Types Of Business Names

Rules for claiming and registering a business name vary depending on your business structure. Naming some structures requires far less effort than others.

Your easiest option might be to file a “doing business as” registration with your state or county clerk if you’re a sole proprietor. This indicates that you’re operating your enterprise under some name other than your own.

It’s not necessary to register your personal name, although you might want to do so if you’re varying it in anyway, such as by using “Sue Smith Decorating” instead of simply “Sue Smith.”

Banks will require that you file a DBA if you want to open a separate business account for your sole proprietorship.

All other business structures must generally register their names, and you might also want to consider trademarking it at the federal level as well or registering a domain name for your website.

A trademark prohibits anyone else from using your name, even if they’re not located in your state. You can also trademark products you’ve created.

What Do You Need To Know About Sole Proprietorship

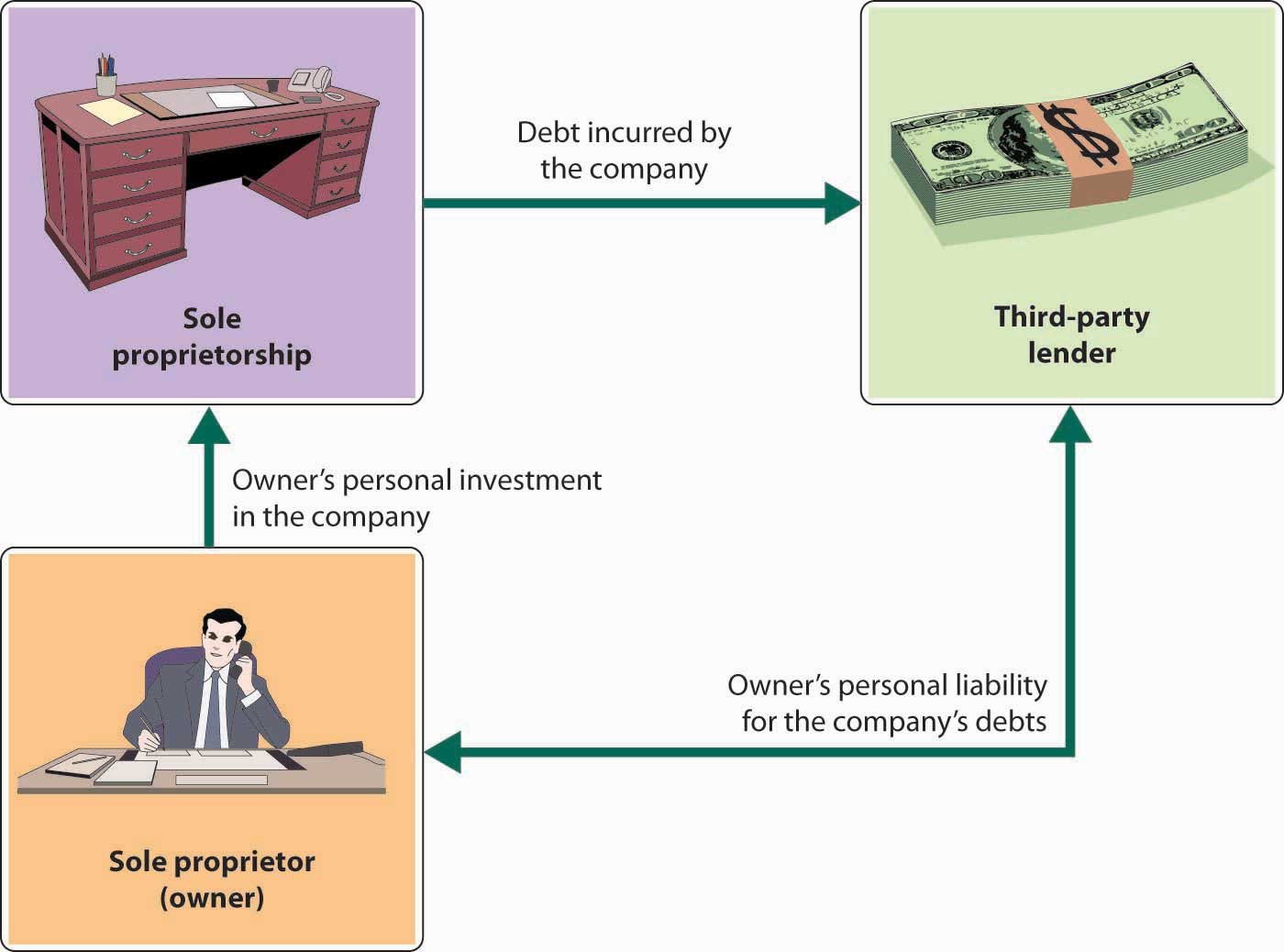

Individual entrepreneurship is the simplest and most chosen structure to start a business. It is an unincorporated company owned and operated by a single person with no distinction between the company and you, the owner. You are entitled to all profits and are responsible for all debts, losses and obligations of your company.

