May Like: How To Make Your Own Solar Cells

Search For A Business Or Not

Once you find the profile of a business entity you want to know more about, you can choose to order a search product to get additional information about that entity.

Corporations

To order a search product for a corporation, other than your own, contact one of the governments authorized service providers:

Other types of businesses

To order a search product for your own entity or an entity that is not a corporation , you can choose to go through one of the above service providers or direct through the government look for the Search Products drop-down list in the entitys profile in the Ontario Business Registry.

What Is Sole Establishment In Uae

Because initial fees are often modest and you can start your business with just one shareholder, a single establishment, also known as a sole proprietorship, might be a viable alternative for entrepreneurs looking to go it alone in the UAE. A qualified foreign investor who establishes a business or establishes a sole proprietorship to provide a professional service is allowed to own 100 percent of the company.

Professional service establishments are excluded from the Commercial Companies Law , although they must be licenced by the Department of Economic Development .

Only UAE nationals or GCC nationalities can form a sole proprietorship to engage out business activity . Expatriates can only establish Sole Proprietorships to provide professional and consulting services .

Foreign-owned businesses must appoint an NSA to assist them in acquiring licences, visas, and other documents. In exchange for an annual fee, a National Service Agent is a UAE national who assists a foreigner with licencing procedures and other government-related affairs. NSAs are not involved in the business in any way.

Read Also: Is It Possible To Make Your Own Solar Panels

What Is Sole Proprietorship In California

The most common form of business ownership is a sole proprietorship. It is not considered a separate entity like a corporation but an extension of a single owner or individual. The company and the owner dont exist apart from each other. A sole proprietorship consists of an individual or a married couple. A business is liable for all debt, obligations that are attached to the business including the profits earned. Moreover, all business-related acts involving employees, delegating decisions, and management are attached to the sole proprietor. The life of sole proprietorship continues to exist until it goes out of business or once the owner passes away.

Advantages Of A Sole Proprietorship

- Requires a minimum amount of capital

- Minimal regulations and compliance requirements from government agencies

- Easy to register

- Sole proprietor has complete control of the business

- Easy to manage, with no necessary formalities or regulations about having a board of directors, committee, or meeting minutes

- Sole proprietor acquires all assets and profits of the business and can freely mix business and personal assets

Don’t Miss: Is Leasing Solar Better Than Buying

Business Identification Number And Business Number

The Central Production and Verification Services Branch assigns a Business Identification Number when a business name is registered in Ontario.

The provincial BIN is different than the federal Business Number . The BN is assigned by the Canada Revenue Agency for federal programs, such as:

- goods and services tax/harmonized sales tax

- import-export accounts

If you are registering a business name under the Business Names Act directly with the Central Production and Verification Services Branch, the following forms must be submitted to the Branch:

How To Register A Business

So youve decided to start a business. Now its time to register it. The process of registering a business is different depending on the type of operation youre starting, how big it is, and what state you live in. Below, we explain the basics of how to get your business registered. But remember, Square does not provide legal or tax advice, and this article is not a substitute for advice from an attorney or tax advisor.

You May Like: How Much Does Solar Energy Save

Register With Your Province Or Territory

Most businesses need to register with the provinces and territories where they plan to do business. In some cases, sole proprietorships operating under the name of the business owner do not need to register. See the website of your provincial or territorial business registrar for more information on their requirements.

Note: This list of links is provided for your convenience. It may not be a comprehensive list of the registration requirements in all provinces and territories. Please check with the authorities in your provincial or territorial government to determine if there is anything else you need to do.

How To File A Dba

Filing a DBA allows your existing or new business to do business as a name other than your legal business name. This can be helpful for getting a brand name established, or to change the name of a business without having to file an amendment to an original filing.

A DBA can be filed by all business structures covered in this article however, LLC and corporation filing can sometimes be different than filing for sole proprietorships and general partnerships in some states.

Or, use a professional service to file your DBA for you.

Recommended Reading: Do Solar Panels Emit Radiation

Benefits Of A Sole Proprietorship In Dubai

- Foreign professionals can keep 100 percent ownership of their company.

- Anywhere in the UAE, including Free Zones, the corporation can legally provide professional services.

- There are no restrictions on where the corporation can rent or buy office space.

- Any paid-up capital requirements have been completely waived by the government.

- According to DED rules, the owner/s can also change the legal form.

How To Start And Register Sole Proprietorship Business In India

There is no government registration needed in order to start a sole proprietorship business in India. You dont have to go to an online registration portal and fill up a form or submit any documents. However, you do need to open a current account with a bank in the name of the business.

A current account in turn requires that you have a specified location from which you are doing business. The bank will ask you to submit at least two documents as proof of business location in the form of government registrations such as shop act license, service tax, CST/VAT, etc.

Need office space in Bangalore for starting a business? Contact Evoma now. Great location, serviced offices, all startup facilities included.

I will explain in detail how to start and register sole proprietorship business in India, and all the documents required. But first, lets take a minute to understand the legal definition of a sole proprietor, and what are the benefits as compared to registering a Partnership, LLP, or pvt ltd company.

Recommended Reading: How Much Does A 10kw Solar System Cost

Law Accounting And Search Firms

A business entity or not-for-profit corporation may hire a firmreferred to as an intermediaryto transact on its behalf.

Currently, intermediaries can transact via authorized service provider or by mail. At this point in time, they cannot transact directly in the Ontario Business Registry, however future system updates will address online access for intermediaries.

The following qualified intermediaries can continue to transact via and email:

- lawyers and paralegals governed by the Law Society of Ontario

- Chartered Professional Accountants governed by the Chartered Professional Accountants of Ontario

- law clerks filing under the direction and guidance of a lawyer governed by the Law Society of Ontario

- members of OAPSOR who regularly file with the ministry on behalf of corporations and other entities, law firms and accounting firms

If you use a trusted, qualified intermediary to transact on your behalf, you will need to share your company key. A company key is similar to the Personal Identification Number you use at the bank or to access other online accounts or services.

To request a company key, complete and submit the Company Key Request Form.