Does A Sole Proprietorship Provide Legal Protection

First off, we have to clear the air on what we mean by legal protection. Basically, a business with legal protection has personal asset protection as a result of whats known as the corporate veil, which separates the finances and assets of each owner from the assets of the business itself.

But in a sole proprietorship, there is no corporate veil, and as a result, no legal protection. In fact, in the eyes of the law, the sole proprietorship is indistinguishable from the owner there is no separation between the sole proprietorships business finances and the owners personal finances.

In our opinion, this is the biggest disadvantage of sole proprietorships. Its difficult to overstate how catastrophic even one liability claim against your business could be if you remain a sole proprietor instead of forming a formal business entity, like a limited liability company or a corporation. After all, if someone sues your sole proprietorship or you default on a debt, you as the owner are 100% liable. That means your creditors can pursue your house, car, personal bank accounts, investments, and more.

Recommended Reading: Do You Have To Register As A Sole Proprietor

Affordable And Easy To Run

You dont have to form a separate legal entity like you would with an LLC or a corporation. And, you dont need to file articles of organization with the California Secretary of State.

You dont even need to draft an LLC operating agreement. You simply start doing business and- boom youre a sole proprietorship in California.

But do sole proprietors need a business license in California?

The answer is yes. Even as a California sole proprietor, youll likely need a business license from your city or county. But thats about all of the paperwork that youll need to get your business up and running.

Theres a lot that you dont need to worry about as a sole proprietor. California sole proprietors dont need to:

- Hold LLC or corporate meetings

- Periodically file paperwork with the Secretary of State.

- Pay any special state taxes or fees

Get Ongoing Help For Your Business

Do you have questions about your business, such as EIDL applications, SBA loans, or other business funding questions? Get ongoing personalized funding help from our team. There are over 4,000 on our waiting list, but you can skip the waitlist completely with this invite link. Join Skip Premium today and get 1-1 support.

You May Like: What Is Pine Sol Good For

Optional: Open A Business Bank Account

This isnât required by the government or anything. Itâs just a piece of advice that will make your life a lot easier at tax time. Open a separate business bank account, and if youâre the credit card type, get a small business credit card. And only use those accounts for business transactions.

Then when it comes time to do your bookkeeping, youâll have all your business income and expenses in clean, separate accounts. Worst case scenario, if you havenât done any bookkeeping all year, you can quickly export all your bank and credit card transactions, without the hassle of trying to figure out what was business and what was personal.

And if you have multiple businesses, this matters even more: open a bank account for each business, since you have to file a Schedule C for each business you own.

Taxes And Sole Proprietorships

A sole proprietor pays federal and state income taxes on all the net income of the business , even if you don’t have cash on hand to pay these taxes.

Your business income is included with your personal income on your personal tax return. The tax rate you pay may on your business income can be hard to determine because it’s all combined. The corporate tax rate is a flat 21% for all corporate income levels, so your tax rate might be higher or lower, depending on your personal tax rate.

And don’t forget the self-employment tax. Sole proprietors must pay self-employment tax on the profits of their business. This withheld from your business income, so you’ll probably have to make quarterly estimated tax payments for this and your business income tax.

The IRS publishes a Tax Guide for Small Business, which you might find helpful in dealing with federal taxes.

Also Check: How Solar Energy Works Step By Step

How To Form A Sole Proprietorship

If youre thinking about opening your own business, forming a sole proprietorship is likely your easiest option.

As a sole proprietor, you have full control over the business there is no legal distinction between you and the business, and you receive all the profits while being responsible for all its debts and liabilities. In short, as soon as you start your business activities, you are a sole proprietor by default. However, there are a few steps you need to take in order to make it all legal.

Forming a sole proprietorship is relatively easy and inexpensive, and once you have formed one, you are free to move forward with business objectives, such as hiring staff, opening a storefront and promoting your business.

Follow the simple steps below to become a sole proprietor, or click here to see a general overview of a sole proprietorships pros and cons. To see if another type of business is a better option for you, see our video series on choosing the right business entity.

Is Malaysia Good At English

According to a survey conducted by Petaling.com, Malaysia is in the high proficiency bracket with the Philippines on English proficiency. A total of 1,021 people were surveyed by EF Education First. The study includes 3 million adults from 88 different countries and regions who do not speak English as their first language. No. 1 on the list was Malaysia. It is ranked 22th the Philippines is ranked 14.

Also Check: Will Solar Panels Increase The Value Of My Home

What Are The Insurance Implications Of Forming A Sole Proprietorship

Sole proprietors are not shielded from any debts or liabilities incurred by the business. Due to personal liability, sole proprietors usually must secure some type of insurance as a way to stay protected in the case of lawsuits. The sole proprietor would want to secure either a small business insurance policy or general liability policy.

How To Become A Sole Proprietor

Kerry Burridge Starting Your Business

A sole proprietor is the most common form of business model in the USA, with 70% of total businesses falling underneath this model. The reasons for this are obvious. As a sole proprietor, you dont have to file anything with the state, avoiding the hefty startup fees that are found in certain regions .

Your choice of business structure will determine how your business runs, your legal liability, and tax obligations. However, bear in mind that while you dont strictly have to register anything, every SP invariably does, for essential business purposes.

Sole proprietors enjoy much more flexibility in comparison to LLCs or C-Corporations. They are the easiest and cheapest to set up. On the other hand, they are not as reputable and the owner is 100% liable if anything goes wrong.

A sole proprietorship is essentially an unincorporated business run by one person only. If you think that a sole proprietorship is the way to go, then follow these step by step instructions to get started.

Don’t Miss: Is It Better To Buy Solar Panels Or Lease

Sole Proprietorships And Partnerships

A sole proprietorship is a business with only one owner.

A sole proprietor is self-employed, performs all business operations and assumes all liabilities.

A partnership company is operated by two or more parties.

In a general partnership, partners are responsible for all aspects of the business, including the debts of the partnership.

A limited partnership can have general and limited partners. Generally speaking, there’s a limit on the liability of a limited partner, while the general partner’s liabilities are not limited.

A limited liability partnership is has no general partners and all partners have limited liability.

Does A Sole Proprietor Need A Tax Id

A sole proprietor may have a federal tax identification number, but this does not determine whether your client must declare their income on Form 1099. A federal tax identification number can be used for a variety of purposes. Must be obtained if you have employees or can only be used for banking purposes.

You May Like: Do You Have To Rinse Pine Sol

When Do You Need An Ein For A Llc

If you already own a sole proprietorship and become the sole owner of a limited liability company that employs staff, or if you need to file a special tax or retirement plan statement, you will need to file a separate EIN for the LLC. payroll taxes. Is the Employer Identification Number the same as the Taxpayer Identification Number ?

Llc Vs Sole Proprietorship: Taxes

A single-member LLC and a sole proprietorship resemble each other in terms of tax treatment. Both are pass-through entities, which means that the business itself doesnt pay income taxes. The owner reports business income on a Schedule C thats attached to their personal tax return, and the income gets taxed at the owners personal income tax rate.

Multi-member LLCs are also pass-through entities, with each owner reporting and paying taxes on their share of the businesss income. The only difference is that a multi-member LLC must file a business tax return with the IRS, Form 1065, U.S. Return of Partnership Income. In addition, each member must attach a Schedule K-1 to their personal tax return, which shows their share of the businesss income.

In addition to income taxes, both LLCs and sole proprietorships might have additional tax responsibilities. No matter which business structure you adopt, youll need to pay payroll taxes if you have employees. Youll also need to collect state and local sales taxes if you sell taxable goods or services. And finally, as a self-employed business owner, youre responsible for paying self-employment taxes to the IRS. These taxes cover your social security and Medicare tax obligations.

A few states and local jurisdictions levy additional taxes on LLCs. Depending on the state, this might be called a franchise tax, LLC tax, or business tax. Youll also have to pay state and local income taxes and payroll taxes.

Don’t Miss: Is It Better To Lease Or Buy Solar

Sole Proprietors Arent Employees

A sole proprietorship doesnt pay payroll taxes on a sole proprietors income or withhold income tax. Because youre working as an independent contractor, your clients dont withhold taxes from your compensation.

Instead, as a sole proprietor, you pay self-employment taxes. Self-employment tax goes towards your Social Security and Medicare and is 15.3% of your net self-employment income. Youll also pay income taxes on your earnings. These taxes must be paid four times a year in the form of estimated taxes.

Anyone that pays you $600 or more within a year must file Form 1099-MISC to report the payment to the IRS.

Register Your Business Name

Sole proprietors have two options when it comes to a business name. Your business name can be the same as your personal name or you can file your business under a different name.

Youll need to use a fictitious business name or a doing business as name if you dont want to use your personal name for your business.

DBAs arent required in most states, however, they come in handy when you open a business banking account or business credit card since these institutions require you to separate your business and personal finances into two different categories.

Each state, county, and municipality has different DBA requirements and registration processes. You can check local government offices and websites for more information about registering your business.

Read Also: How To Get Certified In Solar Panel Installation

Whats A Sole Proprietorship

In accordance with the IRS , a sole proprietorship is actually an unincorporated business entity with one proprietor. Spouses may also collectively possess and run a sole proprietorship.

A sole proprietorship doesnt require that you register businesses formation reports because of the county. So if youre running a business independently and havent registered the organization, you already have a sole proprietorship. In fact, as soon as you start providing goods or treatments on the market, you may be operating as a sole proprietorship.

As a single proprietor, all company income move across to you as they are reportable in your private income tax forms. You will need to spend county and national income taxes on your profits, and you will need to pay a self-employment income tax. Common examples of main proprietorships feature freelance home writers, professionals, and bookkeepers.

This kind of company arrangement has some pronounced benefits and drawbacks. Why dont we go over them.

You Own The Business Personally

This means that you make all of the decisions and dont need to consult with anyone. Youre the supreme ruler of your business. *muwhahahahaha*

Everything that your business owns, you personally own. In other words, all of the money that your business earns is your personal money. Even though its wise to have a separate bank account for your business, its not legally required.

Also Check: Is It Safe To Use Pine Sol While Pregnant

Can A Sole Proprieter Have An Ein Number

Answer. A sole proprietorship with no employees who doesn’t file a special tax or retirement plan statement doesn’t need an EIN . In this case, the sole proprietorship uses its social security number as its tax identification number. However, if the sole proprietor hires an employee or has to file a special tax or retirement plan statement, the sole proprietor needs an EIN to conduct business and cannot use its unlisted number.

How Do I Incorporate My Sole Proprietorship

A sole proprietorship is the simplest and most common type of business entity. The main feature of this business structure is that it must have one sole owner. Over time, you may outgrow this structure and seek to incorporate.

An incorporated business means that it is a separate legal entity distinguished from its owners and directors. There is a range of benefits to incorporating your sole proprietorship, including risk protection and taxation benefits.

This article will take you through how you can incorporate your sole proprietorship.

Also Check: What Is The Cost Per Kilowatt Hour For Solar Energy

Create A Business Plan

Business plans aren’t just necessary for startups seeking a business loan. The primary reason to create a business plan is to find out if your idea has a chance of becoming successful.

Once you’ve chosen a home-based business idea you’re passionate about, write a business plan, including:

- An executive summary of your business idea

- Research into your target market and competition

- A description of your ideal customer

- Your marketing strategy

- Financial planning

- Your operating plan

The research and thinking that you do as you work through the business plan will help you refine your business idea and plan for how you will successfully launch yourself into your market without costly real-world trial and error. If your business plan shows you that your idea isn’t viable, don’t be afraid to shelve it, choose another home-based business idea, and go through the process again.

How A Draw Works

If you put your own money into the business, you can draw it out to pay yourself back. You can also increase your capital account by making a profit. The profit goes into your capital account. So, if your revenues are greater than your expenses this month by $3,000, you can draw out all or some of that $3,000 for your expenses.

If you don’t have any money in your capital account, you can’t draw any money out for personal expenses. For example, if you start a new business and you have little income and lots of money that must be paid out, for rent, equipment, and interest on your business loan, there is nothing left to pay you for personal expenses.

Read Also: How To Set Up A Small Solar Panel System

What Is Sole Proprietorship In California

The most common form of business ownership is a sole proprietorship. It is not considered a separate entity like a corporation but an extension of a single owner or individual. The company and the owner dont exist apart from each other. A sole proprietorship consists of an individual or a married couple. A business is liable for all debt, obligations that are attached to the business including the profits earned. Moreover, all business-related acts involving employees, delegating decisions, and management are attached to the sole proprietor. The life of sole proprietorship continues to exist until it goes out of business or once the owner passes away.